Trading Diary

November 17, 2003

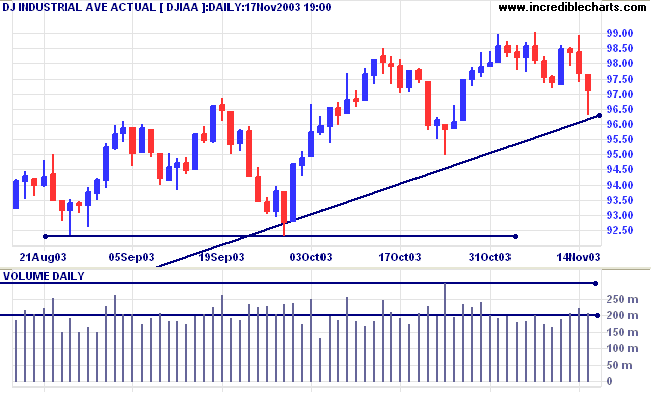

The intermediate trend is down.

The primary trend is up. A fall below 9000 will signal reversal.

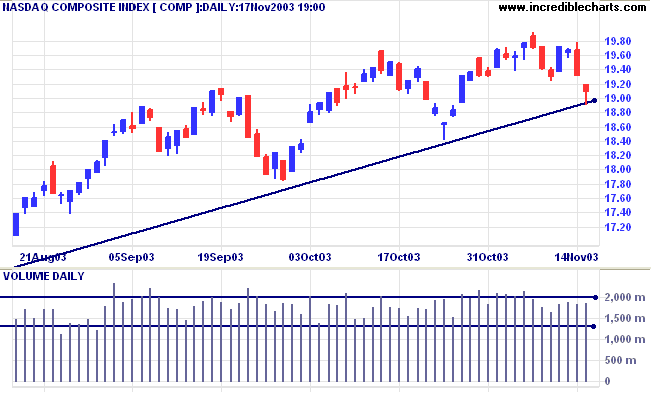

The intermediate trend has turned down. Expect resistance at 2000 and 2100, the January 2002 high.

The primary trend is up. A fall below 1640 will signal reversal.

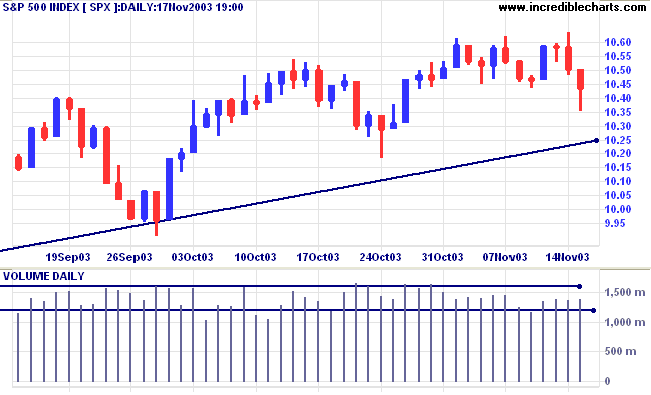

The intermediate trend is uncertain. Expect support at the primary trendline.

Short-term: Bullish if the S&P500 is above 1062. Bearish below 1043 (Tuesday's low).

Twiggs Money Flow (100) continues to signal accumulation.

Intermediate: Bullish above 1062.

Long-term: Bullish above 960.

Revision: according to Dorsey a fall below 70% (not a 3-box reversal) would signal a bear alert.

Preliminary figures for November show the University of Michigan index up sharply at 93.5, compared to 89.6 in October. (more)

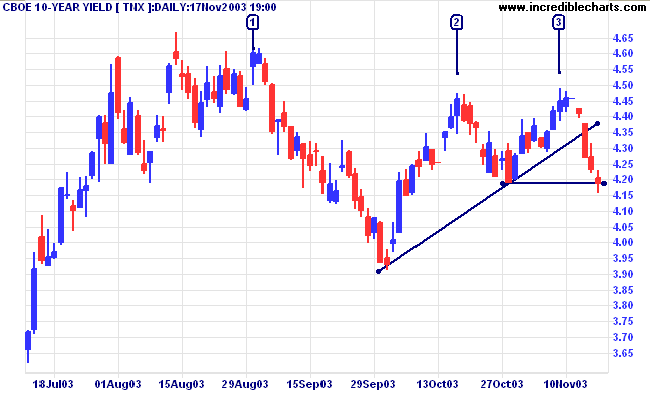

The yield on 10-year treasury notes fell to 4.19%.

The intermediate trend is up but equal highs, [2] and [3], below a higher peak [1] are a bear signal. A close below 4.19% will signal reversal.

The primary trend is up.

New York (21:03): Spot gold has had a highly volatile day, rising to 399, falling back to 385, and then recovering to $392.80.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has whipsawed back below its signal line.

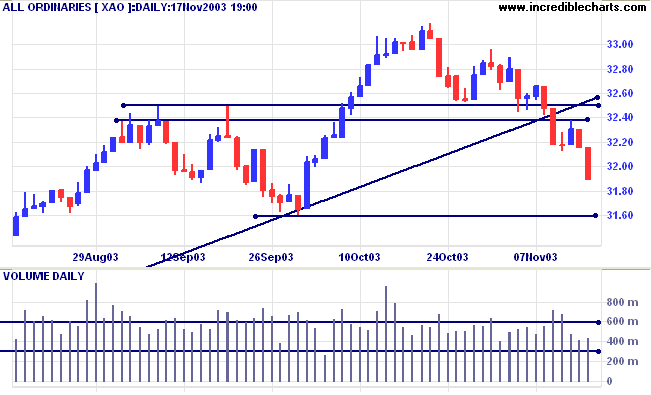

Short-term: Bullish if the All Ords crosses back above resistance at 3250. Bearish below 3238.

Intermediate term: Bullish above 3250. Bearish below 3160.

Long-term: Bearish below 3160.

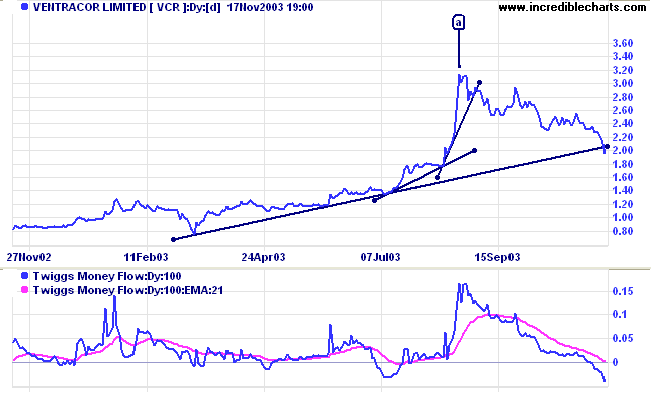

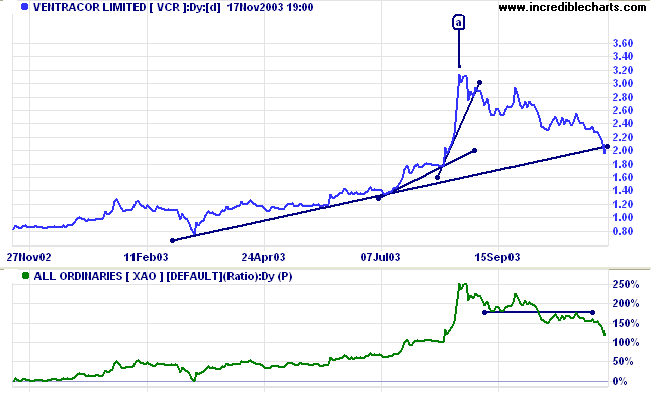

Last covered on October 30,2003.

VCR has crossed below the primary supporting trendline after correcting off the blow-off (accelerating trend/spike) at [a]. Twiggs Money Flow (100) has crossed below zero, signaling strong distribution.

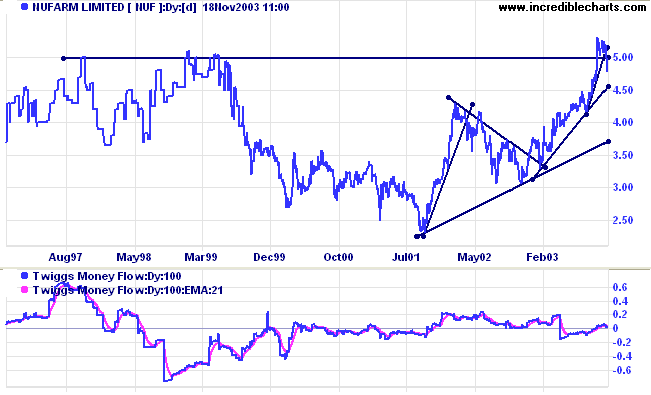

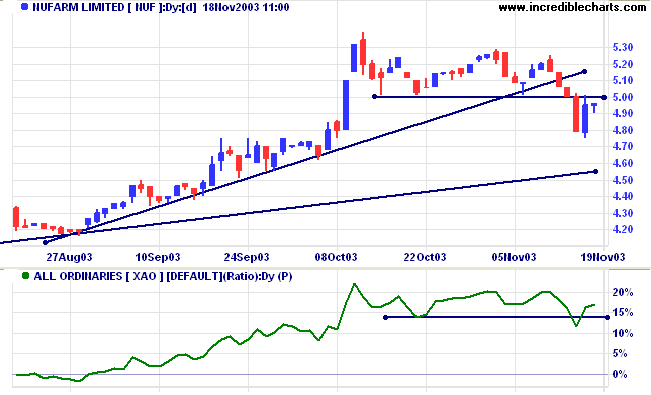

NUF broke briefly above the major 5.00 resistance level before retreating below.

Twiggs Money Flow (100) has crossed to below its signal line after a healthy rise.

Relative Strength (xao) has crossed back above the RS support level, leaving some hope for the bulls. A peak below the RS support level will be a strong bear signal.

~ German proverb.

We are busy with the transfer to the new dual-CPU server

and expect to have the charts available this week.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.