Trading Diary

November 11, 2003

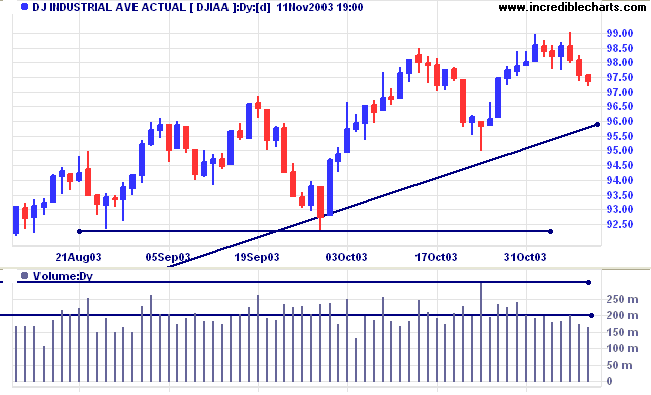

The intermediate trend is down.

The primary trend is up. A fall below 9000 would signal reversal.

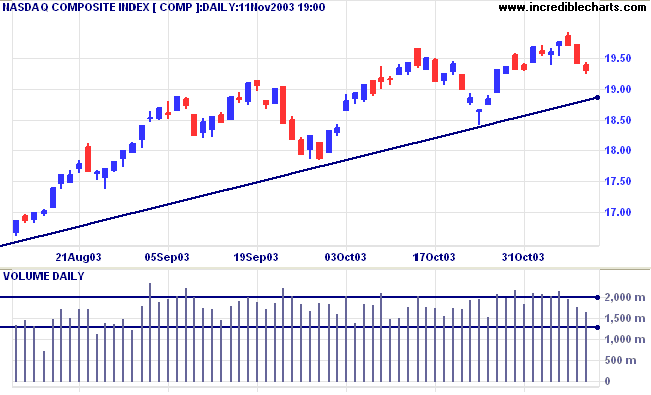

The intermediate trend is up. Expect resistance at 2000 to 2060.

The primary trend is up. A fall below 1640 will signal reversal.

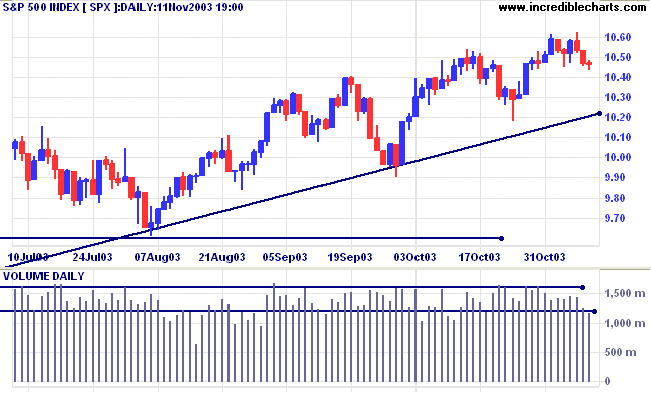

The intermediate trend is up. Expect resistance at 1100, a significant support level from 2001/02.

The primary trend is up. A fall below 960 will signal reversal (the low from the secondary correction in August).

Short-term: Bullish if the S&P500 is above 1048 (Tuesday's High). Bearish below 1043 (Tuesday's Low).

Intermediate: Bullish above 1062 (Friday's High).

Long-term: Bullish above 960.

There was no trade on CBOE interest rate instruments on Tuesday. The yield on 10-year treasury notes on Monday was 4.46%.

The intermediate trend is up.

The primary trend is up.

New York (19:39): Spot gold continues to rise, currently at $387.60.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

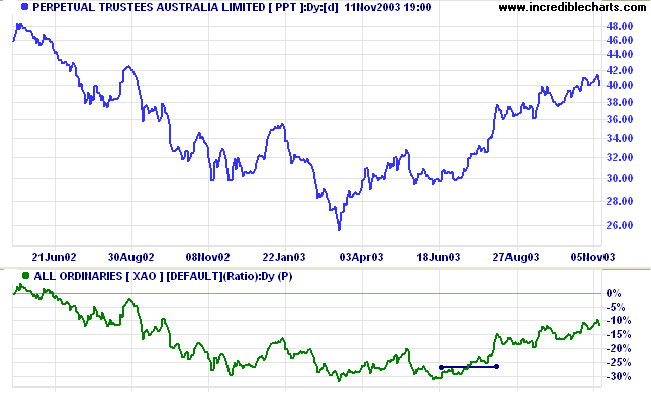

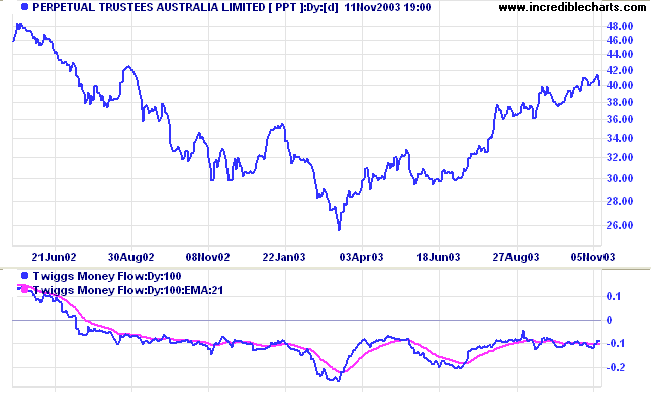

MACD (26,12,9) and Slow Stochastic (20,3,3) are both below their signal lines, while Twiggs Money Flow (100) has crossed below zero after a bearish triple divergence.

-

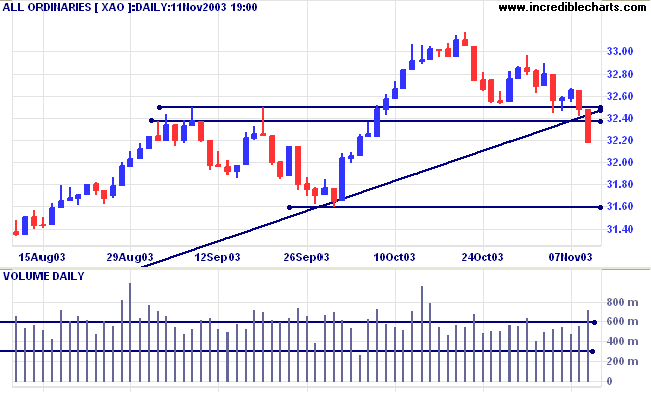

At the previous peak (3238 to 3250 on the

above chart), where former resistance has become support.

Failure to penetrate this initial level (often roughly a 50%

retracement) signals a strong up-trend.

- At the previous support level (3160 to 3165 on the above chart), from the last trough. When the index has retraced 100% of the previous up-swing. Penetration will signal a primary trend reversal; while failure to do so will most likely result in a consolidation pattern before continuation of the up-trend.

Short-term: Bearish below 3238.

Intermediate: Bearish below 3160. Bullish above 3250. The intermediate trend is down but a swing back above resistance would be bullish.

Long-term: Bearish below 3160. The index has penetrated the primary trendline and a fall below support at 3160 will signal reversal. The primary trend is up but the rally is extended: probability of a reversal increases with each successive primary trend movement.

Last covered September 8, 2003.

Within the Financial-x-Property sector [XXJ] there are two industries that have run counter to the dominant banking industry: Investment and Insurance.

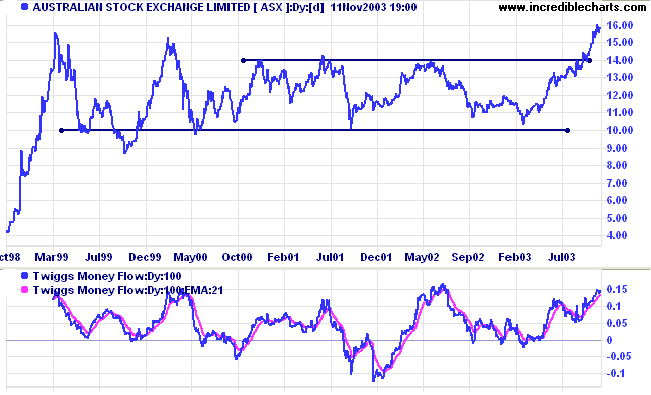

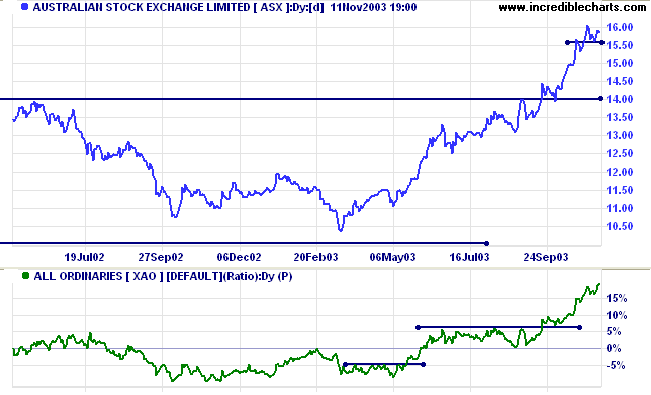

ASX has broken out of a long-term trading range, while Twiggs Money Flow (100) is bullish, having completed a higher low - higher high sequence.

It would be prudent to wait for a pull-back that respects support at 14.00.

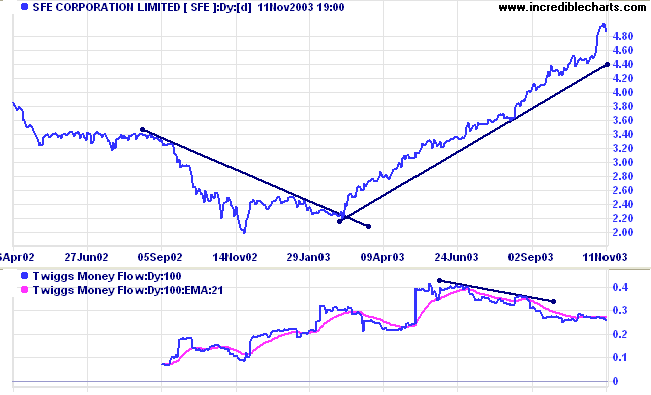

SFE is also in a strong up-trend with Twiggs Money Flow (100) displaying a bearish divergence.

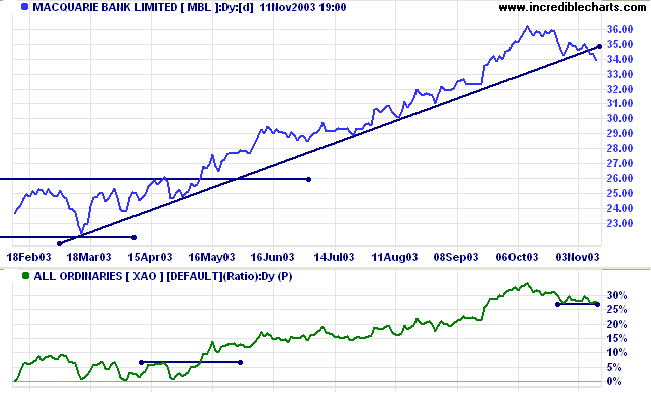

Last covered January 14, 2003.

Macquarie Bank broke below its primary supporting trendline while Relative Strength (xao) is weakening.

Last covered on August 20, 2002.

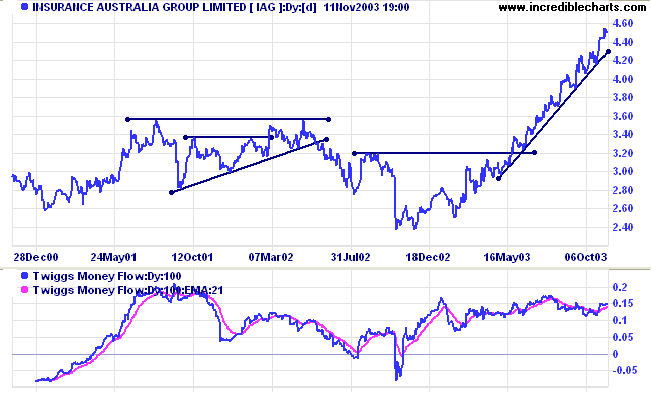

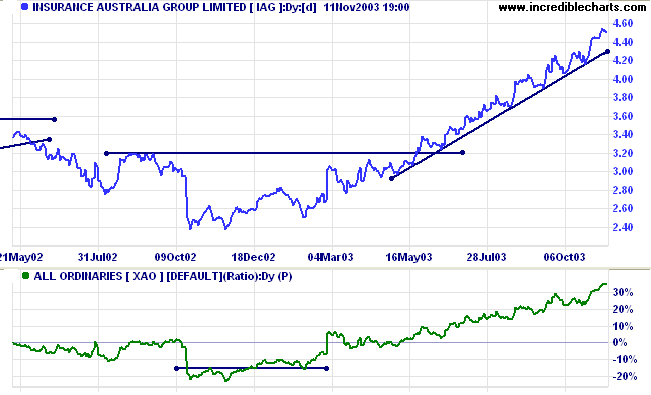

IAG displays a strong up-trend with Twiggs Money Flow (100) signaling accumulation.

The trend is extended and I am hoping for a pull-back soon.

Last covered on May 5, 2003.

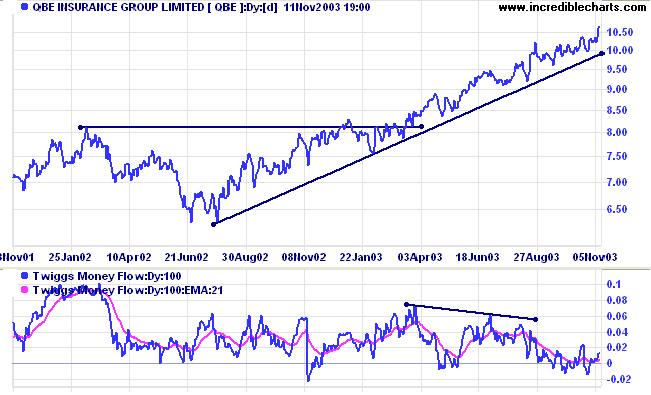

QBE displays a similar strong up-trend, with Relative Strength (xao) rising. But Twiggs Money Flow (100) signals a bearish divergence.

~ John Maynard Keynes: in a letter to J.Viner.

There is a lively debate on the Chart Forum at Chart Patterns: Linear vs Log.

The discussion has focused on trendlines (and some interesting interpretations):

Do you prefer to draw trendlines on Linear (Normal) or Log scale charts?

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.