The new version with NYSE, Nasdaq and Amex charts is now available.

Please check Help >> About to confirm that your version has automatically updated.

If there are any problems with the updater,

you can download and install the latest version over your existing version.

Trading Diary

December 8, 2003

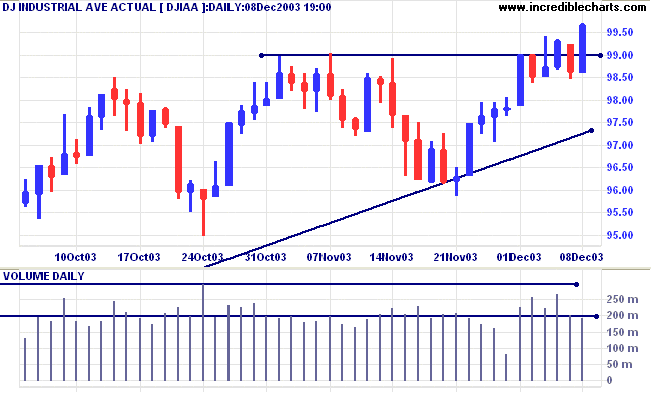

The intermediate trend is up.

The primary trend is up.

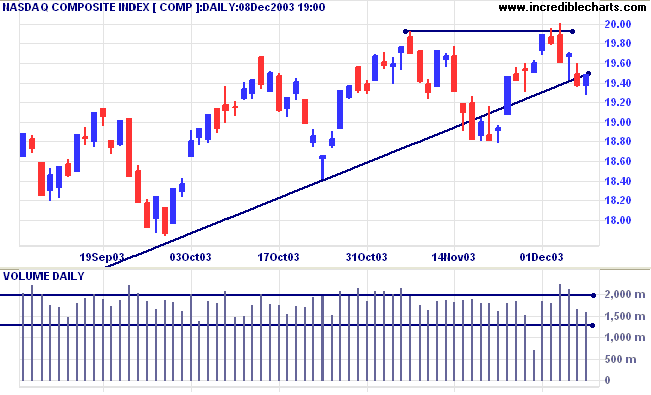

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

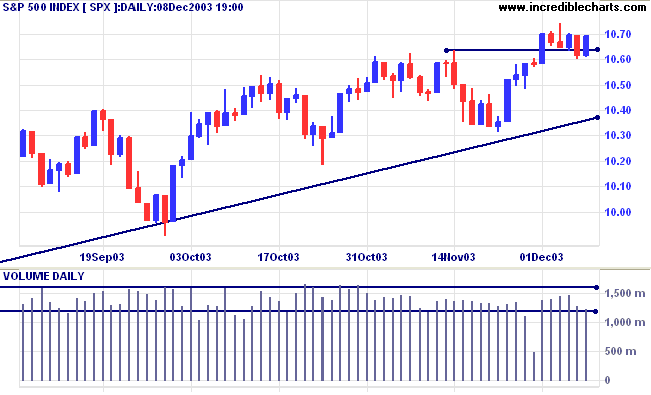

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 breaks above resistance at 1070. Bearish below support at 1060.

Intermediate: Bullish above 1070.

Long-term: Bullish above 960.

The dollar sank to a record low of $1.22 to the euro. (more)

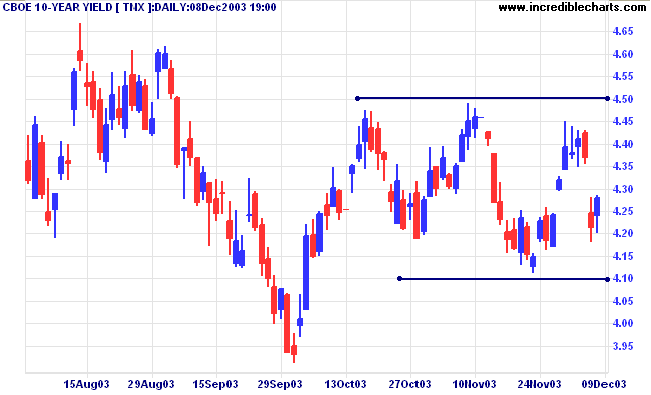

The yield on 10-year treasury notes is ranging between 4.1% and 4.5%, closing up at 4.27%.

The intermediate trend is down.

The primary trend is up.

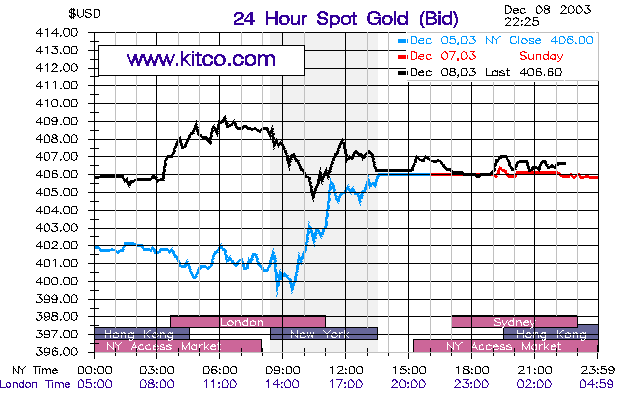

New York (22.25): Spot gold is level at $406.60.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

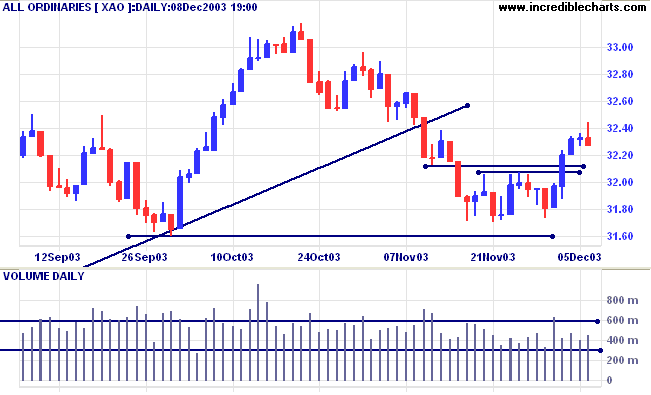

The intermediate up-trend continues.

Short-term: Bullish above 3236, Friday's high. Bearish below 3173 (Monday's low).

Intermediate term: Bullish above 3173. Bearish below 3160.

Long-term: Bearish below 3160.

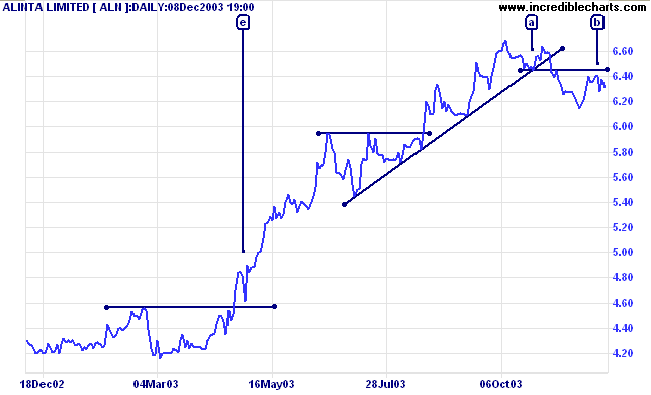

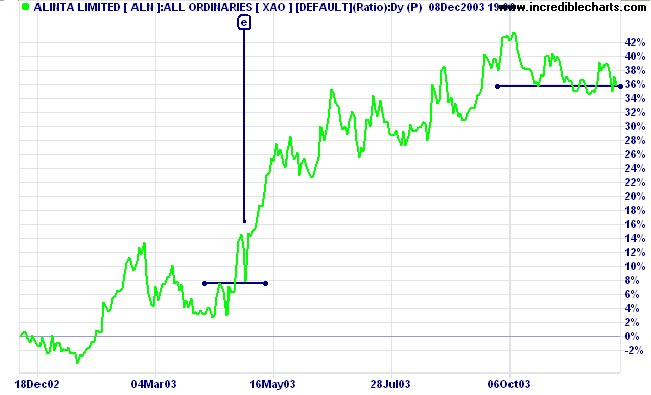

Last covered on September 4, 2003.

Alinta has left a gap at [b], between the latest peak and the previous trough [a], after breaking below its long-term trendline. Bill McLaren identifies this as a signal for a fast down-trend.

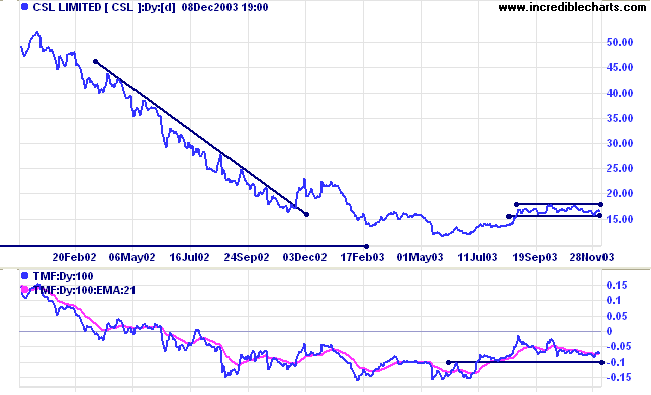

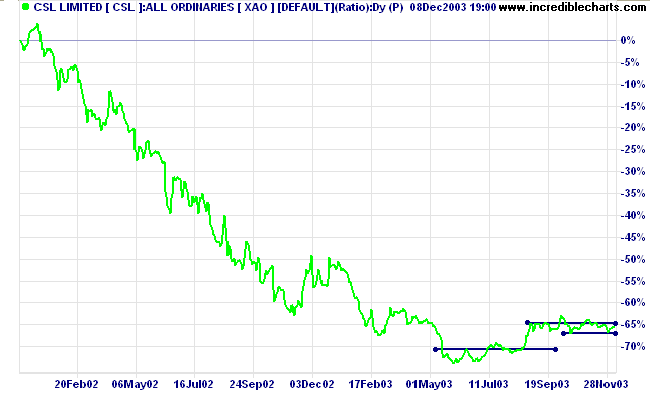

Last covered on October 7, 2003.

CSL is forming a broad base after a strong down-trend. Twiggs Money Flow (100) has crept upwards since June.

The narrow range at the resistance level is bullish.

they are vexations to the spirit.

~ Max Ehrmann: Desiderata (1927)

US stocks and US indexes are still being added to the stock screen module

and should be available by next week.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.