If you have any suggestions as to how we can improve the charts, website or newsletter,

please post them at the Chart Forum: Suggestion Box.

Trading Diary

October 15, 2002

The Nasdaq Composite Index gapped up to close at 1282, an increase of more than 5%. The follow-through day completes a bottom reversal as defined by William O'Neil. The primary trend will reverse if the rally lasts 3 or more weeks and breaks above 1426.

The S&P 500 gained 40 points to close at 881, breaking through resistance at 855. The follow-through day completes a bottom reversal as defined by William O'Neil. The index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 14).

Better than expected results from Johnson&Johnson, Citigroup and General Motors boosted the market at the opening. (J&J)(Citi)(GM)

Intel later disappointed with third-quarter earnings of 11 cents per share compared to expectations of 13 cents. (Intel)

New York: Spot gold last traded at $US 313.50, falling 390 cents to the lowest close in more than a month.

A break above 3150 will signal a primary trend reversal.

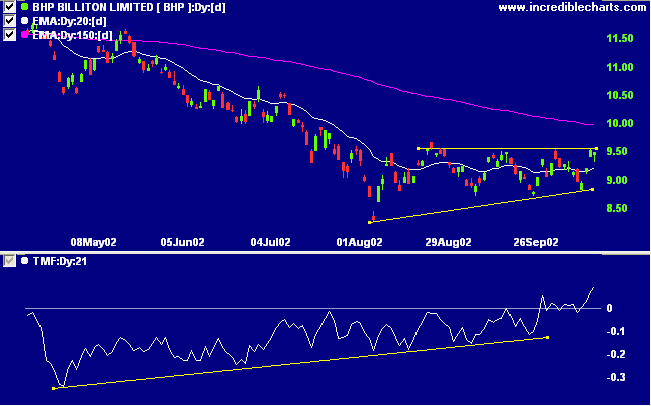

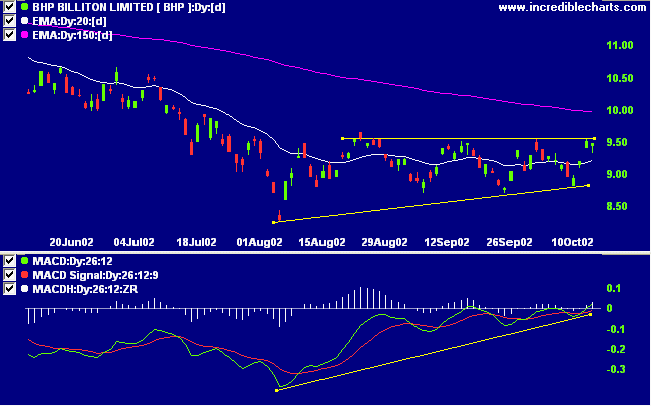

MACD (26,12,9) has joined Slow Stochastic (20,3,3) above its signal line. Twiggs money flow signals accumulation following a bullish divergence.

Last covered on August 7.

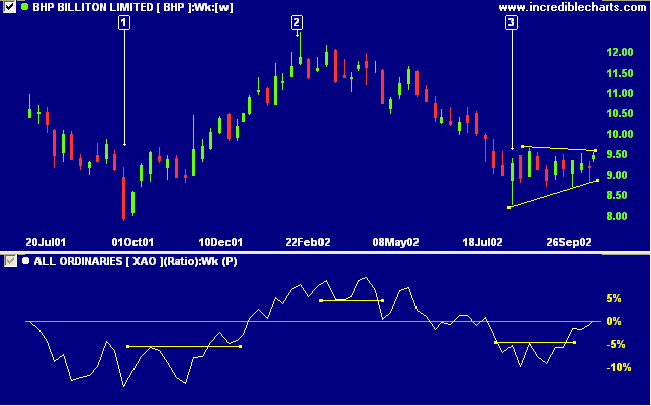

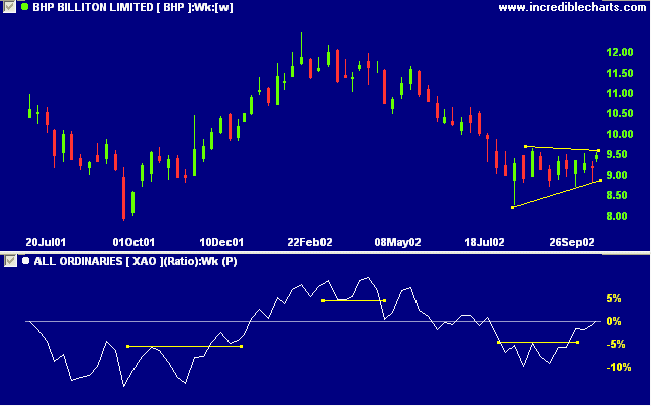

BHP has formed two fairly equal lows about 12 months apart, after a stage 4 down-trend. A rise to 12.50 would complete a double bottom reversal. Relative strength (price ratio: xao) is rising and the stock appears to be forming a bullish ascending triangle.

At times like this it is important to ignore all the speculation and conflicting opinions in the press

and to just concentrate on the message from the charts:

You do not need to know what the market is going to do!

All you need to know is what the market has actually done! This is the key!

- William J O'Neil, How to Make Money in Stocks

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.