See the What's New page for details.

Trading Diary

August 28, 2002

The Nasdaq Composite gapped downwards, falling 2.5% to close at 1314. The secondary rally may be reversing. The primary cycle is in a down-trend.

The S&P 500 lost 17 points to close at 917. The primary trend is down, with a secondary correction.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (August 27).

Intel CEO Craig Barret's cautious outlook on the computer industry weighs heavily on the market. (more)

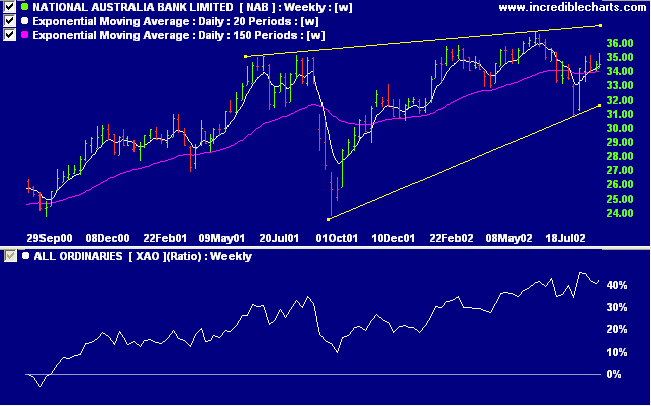

NAB closed its foray into the US market with the sale of its last mortgage servicing rights to Washington Mutual, at a loss of $104 million. (more)

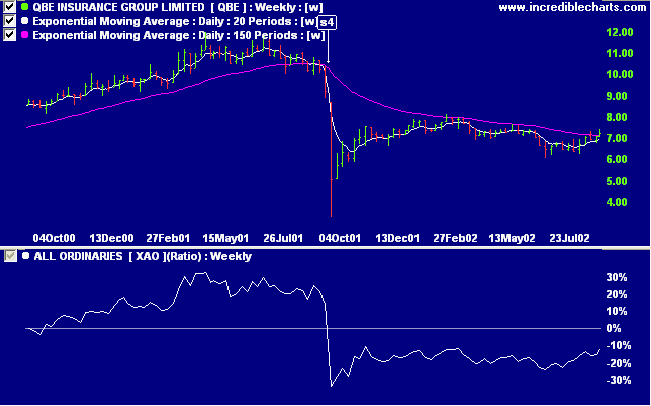

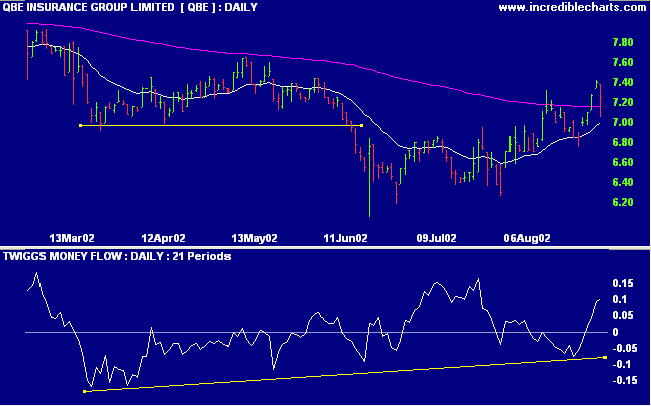

QBE Insurance reported a 6% drop in net profit for the half-year to 30 June and predict 10% to 15 % growth for next year. (more)

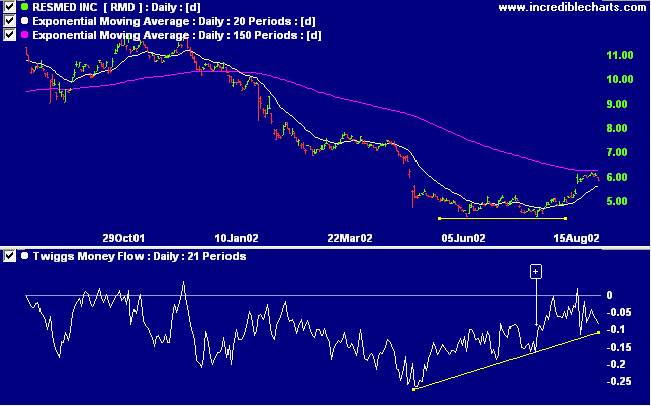

RMD has built a broad base after a lengthy down-trend. The 150-day moving average has leveled out while relative strength (price ratio: xao) is recovering. Twiggs money flow and MACD have completed bullish divergences.

It is not necessary to get everything right - but it is necessary to get the right things right.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.