All Hands To the Pump

By Colin Twiggs

March 6, 2008 9:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

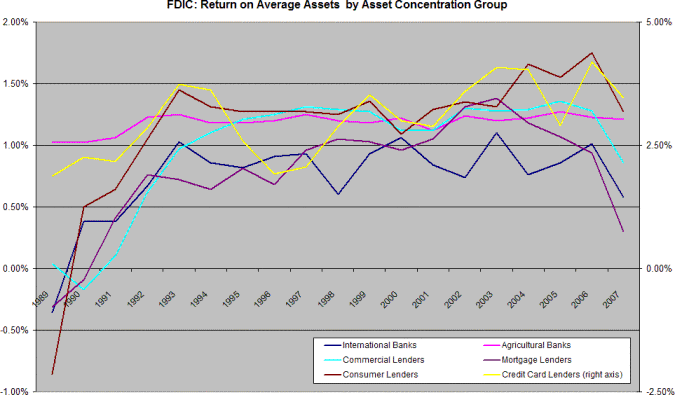

Bank Exposure

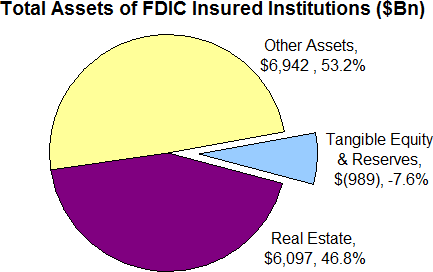

Despite their carefully cultivated image of solidity and reliability, banks are highly-leveraged institutions whose capital reserves can be wiped out by a relatively small decline in asset values. Tangible equity and reserves of FDIC insured institutions total almost $1 trillion at December 2007, or just 7.7% of their $13 trillion in total assets. Real estate assets amount to a shade over $6 trillion, to which we should add securitized real estate loans — giving $7.3 trillion of total exposure to real estate. This means that a 1 percent loss on real estate assets would wipe out 7.3% of all capital reserves — and a 10 percent loss (not envisaged) would wipe out three quarters of tangible equity and reserves.

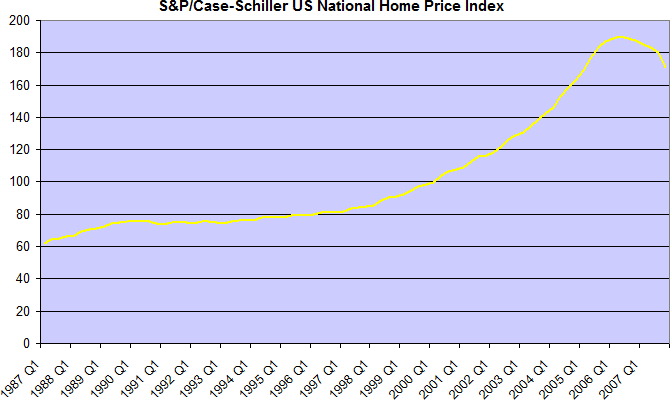

Now not all real estate loans are about to default. Housing prices may have fallen 10 percent from their 2006 peak, according to the S&P/Case-Shiller U.S. National Home Price Index, but this does not translate to an equivalent fall in bank asset values.

In most cases, banks have a built-in margin of safety, with

loan values at less than 100% of valuation, but this is being

whittled away. The percentage of defaulting (non-accruing or

90+ days past due) real estate loans is more severe than the

FDIC figure of 1.7% (December 2007), which excludes $1.3

trillion of securitized loans where default rates are a lot

higher.

With real estate values continuing to fall, we can understand

why the Fed cry is "all hands to the pump."

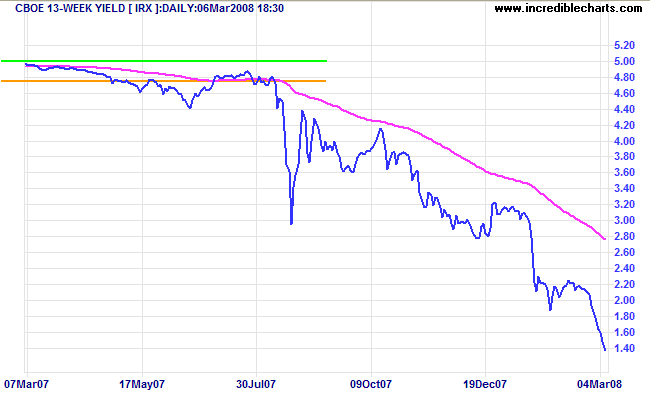

Treasury Yields

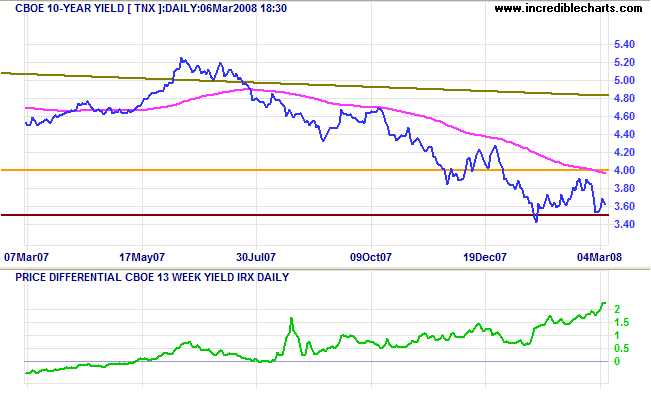

Ten-year treasury yields found support at 3.50%. The strong down-trend, however, continues. The rising yield differential results from falling short-term rates.

Short-term yields show market expectations of further rate cuts — falling below 1.50 percent. The strong down-trend continues.

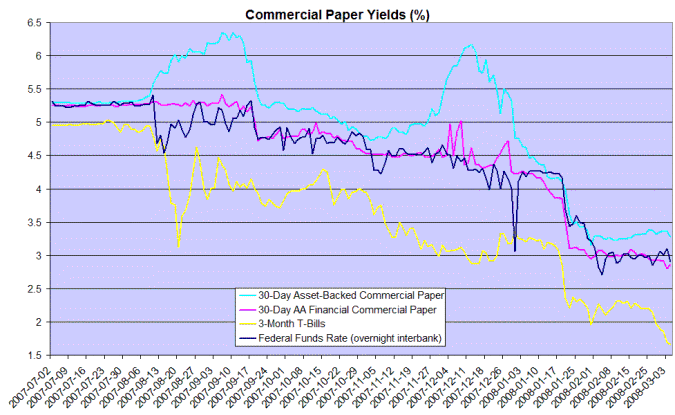

Financial Markets

The spread between t-bill and commercial paper rates has again widened, indicating increasing concern over the strength of the financial sector. The fed funds rate dipping below its 3.0% target signals that further rate cuts are likely.

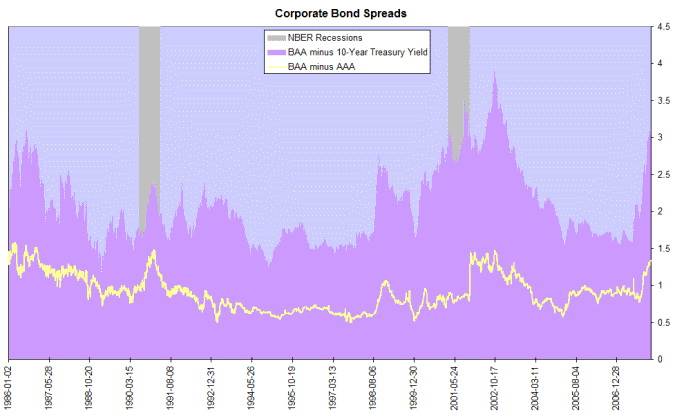

Corporate Bonds

Corporate bond spreads have climbed to levels last seen during the 2001 recession.

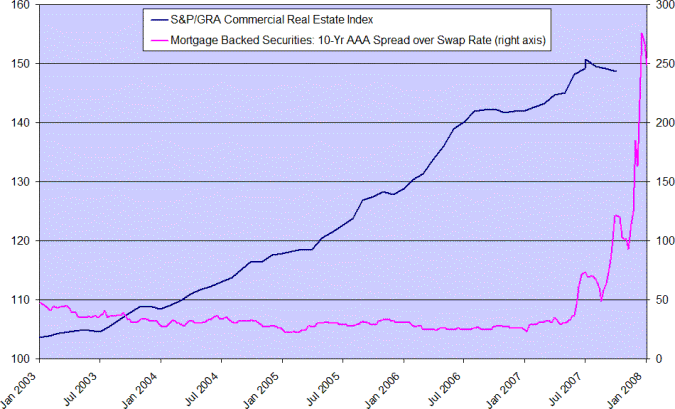

Commercial Real Estate

So far, the S&P/GRA commercial real estate index shows a drop of only 1 percent from its 2006 peak, but spreads for AAA rated (10-year) commercial mortgage-backed securities have subsequently climbed to 250 points above the swap rate. Further contraction of the commercial real estate market is expected.

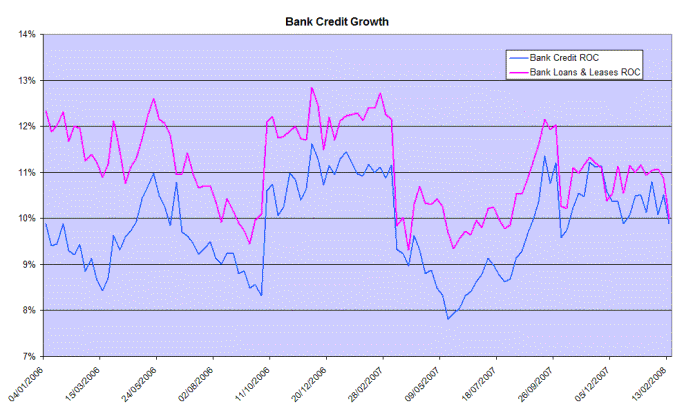

Bank Credit

Bank credit growth is expected to fall below 10%. A sharp decline would threaten a full-blown recession.

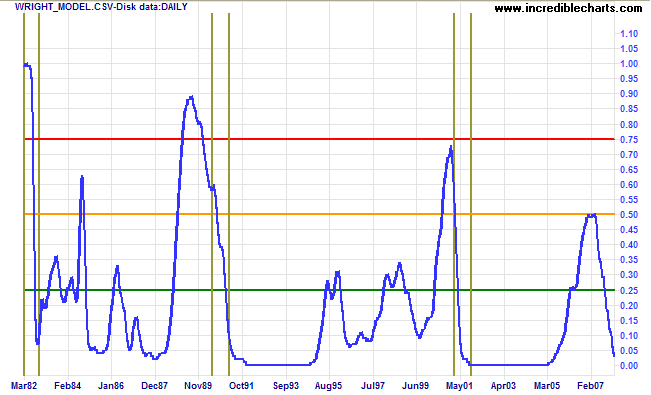

Wright Model

Jonathan Wright's recession prediction model shows probability of a recession (in the next four quarters) has now fallen to 3 percent. My criticism of the model is that it underestimated the probality of recession at the end of 2006. The recent peak should have been a lot higher — around 70 to 80 percent. And I do not believe that the probability of recession 12 months ahead is low — I would assign a probability of 60 to 70 percent.

The amount of ordinary commerce, internal and external, of a

country may be computed at a fixed sum. A certain sum of money

is needed to circulate among the society in order to carry on

their business. This precise sum is discoverable by calculation

and reducible to certainty. You may emit paper or any other

currency for this purpose until you reach this rule, and it

will not depreciate. After you exceed this rule it will

depreciate and no power or set of legislation hitherto invented

can prevent it. In the case of paper, if you go on emitting

forever, the whole mass will be worth no more than that which

was emitted within the rule.

~ John Adams writing on the collapse of the Continental

currency (circa 1780).

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.