We wish our readers peace and goodwill over Christmas

and prosperity in the year ahead.

Trading Diary

December 15, 2003

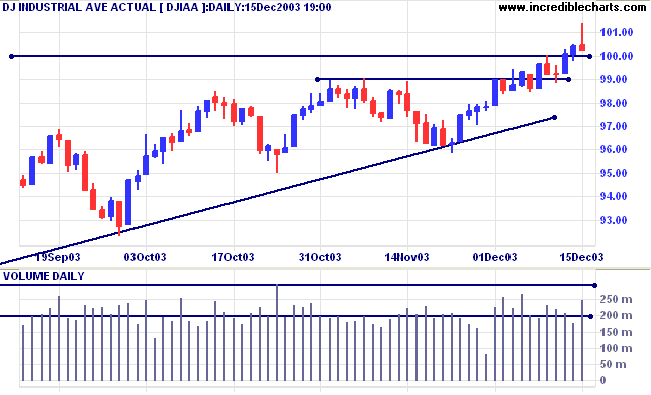

The intermediate trend is up.

The primary trend is up. A fall below support at 9000 will signal reversal.

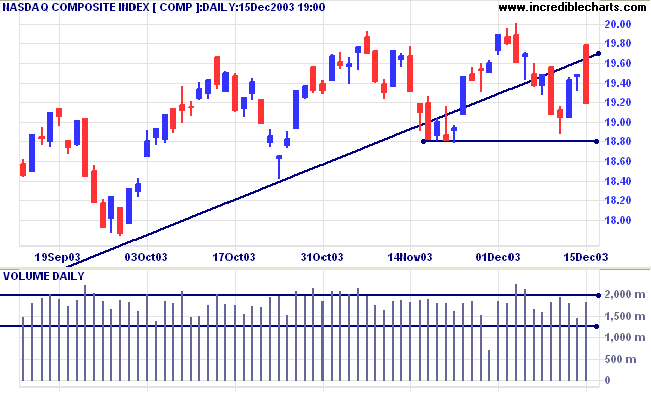

The intermediate trend is uncertain. A fall below 1880 will complete a double top reversal pattern with a target of 1760: 1880-(2000-1880).

The primary trend is up. A fall below support at 1880 will signal reversal.

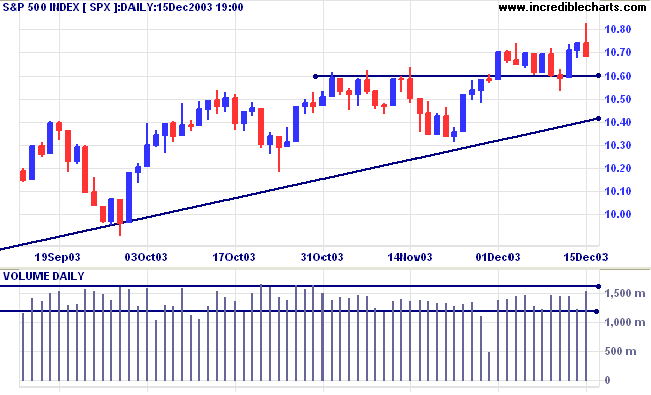

The intermediate trend is up.

Short-term: Bullish if the S&P500 is above today's high of 1082. Bearish below 1053, Wednesday's low.

Intermediate: Bullish above 1082.

Long-term: Bullish above 960.

The dollar reached a record low of $1.2311 against the euro. (more)

The yield on 10-year treasury notes is up at 4.27%.

The intermediate trend is down.

The primary trend is up.

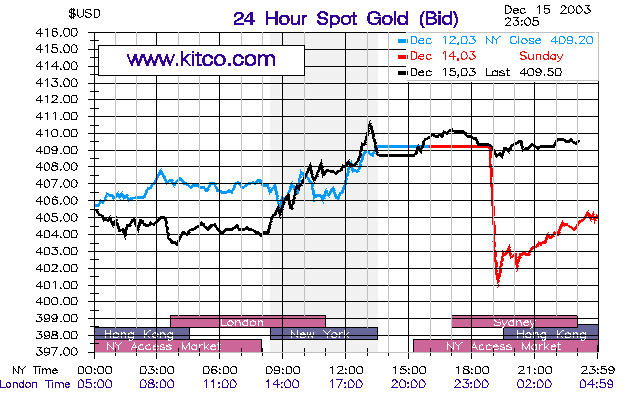

New York (23.05): Spot gold rallied to $409.50 after earlier testing support at 400.

The intermediate trend is up.

The primary trend is up. Expect resistance at 415.

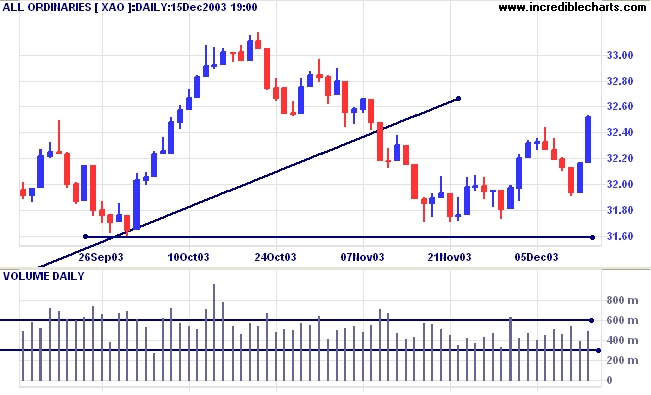

The intermediate up-trend continues.

Short-term: Bullish above 3213, Thursday's high. Bearish below 3173 (the December 1 low).

Twiggs Money Flow (100) is leveling out, with equal lows, after a bearish triple divergence.

Intermediate term: Bullish above 3213. Bearish below 3160.

Long-term: Bearish below 3160.

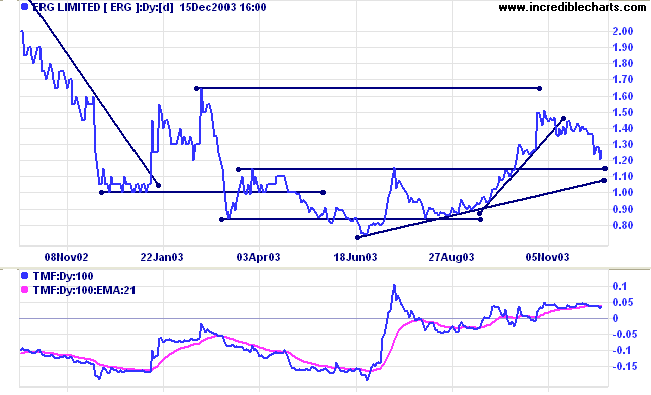

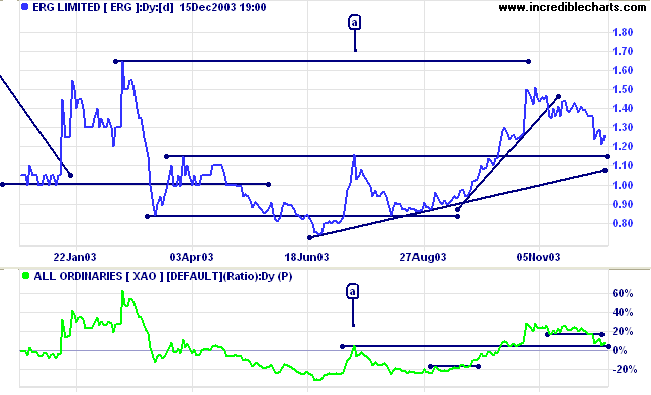

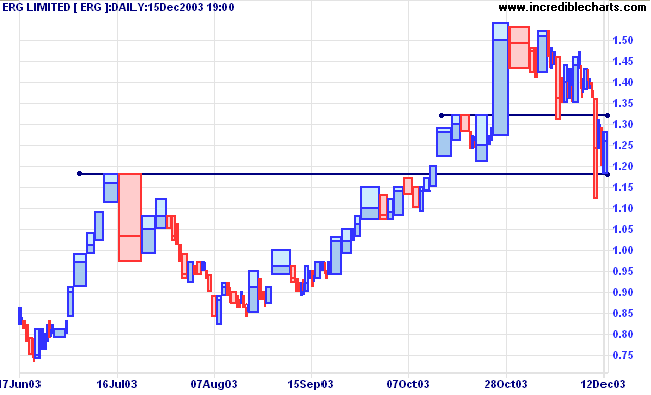

Last covered November 4, 2003.

ERG formed a broad base during 2003, followed by a strong intermediate rally. The rally lost momentum and we now see a correction back to the primary trendline. Twiggs Money Flow signals buying pressure, with a rise above zero.

A fall below support on price and RS charts will be bearish, confirmed if a pull-back respects the new resistance level.

Last covered October 1, 2003.

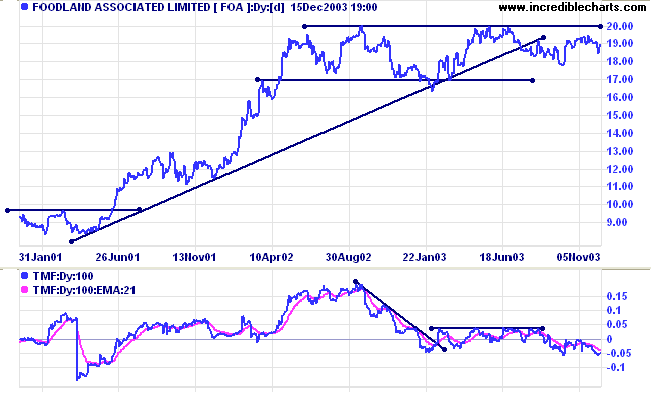

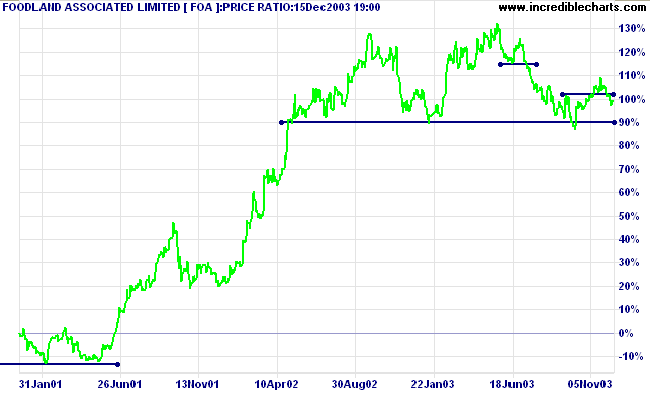

FOA has formed a broad stage 3 top. Twiggs Money Flow (100) continues to decline, signaling selling pressure. Support is at 16.00 to 17.00.

by those who were never at her school, teaches us only to extend a simple maxim

universally known and followed even in the lowest life,

a little farther than that life carries it.

And this is not to buy at too dear a price.

Now, whoever takes this maxim abroad with him into the grand market of the world,

and constantly applies it to honors, to riches, to pleasures,

and to every other commodity which that market affords,

is, I will venture to affirm, a wise man;

and must be so acknowledged in the worldly sense of the word:

for he makes the best of bargains,

since in reality he purchases everything at the price of a little trouble,

and carries home all the goods I have mentioned,

while he keeps his health, his innocence and his reputation,

the common prices which are paid for them by others,

entire and to himself.

- Henry Fielding: Tom Jones (1749).

Today is the last daily newsletter until Monday, January 5th.

I will continue with the weekly updates.

Enjoy the Christmas break.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.