|

US DATA UPDATE. We have received a corrupted file from our US data suppliers and are awaiting a replacement. Please note that Index time stamps may show 01Sep2003 but the data for that day is blank. We will send a later revision when the correction is through. |

Trading Diary

September 1, 2003

The Commerce Department reports that consumer spending, which accounts for about two-thirds of economic activity, grew 0.8 percent in July, compared to 0.6% in June. (more)

The yield on 10-year treasury notes is almost unchanged from last week at 4.45%.

The intermediate and primary trends are both up.

New York (13.30): Spot gold ended the week up at $375.30.

The primary trend is up.

Price has broken above a symmetrical triangle, with a target of 420. There may still be some resistance at 382.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above;

Twiggs Money Flow signals accumulation.

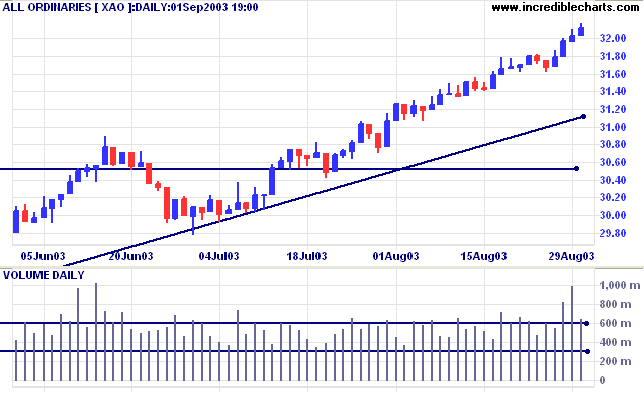

Short-term: Go long if the All Ords is above 3203. Go short if the intermediate trend reverses.

Intermediate: Go long if the index is above 3160.

Long-term: Take long positions if the index is above 2978 .

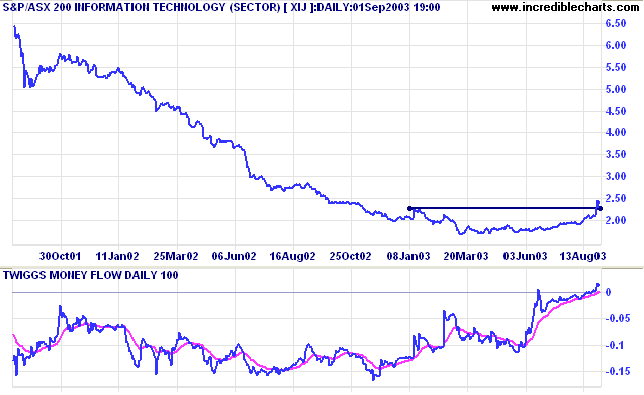

Like Lazarus rising from the dead, the IT sector index [XIJ] has made a new high for 2003, signaling a primary up-trend.

Relative Strength, MACD and Twiggs Money Flow (100) are all rising.

MACD is bullish; Relative Strength is rising; while Twiggs Money flow still lingers below zero, signaling distribution.

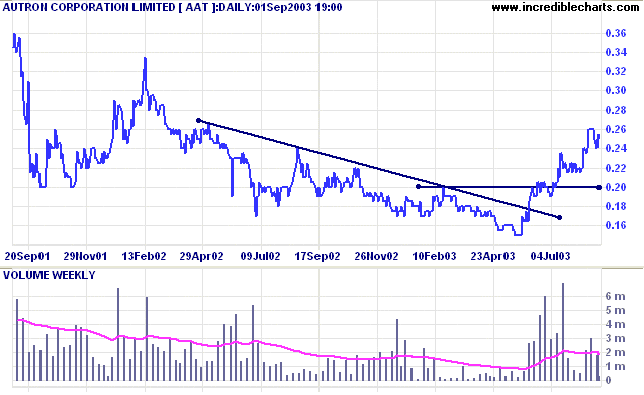

V-bottoms often retreat to re-test support levels at the base.

MACD and Relative Strength are both level, while Twiggs Money has fallen back below zero, signaling distribution, after a sharp upward spike.

MACD has completed a bearish trough below zero; Relative Strength is falling; and Twiggs Money Flow signals strong distribution.

Relative Strength is rising; MACD is bullish; while Twiggs Money flow still signals distribution after a sharp drop in May.

MACD is bullish; Relative Strength is rising; while Twiggs Money Flow still signals distribution.

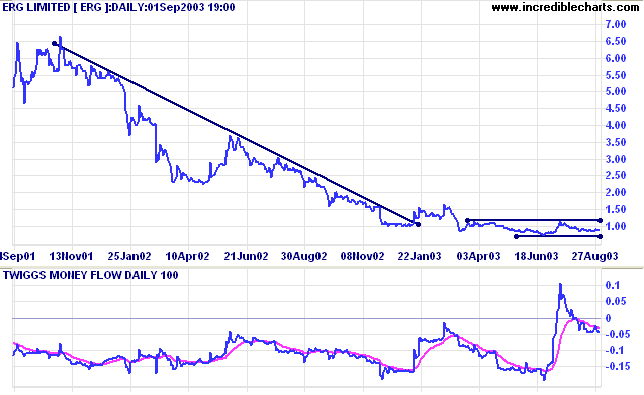

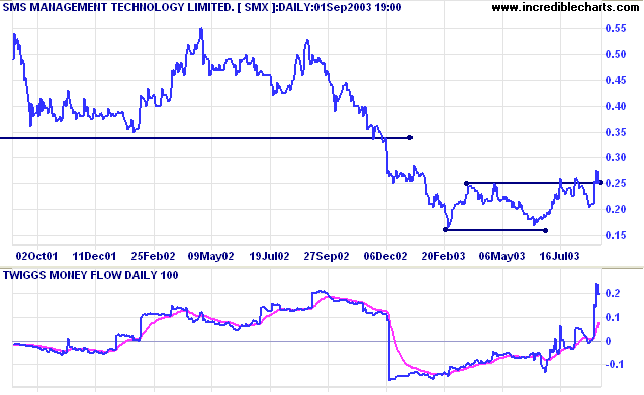

Twiggs Money Flow has spiked sharply, signaling strong accumulation; MACD is fairly bullish and Relative Strength threatens to make a new 3-month high.

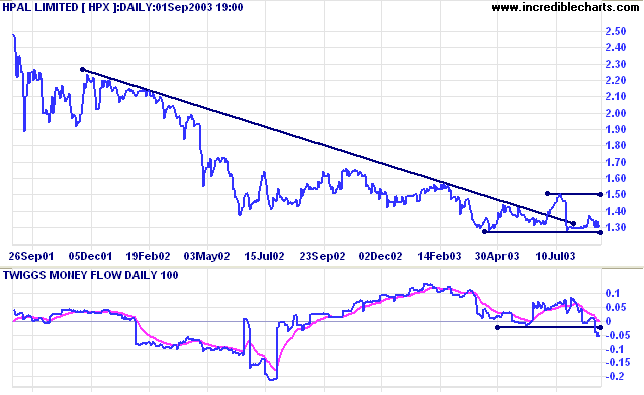

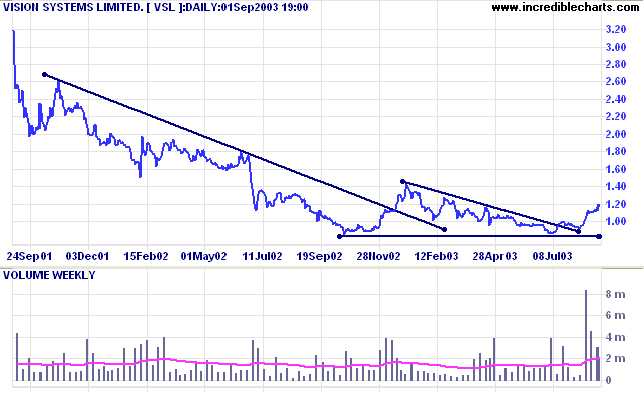

Relative Strength is rising; MACD is fairly bullish; while Twiggs Money Flow signals a bearish divergence.

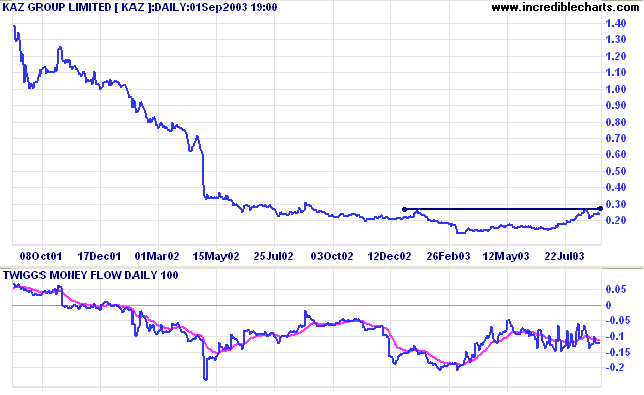

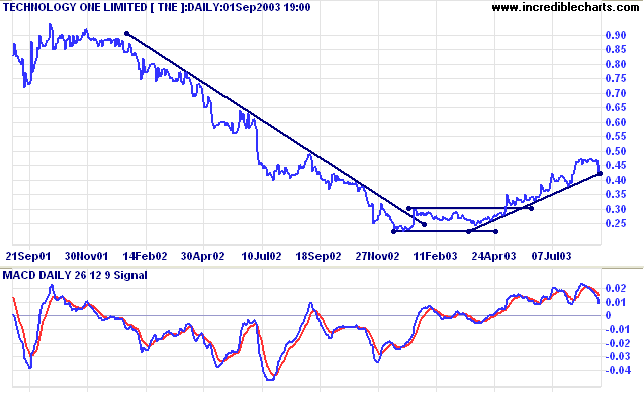

MACD is bullish; Relative Strength is rising; but Twiggs Money Flow still signals distribution.

A break below the trendline would be a further bear signal.

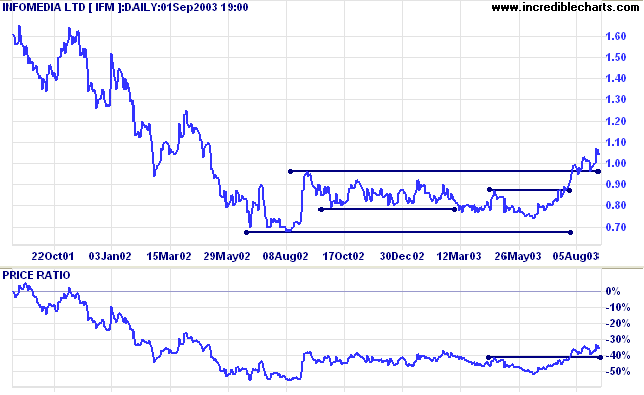

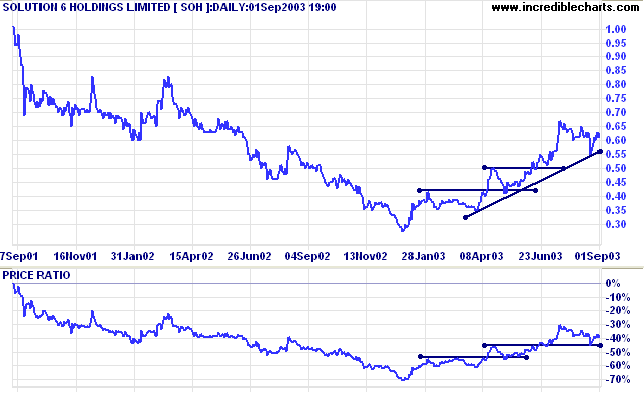

Relative Strength has formed a bullish 3-month high; Twiggs Money Flow signals strong accumulation; and MACD is bullish.

to get advice from those who take the subway.

~ Warren Buffet

|

To search for a stock in the Trading Diary archives,

use the normal Search function at the top of the

website page.

Example: To search for Newscorp entries in the current

year, enter +[ncp] +"back issues" in the

search field.

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.