| Money Management |

| The Diary has in the past placed too much emphasis on entry and exit points and not enough on money management -- the key to successful trading. Even if you only make 50% correct calls, you can still profit, provided that you cut your losses short and stay with the trend when you get it right. Unsuccessful traders tend to take profits too quickly and fail to cut their losses when the trend goes against them. |

Trading Diary

August 6, 2003

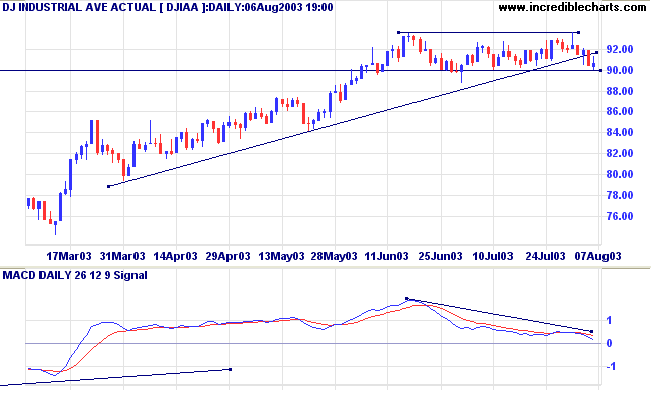

The intermediate trend is up but the index has penetrated the supporting trendline. A break below 9000 will signal a reversal.

MACD and Twiggs Money show bearish divergences.

The primary trend is up.

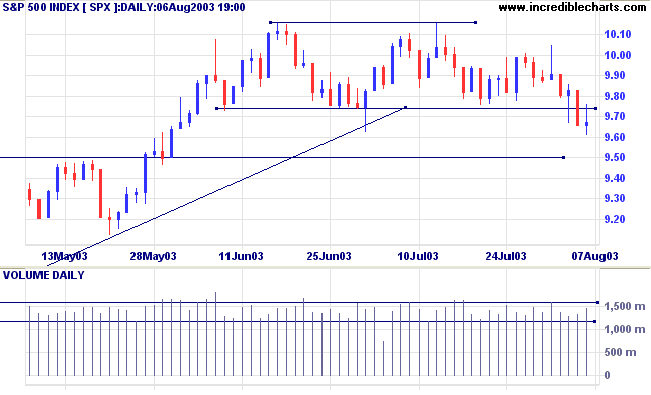

The intermediate trend is down.

MACD and Twiggs Money Flow (21) display bearish divergences.

The primary trend is up.

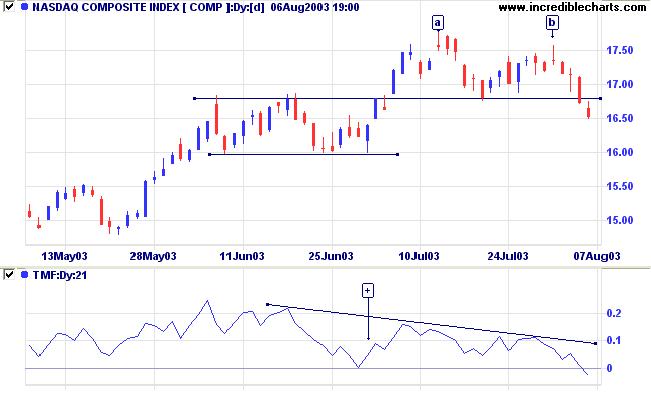

The intermediate trend is down. Support is at 1600.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 950.

Long-term: Long is the index is above 1000.

The Institute for Supply Management (ISM) service sector index climbed to 65.1 from 60.6 in June. (more)

The yield on 10-year treasury notes lost 15 points to 4.29%.

The intermediate and primary trends are both up.

New York (19.14): Spot gold has leveled at $351.20.

The primary trend is still upwards.

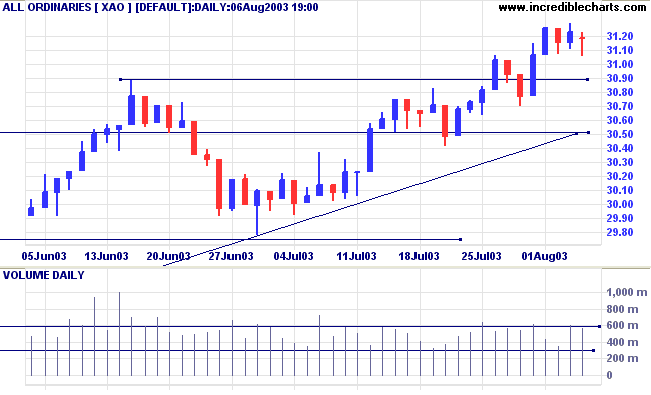

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3127. Short if the index falls below 2978.

Intermediate: Long if the index is above 3127.

Long-term: Long if the index is above 2978 .

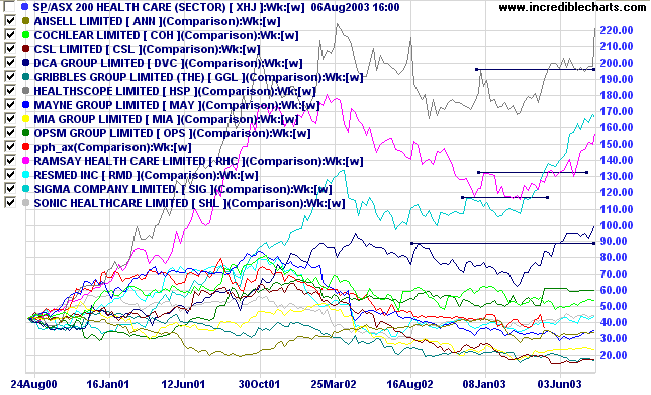

Several stocks in the Health Care sector are making new highs:

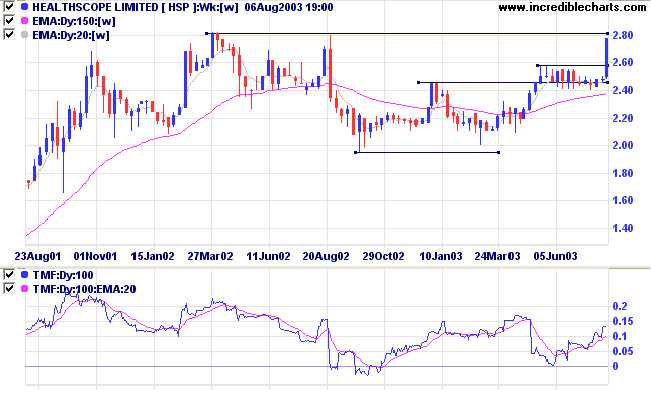

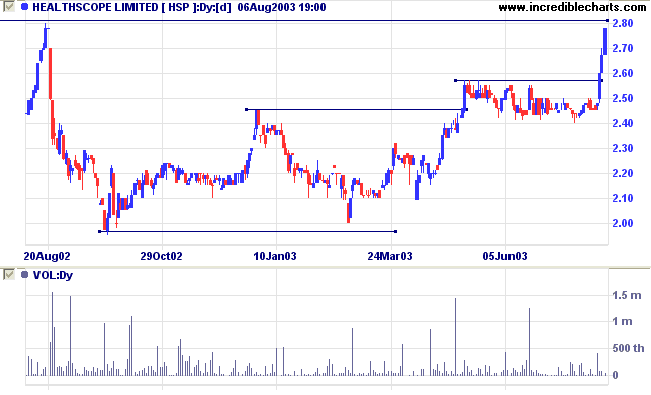

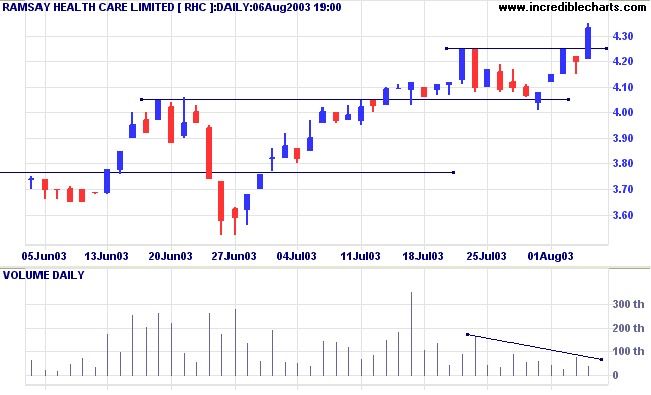

Last covered April 29, 2003.

Healthscope has rallied sharply and is approaching the stock's previous high.

Twiggs Money Flow (100) signals strong accumulation and Relative Strength (price ratio: xao) has made a 3-month high.

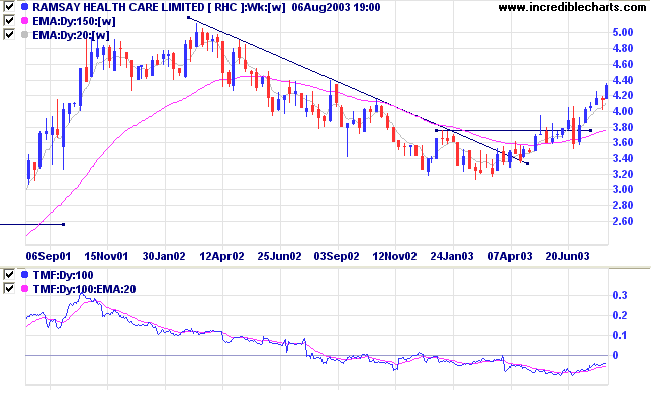

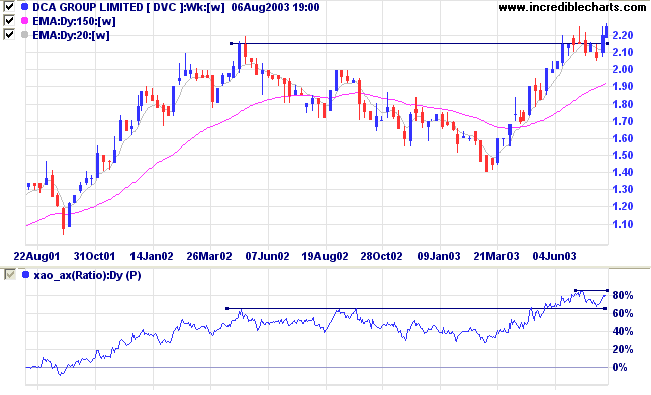

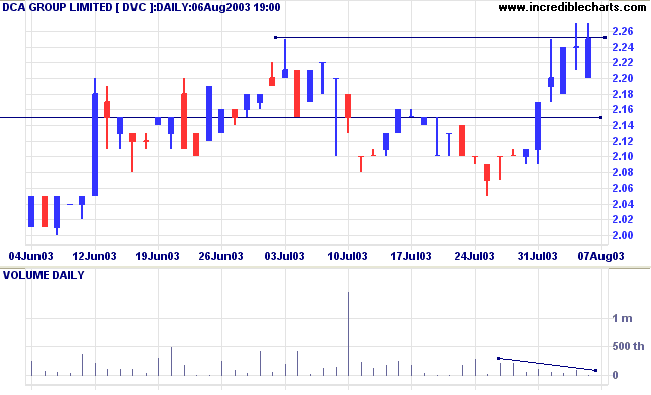

Last covered April 30, 2002.

Ramsay has rallied off a double bottom, completed May 2003.

Last covered on August 15, 2002.

DCA is making new highs after a strong rally.

Twiggs Money Flow (100) signals accumulation. Relative Strength (price ratio: xao) is rising but the latest rally has yet to make a new high.

Further consolidation is likely, before enough buying pressure builds to fuel another rally.

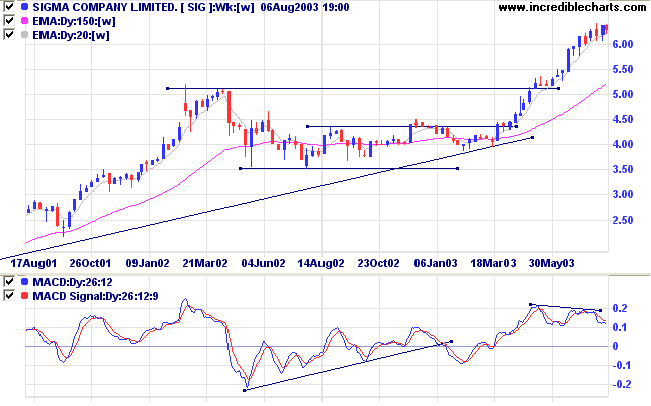

Last covered April 29, 2003.

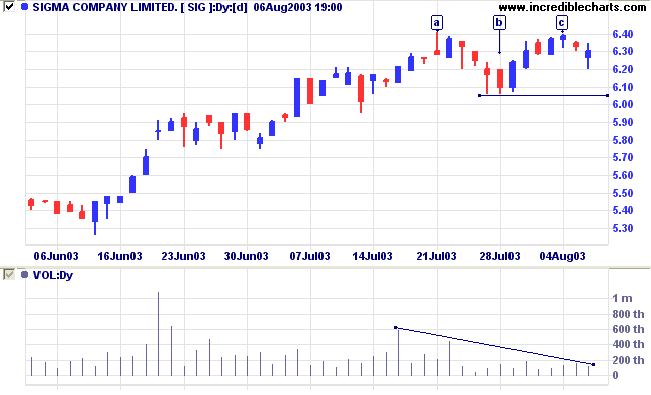

Sigma resumed its' stage 2 rally after a lengthy mid-point consolidation.

Twiggs Money Flow (100) signals strong accumulation. Relative Strength (price ratio: xao) is rising but, again, the latest rally has yet to make a new high. MACD shows a bearish divergence.

Rules Conditional # 4

Public opinion is not to be ignored.

A strong speculative current is for the time being

overwhelming,

and should be closely watched.

The rule is to act cautiously with public opinion, against

it, boldly.

......Every speculator knows the danger of too much

"company".

~ SA Nelson: The ABC of Stock Speculation (1903).

| Stock Screens: Bollinger bands |

|

Intermediate corrections often end

close to the 50-day moving average. To highlight

up-trending stocks close to the MA: |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.