| Searching the Trading Diary Archives |

Use the normal Search function at the top

of the website page:

EXAMPLE |

Trading Diary

July 22, 2003

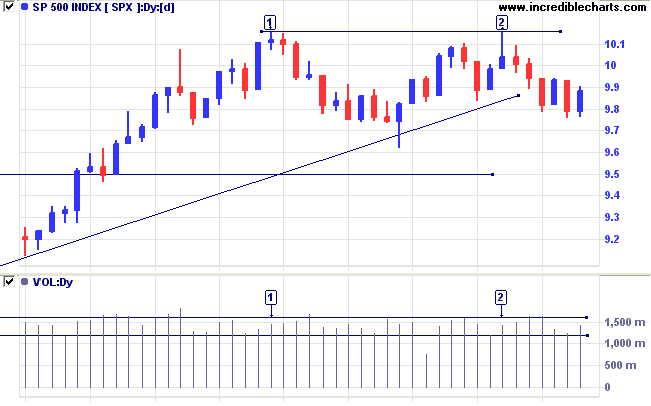

The intermediate trend is up. A fall below 8968 will signal a reversal.

The primary trend is up.

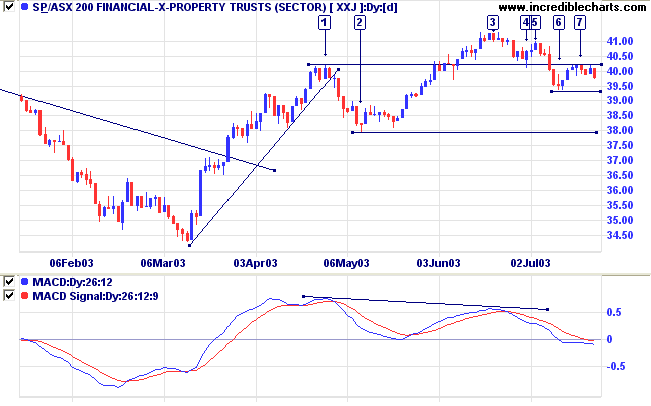

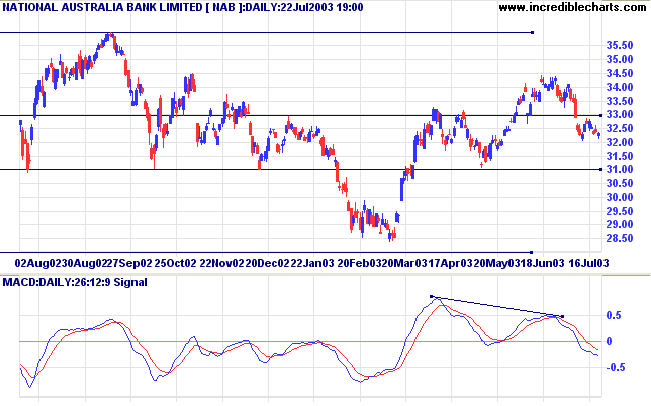

The intermediate trend has turned down. MACD shows a bearish divergence.

The primary trend is up.

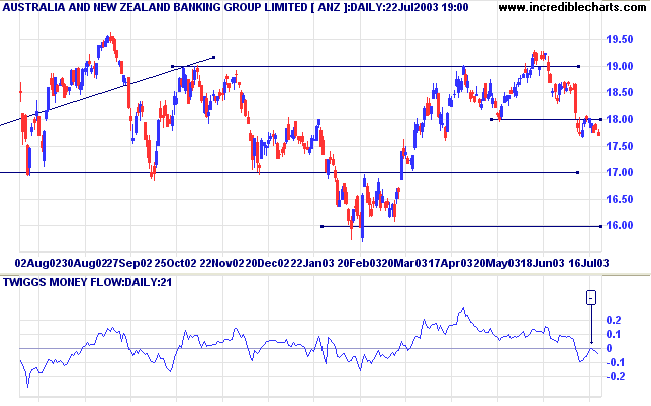

The intermediate trend is up. If price respects support at 1680, this will signal trend strength.

The primary trend is up.

Short-term: Long if the S&P500 is above 994. Short if below 975.

Intermediate: Long if S&P 500 is above 1015. Short if below 962.

Long-term: Long.

Treasury Secretary John Snow expects higher GDP growth and lower unemployment in the second half of the year. (more)

The Internet retailer reported earnings (before charges) of 10 cents a share for the second quarter, compared to forecasts of 6 cents. (more)

The yield on 10-year notes eased slightly to 4.12%.

The intermediate trend is up; the primary trend is down.

New York (18.37): Spot gold has leveled out at $351.20.

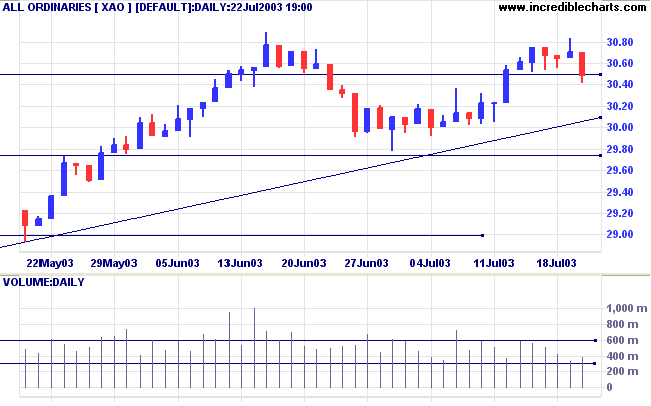

The primary trend is up.

The intermediate trend is up.

The primary trend is up (marginally).

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3071; short if below 3050.

Intermediate: Long if the index is above 3083; short if below 2979.

Long-term: Long if above 2979.

Financials-X-Property [XXJ] has weakened over the last month, with lower highs at [5] and [7]. The latest high at [7] was unable to break through resistance from the previous low [4] and the high of [1], signaling trend strength. MACD shows a bearish divergence and we are likely to see a test of support at 38.00.

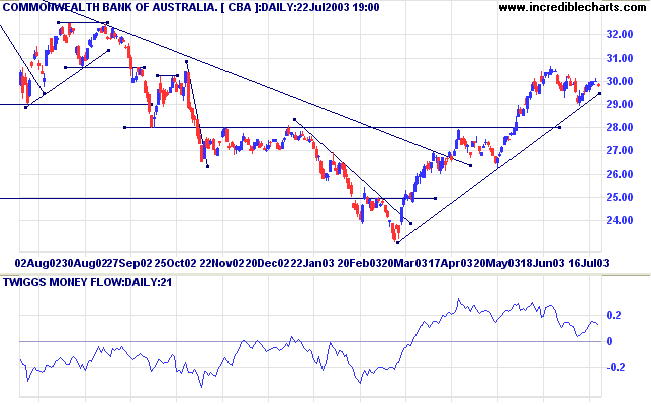

MACD shows a bearish divergence, while Twiggs Money Flow (21) and Relative Strength (price ratio: xao) are weak.

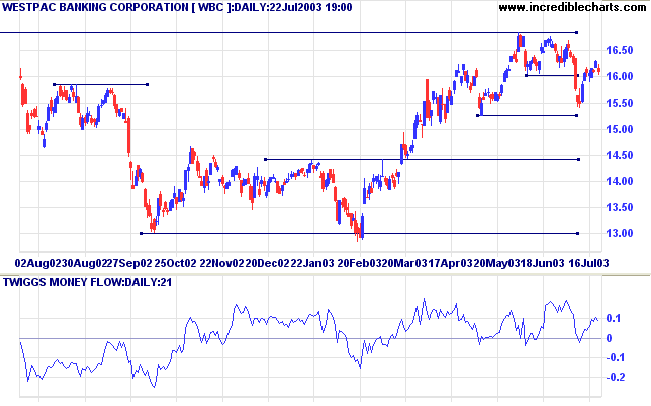

MACD is bullish; Relative Strength (price ratio: xao) is rising; and Twiggs Money flow (21) signals accumulation.

but rather the striving and struggling for some goal worthy of him.

What he needs is not the discharge of tension at any cost,

but the call of a potential meaning waiting to be fulfilled by him.

~ Viktor Frankl: Man's Search For Meaning (1963).

|

Chart Forum: Email Notification by Thread |

|

Members can now elect to receive emails

in respect of a specific thread on the Chart Forum, and

not the entire Topic: (1) Open your Profile; (2) Click the Choose button next to the Topic; (3) Select a specific thread. For example, a member who wants to receive mail from the Melbourne East Trading Group can select Melbourne East, rather than receive mail in respect of every trading group under that topic on the Forum. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.