A number of members have difficulty posting chart images to the forum. Here is a brief guide:

1. Use File >> Save Chart As Image to save the chart as a PNG image (suggested size: 651 x 406 pixels).

2. Save the image to your desktop or a convenient folder.

3. At the end of your posting to the Chart Forum, type \image{name}

For convenience, use the stock code as the name, eg. \image{XAO}

The name does not have to match the filename from 2.

4. Preview your posting and a box will be displayed showing the position of the image.

5. Save and you are prompted for the location of the chart image.

Use the Browse button to locate the image from 2.

Trading Diary

November 28, 2002

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 48% (November 27).

New York: Spot gold reversed up 70 cents to $US 317.60.

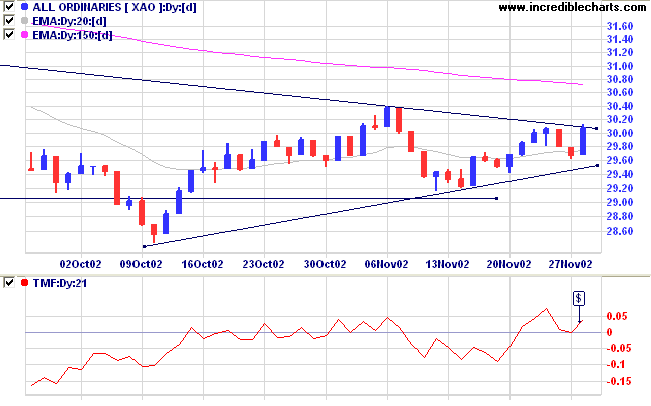

The primary trend will reverse if the index rises above 3150.

The Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs money flow has reversed up without crossing the zero line, a bullish signal.

Last covered on September 20.

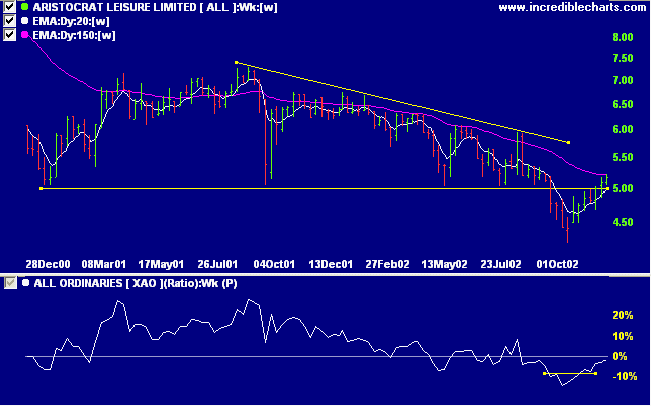

ALL formed a bearish descending triangle over the last 2 years with a base at 5.00 before experiencing a downward breakout in September, accompanied by rising volume. Price has since reversed back sharply, breaking above the 5.00 resistance level. Relative strength (price ratio: xao) is rising.

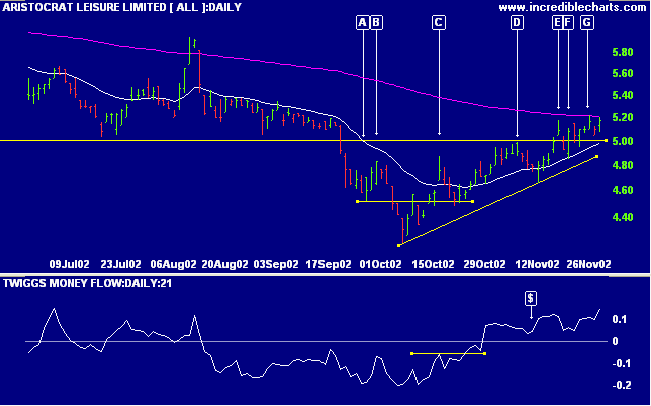

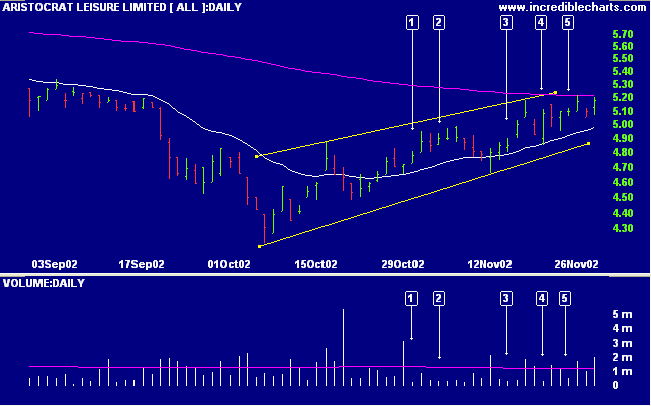

After breaking through support at 5.00, ALL pulled back briefly to [B] before falling sharply to the low of 4.21. However, the rally to [C] broke above the low of [A] and the ensuing 3-day correction failed to close below the same support level, confirming that the down-trend had weakened and was unlikely to carry much further. The next rally [D] tested resistance at 5.00 before the breakout at [E], after a series of higher lows.

For further guidance see Understanding the Trading Diary.

Simple is best.

- Monty Roberts: Horse Sense For People

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.