Trading Diary

August 15, 2002

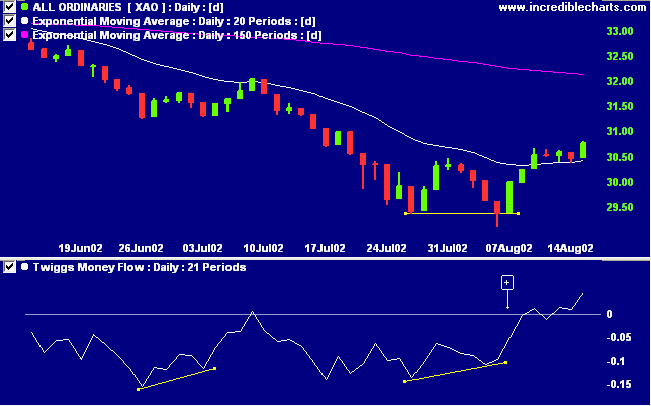

The Chartcraft NYSE Bullish % Indicator has given a bull alert signal, with a reading of 32% (August 14).

The Nasdaq Composite gained 0.8%, to close at 1345 after

testing resistance at 1355.

The primary cycle is in a down-trend.

The S&P 500 made the strongest rally, gaining 11 points to close at 930. The primary cycle is in a down-trend.

Dell reported second-quarter earnings of 19 cents per share, compared to 16 cents a year earlier. (more)

Adelphia, WorlCom, CMS Energy and Qwest were among 31 stocks which have either restated earnings or failed to certify. (more)

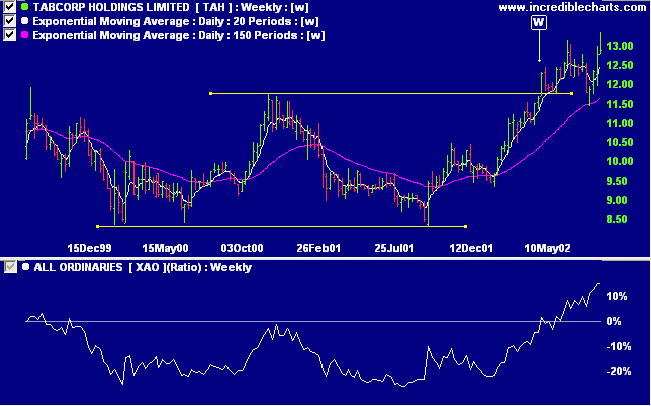

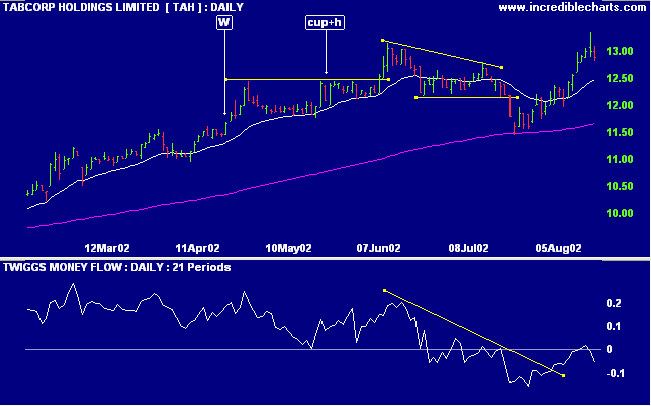

The Victorian gaming and wagering company reported a 39% rise in profits after a strong performance from Star casino. (more)

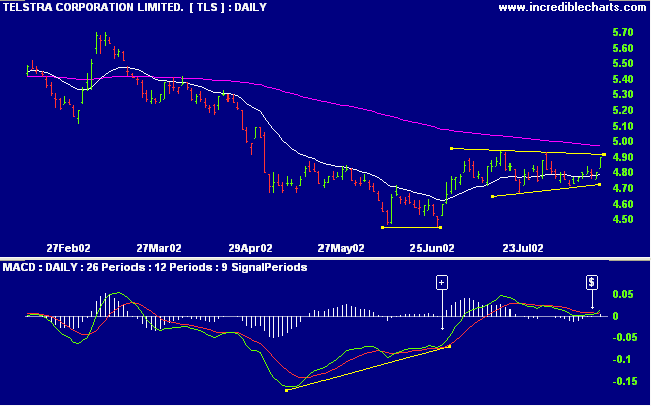

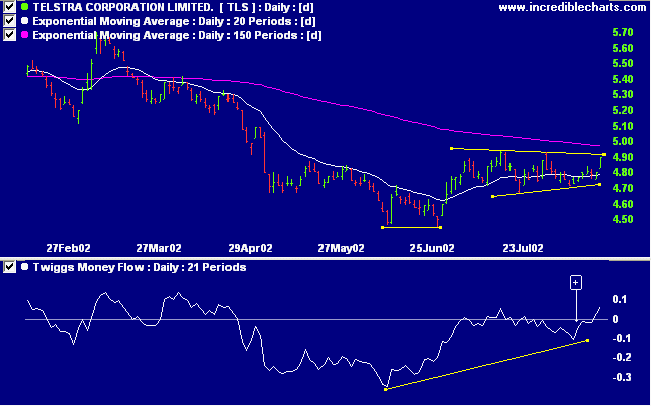

TLS is entering a stage 1 base after a lengthy decline. Relative strength (price ratio: xao) is rising and MACD has completed 2 bullish signals: a bullish divergence [+] followed by MACD respecting the zero line at [$].

If you can trust yourself when all men doubt you,

But make allowance for their doubting too....

Rudyard Kipling.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.