Relief rally

By Colin Twiggs

August 1st, 2011 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Some Asian markets rallied after President Obama announced late Sunday evening that leaders of both parties, in both chambers, had reached agreement to lift the ceiling on federal debt and reduce the budget deficit.

We are likely to witness a relief rally this week, but raising the debt ceiling is not a solution to the problem. This is merely the opening round in a long-term ideological struggle between the Tea Party on the right and champions of big government on the left. Calls for small government are growing as disgruntled taxpayers ask themselves what they have to show for the $14 trillion of debt already incurred. Stubbornly high unemployment is likely to expand that support base even further in the years ahead.

If the markets worry were that the US government would default on its debt in 48 hours, then the celebrating is justified. But if they think that the US government and elected politicians have finally found a way out of the deficit hole that we've dug in the last decade or so, then they're over-optimistic. There's a lot of work to be done — and a lot of opportunities to fail to meet expectations........

~ WSJ Economics Editor David Wessel commenting on the the deal to lift the debt ceiling (WSJ video).

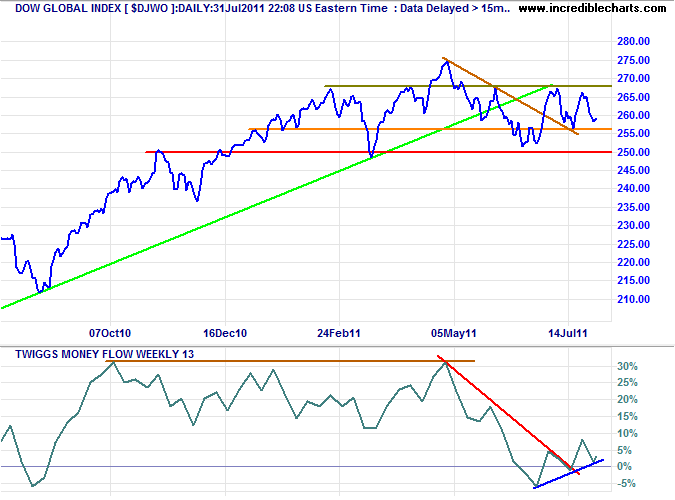

Global Index

The Dow Jones Global Index, having already broken the descending trendline, is expected to test resistance at 268. Breakout would reach the May high of 275. Rising 13-week Twiggs Money Flow indicates medium-term buying pressure. Reversal below support at 256 is unlikely at present, but would test primary support at 250.

USA

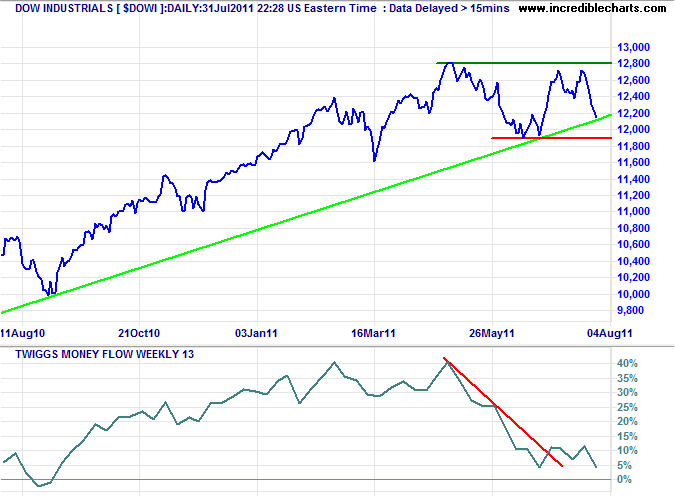

Dow Jones Industrial Average

The Dow Industrial Average is expected to rally to 12800, respecting the rising trendline. Breakout would signal a fresh advance to 13800*, but bearish divergence on 13-week Twiggs Money Flow warns of long-term selling pressure.

* Target calculation: 12800 + ( 12800 - 11800 ) = 13800

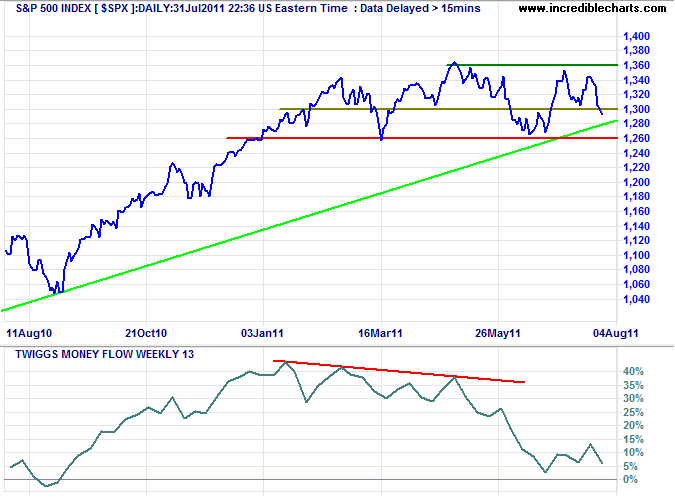

S&P 500

The S&P 500 is in a similar situation, with bearish divergence on 13-week Twiggs Money Flow warning of selling pressure. Another test of 1360 is likely in the short-to-medium term, but the long-term picture remains bearish. Breach of primary support 1260 would signal a reversal.

* Target calculation: 1360 + ( 1360 - 1260 ) = 1460

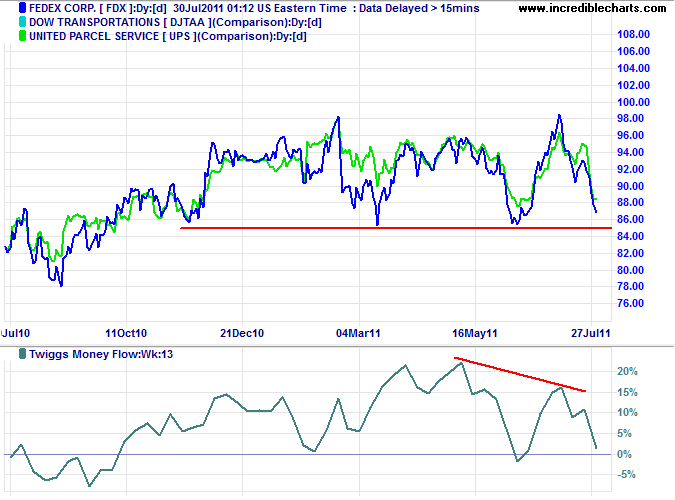

Transport

Transport stocks are weak, with bearish divergence on 13-week Twiggs Money Flow warning of Fedex reversal to a primary down-trend. UPS is also testing support, reflecting weak economic activity levels.

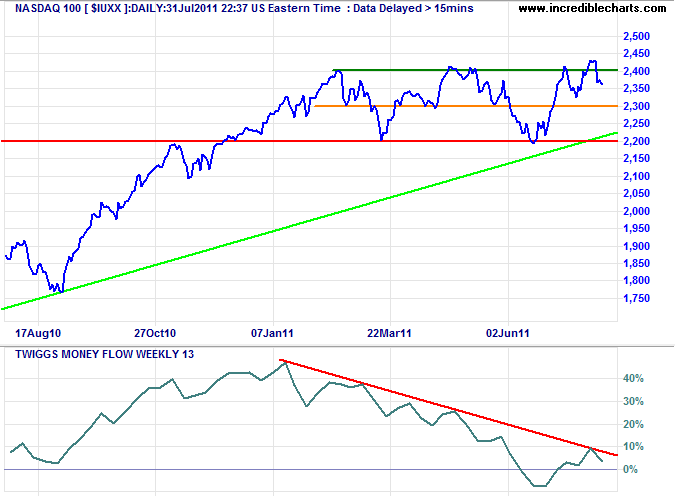

Technology

The Nasdaq 100 is likely to re-test resistance at 2400, but strong bearish divergence on 13-week Twiggs Money Flow warns of a primary trend reversal.

* Target calculation: 2400 + ( 2400 - 2200 ) = 2600

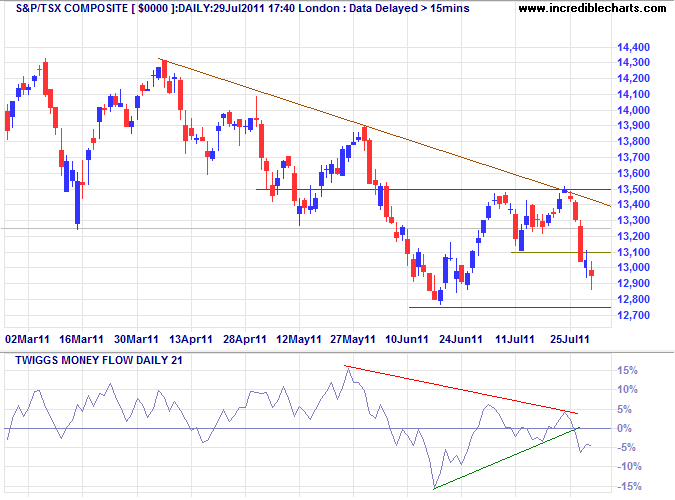

Canada: TSX

The TSX Composite Index is likely to rally in the short-term, but continue its primary down-trend in the medium-term, testing support at 12750. Failure of support would offer a target of 12000*. 21-Day Twiggs Money Flow below zero warns of medium-term selling pressure.

* Target calculation: 12750 - ( 13500 - 12750 ) = 12000

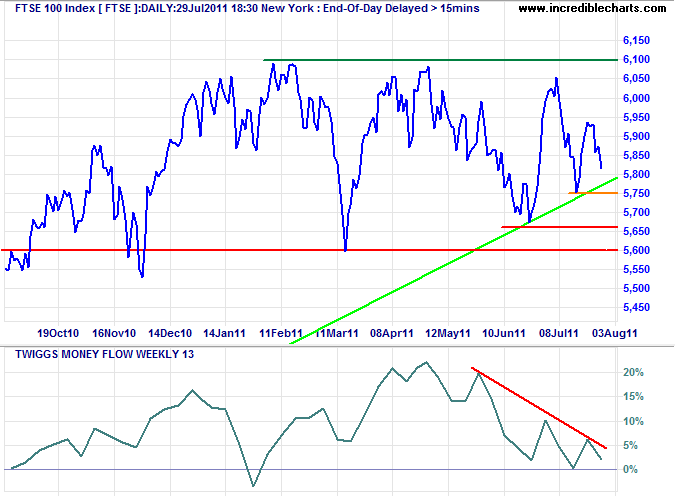

United Kingdom

The FTSE 100 may rally off the rising trendline, but 13-week Twiggs Money Flow continues to warn of selling pressure. Breach of support at 5600/5650 would signal a primary down-trend.

* Target calculation: 6100 + ( 6100 - 5700 ) = 6500 or 5600 - ( 6100 - 5600 ) = 5100

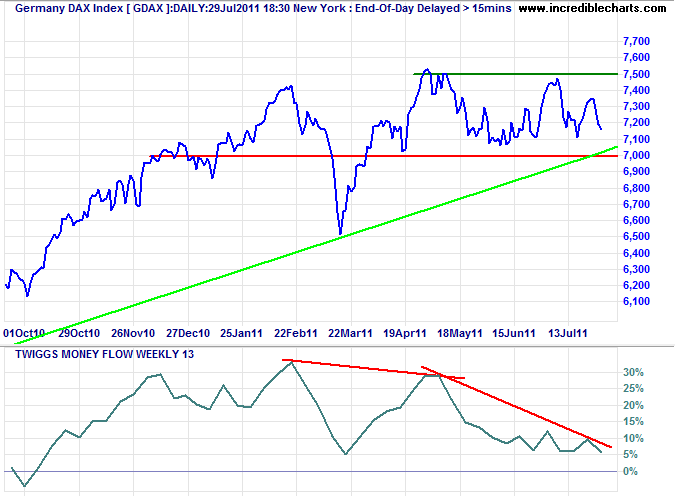

Germany

The DAX is headed for another test of support at 7000/7100. Breakout would indicate a primary down-trend. Bearish divergence on 13-week Twiggs Money Flow continues to warn of selling pressure.

* Target calculation: 7500 + ( 7500 - 7000 ) = 8000

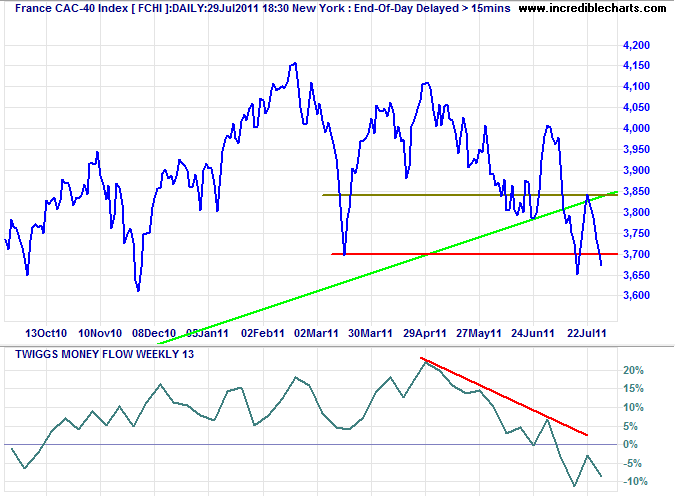

France

The CAC-40 reversed below support at 3700, signaling a primary down-trend. 13-week Twiggs Money Flow below zero confirms strong selling pressure.

* Target calculation: 3700 - ( 4100 - 3700 ) = 3300

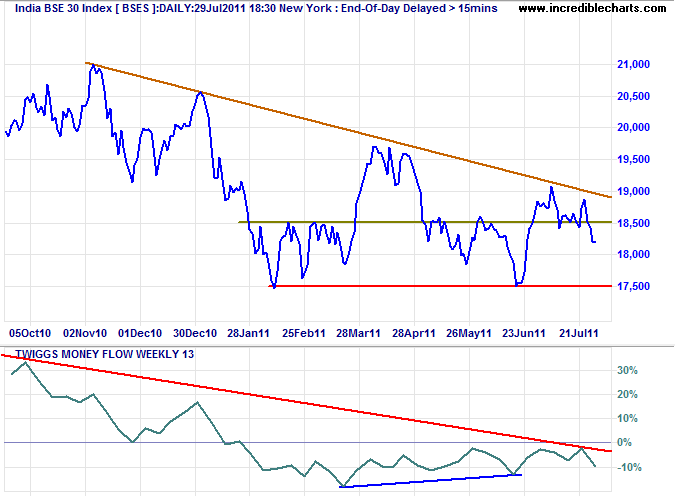

India

The Sensex gapped up at Monday's open, but had retreated to 18300 by midday. Respect of the declining trendline and 13-Week Twiggs Money Flow persisting below zero both warn of another test of primary support at 17500.

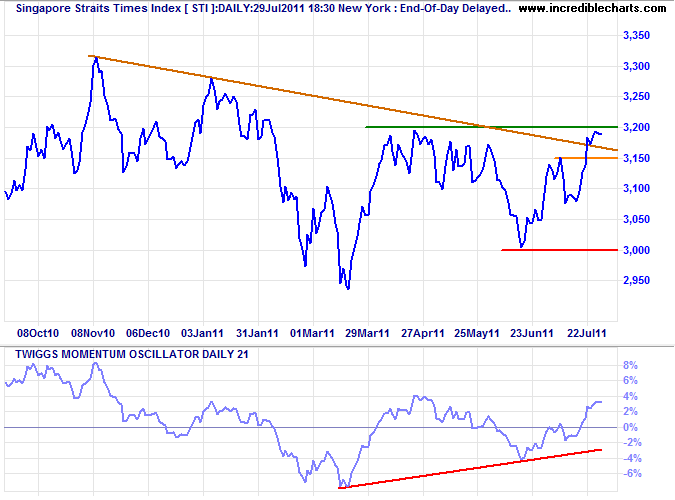

Singapore

The Straits Times Index is holding above 3200 Monday, indicating the start of a primary up-trend. It may be prudent to wait for retracement to confirm the new support level.

* Target: 3200 + ( 3200 - 3000 ) = 3400

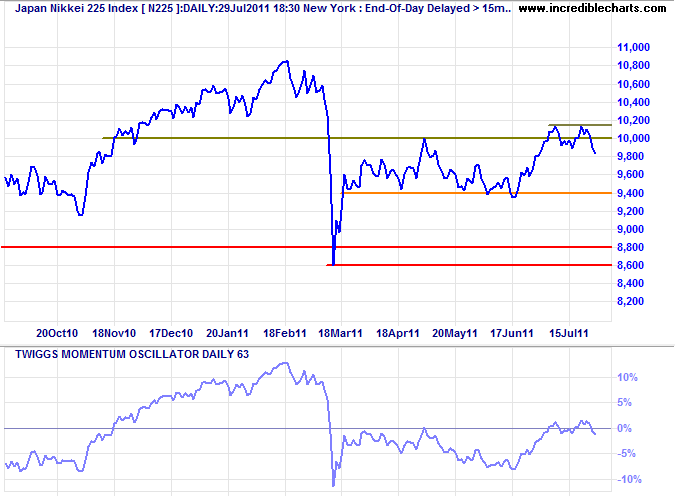

Japan

The Nikkei 225 rallied above 10000 Monday morning, but lost ground in afternoon trading. Long-term (63-day) Momentum oscillating around zero indicates no real trend at present. Reversal below 9900 would suggest another test of support at 9400.

* Target calculation: 10000 + ( 10000 - 9300 ) = 10700

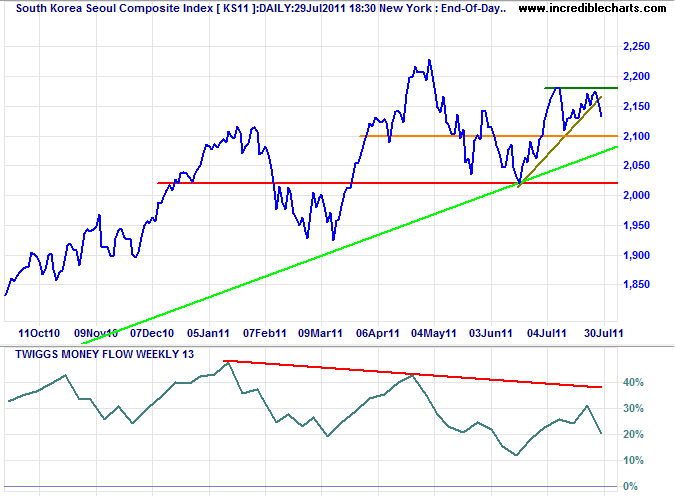

South Korea

The Seoul Composite Index rallied Monday to test resistance at 2180. Breakout would indicate an advance to 2320*. Reversal below 2100 is unlikely, but would re-test primary support at 2000. Buying pressure is gradually weakening but remains positive according to 13-week Twiggs Money Flow.

* Target calculation: 2180 + ( 2180 - 2020 ) = 2320

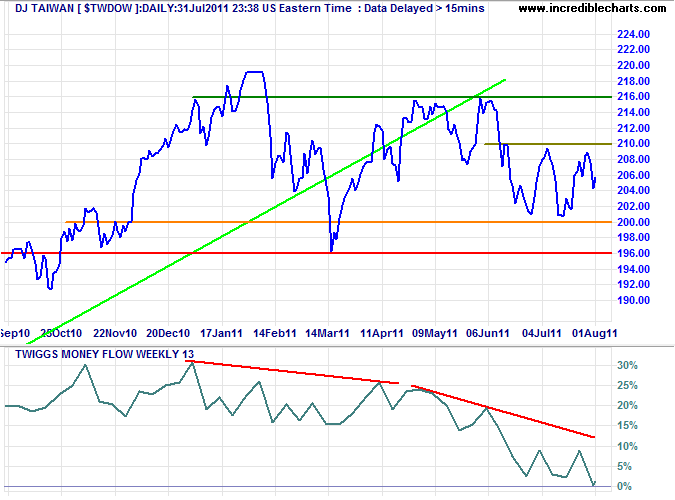

Taiwan

The Dow Jones Taiwan Index continues to warn of reversal to a primary down-trend, with breach of the declining trendline and bearish divergence on 13-week Twiggs Money Flow. Failure of support at 200 would test primary support at 196.

* Target calculation: 196 - ( 216 - 196 ) = 176

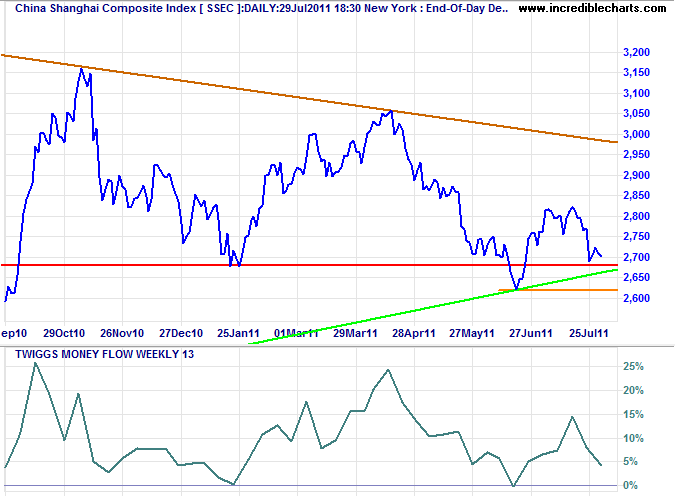

China

The Shanghai Composite Index was unmoved, trading sideways for most of Monday. Reversal below 2700 would warn of a primary down-trend — confirmed if support at 2620 is breached. Reversal of 13-week Twiggs Money Flow below zero would strengthen the signal.

* Target calculations: 2700 - ( 3000 - 2700 ) = 2400

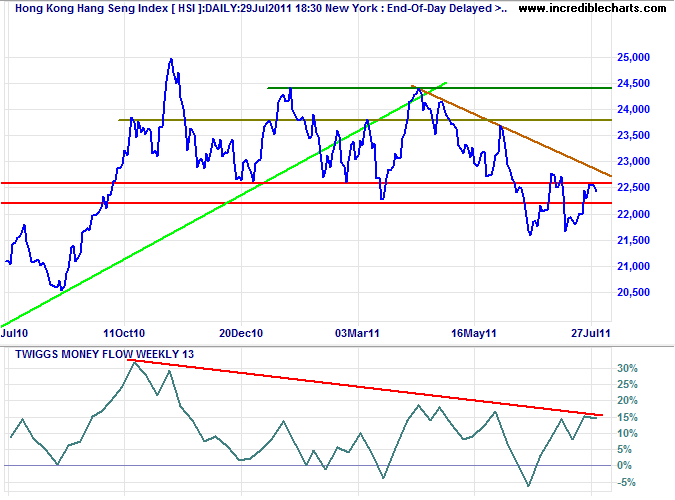

The Hang Seng Index fared better Monday, testing the descending trendline at 22800. Reversal below 22200 would warn of a primary down-trend and breach of 21500 would confirm. 13-Week Twiggs Money Flow, however, is holding above zero, indicating medium-term buying support.

* Target calculation: 22200 - ( 24400 - 22200 ) = 20000

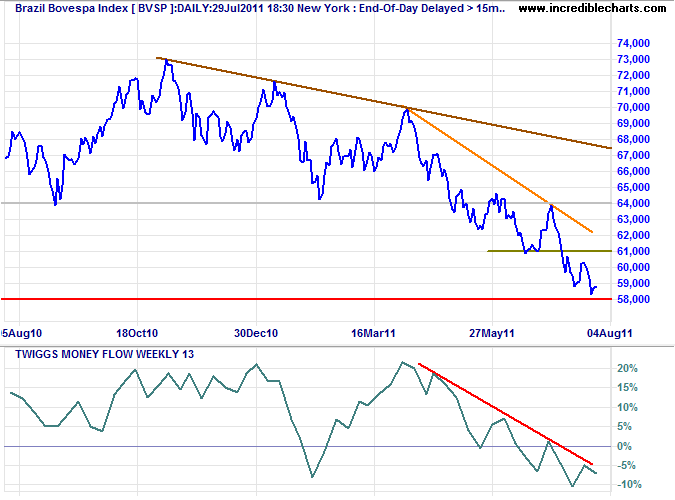

Brazil: Bovespa

The Bovespa Index continues in a strong primary down-trend. Expect support at the May low of 58000*. Failure would offer a target of 55000*. Declining 13-week Twiggs Money Flow below zero indicates strong selling pressure.

* Target calculation: 58000 - ( 61000 - 58000 ) = 55000

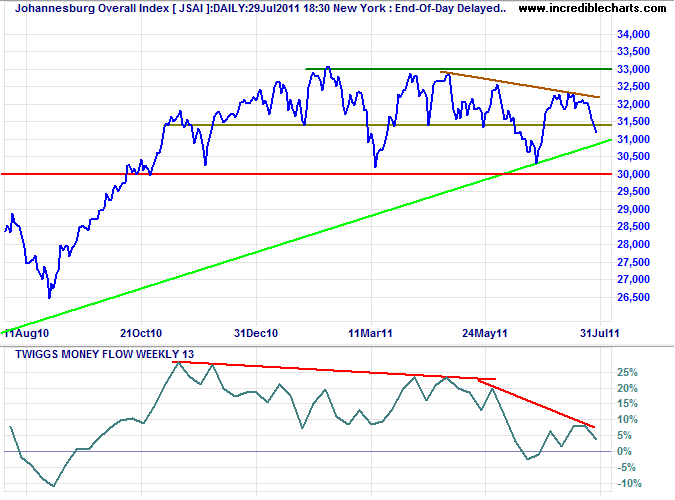

South Africa: JSE

The JSE Overall Index retreated below 31400/31500, indicating another test of 30000. The failed swing (did not reach 33000) is a bearish sign. Declining 13-week Twiggs Money Flow warns of selling pressure.

* Target calculation: 33000 + ( 33000 - 30000 ) = 36000 or 30000 - ( 33000 - 30000 ) = 27000

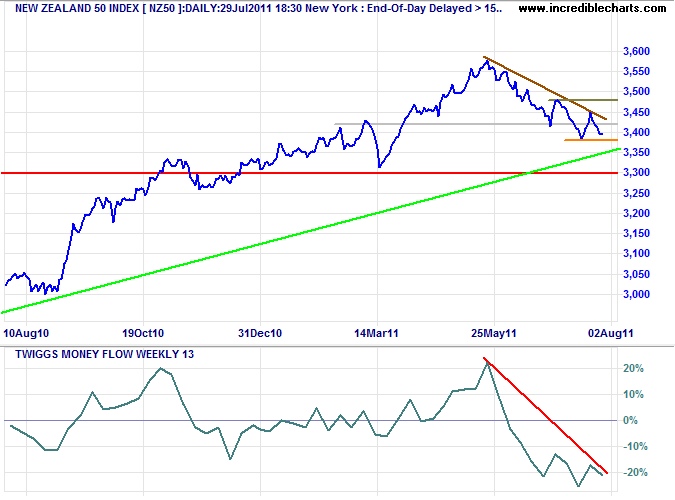

New Zealand: NZX

The NZ50 rallied to 3420 Monday, but remains in a down-trend, headed for primary support at 3300. 13-Week Twiggs Money Flow far below zero continues to warn of reversal to a primary down-trend.

* Target calculation: 3425 + ( 3425 - 3300 ) = 3550

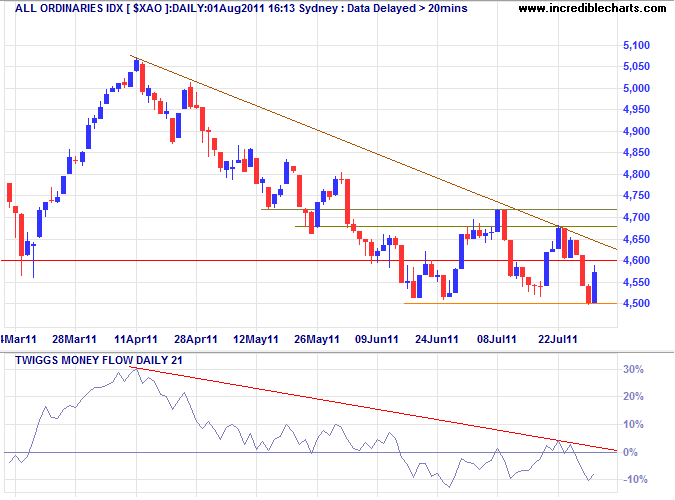

Australia: ASX

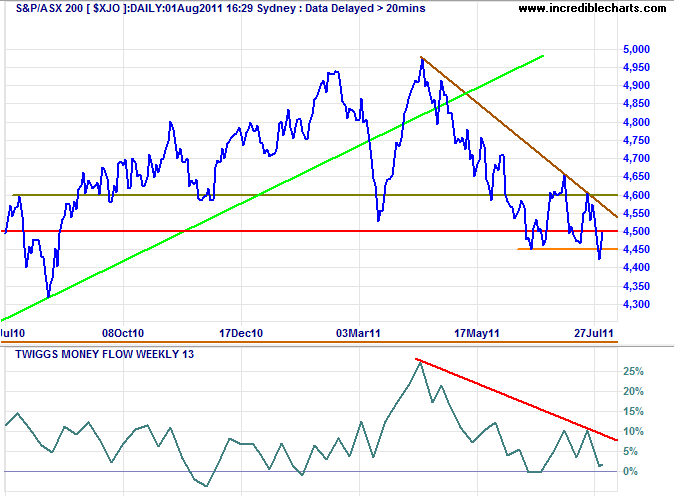

The All Ordinaries rallied to test resistance at the former primary support level of 4600. Expect follow-through Tuesday if the Dow rallies, but the index remains in a primary down-trend. 21-Day Twiggs Money Flow below zero continues to warn of selling pressure.

* Target calculation: 4600 - ( 5000 - 4600 ) = 4200

A longer-term view of the ASX 200 reinforces the bearish picture, with declining 13-week Twiggs Money Flow indicating selling pressure. Reversal below 4450 would confirm the down-trend.

* Target calculation: 4500 - ( 5000 - 4500 ) = 4000

The chief business of the American people is business.

~ Calvin Coolidge

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.