Trading Diary

November 10, 2003

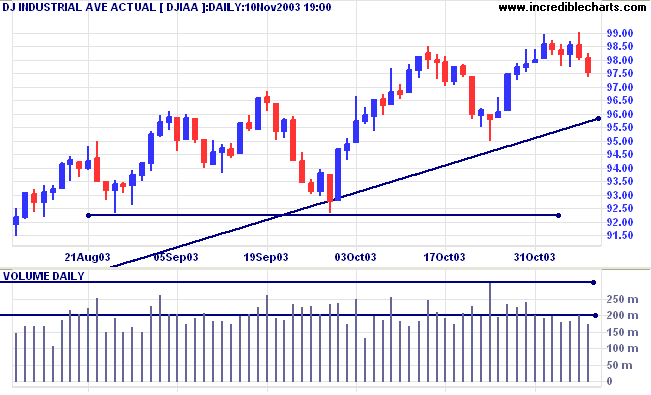

The intermediate trend is down.

The primary trend is up. A fall below 9000 will signal reversal.

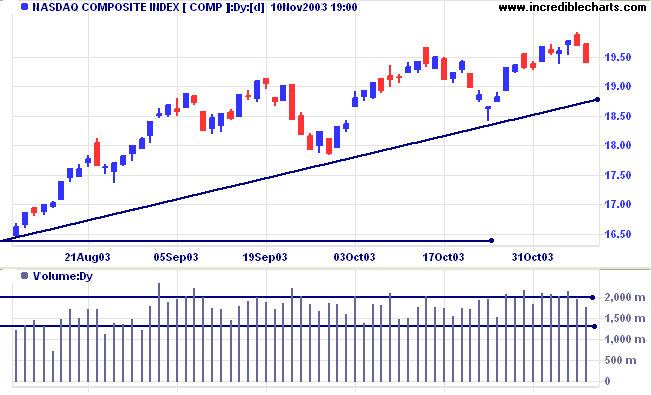

The intermediate trend is up. Expect resistance at 2000 to 2060.

The primary trend is up. A fall below 1640 will signal reversal.

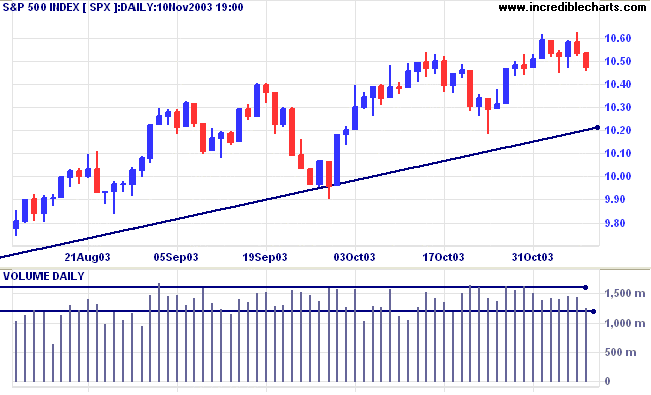

The intermediate trend is up. Expect resistance at 1100.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1062. Bearish below 1045.

Intermediate: Bullish above 1062.

Long-term: Bullish above 960.

Despite several chip stock upgrades, techs sank lower at the start of the week. (more)

The yield on 10-year treasury notes increased slightly to 4.46%.

The intermediate trend is up.

The primary trend is up.

New York (16:49): Spot gold has recovered to $385.70.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

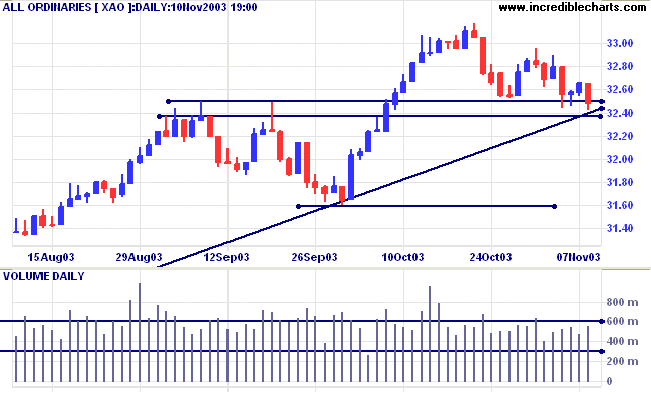

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. The index is testing the primary trendline, but only a fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3267. Bearish below 3238.

Intermediate: Bullish above 3267.

Long-term: Bullish above 3160.

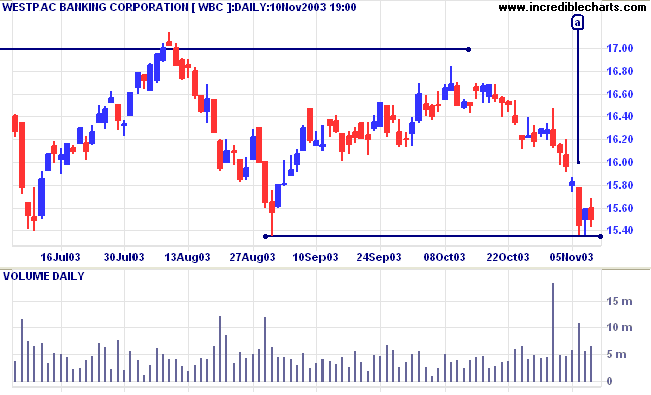

Last covered October 27, 2003.

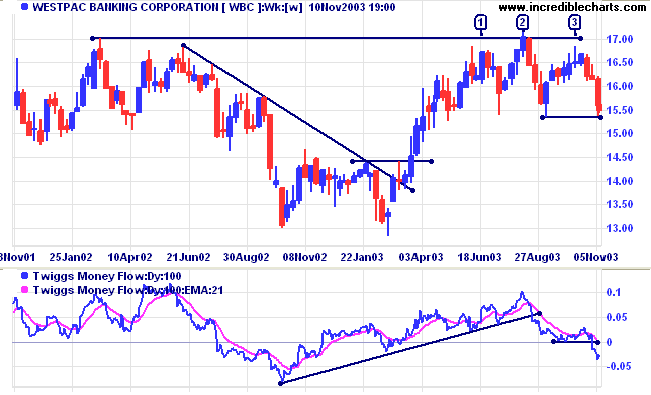

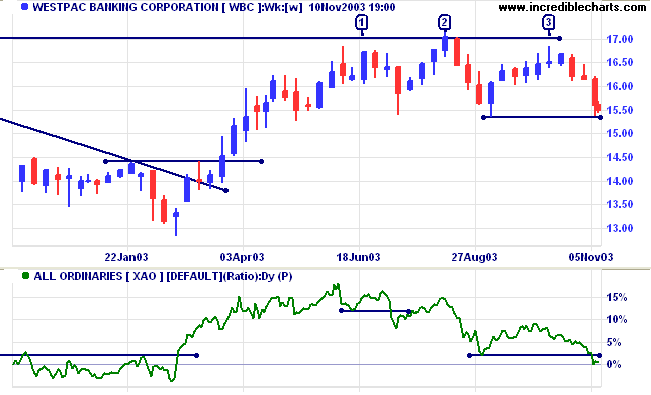

After a false break above the previous high of 17.00 at [2], WBC threatens to complete a head and shoulders reversal. The head is at [2], with shoulders at [1] and [3]. I prefer to draw the neckline horizontally from the low between [2] and [3], at 15.35. This is not in accordance with the classic H&S chart pattern, which would draw a sloping neckline, but it does coincide with a trend change in terms of Dow Theory: a lower high at [3] followed by a break below the previous low - to me a more meaningful signal.

Twiggs Money Flow (100) displays a strong bear signal, falling below the previous low as well as crossing below zero.

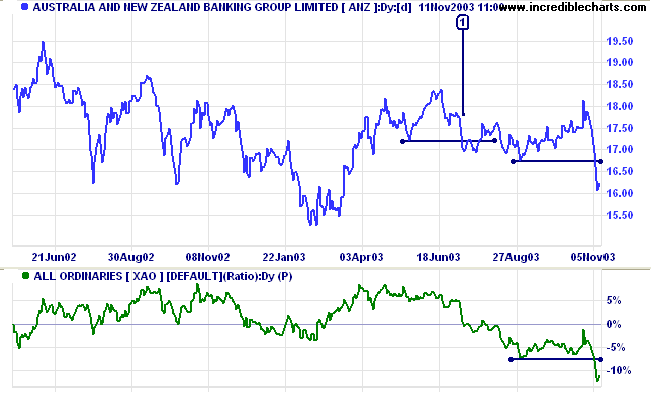

Last covered October 16, 2003.

ANZ continues to fall after an earlier trend reversal at [1]. Relative Strength (xao) and Twiggs Money Flow (100) are bearish.

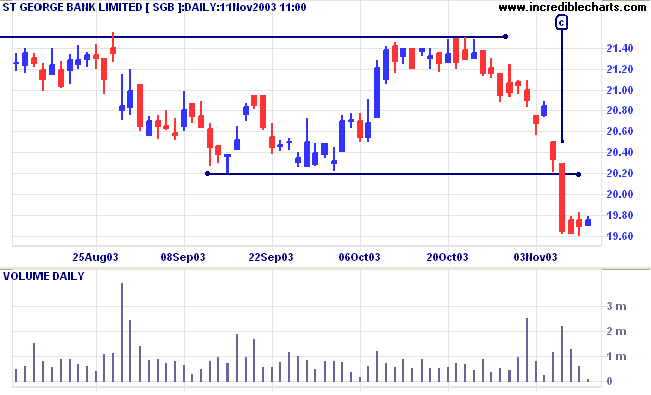

Last covered November 6, 2003.

SGB appears to be consolidating after the sharp drop at [c]. Declining volume supports a bearish continuation signal.

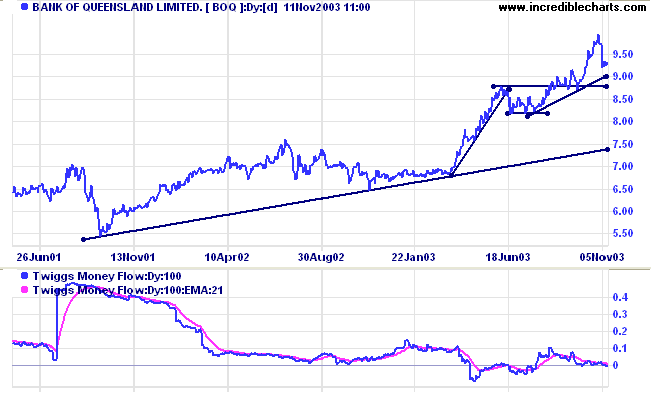

Last covered on July 7, 2003 (before the rights issue on August 20, 2003 with a dilution factor 0.98).

I will be watching stocks such as BOQ, which have not followed the sector trend, for signs of weakness.

|

So far as any inferences from the

Dow-Jones stock averages is concerned

the major bull market in stocks is still

ruling......... Sometime, and probably next year, we shall experience a marked shortage of capital for investment and speculation, and the stock market will know it first. It will develop a major downward movement, when the whole country is bubbling with prosperity and ever expanding hope. ~ William Peter Hamilton: The Wall Street Journal (November 9, 1925). |

(shades of Von Mises' credit expansion)

The error was due to manual intervention on our part.

The update is now in place.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.