Tipping point

By Colin Twiggs

August 3, 2011 8:00 p.m. ET (10:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

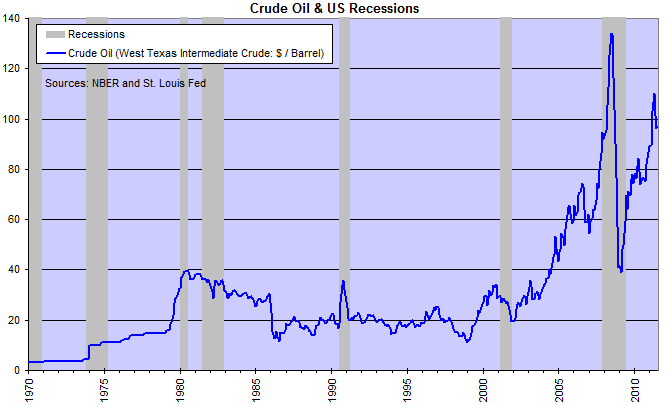

Markets are approaching the tipping point at which they will confirm a primary down-trend. The probability of a bear market is around 75 percent, with 80 about as high as you can get at a turning point. I highlighted in May that every significant spike in crude oil prices in the last 50 years has been followed by a recession — and the current spike is likely to prove no different. Ben Bernanke will modestly decline to take the credit, but the initial groundwork for higher oil prices was laid by QEII. Prices had started to rise well before the conflict in Libya.

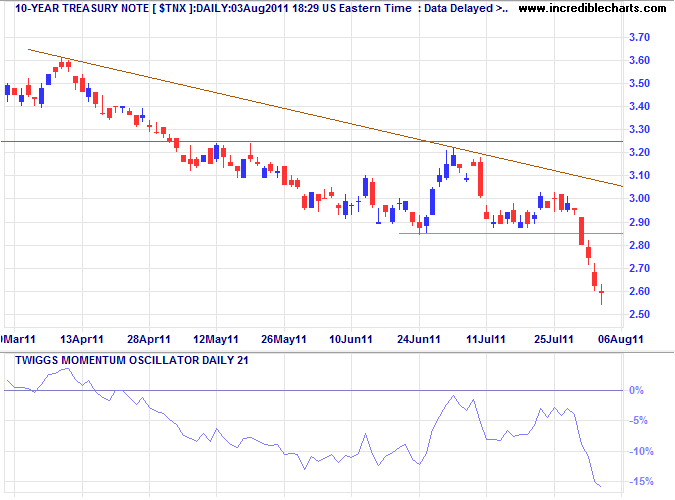

Investor flight to safety is clearly signaled by the sharp fall in 10-year treasury yields. Other safe havens such as gold and the Swiss franc display a corresponding spike over the last few days.

US Market

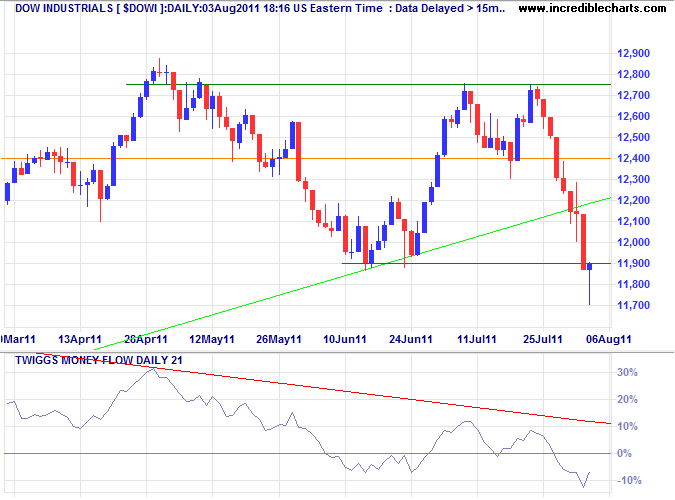

The long tail on today's candle for the Dow Jones Industrial Average indicates buying support, but 21-Day Money Flow below zero warns of longer term selling pressure. Only recovery above the rising trendline would call the bear signal into question. Follow-through below today's low at 11700 would confirm the primary down-trend — as would a close below 1250 on the S&P 500.

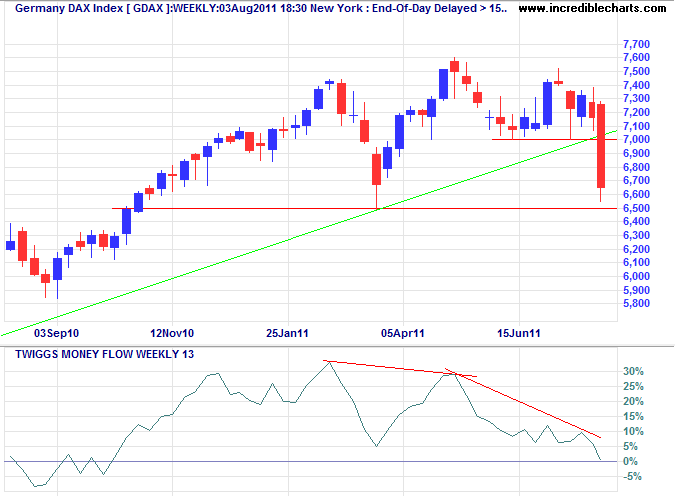

UK and Europe

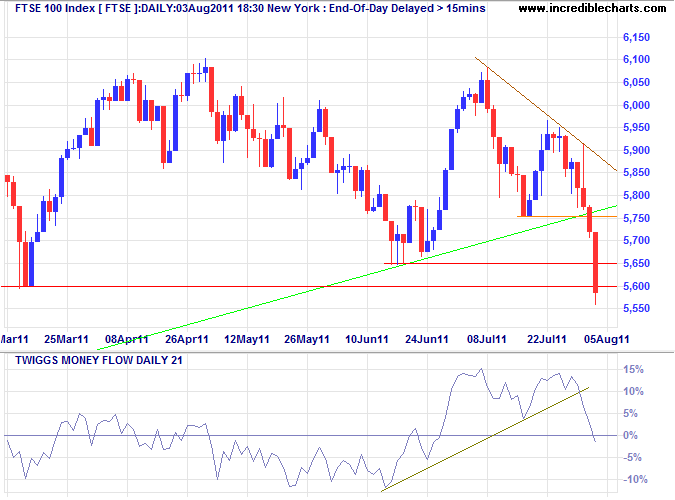

The FTSE 100 followed through below 5600 after breaking primary support at 5650, confirming a primary down-trend.

The DAX similarly broke primary support at 7000 on the weekly chart and is now testing its earlier support level at 6500 — breach of that would be the final nail in the coffin. Bearish divergence on 13-week Twiggs Money Flow has been warning of selling pressure for several months.

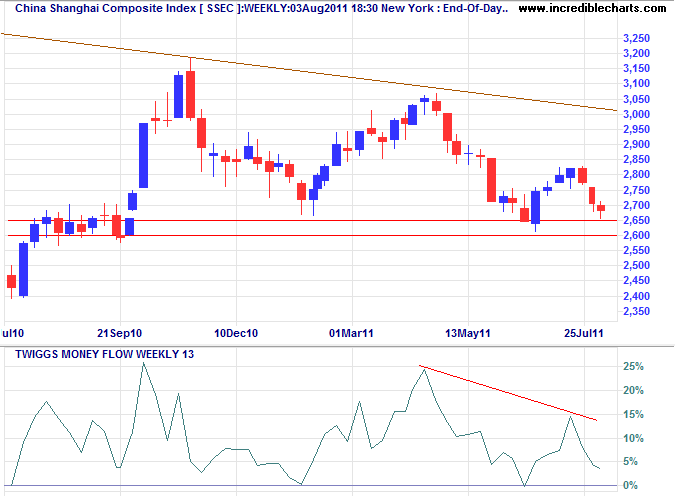

China

The Shanghai Composite Index is testing primary support at 2650 on the weekly chart. Follow-through below 2600 would confirm a primary down-trend. Declining 13-week Twiggs Money Flow again warns of selling pressure.

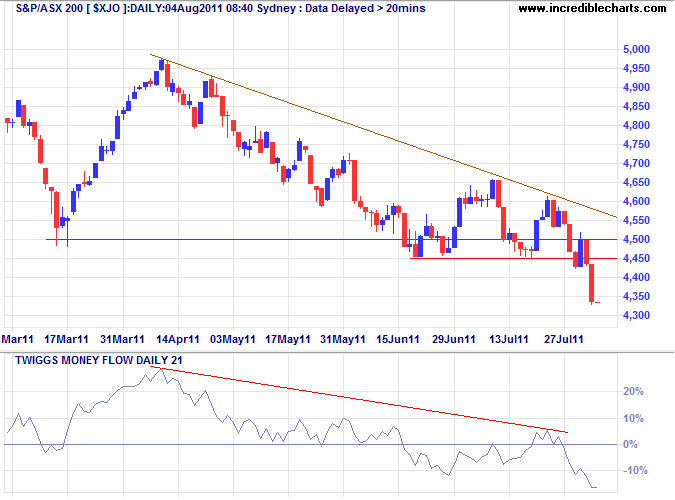

Australia

After several tentative attempts, the ASX 200 broke through support at 4500, following Brazil into a primary down-trend. Wednesday's follow-through below 4450 confirmed the signal. 21-Day Money Flow below zero indicates selling pressure. Expect retracement to test resistance at 4500, but target for the breakout is 4000*.

* Target calculations: 4500 - ( 5000 - 4500 ) = 4000

I think it was a long step forward in my trading education when I realized at last that when old Mr Partridge kept on telling other customers, "Well, you know this is a bull market!" he really meant to tell them that the big money was not in the individual fluctuations but in the main movements — that is, not in reading the tape but in sizing up the entire market and its trend.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.