|

Daylight Saving ASX As of 26 October 2003, Daylight Saving started in New South Wales, Victoria, South Australia and the ACT. Market hours remain unchanged in these States but will commence one hour earlier in all other States. NYSE/Nasdaq As of 26 October 2003, Daylight Saving ended in New York. NYSE/Nasdaq market hours (and updates) commence 2 hours later in New South Wales, Victoria, South Australia and the ACT and one hour later in all other States. |

Trading Diary

October 27, 2003

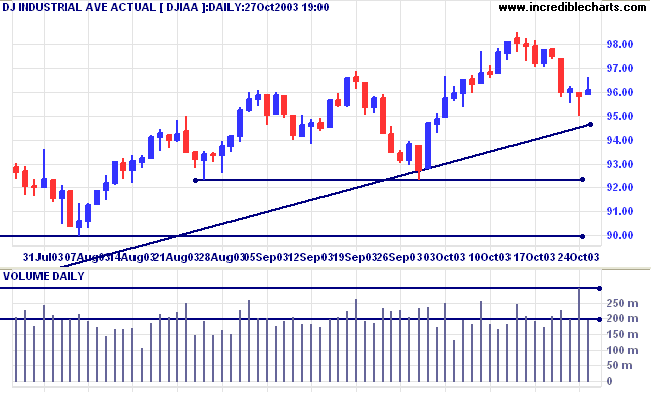

The intermediate trend is down.

The primary trend is up. A fall below 9000 will signal reversal.

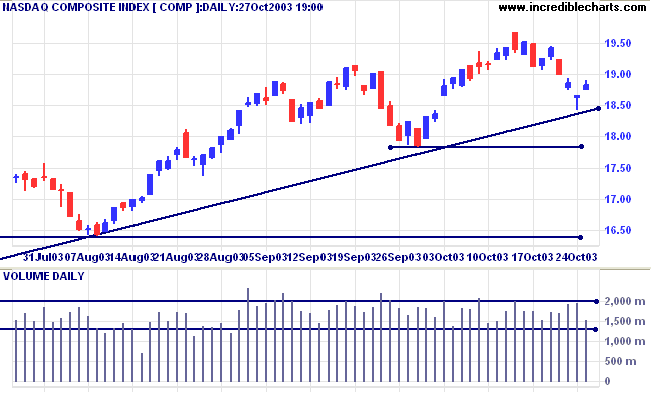

The intermediate trend is down. Expect support at 1783.

The primary trend is up. A fall below 1640 will signal reversal.

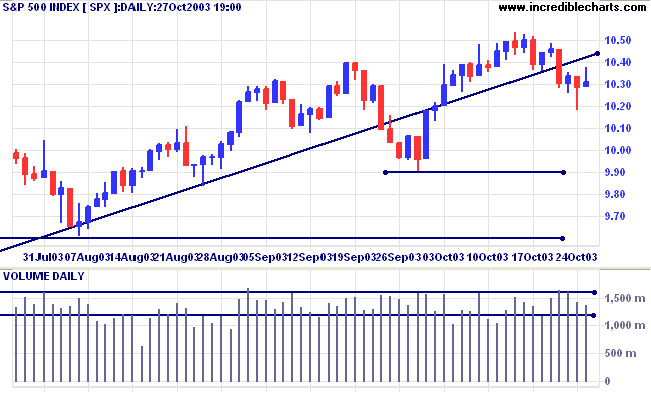

The intermediate trend is down.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1054. Bearish below 1026.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

The Fed is set to meet Tuesday but is expected to leave rates unchanged. (more)

The yield on 10-year treasury notes rallied slightly to 4.26%.

The intermediate trend is down.

The primary trend is up.

New York (17:32): Spot gold eased slightly to $387.20.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

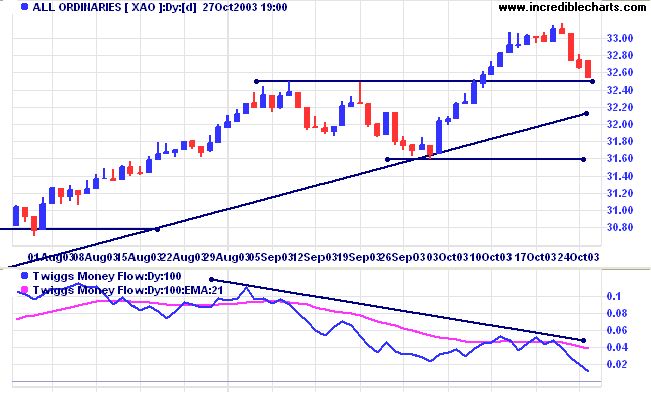

The primary trend is up. The rally is extended and the probability of a reversal increases with each successive primary trend movement.

A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3238.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

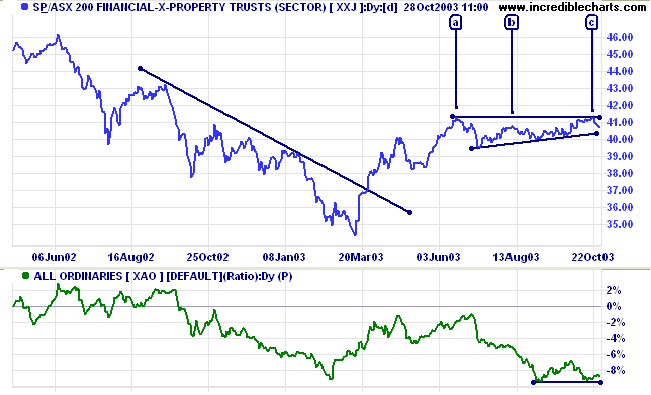

The Financials-X-Property index [XXJ] has consolidated over the period from [a] to [c]. This is not really an ascending triangle because of the lower high at [b]. Relative Strength has fallen markedly over this period but now appears to have formed equal lows in the past 2 months. A fall of RS below the recent lows will be a bear signal; a rise above the October high will be bullish.

~ Mark Douglas: Trading in the Zone.

Some traders use cross-hairs to line up bars on a chart, or to check the date or price level:

(1) Select View >> Crosshair Cursor on the main menu.

(2) Click and hold the mouse pointer at the desired location and cross-hairs will appear.

If you have used Zoom on a chart, depress the ALT key before using the Crosshairs.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.