| Incredible Charts version 4.0.2.300 |

| The new version will be released this week. Changes include a revised watchlist and securities menu, enabling the addition of ETOs, warrants and US stocks, and a new printer module, with greater printer compatibility and functionality. |

Trading Diary

August 13, 2003

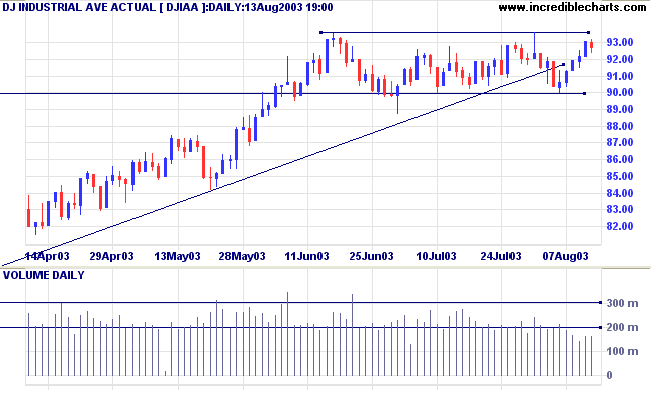

The intermediate trend is up. The index is consolidating between 9000 and 9300.

The primary trend is up.

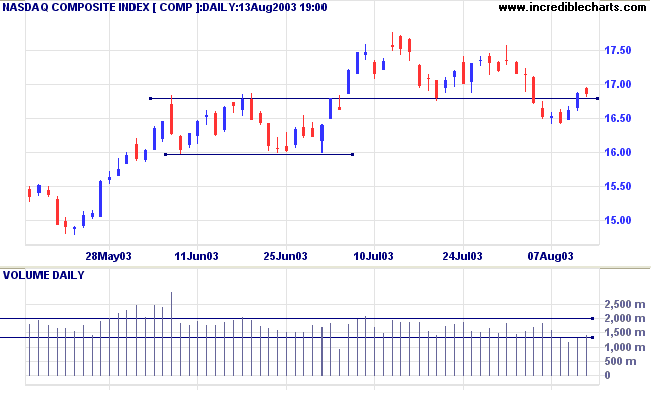

The intermediate trend is down.

The primary trend is up.

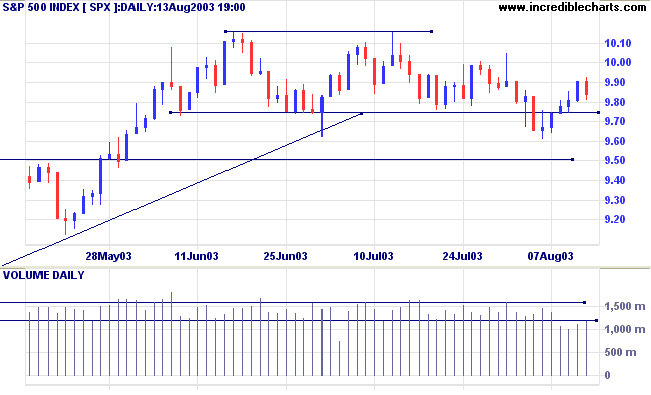

The intermediate trend is down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 980.

Intermediate: Long if S&P 500 is above 1015. Short if below 980.

Long-term: Long is the index is above 950.

Consumers are spending, boosted by gains from mortgage refinancing, but businesses are not hiring more staff. (more)

The yield on 10-year treasury notes rallied to a new 1-year high of 4.56%.

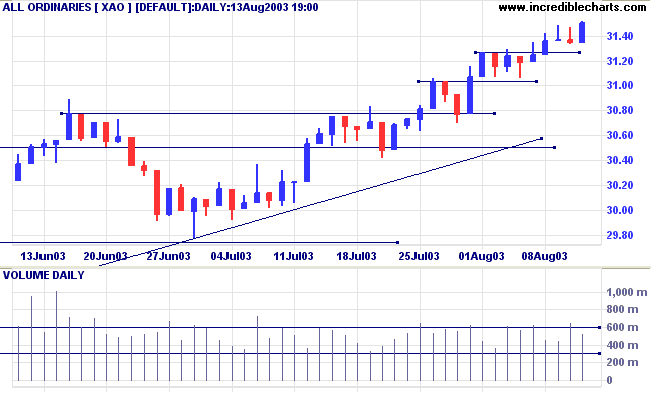

The intermediate and primary trends are both up.

New York (19.20): Spot gold rallied strongly to $362.20.

The primary trend is still upwards.

The intermediate up-trend continues.

The primary trend is up.

Slow Stochastic (20,3,3) has crossed to above its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3149. Short if the intermediate trend turns down.

Intermediate: Long if the index is above 3149.

Long-term: Long if the index is above 2978 .

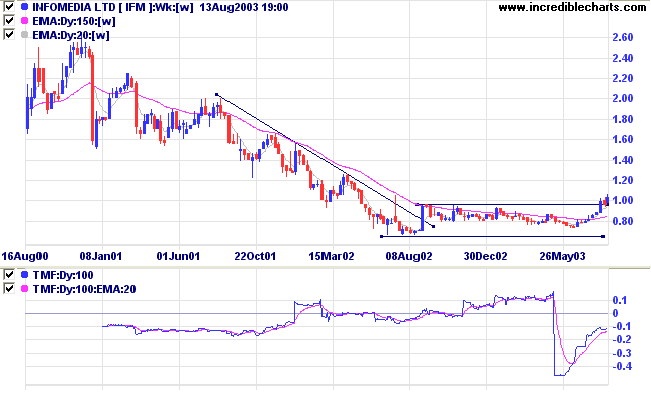

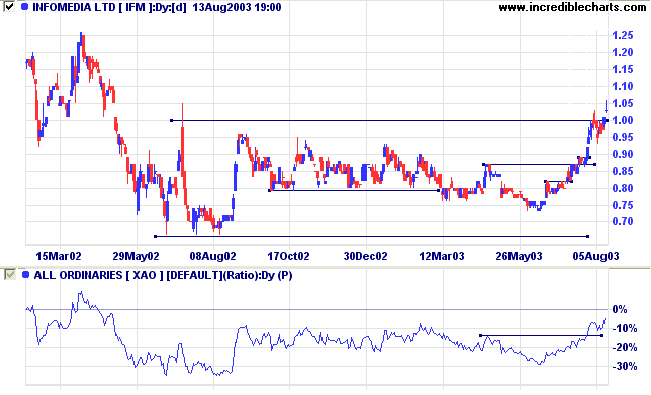

The IT sector has formed a stage 1 base and IFM has registered a breakout from a broad stage 1 base.

Twiggs Money Flow (100) displays a huge dip in early May but has since recovered strongly.

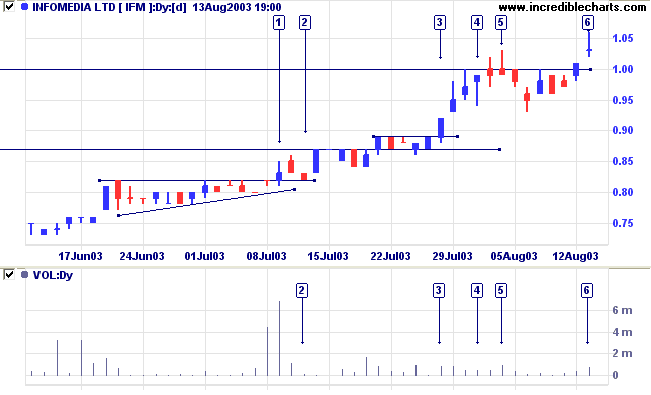

Low volume and daily range on a short pull-back at [2] presents an ideal entry point for short-term traders.

Price subsequently encountered resistance at 1.00 with reversal signals at [4] and [5].

The subsequent breakout at [6] displays a weak close and low volume, signaling that a re-test of the 1.00 support level is likely.

Longer-term traders need to be prudent and wait for a clear buy signal: as at [1] and [2].

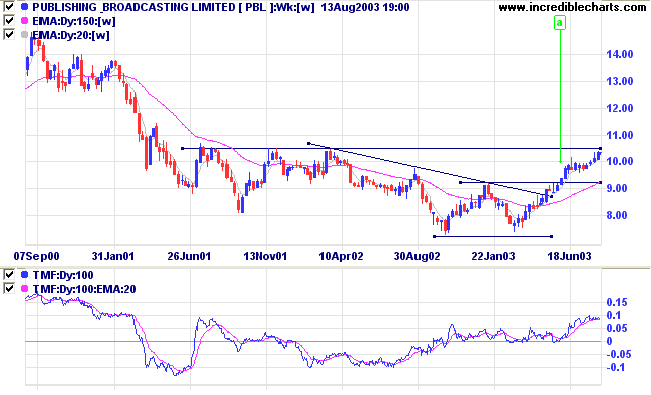

Media stocks are starting to improve. PBL completed a double bottom at [a] and is now approaching resistance at 10.50, the first target for the breakout.

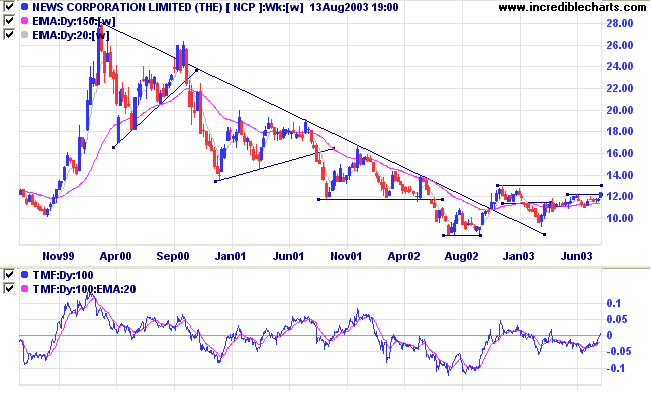

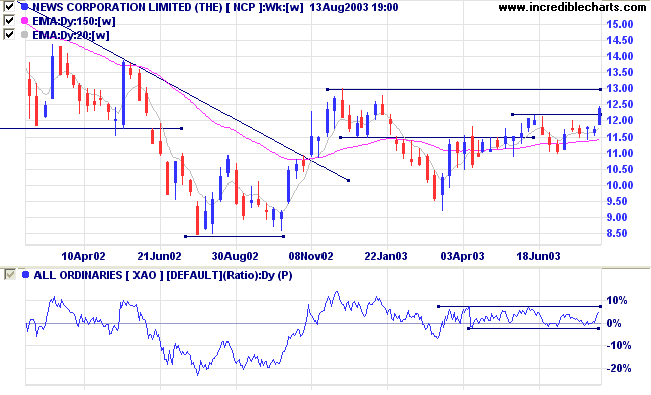

Strong results hardly budged NewsCorp's price in the US.

There has been some recent buying in anticipation of the results, with Twiggs Money Flow (100) crossing into positive territory, but NCP is still in a stage 1 base.

If I had six hours to chop down a

tree,

I'd spend the first four hours sharpening the axe.

~ Abraham Lincoln.

| Tip: Transferring Watchlists and Project files |

|

To transfer watchlist (.viz) and project

(.ini) files between computers, use File>>Export

Files and File>>Import

Files. See Help: Importing and Exporting Files for details. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.