|

ETOs and

Warrants We are making progress. ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

October 1, 2003

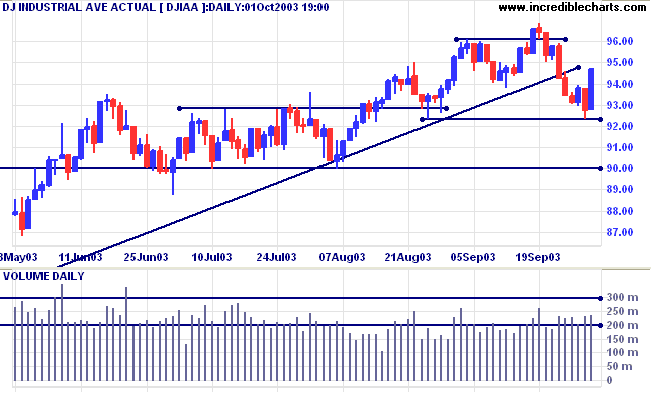

The intermediate down-trend is weak.

The index is below the upward trendline, signaling primary trend weakness. A fall below 9000 will signal reversal.

The intermediate trend is down.

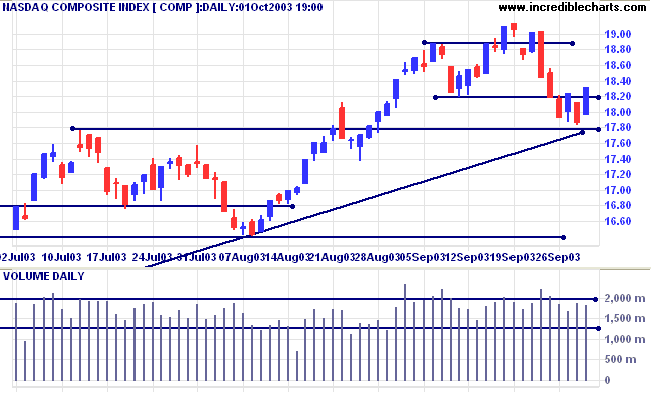

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

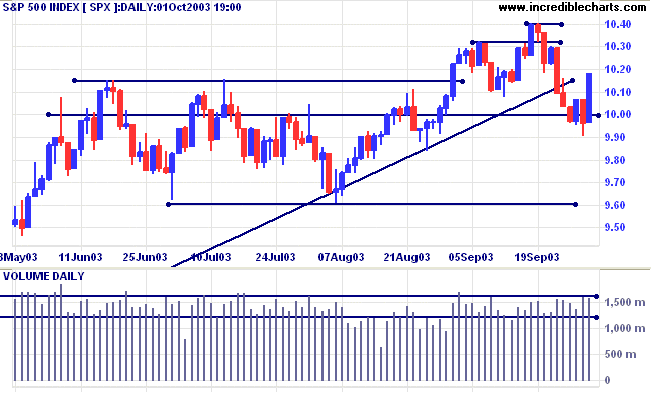

The intermediate down-trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

Short-term: Bearish below 996. Bullish above 1040.

Intermediate: Bullish above 1040. Bearish below 960.

Long-term: Bullish above 1040.

The Institute for Supply Management manufacturing index fell to 53.7, from 54.7 in August. (more)

The yield on 10-year treasury notes eased lower to 3.93%, below support at 4.00%.

The intermediate trend is down.

The primary trend is up. The fall below 4.00% signals weakness.

New York (20:02): Spot gold is level at $384.30.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

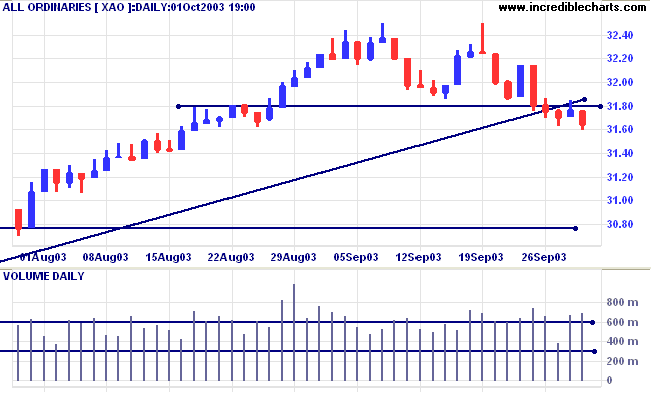

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow (21) signals distribution.

Short-term: Bullish if the All Ords is above 3250. Bearish below 3162.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

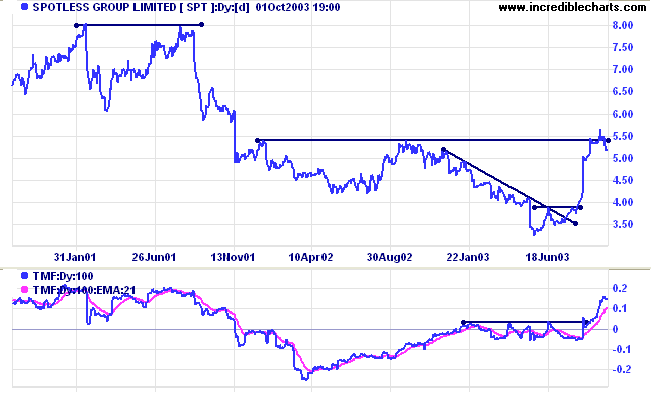

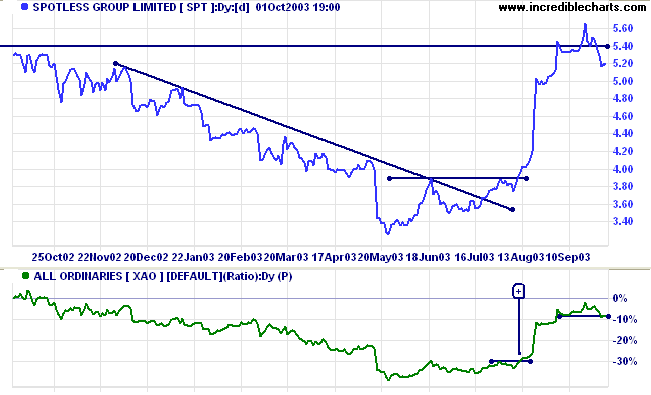

Last covered on August 26, 2003.

SPT rallied strongly off a narrow mid-year bottom. Price broke through resistance at 5.40 but this proved to be a marginal break, with a retreat back below the resistance line. Twiggs Money Flow (100) signals accumulation. MACD is bullish.

Price may consolidate between 5.00 and 5.66, which would favor an upside breakout.

A close below 5.00 will be bearish.

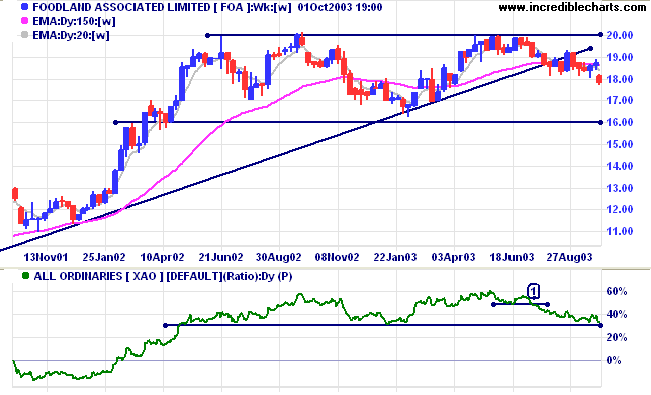

Last covered June 23, 2003.

FOA has formed a broad stage 3 top below resistance at 20.00. Relative Strength (price ratio: xao) started to trend down at [1], an intermediate signal. A fall below the support line from January will warn of a reversal in the primary trend.

To go forward with strength is to have ambition.

To not lose your place is to last long.

To die but not be forgotten - that's true long life.

~ Lao Tse.

|

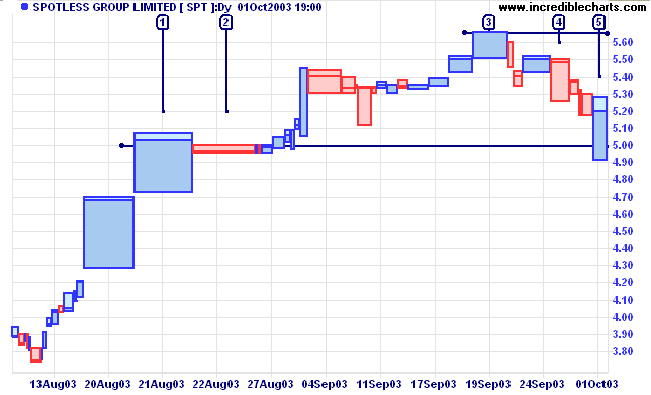

To change to broader price/indicator

bars, as in the above charts: (1) select Format Charts >> Indicator Width; (2) check the box next to [2]. To alter the width of the price bars separately: (1) select Format Charts >> Indicator Width >> Set Candle/OHLC/Parabolic SAR Width; (2) enter a value between 1 and 5 in the pop-up box; (3) click OK. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.