Don't Blame The Free Market

By Colin Twiggs

March 27, 2008 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Free Market

The

Financial Times features an article pronouncing the end of

a three decade move towards market-driven financial systems and

quotes Joseph Ackermann as saying: "I no longer believe in the

market's self-healing power". The Deutsche Bank CEO appears to

have forgotten that financial markets are the exact opposite of

a free market. Instead of allowing the market to establish its

own equilibrium rate of interest, matching supply of credit

with demand, the Fed and other central banks impose artificial

rates for political ends.

The current financial crisis was wrought by the Fed imposing

just such an artificially low rate. The resulting mis-match

between supply of credit and demand encouraged poor lending

practices and fuelled a housing bubble of epic proportions.

Financial markets require greater policing, but precisely

because they are not free — and there is no market

mechanism to prevent the resulting excesses.

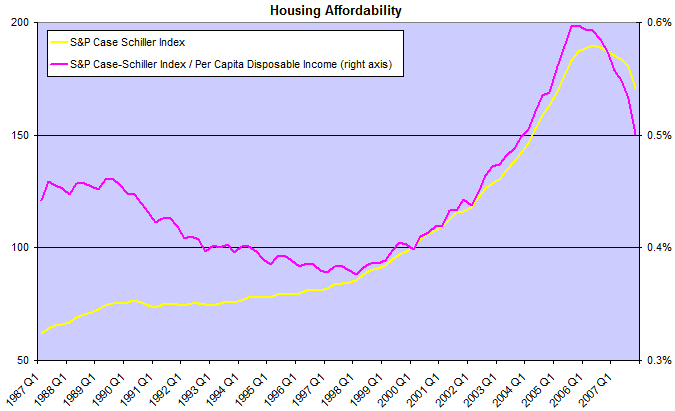

The Housing Bubble

The seriousness of the housing bubble is best illustrated by the ratio of the S&P Case-Shiller Composite Housing Index to Disposable Income per capita (before adjustment for inflation). The previous high of 0.45% in the late 1980s was dwarfed by the reading of close to 0.6% in 2005/2006. There has since been a strong retracement, but the index remains well above the 0.4% level needed to motivate home-buyers.

With

real estate exposure exceeding $7 trillion and total

capital and reserves of just under $1 trillion, a further 10%

fall in house prices would have a devastating effect on the

banking system. Much of their normal margin of safety has

already been wiped out by the existing fall. While this may

appear an extreme scenario, the economy faces falling

consumer sentiment and declining incomes from an

approaching recession.

I am sure that the problem has been keeping Ben Bernanke awake

at nights. With interest rates already close to record lows,

the only tool the Fed has left in its toolbox is inflation. By

raising nominal incomes rather than lowering house prices they

can achieve the same end — but at what long-term cost to

the economy?

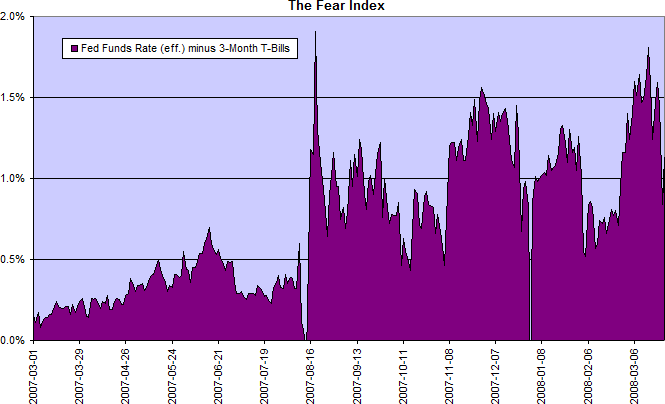

Financial Markets — The Fear Index

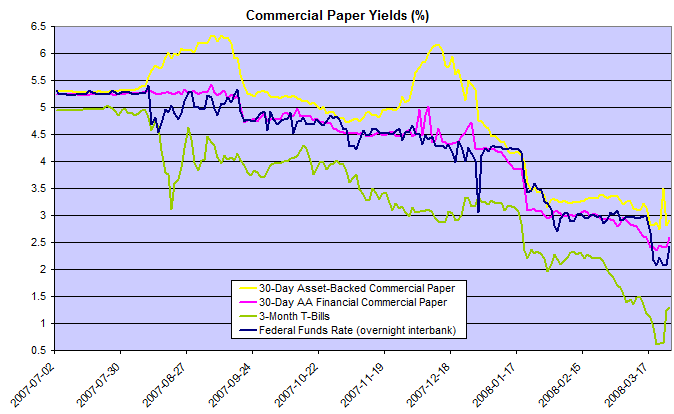

The spread between the fed funds rate and 3-month T-bills remains above 1.0%, warning of an unstable market — where investors prefer the safety of treasury securities against higher yields in the inter-bank and commercial paper markets.

The 1998 LTCM collapse, by comparison, caused a relatively brief spike above 1.0%.

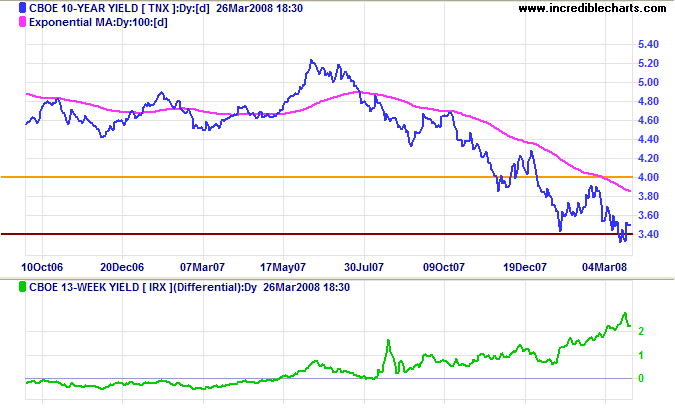

Treasury Yields

Ten-year treasury yields found support at 3.40%. Expect either consolidation or a reaction to test the long-term moving average. The rising yield differential indicates that bank margins are improving, but financial markets are likely to suffer from the after-effects of the 2006/2007 negative yield differential for most of 2008.

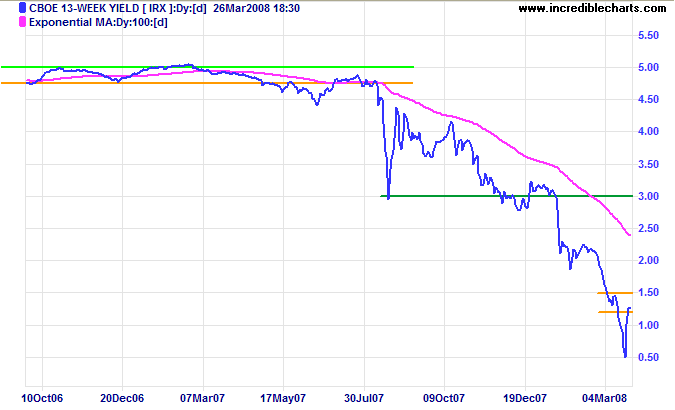

Three-month treasury bills yields have recovered from the sharp fall last week, but the strong down-trend continues.

Financial Markets — Commercial Paper

The wide spread between treasury bill and commercial paper rates reflects investors aversion to lending in the financial markets.

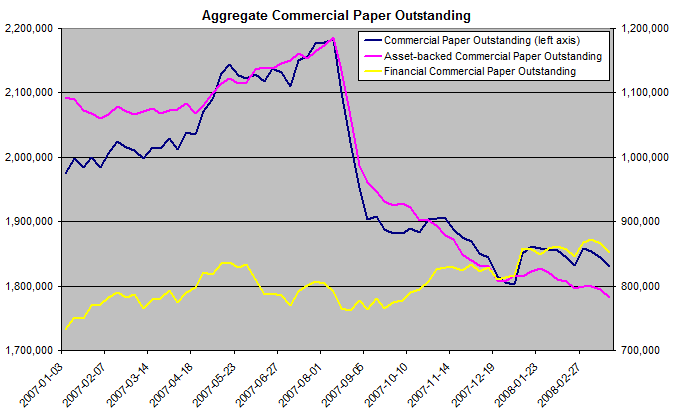

Total asset-backed commercial paper in issue declined below $800 billion, with banks forced to take debt back onto their balance sheets as investors shun new offers.

Corporate Bonds

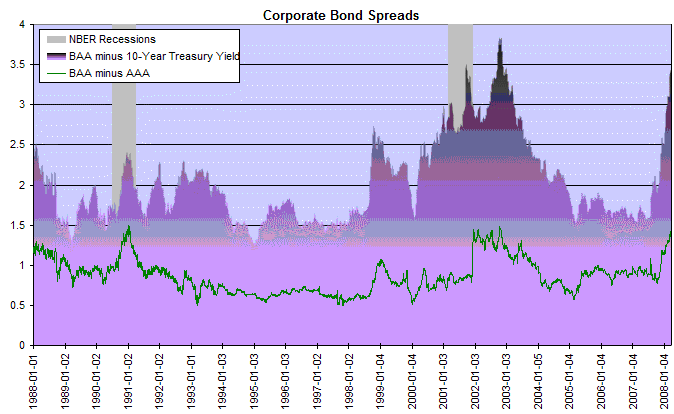

Corporate bond spreads remain at levels last seen during the 2001 recession.

Bank Credit

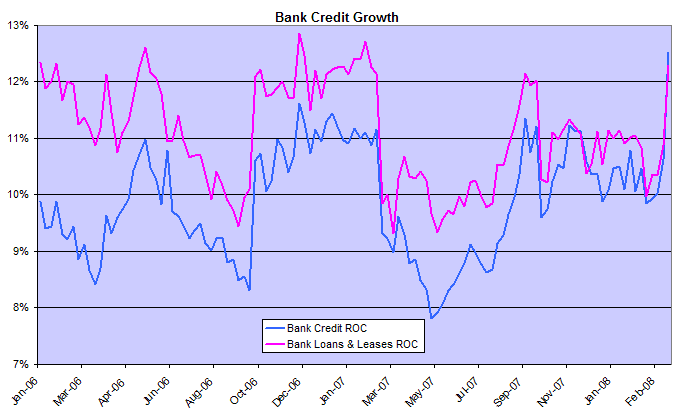

Bank credit growth is rising sharply as the Fed's liquidity measures take effect. Unfortunately the figures are somewhat distorted by the break-up of off-balance sheet structures.

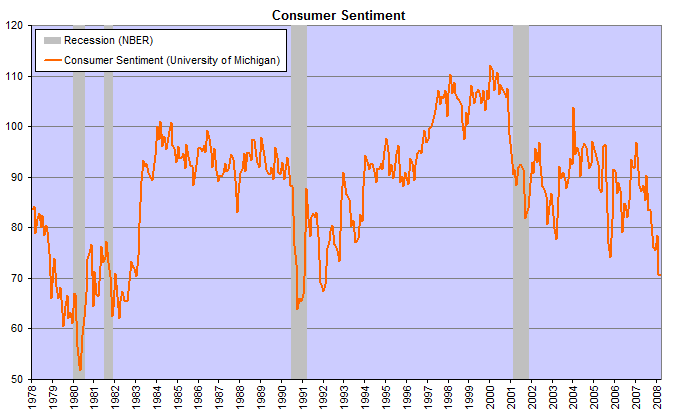

Consumer Sentiment

Conference Board consumer confidence and University of Michigan consumer sentiment surveys both record a significant drop in their March 2008 readings. Falls of this magnitude normally herald the start of a recession.

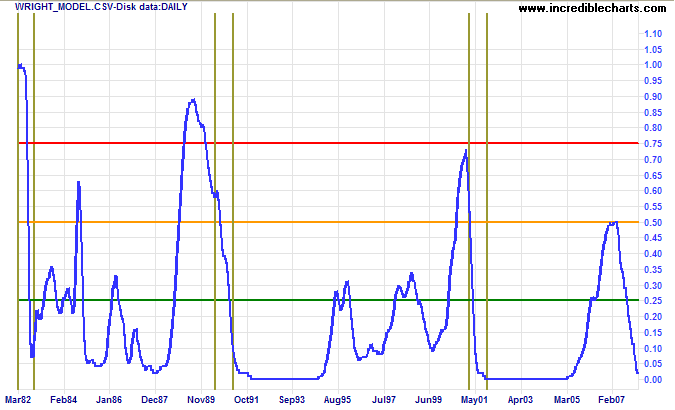

Wright Model

Jonathan Wright's recession prediction model shows probability of a recession in the next four quarters fell to 2 percent.

I would prefer to stop publishing the model, as I believe it failed to predict the current recession in a relatively low interest rate environment. Some readers, however, have indicated that they still find it useful; so I continue to include it, solely for their benefit.

The trouble with most people is that they think with their

hopes or fears or wishes rather than with their minds.

~

Will Durant.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.