|

Searching for ETOs and

Warrants You will need to upload the menu before doing a search: (1) select Securities >> ASX ETOS & WARRANTS >> Upload ASX ETOS & WARRANTS Menu; and (2) click Yes if you want the menu to update at the start of each session. US stocks will follow shortly. |

Trading Diary

October 16, 2003

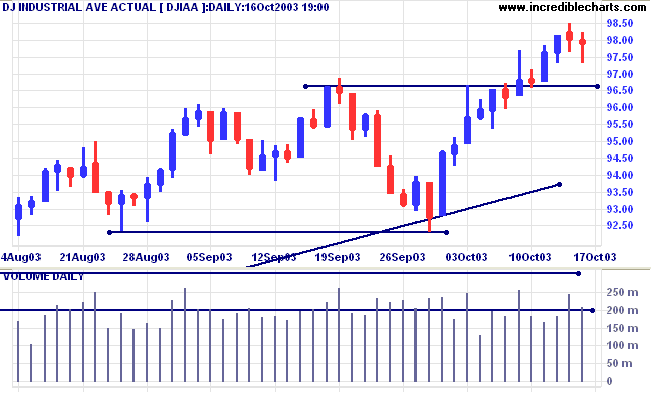

The intermediate trend is up.

The primary trend is up. A fall below 9230 would signal reversal.

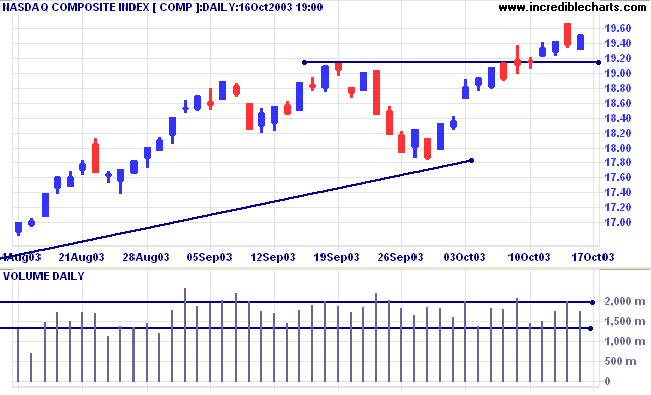

The intermediate trend is up.

The primary trend is up.

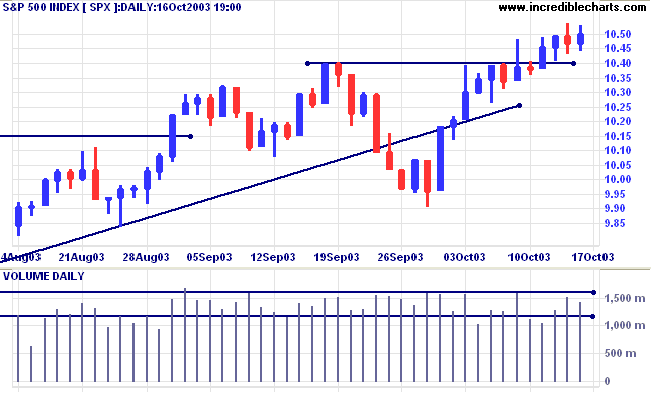

The intermediate trend is up.

The primary trend is up.

Short-term: Bullish if the S&P500 is above 1043.

Intermediate: Bullish above 1043.

Long-term: Bullish above 990.

The Fed reports that industrial production rose 0.4% in September, against 0.1% in August. (more)

New unemployment claims fell to 384,000 last week, compared to a revised 388,000 the week before. (more)

The yield on 10-year treasury notes climbed to 4.46%.

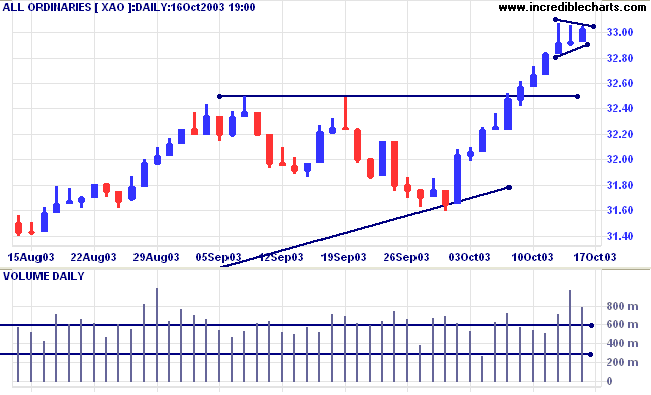

The intermediate trend is up.

The primary trend is up.

New York (20:56): Spot gold eased to $371.00.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

The primary trend is up. The rally is extended after 3 secondary corrections back to the trendline; the probability of a reversal increases with each consecutive rally.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line having completed another bearish divergence.

Short-term: Bullish if the All Ords is above 3307.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160. Tighten stops (to intermediate level) when the secondary rally ends.

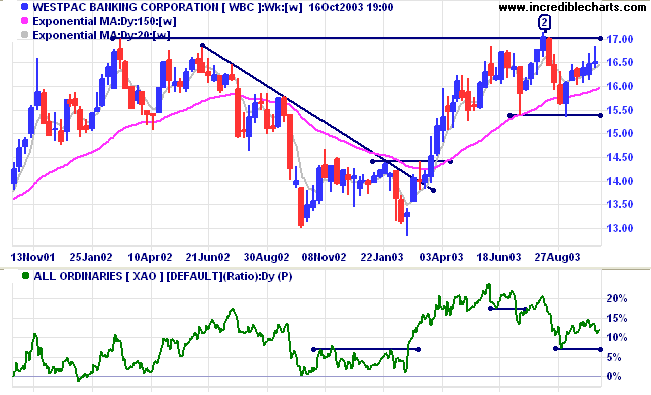

Last covered July 22, 2003.

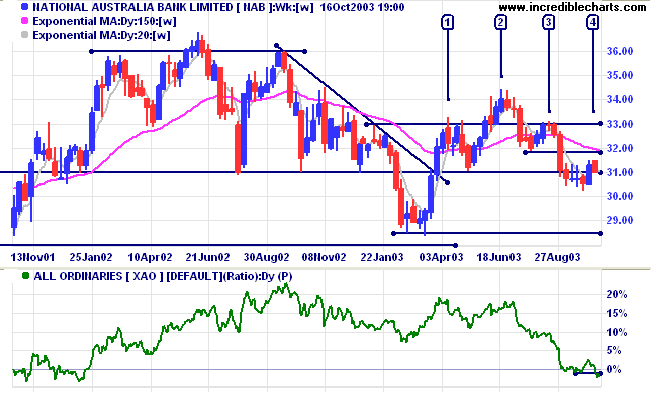

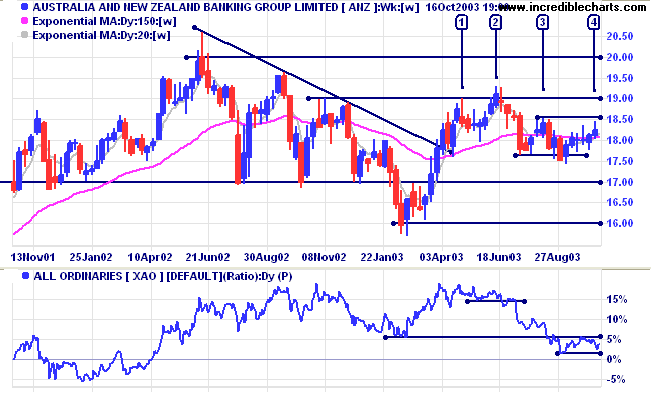

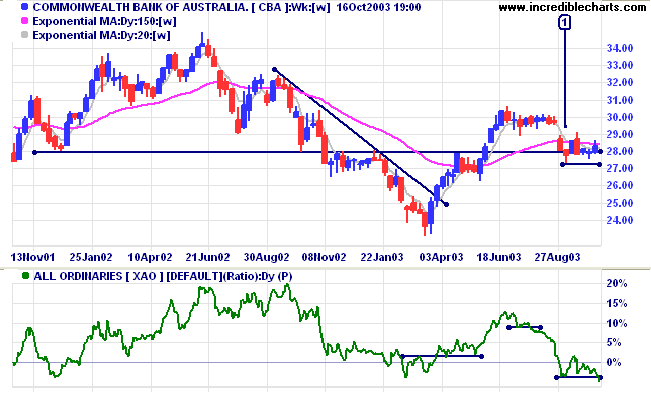

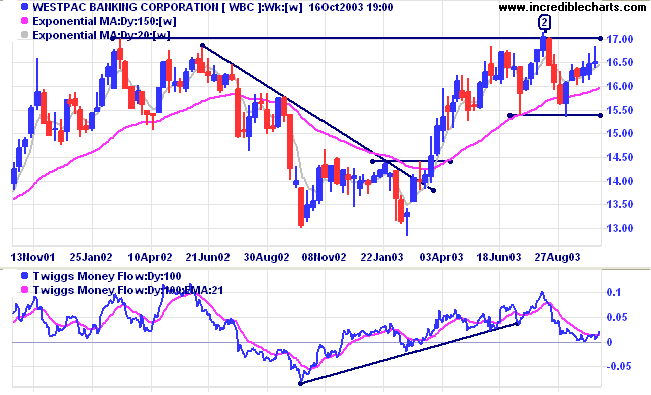

The major banks have lost momentum since their upward drive in the first half of the year and now appear headed for a re-test of support levels.

~ Will Rogers, cowboy humorist (1879 - 1935).

|

ETOs and warrants are only updated after the market

close. We will add hourly updates when the data feed is available from our data supplier. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.