|

Incredible Charts version

4.0.2.600 The new version contains some adjustments necessary for the loading of ETOs and Warrants: members who had selected Time Period >> Chart 3 Years Data [Quicker], were receiving 404 errors - file not found. See What's New for details. Check Help >> About to ensure that you have received the automatic update. |

Trading Diary

October 20, 2003

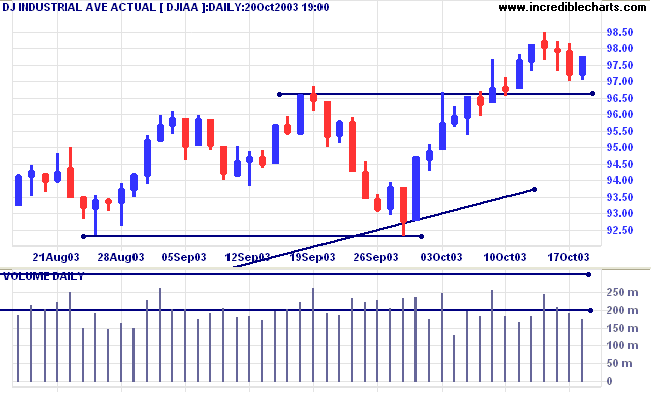

The intermediate trend is up. An up-turn above 9660 will signal trend strength.

The primary trend is up. A fall below 9000 will signal reversal.

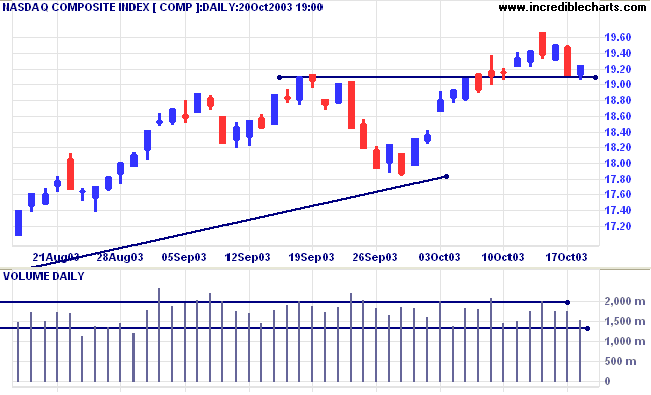

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal.

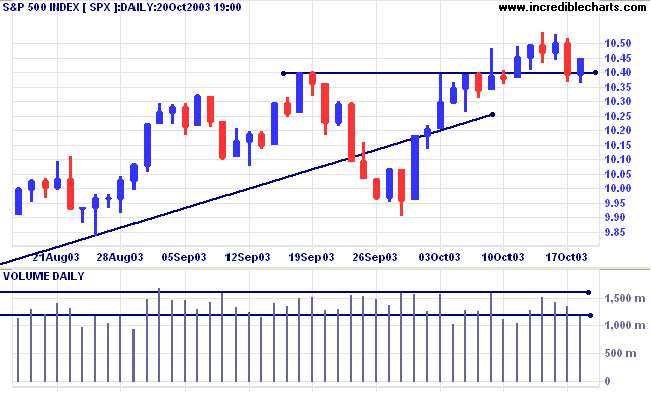

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1045.

Intermediate: Bullish above 1045.

Long-term: Bullish above 960.

Economists received mixed signals from leading indicators for September. (more)

The yield on 10-year treasury notes eased to 4.38%.

The intermediate trend is up. Expect resistance at 4.60%.

The primary trend is up.

New York (13.30): Spot gold is up slightly at $373.50.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

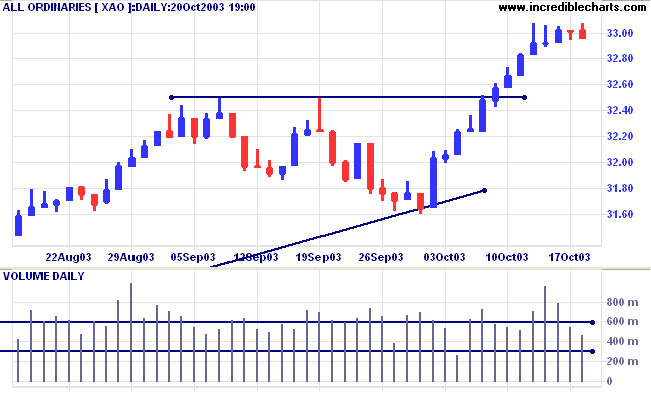

The primary trend is up. A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed above; Twiggs Money Flow (100) is below the signal line and displays a "triple" bearish divergence.

Short-term: Bullish if the All Ords is above 3307. Bearish below 3283.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160.

A new sub-industry was highlighted by weekly stock screens:

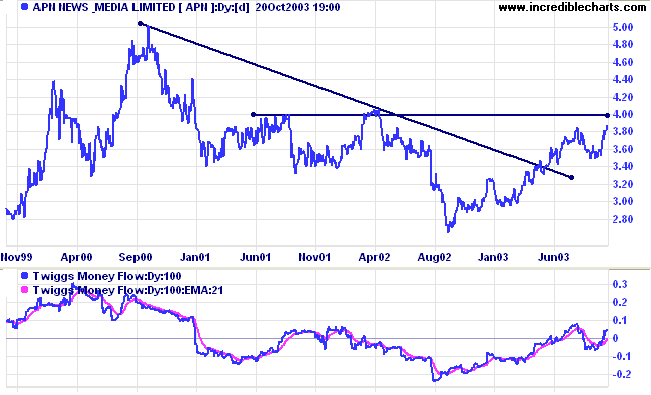

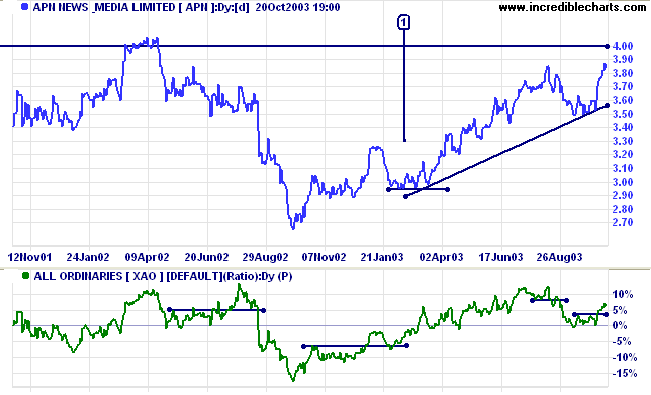

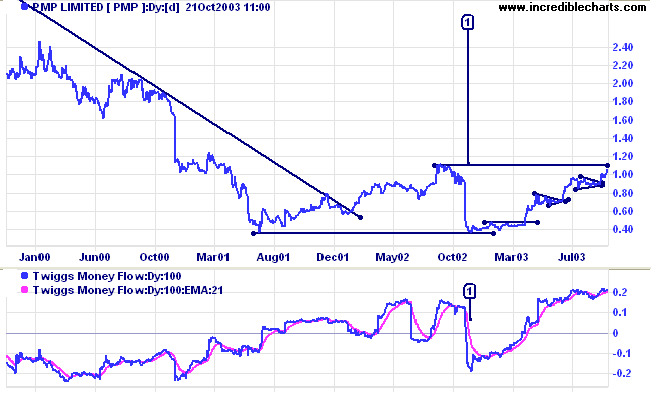

Twiggs Money Flow (100) has risen above zero, signaling accumulation.

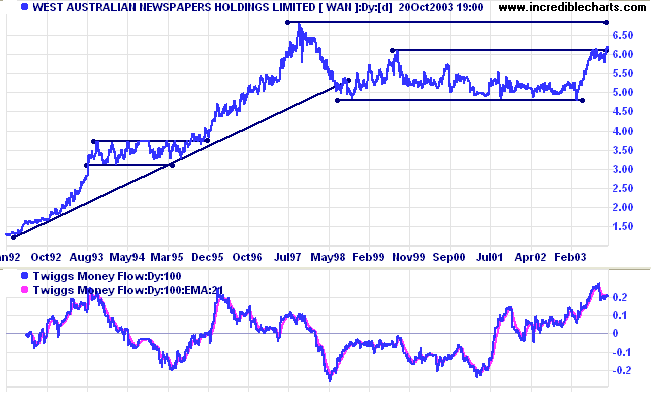

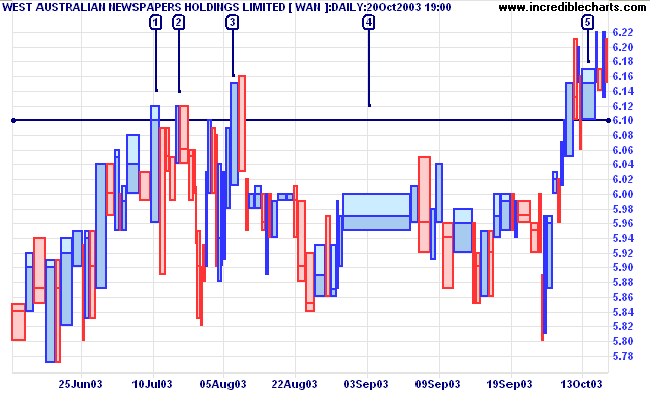

Relative Strength (price ratio: xao) is recovering, after a secondary correction. Price is likely to encounter strong resistance at 4.00: there has been insufficient volume on the sell-off in 2002.

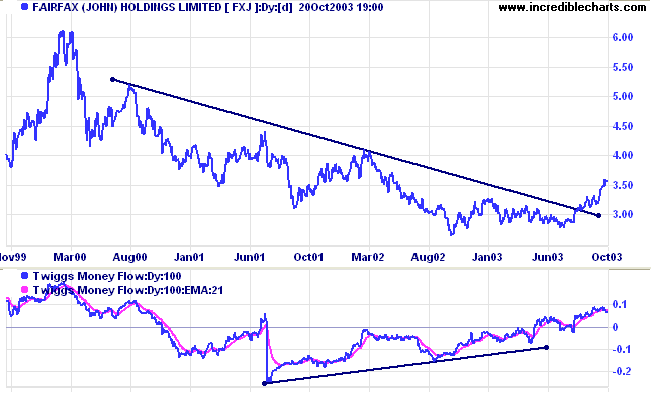

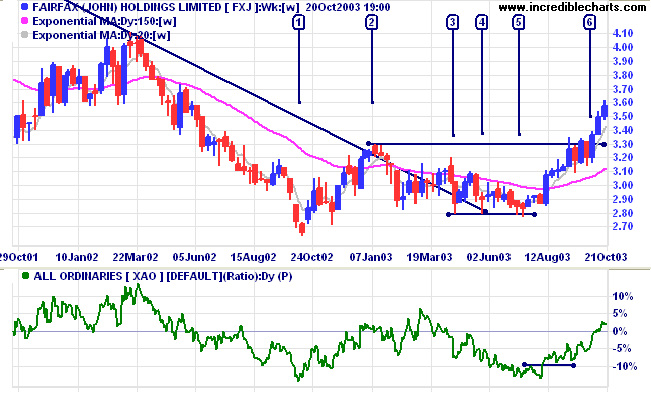

Twiggs Money Flow (100) signals strong accumulation. The target is overhead resistance at 6.80.

conversely, when a market is oversold, the tendency is to become dull on declines and active on rallies.

Bull markets terminate in a period of excessive activity and begin with comparatively light transactions.

~ Robert Rhea: Dow Theory (1932).

For faster loading, select Time Period >> Chart 3 Years Data.

The smaller files enable quicker loading.

To restore the complete data history,

select Time Period >> Chart Complete Data.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.