|

ETOs and

Warrants We expect ETOs and warrants to be available by this evening. The data feed has given us a few problems so this section will have to remain as beta until we are satisfied that all the bugs have been ironed out. US stocks will follow. |

Trading Diary

October 13, 2003

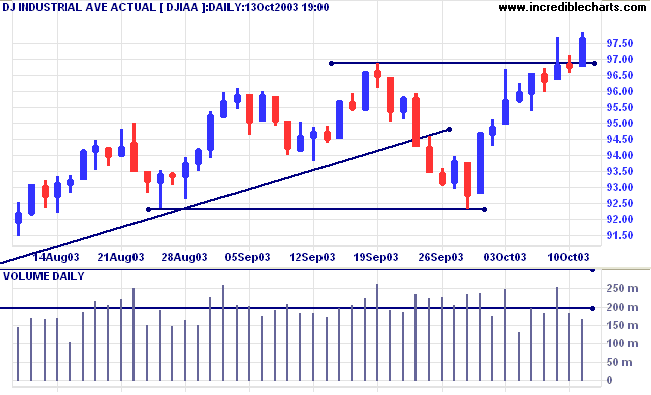

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

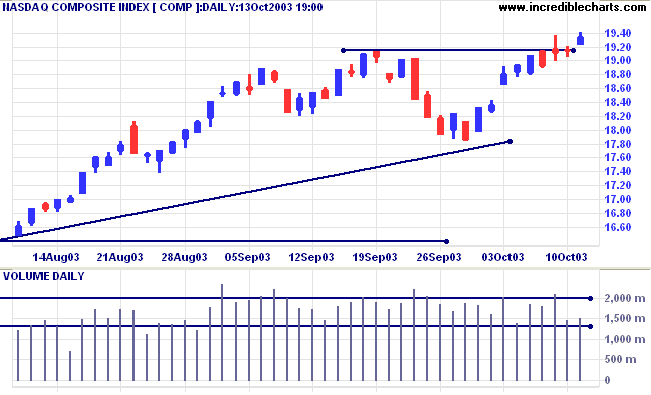

The intermediate trend is up.

The primary trend is up.

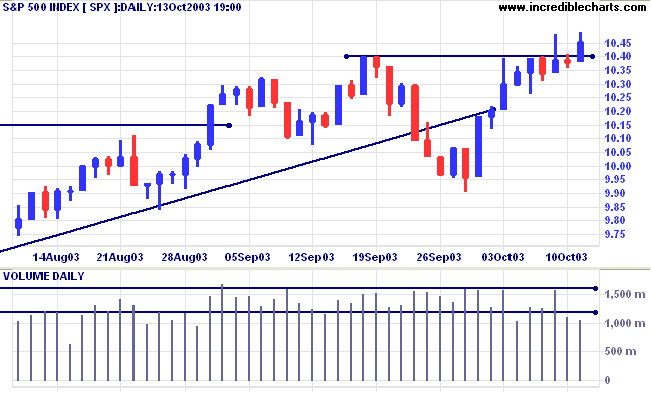

The intermediate trend is up.

The primary trend is up.

Short-term: Bullish if the S&P500 is above 1040.

Intermediate: Bullish above 1040.

Long-term: Bullish above 990.

The mobile phone maker surprised the market with third-quarter earnings of 6 cents a share, equal to the same quarter last year, while analysts were forecasting 3 cents. (more)

The yield on 10-year treasury notes ended last week at 4.25%.

CBOE interest rate products were closed Monday, for Columbus Day holiday.

The intermediate down-trend is weak.

The primary trend is up.

New York (20:37): Spot gold is slightly up at $373.60.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

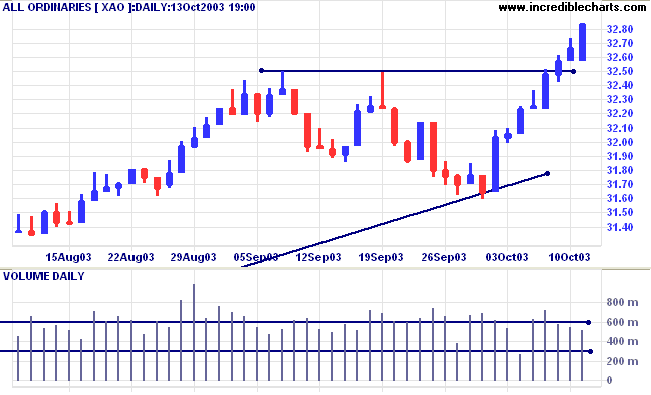

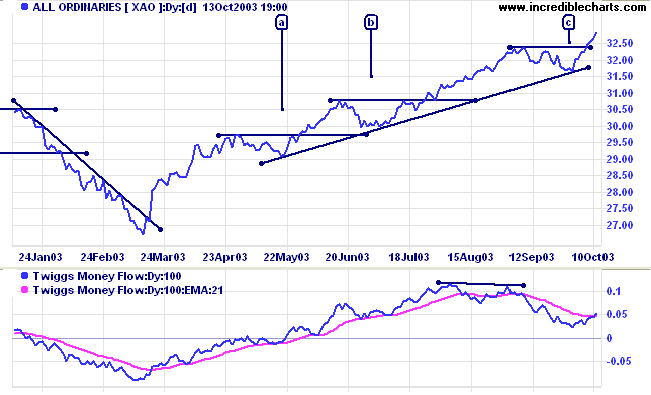

The primary trend is up. The rally is extended after 3 secondary corrections back to the trendline at [a], [b] and [c]. The probability of a reversal increases with each consecutive (secondary) rally.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (100) has turned above its signal line but still displays a bearish divergence.

Short-term: Bullish if the All Ords is above 3250.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160. Tighten stops when the intermediate trend reverses.

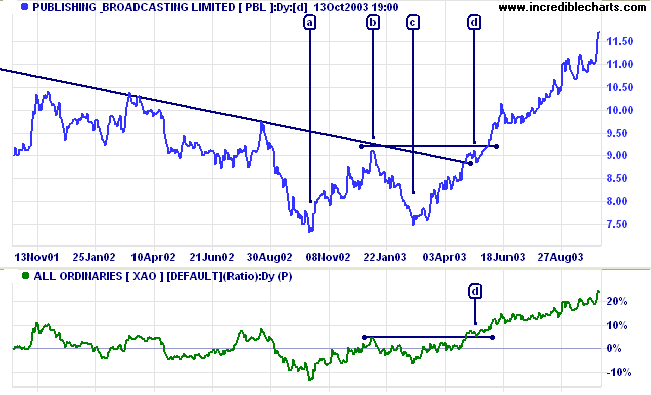

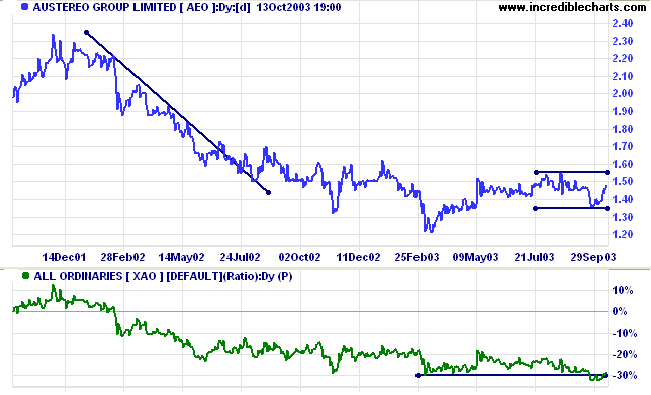

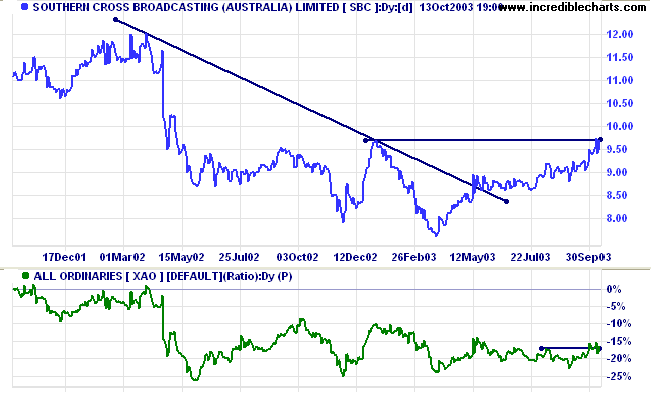

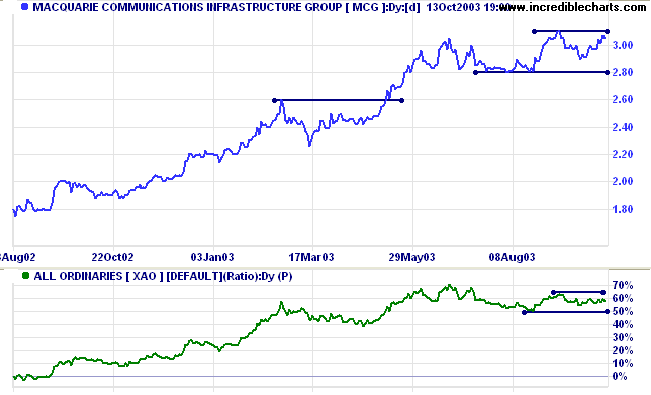

This sub-industry popped up in my weekly stock screens.

The target of 10.77 for the double bottom (9.12 + (9.12 - 7.47)) has already been exceeded, so we may well see a correction. But overhead resistance is still some way off at 13.75.

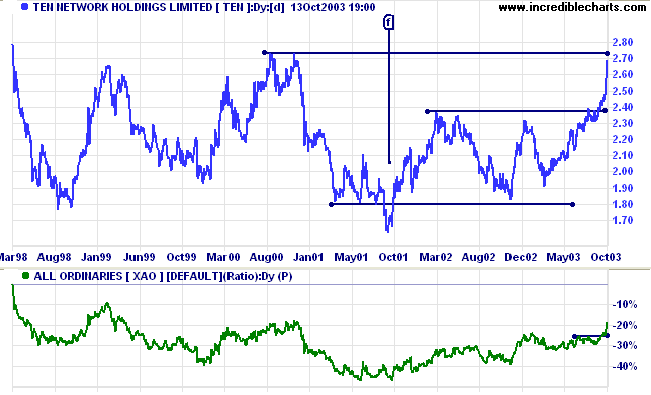

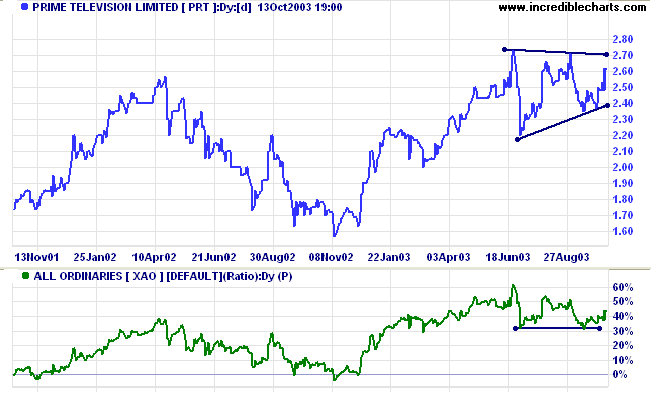

Price has completed a triple bottom and the target should be resistance at 2.75 to 2.80, the upper end of the range. Relative Strength (price ratio: xao) is rising strongly.

(1) Anything can happen;

in order to make money; ........

~ Mark Douglas: Trading in the Zone.

When you set up the Price Ratio/ Price Comparison

indicator, select Apply to Project or Apply to

Security from the center pane of the Indicator Panel.

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.