| Incredible Charts version 4.0.2.300 |

| The new version will be released this week. Changes include a revised watchlist and securities menu, enabling the addition of ETOs, warrants and US stocks, and a new printer module, with greater printer compatibility and functionality. |

Trading Diary

August 11, 2003

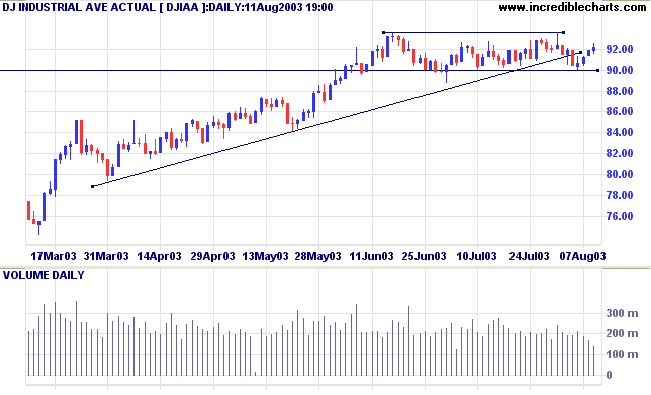

The intermediate trend is up.

The primary trend is up.

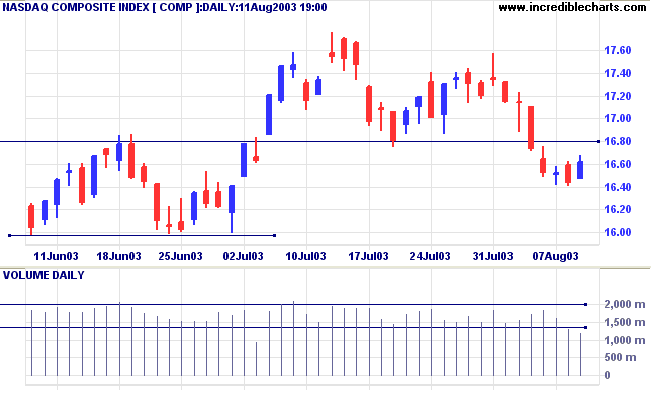

The intermediate trend is down.

The primary trend is up.

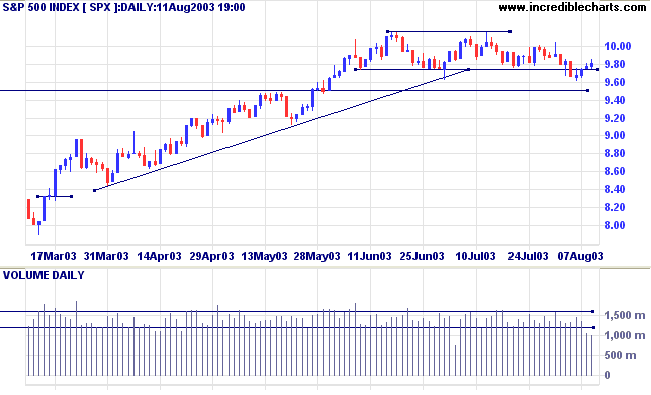

The intermediate trend is down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 974.

Long-term: Long is the index is above 950.

The Fed is expected to leave interest rates unchanged at its Tuesday meeting. (more)

The yield on 10-year treasury notes rallied to 4.37%.

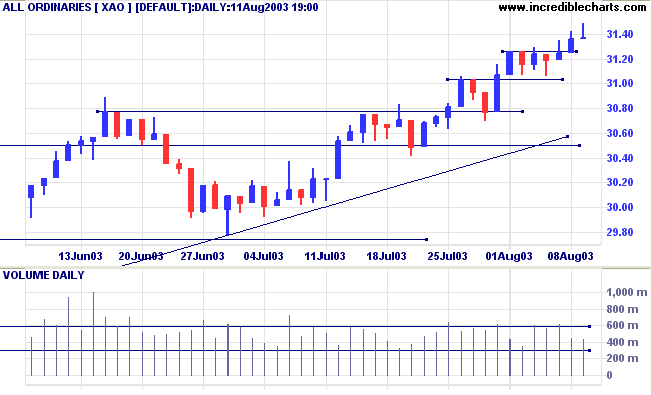

The intermediate and primary trends are both up.

New York (17.16): Spot gold rallied to $361.20.

The primary trend is still upwards.

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3149. Short if the index falls below 2978.

Intermediate: Long if the index is above 3149.

Long-term: Long positions if the index is above 2978 .

The Reserve Bank warns that the current rise in housing prices is unsustainable and financial institutions are vulnerable to a collapse in prices. (more)

Several stocks from this sub-industry have shown strong growth over the last 3 months:

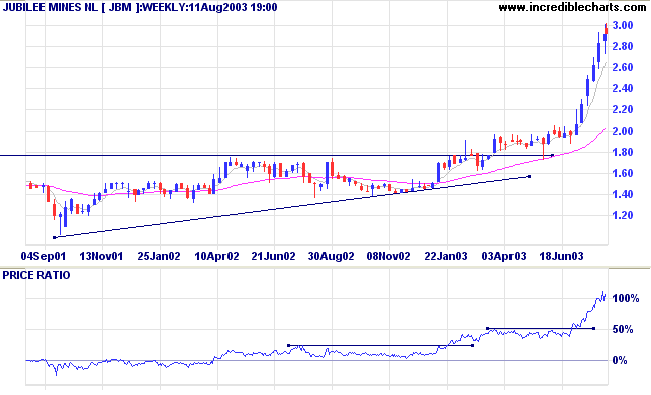

Last covered on July 31, 2003.

JBM is the top performer, having gained 54% in the last 3 months. Relative strength is rising strongly.

The rally is extended and appears due for a correction.

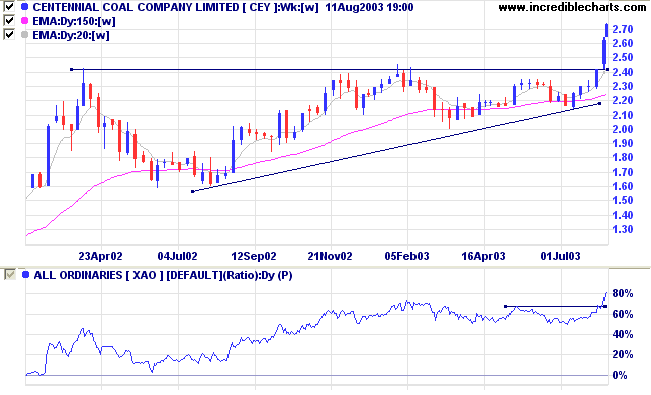

Last covered on August 4, 2003.

CEY has broken out of an ascending triangle and made new 3-month highs on the Relative Strength and Twiggs Money Flow (100) indicators.

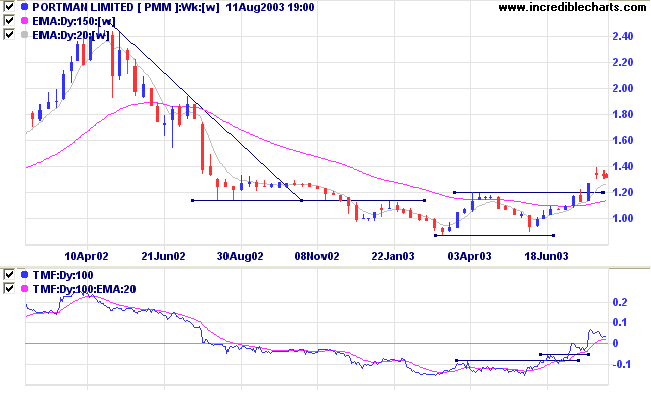

Last covered on July 9, 2002.

PMM broke out of a broad stage 1 base, accompanied by strong volume.

Relative Strength and Twiggs Money Flow (100) are rising.

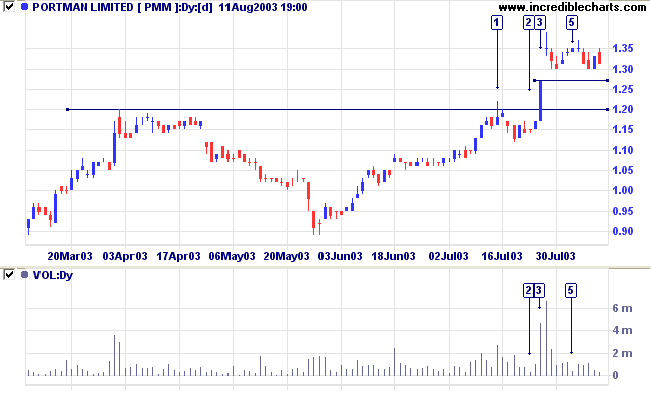

The first break at [1] proved to be a false break and was followed by a short-term entry point at [2], with a dry up of volume and volatility at the end of the correction. The break at [3] was followed by an upward gap on strong volume, exhausting short-term buying pressure. The subsequent rally to [5] displayed weak volume and failed to make new highs. Support levels are at 1.27, the high of [3], and at 1.20.

Last covered on October 15, 2002.

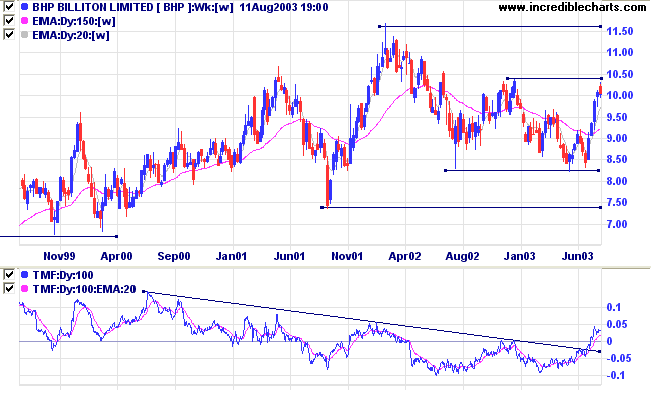

BHP is approaching resistance at 10.30 after completing a double bottom, May to July 2003.

Twiggs Money Flow is rising while Relative Strength is neutral. Not exciting.

Laws Conditional # 6.

........It is better to act on general than on special

information (it is not so misleading), viz.: the state of the

country, the condition of the crops, manufactures, etc.

Statistics are valuable, but they must be kept subordinate to

a comprehensive view of the whole situation.........."When in

doubt do nothing." Don't enter the market on half conviction;

wait till the convictions are fully matured.

~ SA Nelson: The ABC of Stock Speculation (1903).

| Tip: Multiple Moving Averages |

|

Pre-set files are available with Daryl

Guppy's Multiple Moving Averages: Select File>>Open Project>>[Multiple Moving Averages - 12]. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.