US stocks and indexes are being added to the stock screen module

and should be available by next week.

Trading Diary

December 11, 2003

The intermediate trend has turned up. If the index is able to hold, with the pull-back respecting the new support level, this will be a strong bull signal.

The primary trend is up. A fall below support at 9000 will signal reversal.

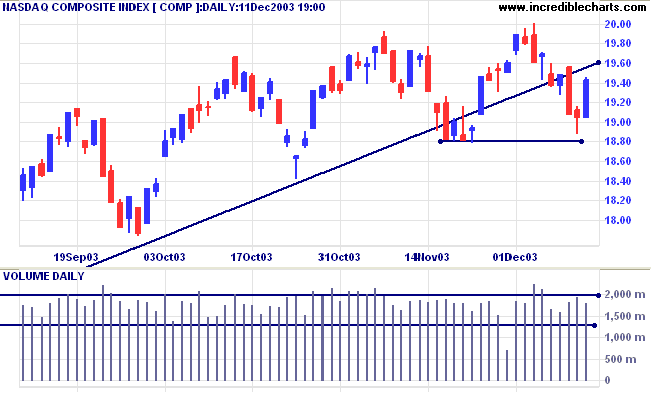

The intermediate trend is uncertain. Expect support at 1880 and 1840, with resistance at 2000. A fall below 1880 would complete a double top reversal, with a target of 1760: 1880-(2000-1880).

The primary trend is up. A fall below support at 1640 will signal reversal.

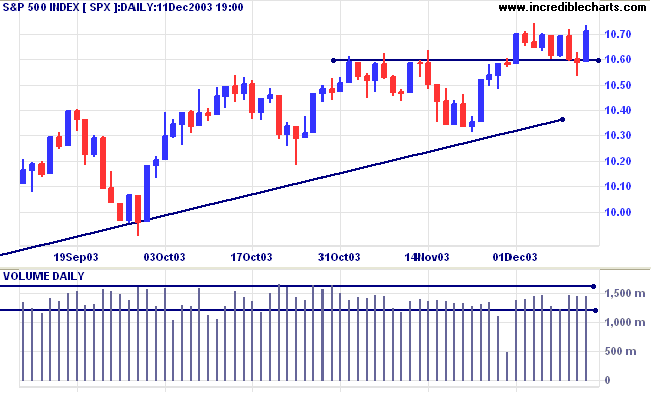

The intermediate trend has turned up.

Short-term: Bullish if the S&P500 is above the high of 1070. Bearish below 1059 (Thursday's low).

Intermediate: Bullish above 1070.

Long-term: Bullish above 960.

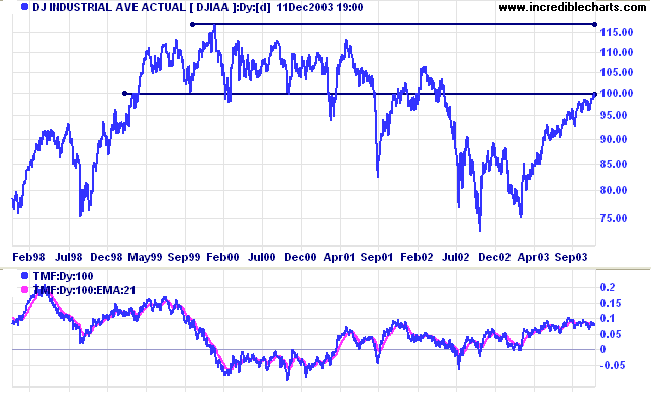

The yield on 10-year treasury notes closed down at 4.23%.

The intermediate trend is down.

The primary trend is up.

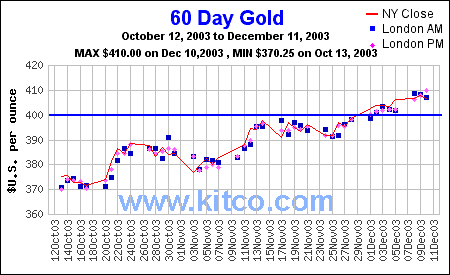

New York (20.41): Spot gold eased to $405.20.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

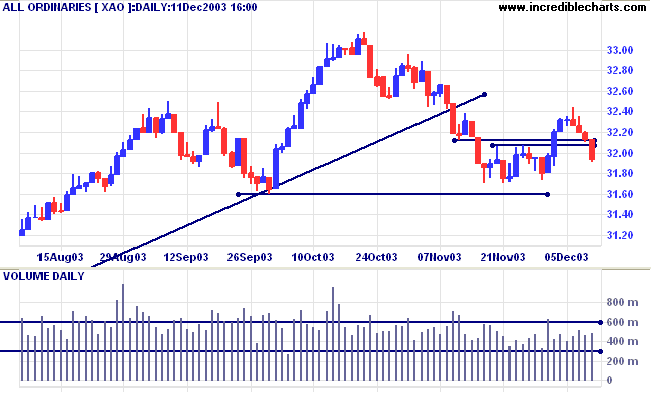

The intermediate up-trend is weakening.

Short-term: Bullish above 3212, today's high. Bearish below 3173 (December 1st low).

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

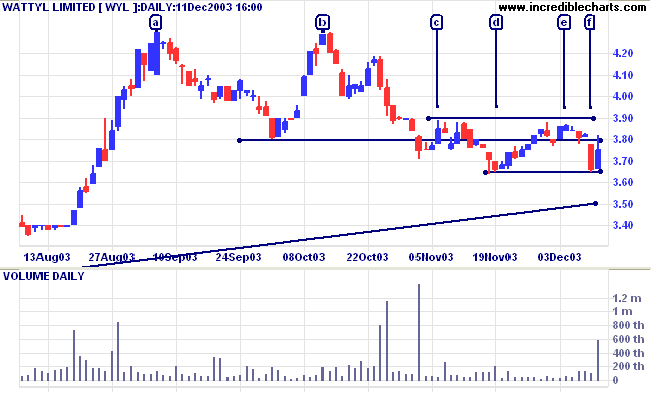

Last covered on November 24, 2003.

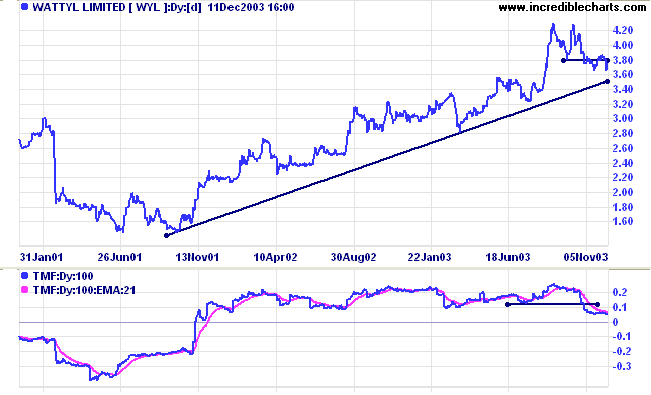

Wattyl has been in a stage 2 up-trend for over 2 years. Recently the stock completed a double top reversal after a fast intermediate up-trend.

Twiggs Money Flow (100) is declining after crossing below its signal line.

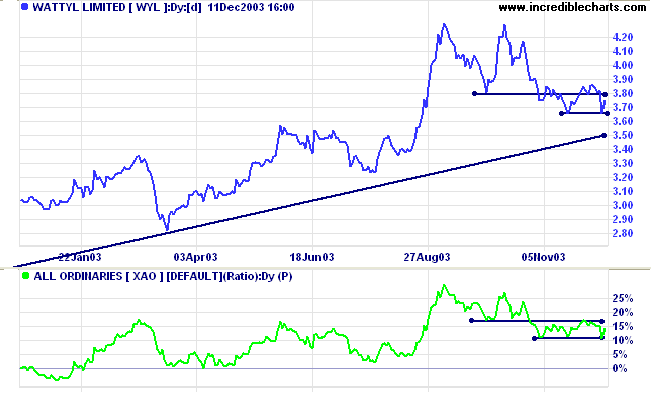

Price then retreated back above the support level and has since consolidated in a narrow range around 3.80; a bearish sign unless the latest pull-back breaks above 3.90. Volume dried up during the consolidation but has picked up today, so we cannot completely write off an upward breakout.

Last covered November 27, 2003.

Need I say more? The chart says it all.

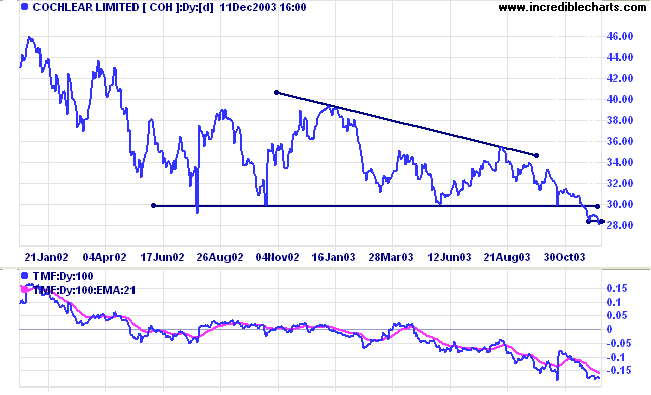

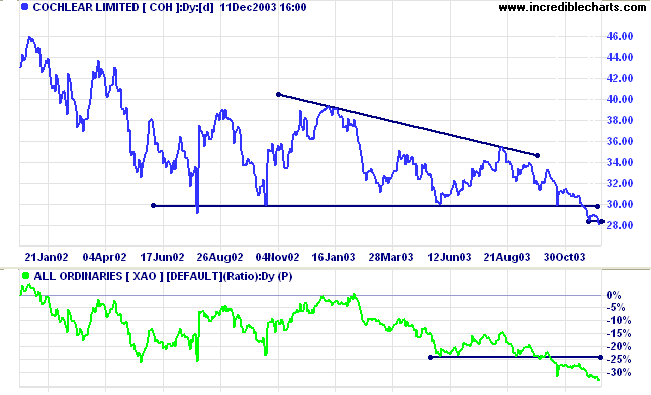

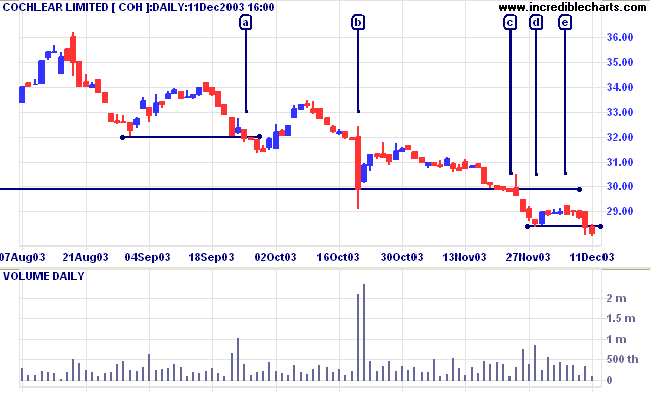

COH has broken below support from a huge descending triangle, while Twiggs Money Flow has been falling for the last 6 months, signaling strong distribution.

.

be gentle with yourself.

~ Max Ehrmann: Desiderata (1927)

Where price history is adjusted for the effect of corporate actions.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.