|

US stocks Our target is to have NYSE, Nasdaq and Amex charts available by Friday. |

Trading Diary

November 4, 2003

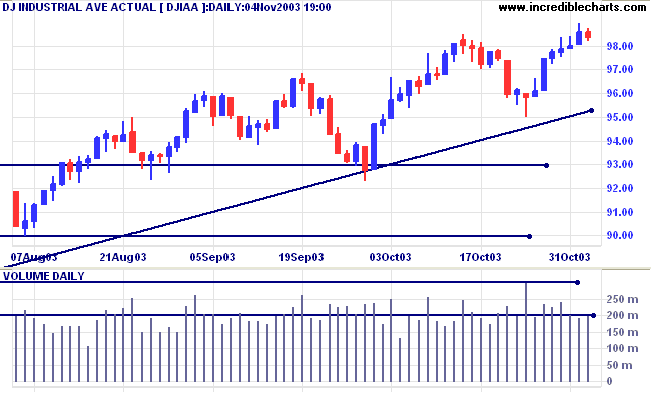

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

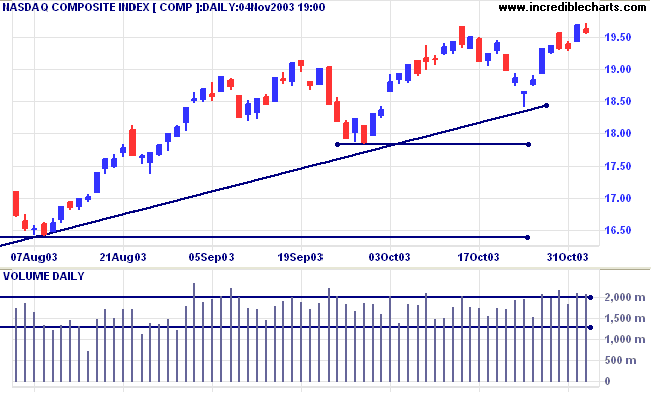

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal. Expect resistance at 2000.

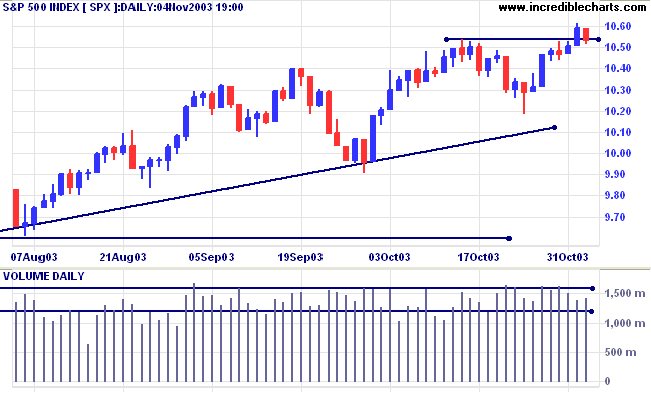

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1059.

Intermediate: Bullish above 1059.

Long-term: Bullish above 960.

The highest level of job cut announcements was recorded since October 2002. Unemployment is still high and many human resource managers do not see a pick-up in hiring until the second quarter of 2004. (more)

The yield on 10-year treasury notes retreated to 4.30%.

The intermediate down-trend is weak.

The primary trend is up.

New York (17.44): Spot gold recovered to $379.90.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

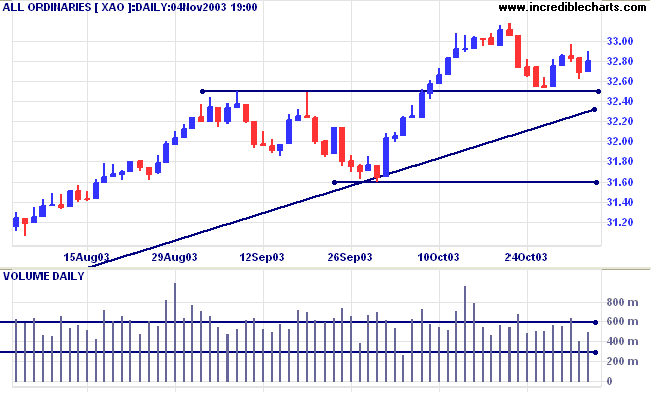

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3296. Bearish below 3250.

Intermediate: Bullish above 3296.

Long-term: Bullish above 3160.

A stock screen of sector indices reveals that IT has out-performed all other sectors of the ASX by a substantial margin over the past 3 months:

| Sector Index | %Move(3M) |

|

Information Technology [XIJ] Materials [XMJ] Consumer Discretionary [XDJ] Health Care [XHJ] Industrials [XNJ] Energy [XEJ] Telecom Services [XTJ] Financial-x-Property [XXJ] Consumer Staples [XSJ] Utilities [XUJ] Property Trusts [XPJ] |

59% 14% 10% 7% 5% 2% 1% 0% 0% 0% -4% |

Last covered on October 28, 2003.

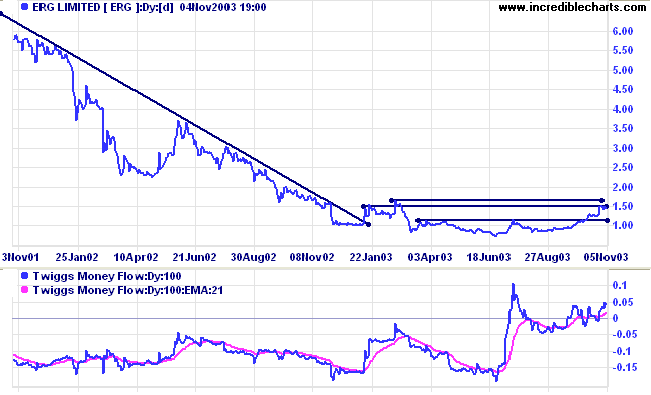

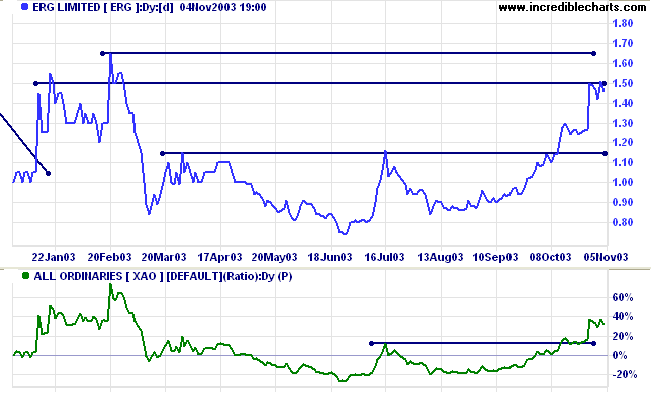

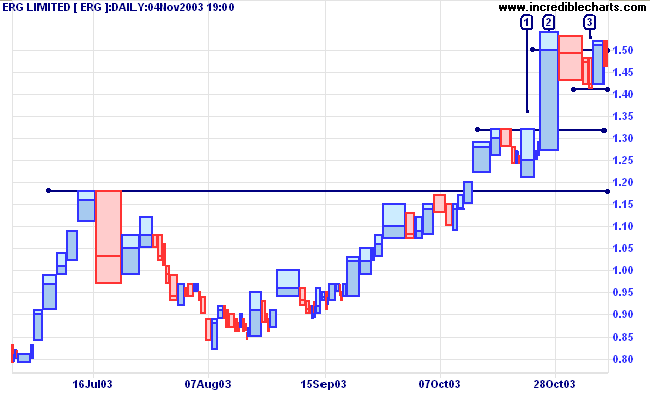

ERG has broken out of a broad base and is testing resistance at 1.50 to 1.80. Twiggs Money Flow (100) has climbed above zero to signal accumulation, after a long period of distribution.

Last covered on September 1, 2003.

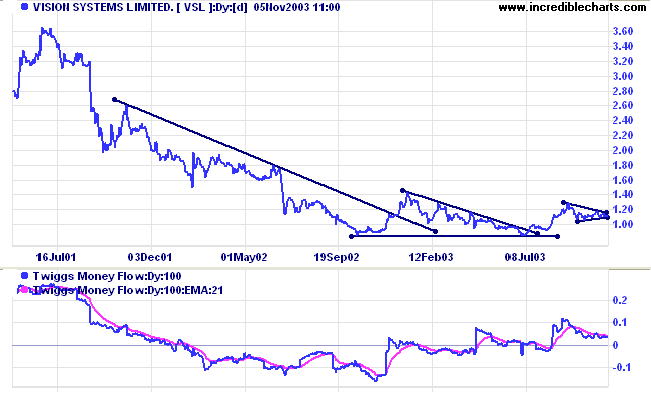

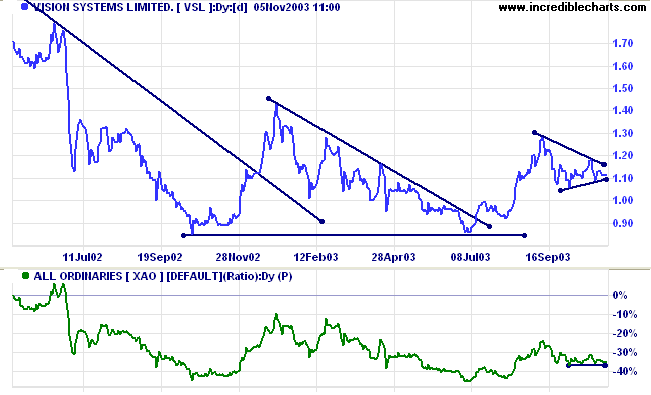

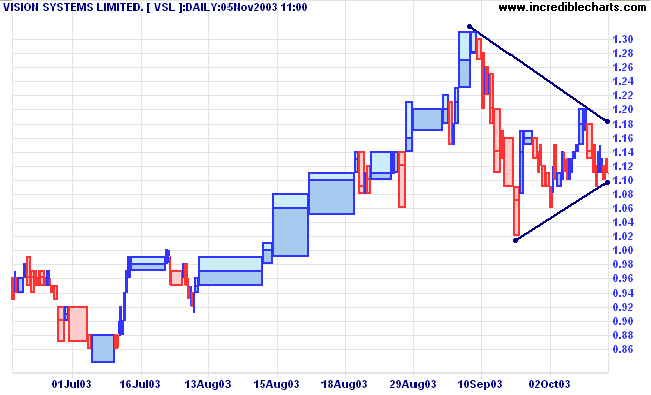

Vision is consolidating after rising off equal lows (July 03 and October 02). The pattern resembles a symmetrical triangle. Twiggs Money Flow (100) signals accumulation.

Your health or possessions - which is worth more?

Gain or loss - in which is there harm?

~ Lao Tse (c. 300 B.C.)

|

Sometimes known as a semi-log scale

because only the one axis (price) is calculated

logarithmically. The log scale You may notice that trendlines drawn on a log chart will not display if you switch to normal scale; they would be meaningless. I prefer to draw trendlines on a normal scale. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.