|

ETOs and

Warrants We are making progress. ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

September 30, 2003

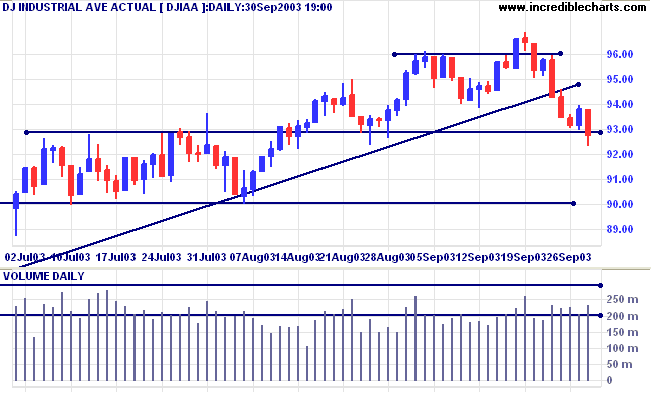

The intermediate has turned down.

The primary trendline has been broken, signaling weakness. A fall below 9000 will signal reversal.

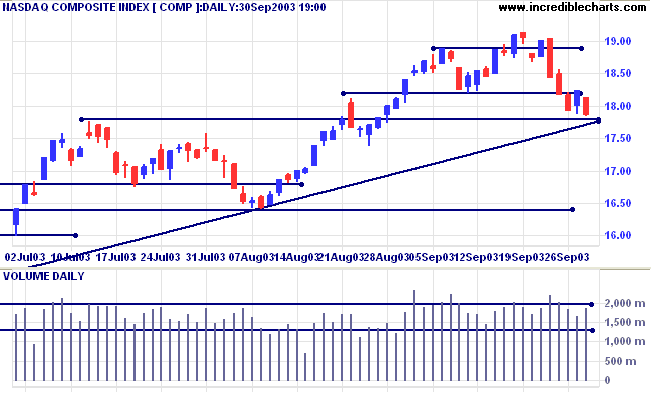

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

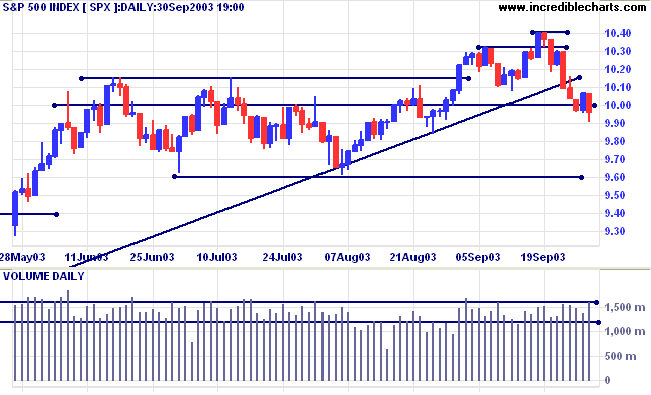

The intermediate trend has turned down.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

Short-term: Bearish below 995.

Intermediate: Bullish above 1040. Bearish below 960.

Long-term: Bullish above 1040.

The US market is under-performing several other major economies and the trend is expected to continue. (more)

The Conference Board index of consumer confidence surprised watchers with a fall to 76.8, from 81.7 in August. (more)

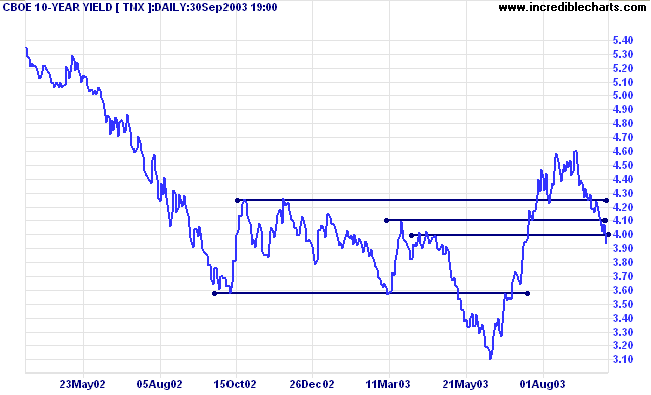

The yield on 10-year treasury notes closed at 3.94%, below support at 4.00%.

The intermediate trend is down.

The primary trend is up. The close below 4.00% signals weakness.

New York (20:12): Spot gold gained 3 dollars to $384.50.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

The primary trend is up. A fall below 3000 will signal reversal.

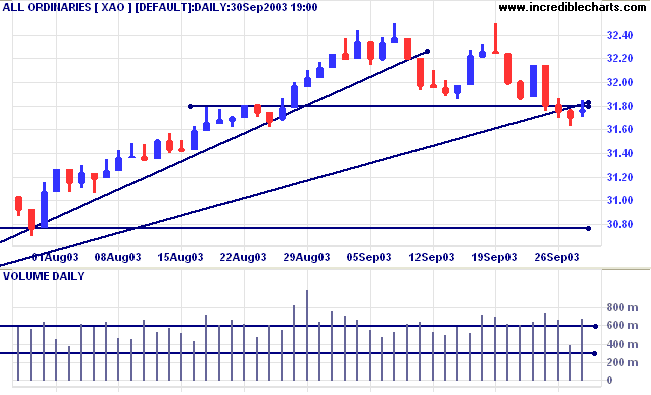

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow (100) displays two bearish peaks below the signal line.

Short-term: Bullish if the All Ords is above 3250. Bearish below 3162.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

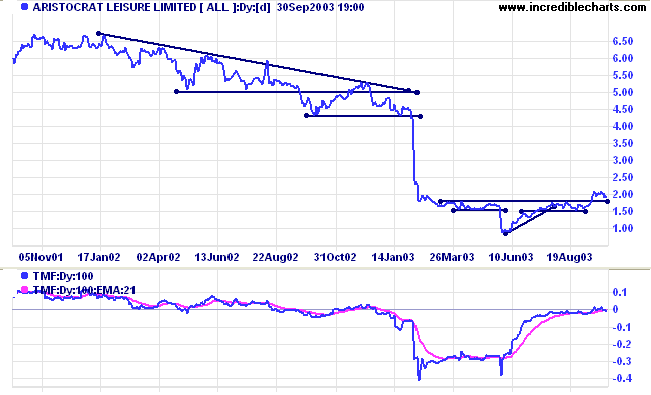

Last covered on November 28, 2002.

Aristocrat experienced a cathartic sell-off at the end of May, with exceptionally high volumes. The stock has since rallied, before consolidating above 1.50. Twiggs Money Flow (100) rose sharply, signaling accumulation.

Price appears to be pulling back to test the new support level.

A close below 1.77 will be bearish.

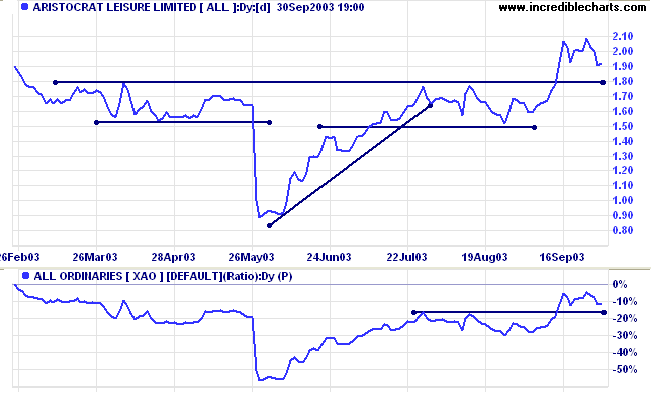

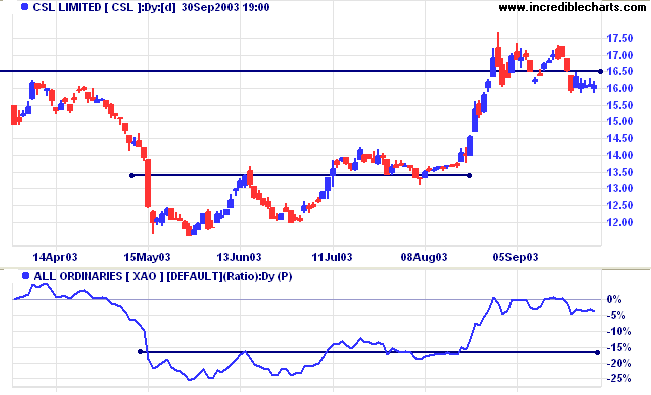

Last covered July 16, 2003.

It is vital when trading breakouts to examine Relative Strength (price ratio: xao). The indicator must be rising for the breakout to be healthy. There is more than one way of measuring this. I prefer to compare highs and lows as with the trend on a price chart:

- a higher low followed by a new high signals reversal to an up-trend;

- a lower high followed by a new low signals reversal to a down-trend.

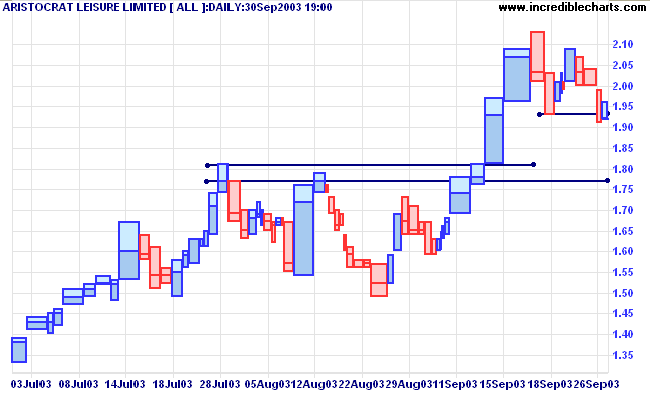

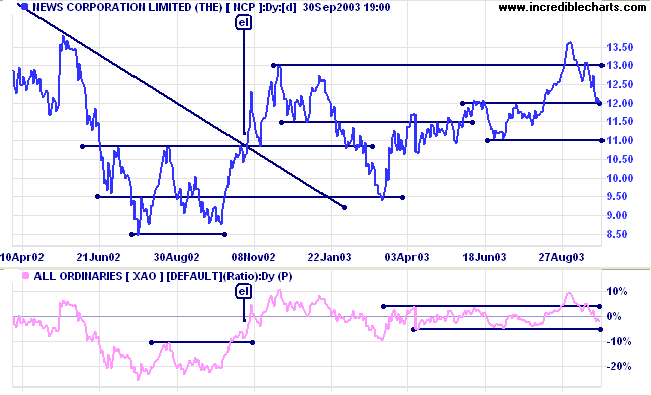

Last covered on August 13, 2003.

After making a new 3-month high, Relative Strength has retreated back within its previous range. Price has also made a marginal break above 13.00; a bearish sign. If RS falls to a new 3-month low, this will be a further bear signal.

To understand yourself is to be wise;

To conquer others is to have strength;

To conquer yourself is to be strong.

~ Lao Tse.

|

To scan for stocks that are in a stage 1

base, try the following: (1) Select the ASX 200 or ASX 300 under Indices & Watchlists; (2) Select %of Price High; (3) Enter 80 as the 3-Month Minimum; (4) Enter 50 as the 3-Year Maximum; (5) Submit. This is not a perfect solution but will return stocks near the upper end of a stage 1 base. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.