|

US Charts With ETOs and warrants available, we can now focus on the US market: NYSE, Nasdaq and Amex stocks. Our target is next Friday. |

Trading Diary

October 30, 2003

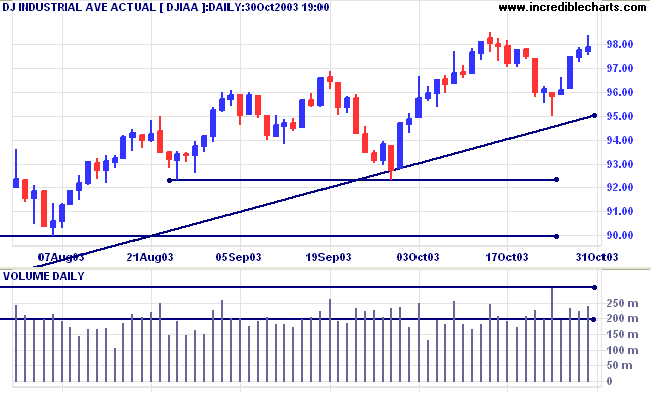

The intermediate trend is down.

The primary trend is up. A fall below 9000 will signal reversal.

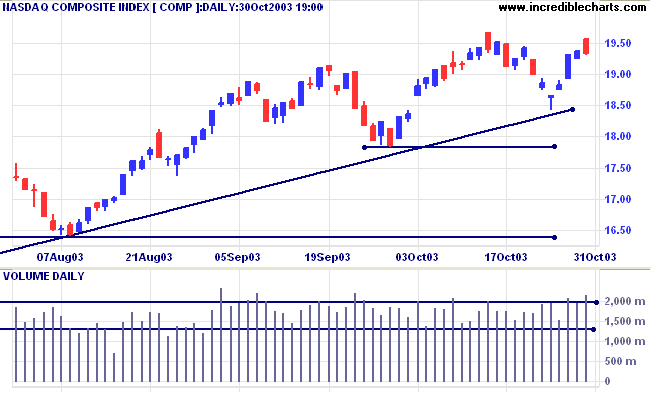

The intermediate trend is down.

The primary trend is up. A fall below 1640 will signal reversal.

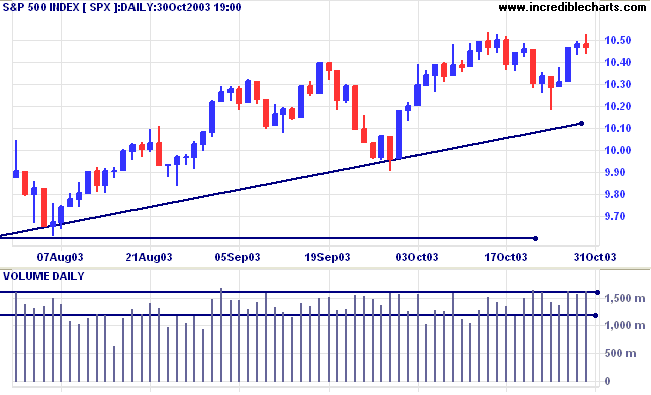

The intermediate trend is down.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1054. Bearish below 1026.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

GDP growth jumped to a record annual rate of 7.2% in the third quarter, compared to 3.3% last quarter. (more)

New unemployment claims are down at 386,000 compared to 391,000 last week. (more)

The yield on 10-year treasury notes rallied to 4.34%.

The intermediate trend is down.

The primary trend is up.

New York (17:32): After reaching 391.00 spot gold retreated to $382.80.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

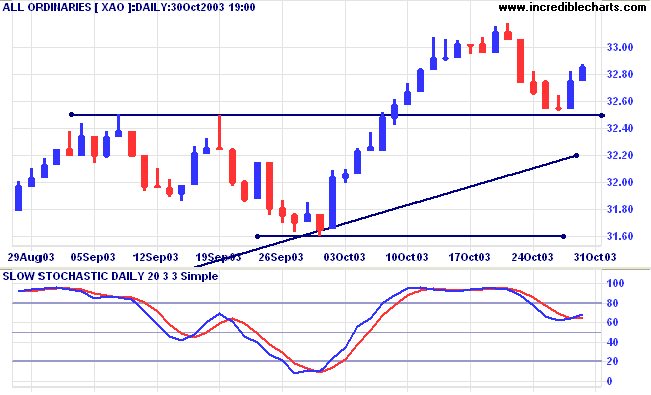

Initial support is at 3238 to 3250; resistance at 3317.

The primary trend is up. The rally is extended and the probability of a reversal increases with each successive primary trend movement.

A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3238.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

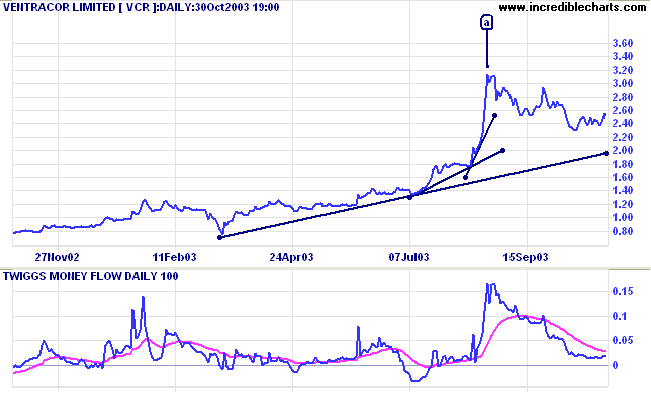

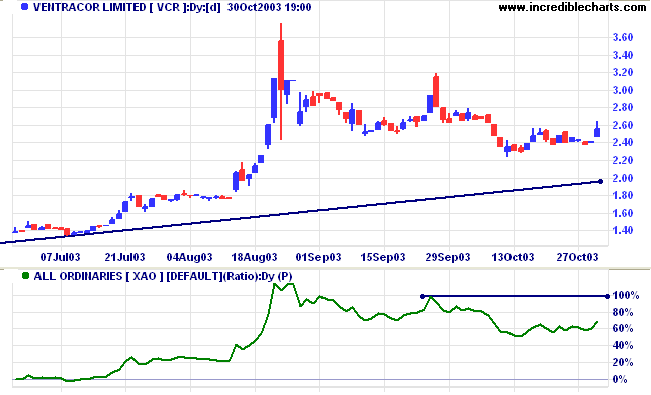

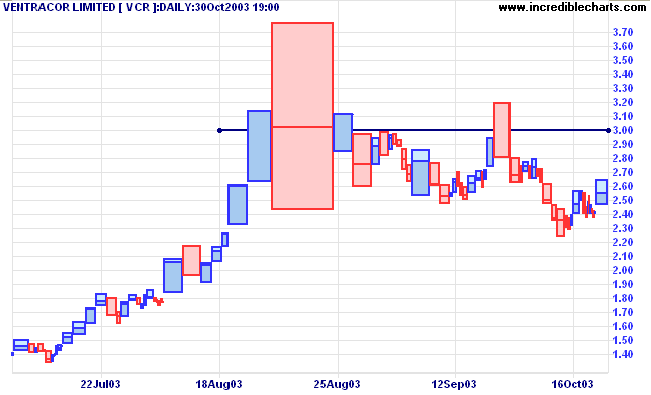

VCR experienced a sharp price spike at [a]. Also known as a "blow-off" or a "parabolic curve", the rapidly accelerating trend is unsustainable and inevitably ends with a retreat back to the long-term trendline, normally a lot sharper than below. Twiggs Money Flow (100) shows a similar pattern but, so far, has held above zero.

three minutes in the ring with a professional boxer.

Your primary objective is to survive:

prepare thoroughly; develop a game plan;

know exactly what you are going to do in every situation;

never let your guard down;

and don't get cocky - overestimating your ability will get you hurt.

|

To edit an indicator: (1) open the indicator panel (main Menu: Indicators); (2) select an indicator in the the right column (eg. MACD, Daily,26,12,9,HideHistogram;;;); (3) amend the settings in the center column (eg. select ShowHistogram); (4) save (>) and exit (x). |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.