Trading Diary

July 5, 2002

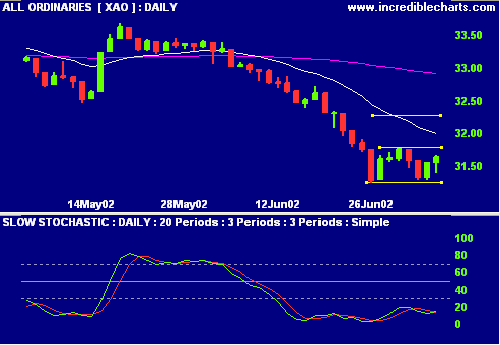

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite rallied almost 5% to

1448.

The primary and secondary cycles are in a down-trend.

The S&P 500 gained 35 points to 989.

Primary and secondary cycles trend downwards.

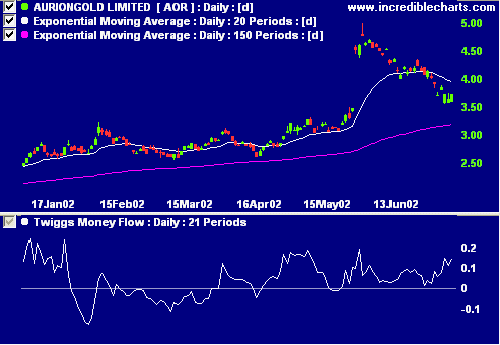

AOR has made a correction (secondary cycle) back towards the long-term moving average

Sector Analysis

Stage

changes are highlighted in red.

Energy [XEJ] - stage 1

Materials [XMJ] - stage 4 (RS is rising)

Industrials [XNJ] - stage 4

Consumer Discretionary [XDJ] - stage 4

Consumer Staples [XSJ] - stage 3

Health Care [XHJ] - stage 4

Property Trusts [XPJ] - stage 2

Financial excl. Property Trusts [XXJ] - stage 3

Information Technology [XIJ] - stage 4

Telecom Services [XTJ] - stage 4 (RS is rising)

Utilities [XUJ] - stage 1

The ASX has ceased to provide the old ASX indices.

Sectors: Relative Strength

A stock screen of equities using % Price Move (1 month:

+10%, 1 year: +30%) is dominated by Gold Explorers

(Producers are notably absent). Oil & Gas Explorers,

Mineral Sands and Diversified Media stocks are also

evident.

Colin Twiggs

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.