Trading Diary

April 30, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow rallied 1.3% on a smaller than expected

decline in consumer confidence, to close at 9946 on strong

volume. The short-trend is down but the secondary cycle

up-trend is intact.

The Nasdaq Composite index rallied 1.9% to close at 1688. The

secondary cycle is still in a down-trend.

The S&P 500 rose 1.0% to close at 1076,

above the key 1070 support level. The down-trend on the secondary

cycle is intact. The two highs at 1180, in January and March, and

the intervening trough at 1070 have formed a double

top chart pattern. The calculated target for the downward

breakout is 960, coinciding with the low of September

2001.

WorldCom CEO quits

CEO Bernard Ebbers, facing $US 30 billion in

debt, plunging stock prices and an accounting investigation,

resigns. (more)

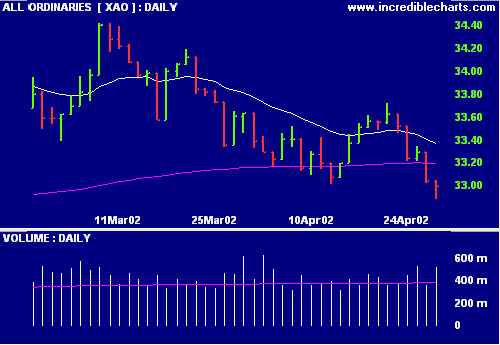

ASX Australia

The All Ords fell to 3288 by the afternoon but

then rallied to close back at 3300 on strong volume. If the index

breaks below 3300, the next major support level is at 3230 to

3240, the same as the target from the double top pattern.

Private hospitals in crisis

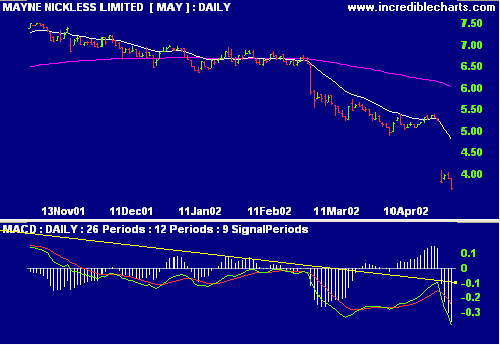

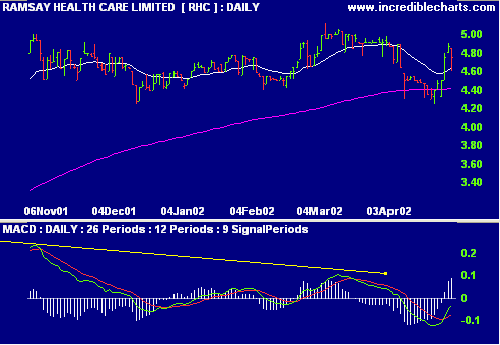

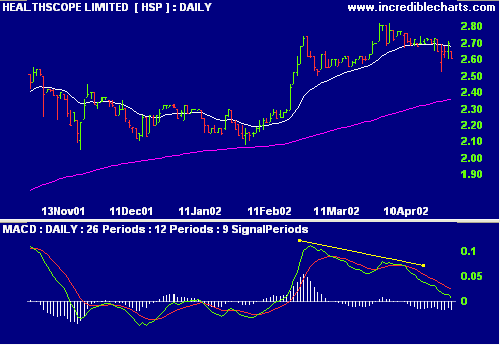

Stocks of Mayne Group [MAY], Ramsay Health

Care [RHC] and Healthscope [HSP] fall as private hospitals are

hit by the medical insurance crisis. (more)

All three stocks are showing bearish

divergence or weakness on MACD.

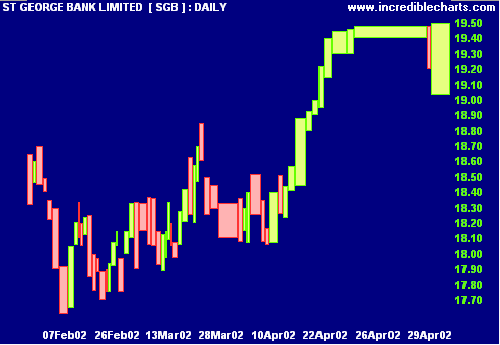

St George [SGB]

St George rises to $19.50 despite $94 million

dot-com write-off. (more)

Equivolume shows strong distribution taking

place at these levels.

Conclusion

Short-term: Avoid long. Keep stop losses on existing trades as

tight as possible.

Medium-term: Wait for an All Ords reversal.

Long-term: Wait for the Nasdaq or S&P 500 to break above

their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Back

Issues

Access the Trading Diary Archives.