|

The latest update is now available. This

includes several improvements to the charting application

to help minimize communication errors. The download also

includes a new version of LiveUpdate.exe to streamline

the live update process. See

What's New for further details. Incredible Charts should update automatically to the new version (check under Help >> About). If this fails, please download and install the latest update over your existing version. |

Trading Diary

February 9, 2004

USA

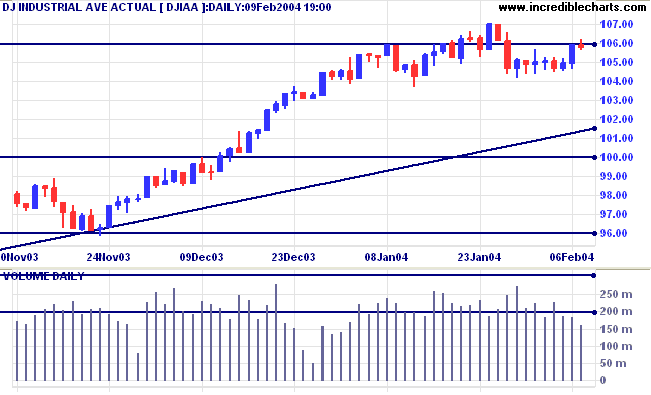

The intermediate trend is uncertain. A fall below 10417 (Jan. 29 low) would signal the start of a down-trend.

The primary trend is up. A fall below support at 9600 would signal reversal.

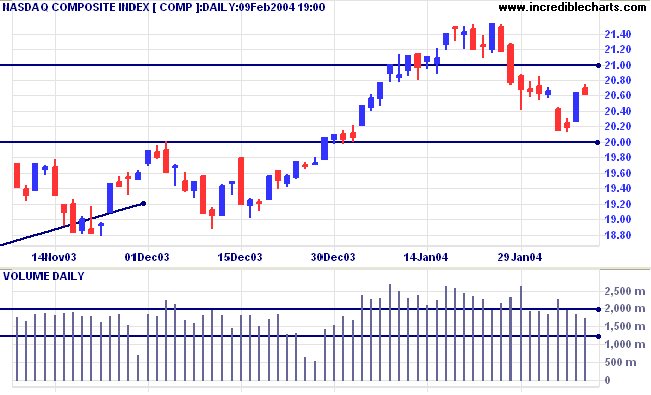

The intermediate trend is down.

The primary trend is up. A fall below support at 1640 will signal reversal.

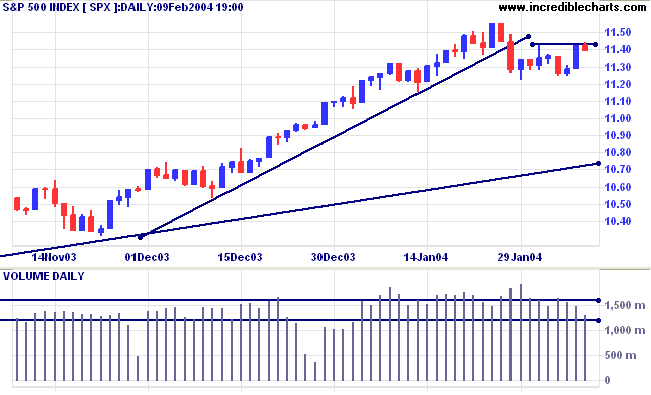

The intermediate trend is uncertain. Resistance is at 1155 and 1175. A fall below 1122 (Jan 29 low) would signal the start of a down-trend.

Short-term: Bullish if the S&P500 is above the high of 1155. Bearish below 1122.

Intermediate: Bullish above 1155.

Long-term: Bullish above 1000.

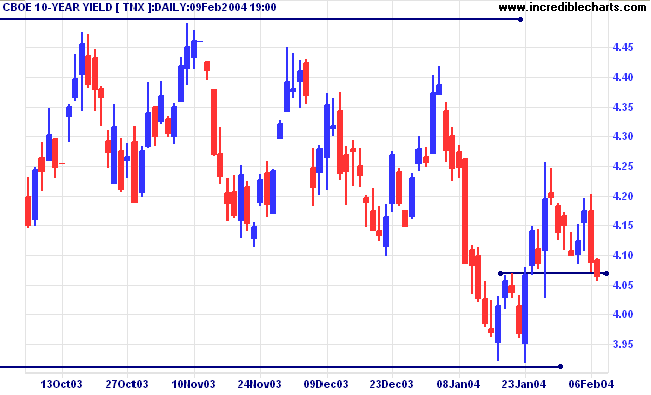

The yield on 10-year treasury notes continued to fall, closing at 4.065%.

The intermediate trend has reversed down.

The primary trend is up. A close below 3.93% will signal reversal.

New York (23.33): Spot gold is up at $407.51.

The intermediate trend is down. Support is at 400.

The primary trend is up.

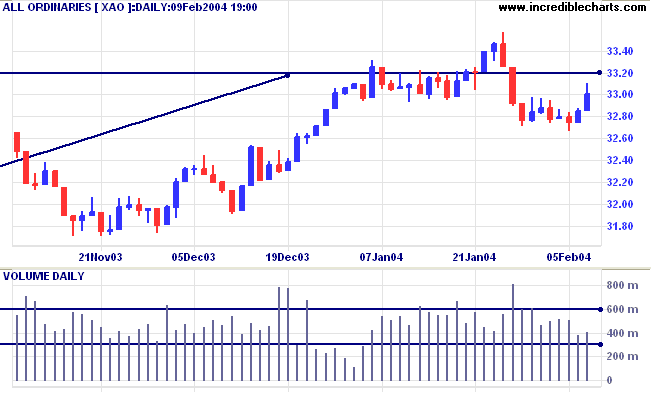

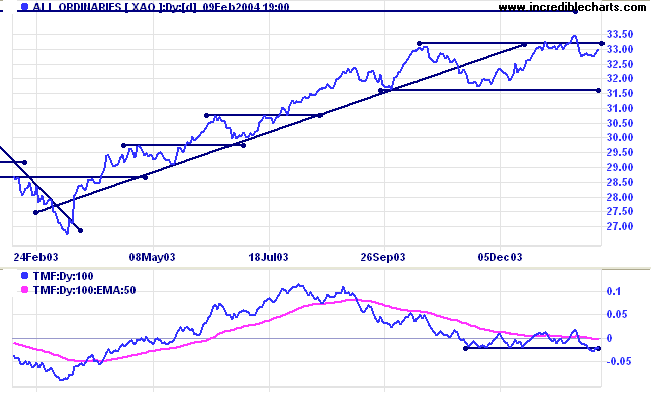

The intermediate trend is uncertain. A follow-through above 3300 will be a positive sign. A fall below the low of 3266 would signal the start of a down-trend.

Short-term: Bullish above 3350. Bearish below 3266.

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

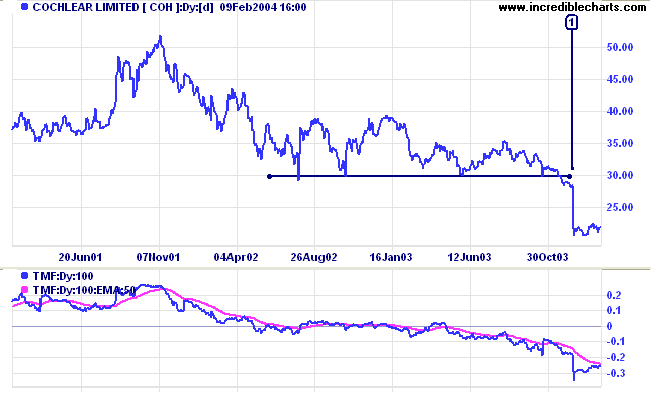

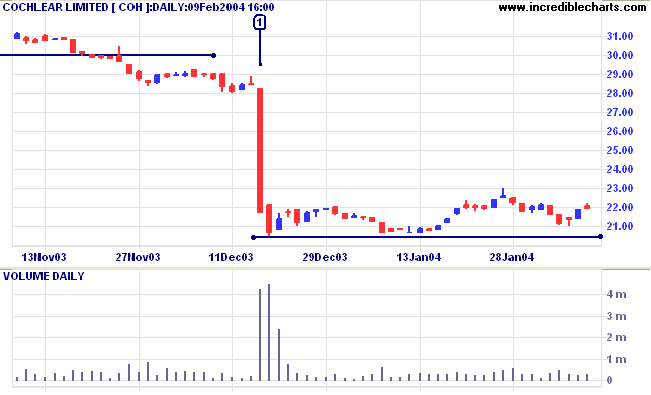

The stock underwent a cathartic sell-off at [1], which may well establish the bottom of the stage 4 down-trend.

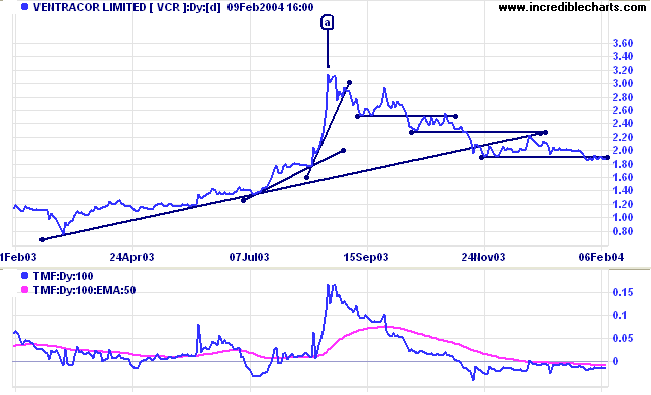

VCR experienced the opposite to COH: a blow-off spike at [a]. Rather than consolidate at the peak (as COH did at the low), blow-offs tend to reverse sharply back to previous support levels. The down-trend in this case has slowed after breaking below the long-term trendline; opposite to what I had expected. A creeping down-trend such as this can either rally or fall sharply; so it would not be a good idea to get in too early.

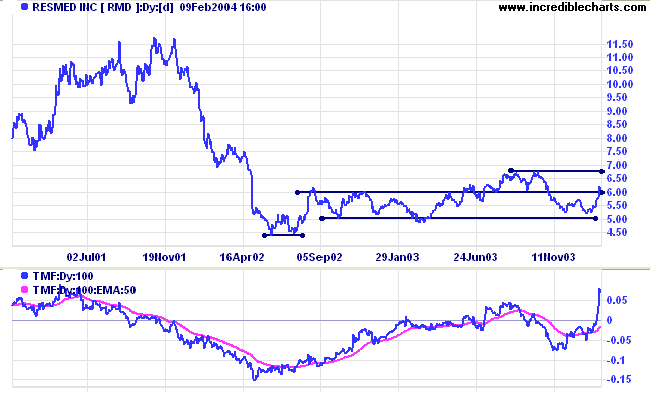

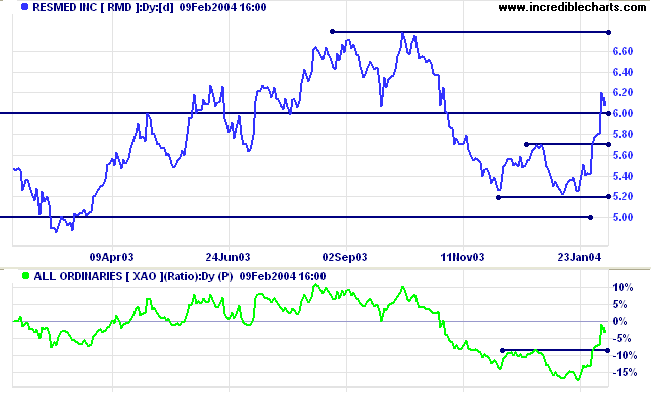

RMD has been in a broad base since 2002. The first breakout failed, after a bearish divergence on Twiggs Money Flow. The indicator (TMF) has since turned up sharply to signal strong accumulation. Price also responded with a rise above the 6.00 resistance level.

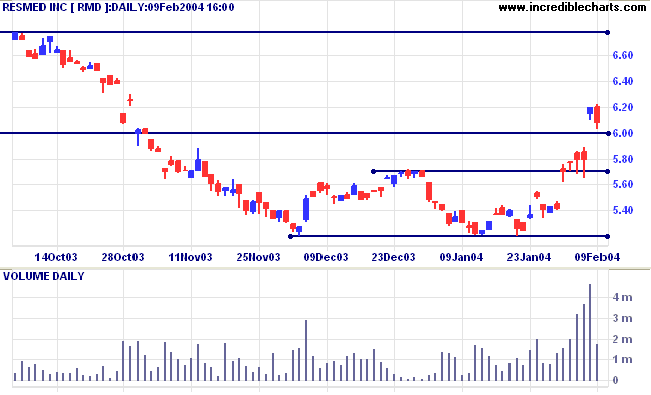

Price formed a breakaway gap above the 6.00 level. Volume is drying up on the pull-back. A rise above 6.20, without filling the recent gap, would be a further bullish sign.

but when there is nothing left to take away.

~ Antoine de Saint-Exupery.

| If you use Windows 2000, please check that you have at least Service Pack 4 or later. There are SSL connection problems with earlier versions. Further information (and the latest update) is available at Microsoft Support. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.