|

ETOs and

Warrants ETOs and warrants are now available. The data feed has given us a few problems so this section will remain as beta until we are satisfied that all the bugs have been ironed out. US stocks will follow. |

Trading Diary

October 15, 2003

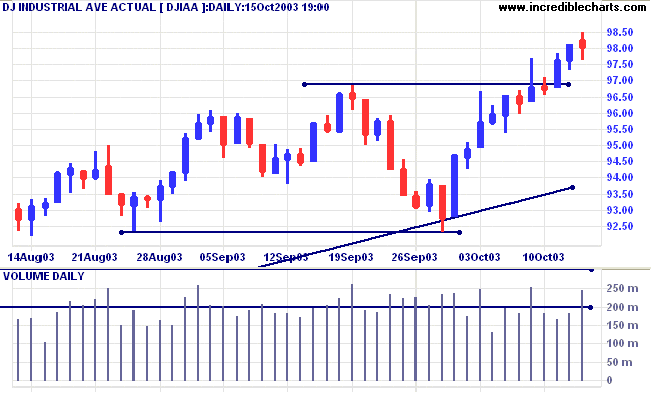

The intermediate trend is up.

The primary trend is up. A fall below 9230 would signal reversal.

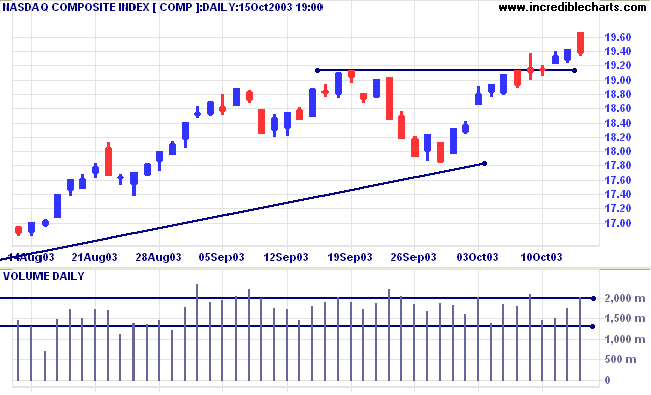

The intermediate trend is up.

The primary trend is up.

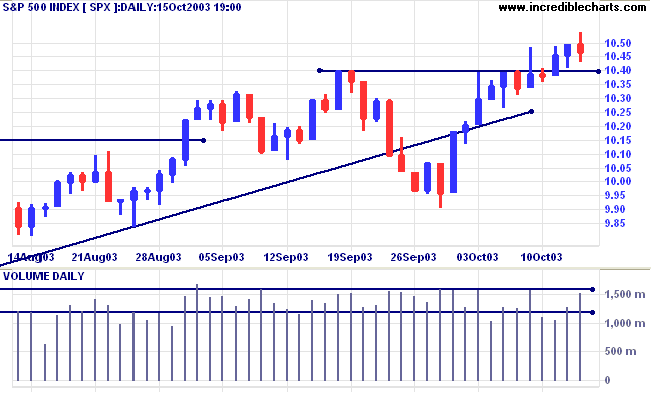

The intermediate trend is up.

The primary trend is up.

Short-term: Bullish if the S&P500 is above 1043.

Intermediate: Bullish above 1043.

Long-term: Bullish above 990.

"The pace of economic expansion has picked up since the last report", according to the latest beige book report, prepared for the next Fed meeting. (more)

Third-quarter earnings were up 5%, in line with forecasts, while sales were below expectations, up 9%. (more)

The yield on 10-year treasury notes rallied to 4.40%.

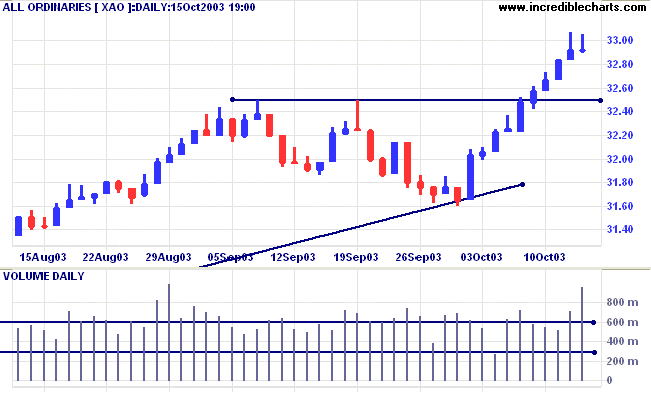

The intermediate trend is up.

The primary trend is up.

New York (18:54): Spot gold is lower at $372.60.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

The primary trend is up. The rally is extended after 3 secondary corrections back to the trendline; the probability of a reversal increases with each consecutive (secondary) rally.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) has crossed below its signal line, completing another bearish divergence.

Short-term: Bullish if the All Ords is above 3289.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160. Tighten stops (to intermediate level) when the secondary rally ends.

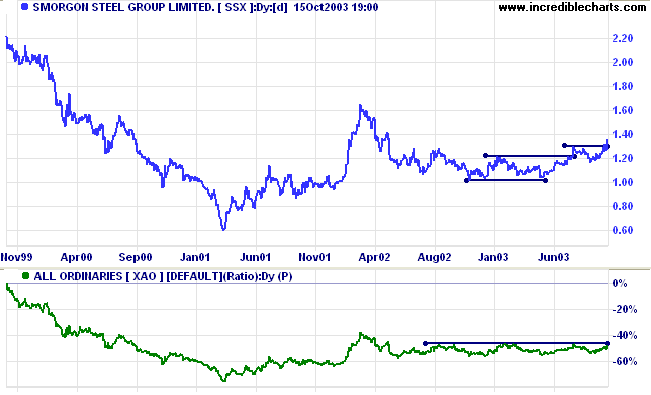

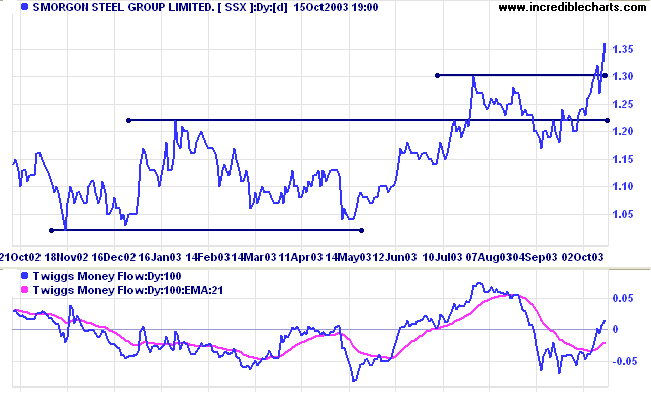

Last covered July 30, 2003.

SSX initially formed an unstable V-bottom in 2001, before retreating to consolidate above support at 1.00.

Price is now rising and Relative Strength (price ratio: xao) threatens to form a new high.

A fall below 1.17 would be bearish.

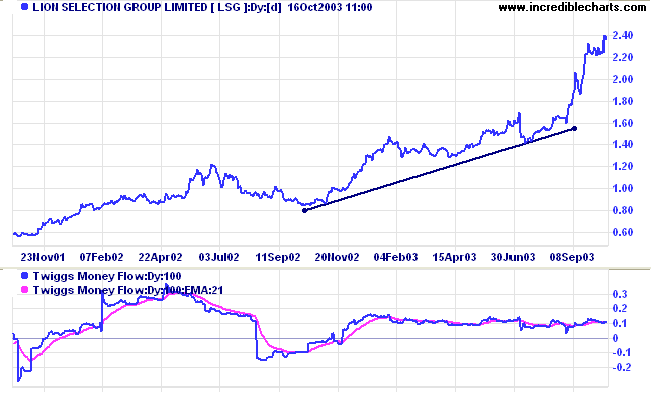

Last covered July 21, 2003.

LSG is one of the strongest performing gold stocks. Price actually made a new high after the recent fall in the gold price .

Twiggs Money Flow (100) signals strong accumulation, holding above zero for almost 12 months. Relative Strength (price ratio: xao) is rising strongly.

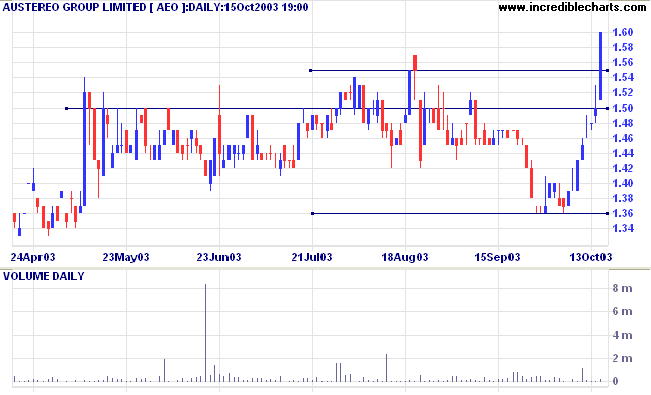

Last covered October 13, 2003.

AEO has broken out of its base, reaching a new high of 1.60, but volume is very weak. Expect a pull-back to test support levels. Support may well form at the round number of 1.50 rather than the previous high of 1.55, formed on light volume.

take a look back every now and then

to make sure it's still there.

~ Will Rogers, cowboy humorist (1879 - 1935).

|

ETOs and warrants are only updated after the market

close. We will add hourly updates when the data feed is available from our data supplier. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.