|

World Clock Here is a world clock that I find useful for coordinating time zones: timeanddate.com/world clock You can add or remove cities using the Setup button. |

Trading Diary

October 28, 2003

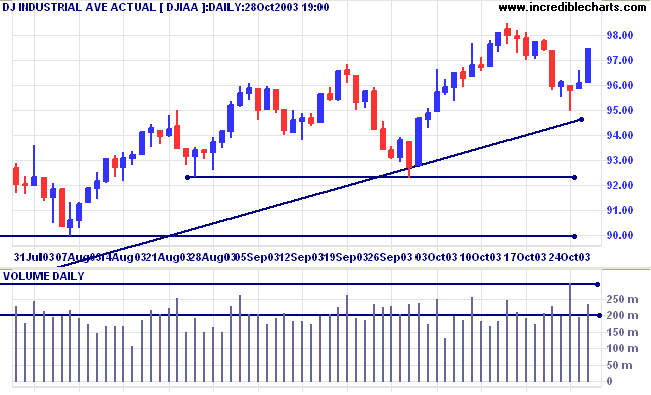

The intermediate down-trend has weakened.

The primary trend is up. A fall below 9000 will signal reversal.

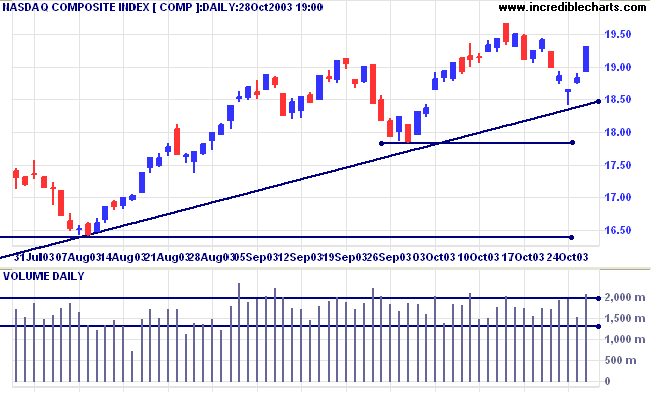

The intermediate down-trend appears weak.

The primary trend is up. A fall below 1640 will signal reversal.

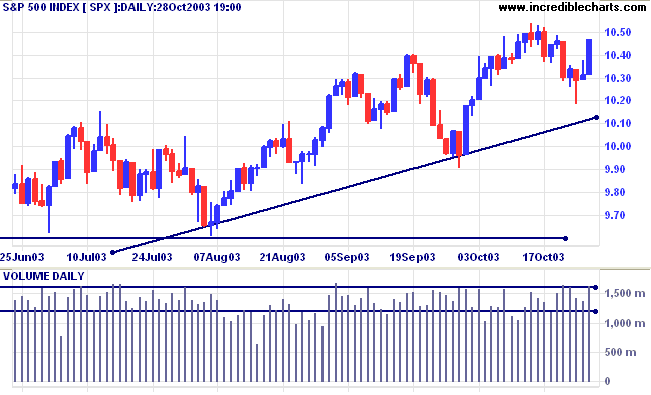

The intermediate down-trend is weak.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1054. Bearish below 1026.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

The Federal Reserve board agrees to hold the overnight bank lending rate at 1.0%, hinting that they will keep rates low for as long as possible. (more)

The Conference Board index of consumer confidence rose to 81.1 from 77 in September. (more)

The yield on 10-year treasury notes fell to 4.19%.

The intermediate trend is down.

The primary trend is up.

New York (20.22): Spot gold fell to $381.90.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

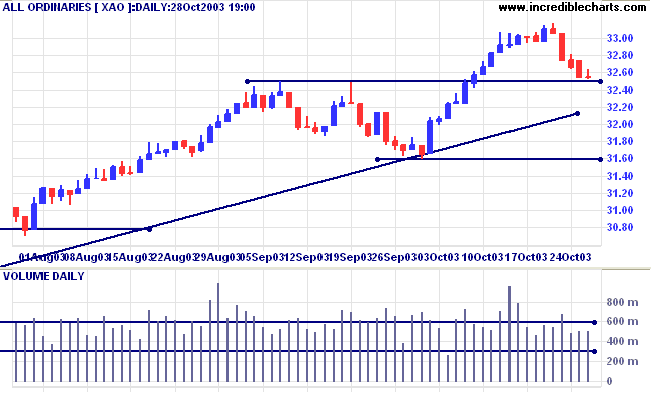

The primary trend is up. The rally is extended and the probability of a reversal increases with each successive primary trend movement.

A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3238.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

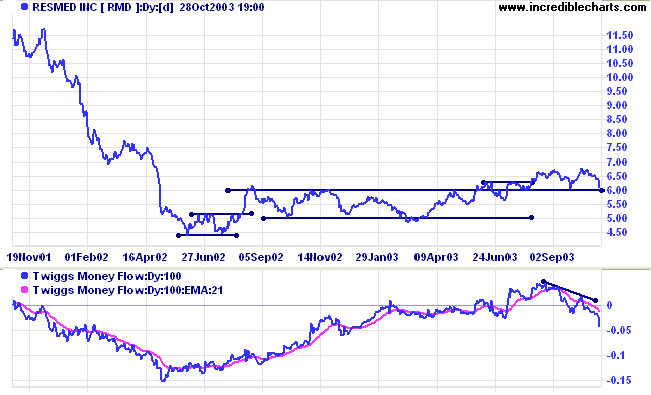

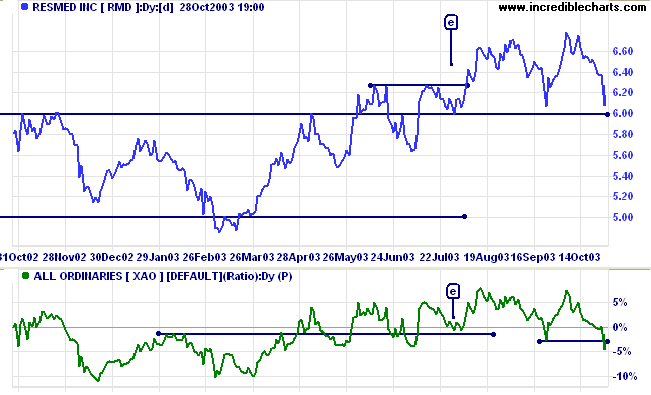

Last covered August 28, 2002. Resmed established a broad base between 5.00 and 6.00 before breaking out in July, after an earlier false break in June. Price has formed equal highs after testing support at 6.00, not a bear signal unless there is a break below the intervening trough. Twiggs Money Flow (100), however, has formed a bearish divergence.

The earlier caption at [e] shows the entry point when price respected the 6.00 support level, confirmed by a similar pattern on RS.

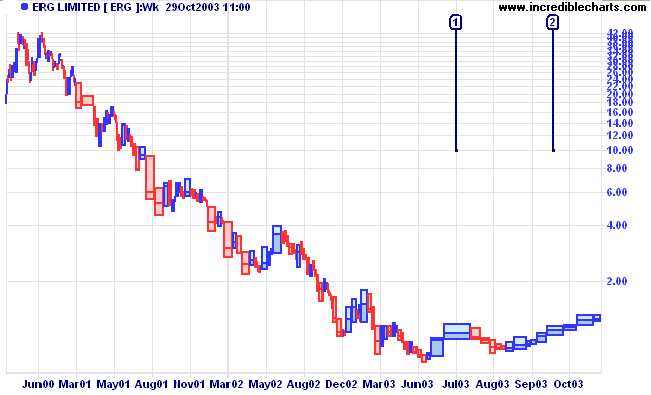

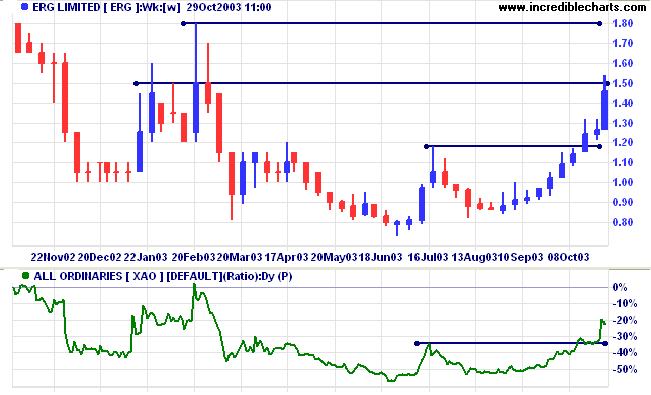

Last Covered September 1, 2003. Weekly equivolume best depicts the accumulation of ERG over the past 5 months, with far broader bars (signaling heavy volume) in the rallies at [1] and [2] than in the previous down-trend. I had to use a log scale because of the spectacular decline over the previous 3 years: from 42.00 to below 1.00.

If Relative Strength respects its support level on the next pull-back, the stock should present entry opportunities.

1 will be rich;

4 will be comfortable;

56 will be on Government support;

34 will be dead.

~ please don't challenge me on these statistics, I got them off a pamphlet.

The moral of the story: focus on getting into the top 5

but don't forget the real priority is to stay out of the bottom 34.

Confused by daylight saving?

See Time Zones for details of how daylight saving adjustments affect you.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.