A collection of the most highly-rated posts since the start of the Forum.

Thanks to Mosaic for coming up with the idea and providing the initial list.

Trading Diary

December 2, 2003

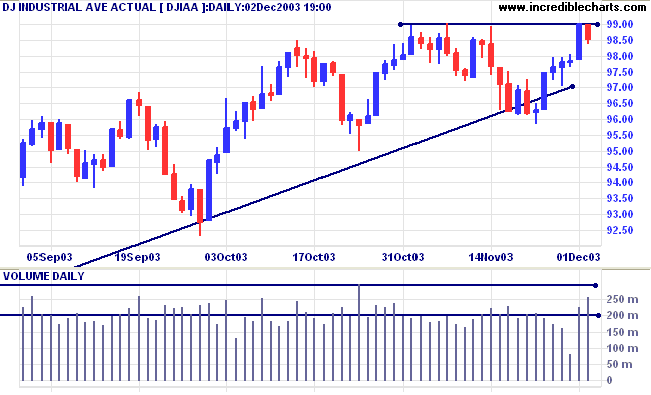

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 9000 will signal reversal.

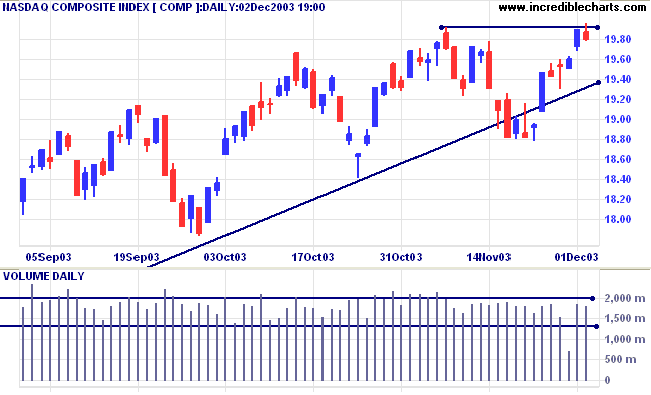

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

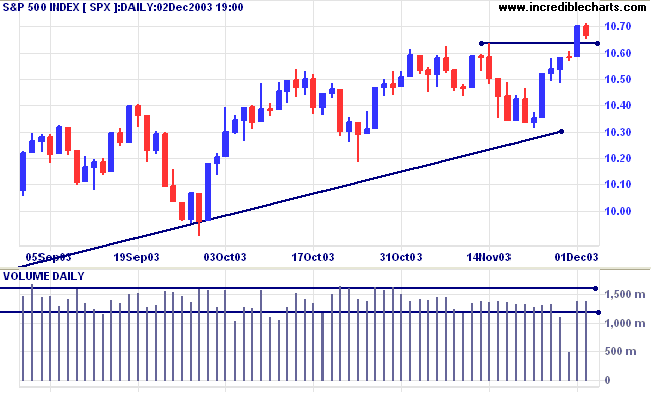

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above support at 1064. Bearish below 1034 (last Tuesday's low).

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

99,000 jobs were cut in November, compared to 171,000 in October. (more)

The yield on 10-year treasury notes eased to 4.38%.

The intermediate trend is down after bearish equal highs below a higher peak.

The primary trend is up.

New York (21.20): Spot gold held above the new 400 support level, currently at $402.70.

The intermediate trend is up.

The primary trend is up. Expect resistance at 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below.

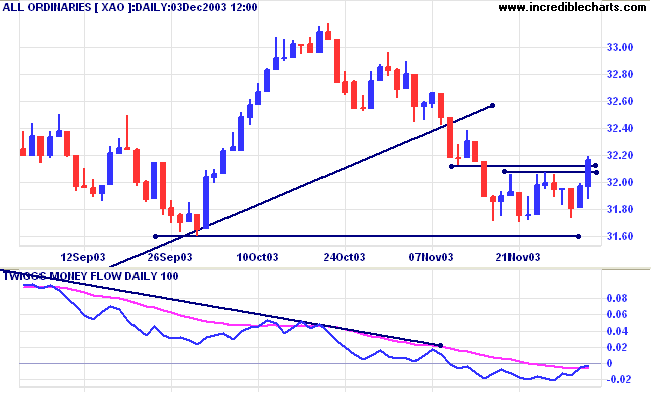

Short-term: Bullish if the All Ords crosses above 3212, the November 12 low. Bearish below 3180 (Tuesday's low).

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

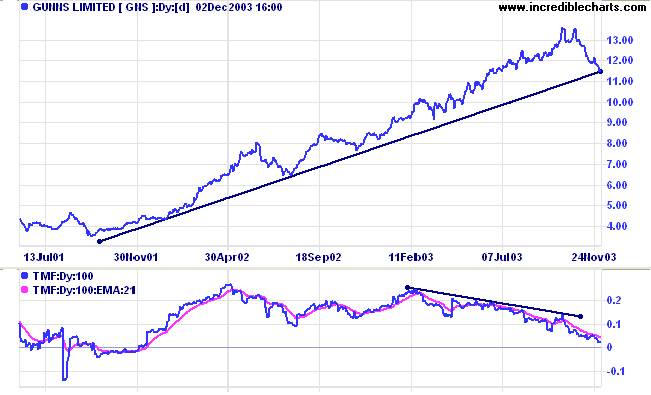

Last covered on February 4, 2003.

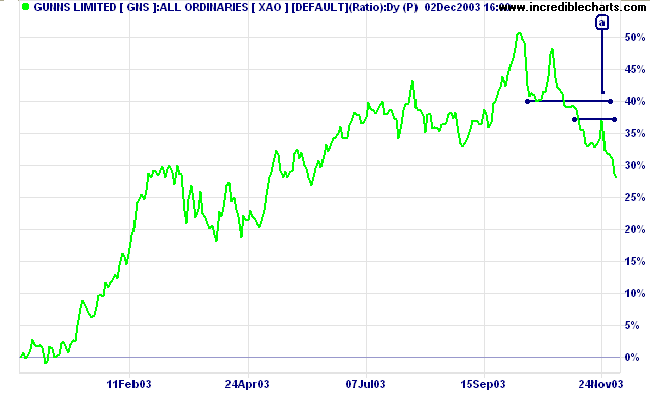

Gunns has been in a strong stage 2 up-trend for a number of years. Price has now corrected back to the primary supporting trendline after a narrow double top in October and a bearish divergence on Twiggs Money Flow (100).

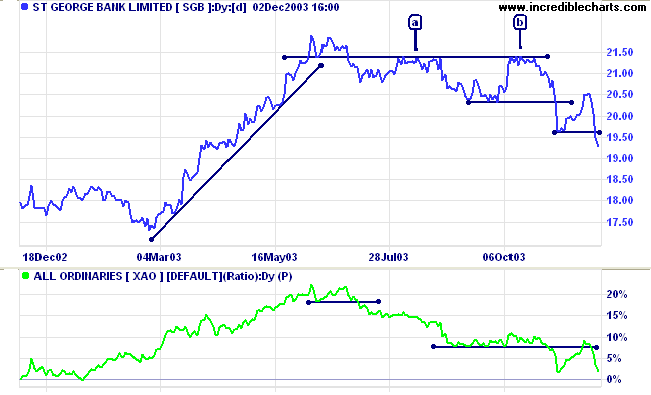

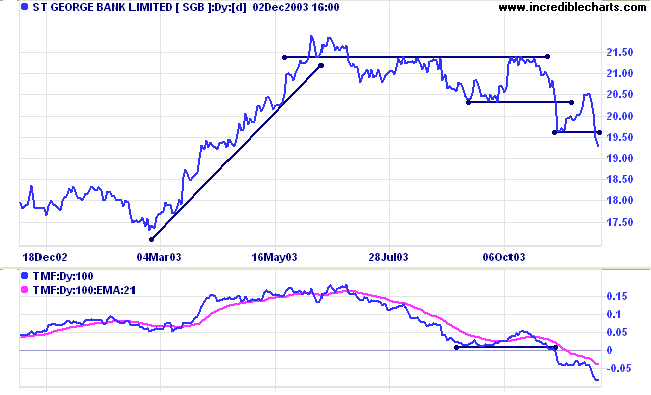

Last covered November 10, 2003.

SGB has declined after bearish equal highs below a previous peak, at [a] and [b]. Relative Strength (xao) has declined since the June high.

People have a bias to want to be right on every trade or investment.

As a result, they tend to gravitate toward high probability entry systems.

Yet quite often these systems are also associated with large losses

and lead to negative expectancy.

~ Van K Tharp: Trade your way to Financial Freedom.

Please alert Support if you experience any difficulties with Incredible Charts File menu.

We have not received any error reports but I have noticed that the menu opens very slowly

and would like to establish whether this is specific to my PC or is experienced by others.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.