|

ETOs and

Warrants ETOs and warrants will be introduced this week. US stocks to follow. |

Trading Diary

October 7, 2003

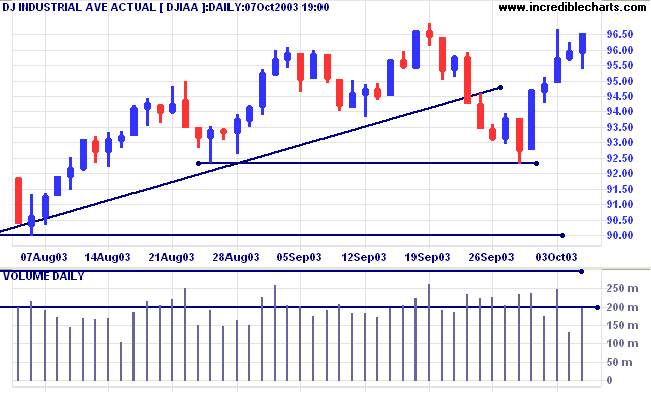

The intermediate trend is down. A rise above 9686 will signal reversal.

The primary trend is up. A fall below 9000 will signal reversal.

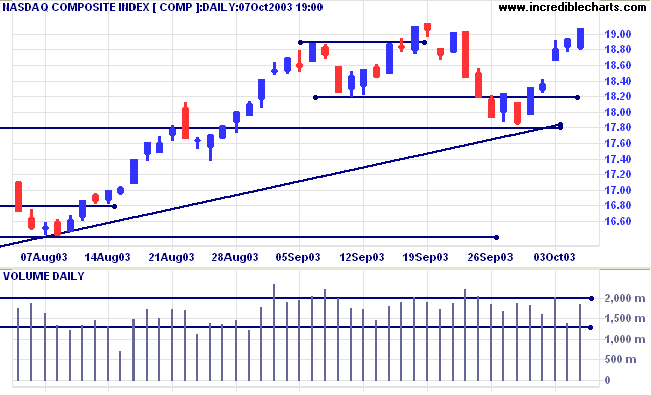

The intermediate trend is down. A rise above 1914 will signal reversal.

The primary trend is up. A fall below 1640 will signal reversal.

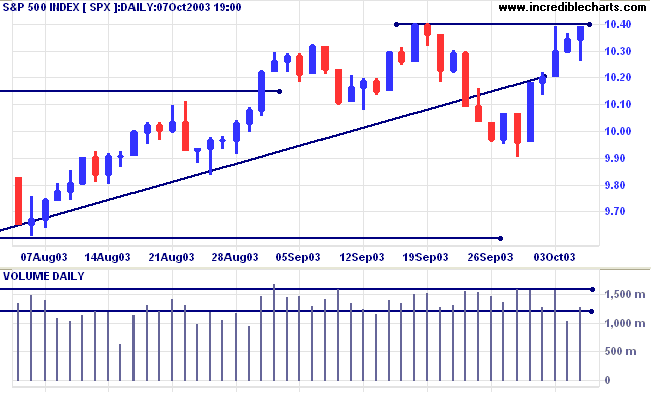

The intermediate trend is weak. A rise above 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1040. Bearish below 1020.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

More than 2 million manufacturing jobs have been lost since the start of the recession. And new jobs added are in the lowest paid sectors. (more)

A three-judge panel allows the list to be enforced pending a final decision by the Appeals Court, saying that the privacy interests of millions of Americans outweigh the economic harm that telemarketers would suffer. (more)

The yield on 10-year treasury notes rallied to 4.24%.

The intermediate down-trend appears weak.

The primary trend is up.

New York (19:18): Spot gold has climbed to $376.00.

The intermediate trend is down.

The primary trend is up. A fall below 350 will signal reversal.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) has crossed to above its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow has turned down, signaling distribution.

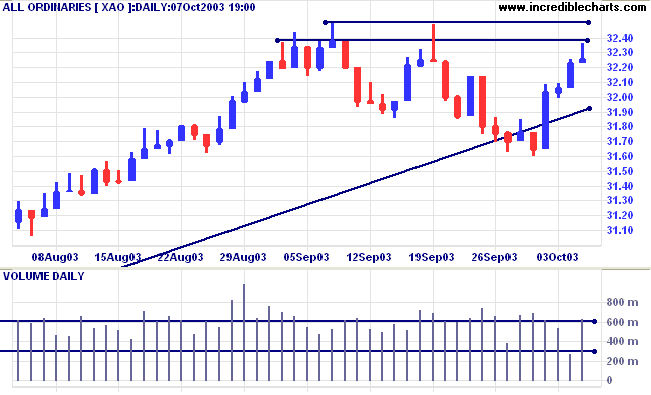

Short-term: Bullish if the All Ords is above 3250. Bearish below 3223.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

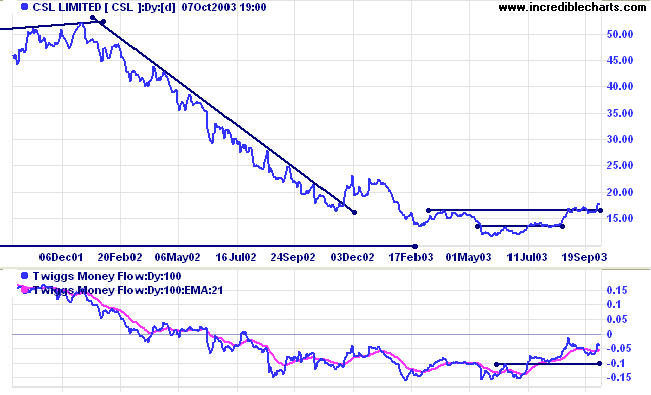

Last covered September 29, 2003.

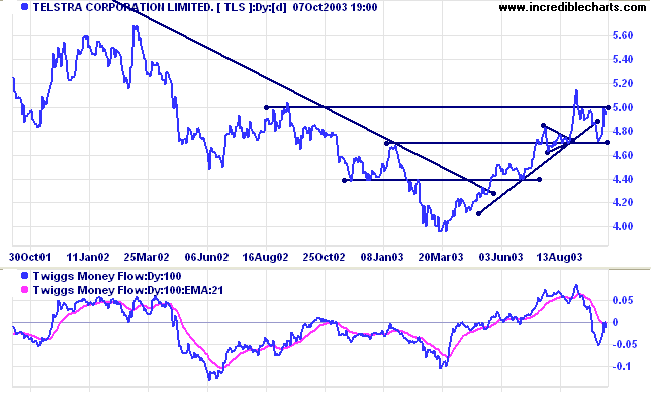

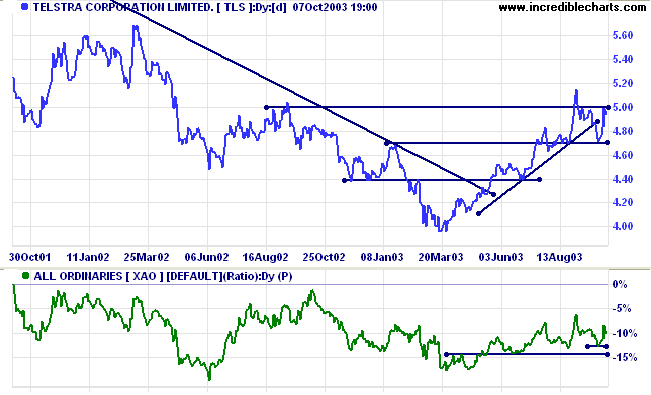

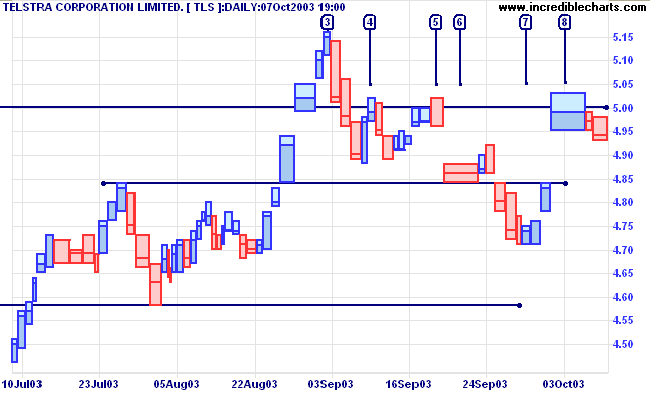

TLS enjoyed a rally off an unstable, narrow bottom; so a re-test of support levels is likely.

Twiggs Money Flow has crossed below zero, signaling distribution.

A fall below 4.70 will be bearish, while a fall below 4.58 will be a stronger signal.

Last covered September 30, 2003.

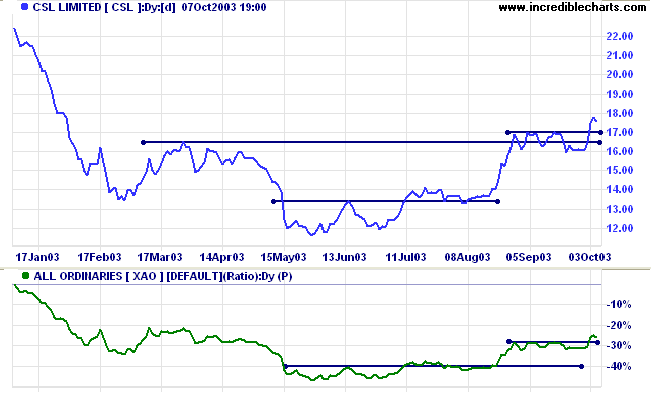

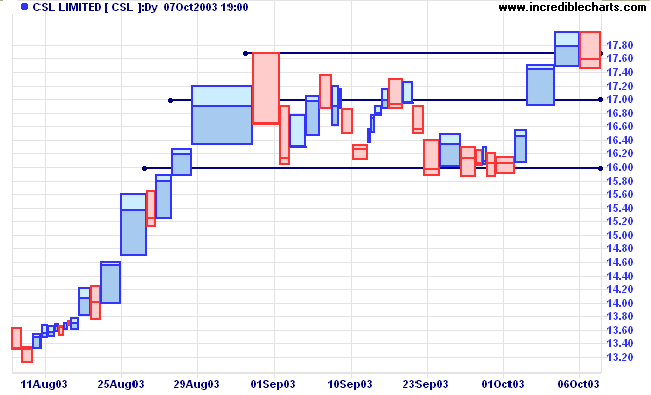

By contrast CSL has formed a reasonably broad base, from February to September, and now shows a bull signal with consolidation at the resistance level.

Twiggs Money Flow (100) is rising.

A close below 16.00 would be bearish.

does not only mean obedience or submission to a small group,

or one that is sharply determined, like a religion or political party.

It means, too, conforming to those large, vague, ill-defined collections of people

who may never think of themselves as having a collective mind

because they are aware of differences of opinion

- but which, to people from outside.....seem very minor.

The underlying assumptions and assertions that govern the group are never discussed,

never challenged, probably never noticed, the main one being precisely this:

that it is a group mind, intensely resistant to change,

equipped with sacred assumptions about which there can be no discussion.

~ Doris Lessing: Prisons We Choose To Live Inside (1994).

|

To open Incredible Charts with a selected

stock or index: (1) open the Default project and chart the selected stock; (2) select Securities >> Make The Current Security the Project Default. The selected security will display whenever the project is opened. To remove the default security, select Securities >> Clear the Project Default. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.