| Chart Forum: Saving Images |

Complete your post on the Chart Forum, leave a space below the last line and then select the Upload Attachment button:

|

Trading Diary

July 31, 2003

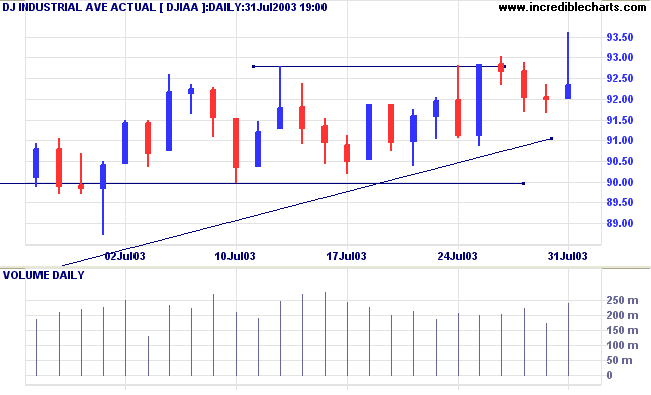

The Dow rallied strongly in early trading before retreating to a weak close at 9234 on higher volume.

The intermediate trend is up. A decline below 9000 will signal a down-turn.

The primary trend is up.

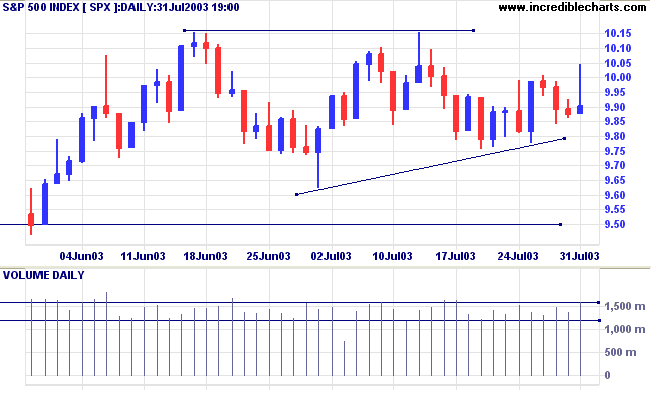

The intermediate trend is up. A fall below 976 will signal a down-turn.

The primary trend is up.

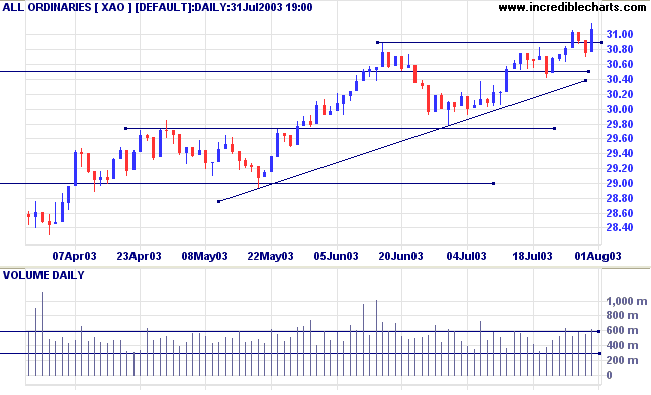

The intermediate trend is up.

The primary trend is up.

Intermediate: Long if the S&P is above 1015. Short if below 962.

Long-term: Long if above 962.

GDP growth almost doubled to 2.4% in the second quarter. (more)

CBOE: The yield on 10-year notes is in a fast up-trend, closing at 4.47%.

The intermediate trend is up; the primary trend is up.

New York (21.00): Spot gold eased further, to $US 354.60.

On the five-year chart, gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) signals accumulation.

Intermediate: The primary trend is up; Long if the All Ords is above 3093. Short if below 2978.

Long-term: Long if the index is above 2978.

It pays to set a definite target, when you enter a long or short position, at which you plan to exit from a trade. This does not mean that you should sell at a set price; you would be disappointed if the stock kept on rising (or falling) after you have exited. Rather adjust your stops to take you out of the trend at the first sign of a reversal:

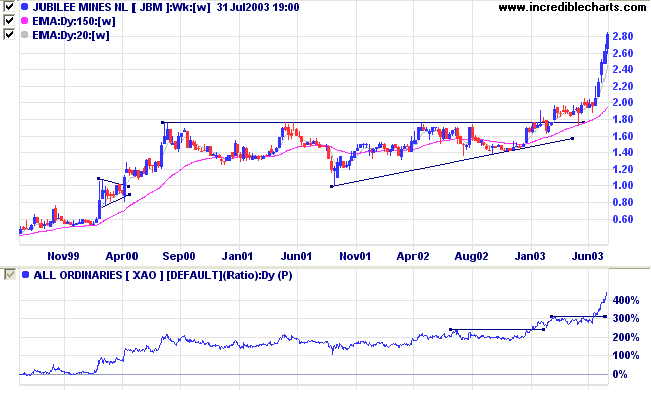

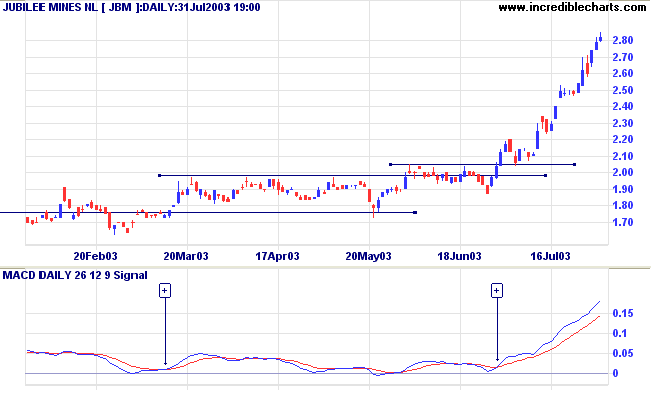

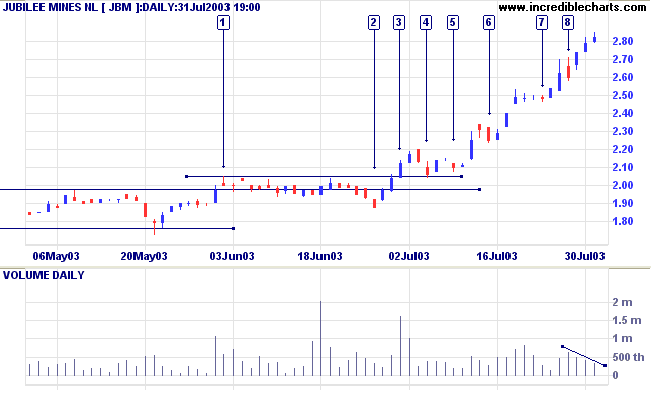

JBM broke above a long-term ascending triangle in February 2003. Relative Strength (price ratio: xao) has also made new highs.

The target for the breakout is 2.60, calculated from the base at 1.00 to the high of roughly 1.80. Price has rallied strongly through 2.60 and risks forming a spike (or "blow-off").

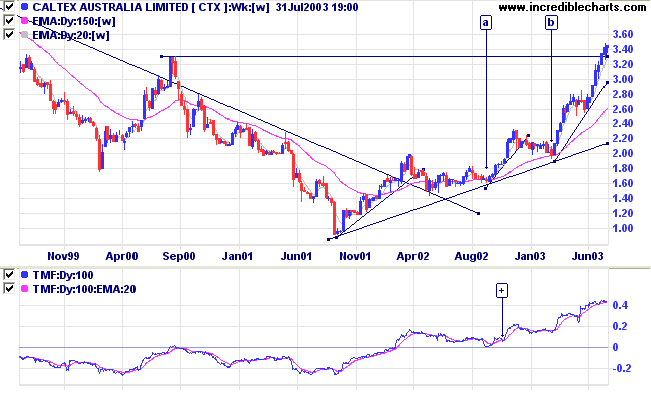

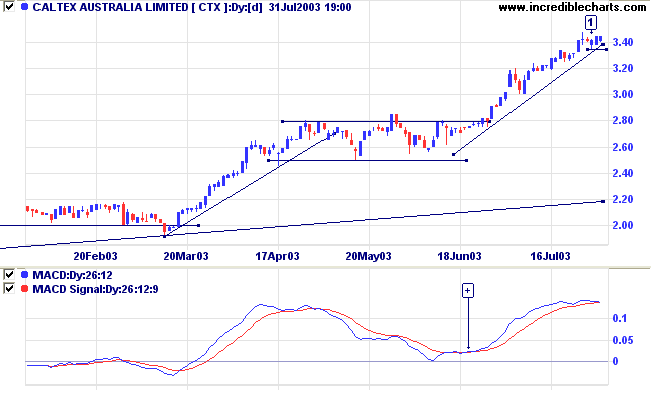

Caltex has rallied strongly off the primary trendline, reaching resistance at 3.30. Twiggs Money Flow (100) and Relative Strength (price ratio: xao) are rising strongly.

Price has reached the initial target and tighter stops should be introduced (for at least half of your position). The latest stop should be placed below the low of [1].

It is better to "average up" than "average down"................

But "buying up" is the reverse of the method just explained;

that is to say, buying at first moderately and as the market advances adding slowly and cautiously to the "line".

This is a way of speculating that requires great care and watchfulness,

for the market will often (probably four times out of five) react to the point of "average".

Here lies the danger. Failure to close out at the point of average destroys the safety of the whole operation.

Occasionally (probably four* times out of five) a permanently advancing market is met with and a big profit secured.

In such an operation the original risk is small, the danger at no time great, and when successful the profit is large.

This method should only be employed when an important advance or decline is expected,

and with a moderate capital can be undertaken with comparative safety.

~ S.A. Nelson: The ABC of Stock Speculation (1903)

* I believe that this is a typographical error and should read "one time out of five".

| Stock Screens: Ranging Stocks |

|

Directional movement

can also be used to identify stocks

that are in a valid up- or down-trend. To select stocks

in an up-trend: |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.