after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

February 4, 2003

The congestion is likely to be a continuation pattern and the index appears headed for a re-test of the 7500 support level.

The primary trend is down.

The Nasdaq Composite closed down 17 points at 1306. The next major support level is at 1200.

The primary trend is up (the last low was 1108 and the last high 1521).

The S&P 500 has also formed a congestion pattern, closing down 12 points at 848. The index appears headed for a re-test of support at 768.

The index is forming a base between 768 and 964.

The Chartcraft NYSE Bullish % Indicator is on a bull correction signal at 46% (February 3).

Secretary of State Colin Powell says that he will present no "smoking gun" to the U.N. but will show that Iraq is not complying with the resolution to disarm. (more)

American International

AIG led the insurance sector lower, announcing that it will take a $US 1.8 billion charge to cover higher than expected claims for workers compensation and executives' liability.

New York (16:30): Spot gold has climbed more than 10.00 dollars to $US 381.80.

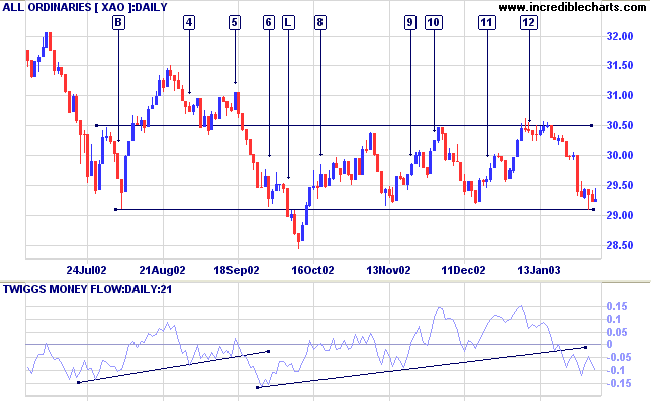

Slow Stochastic (20,3,3) has crossed to above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

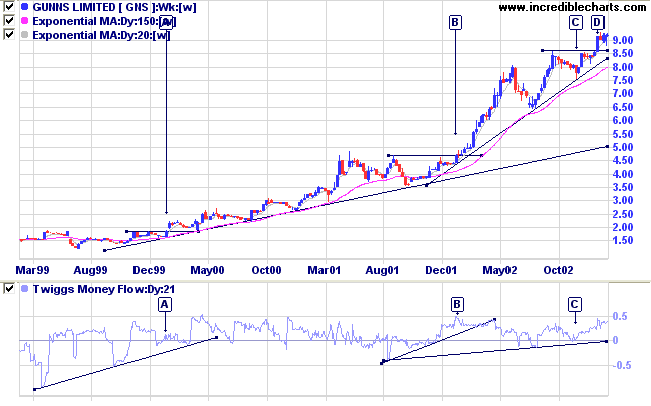

Last covered on November 26, 2002.

Gunns has been in a stage 2 up-trend since breaking above the 3-month high at [A]. A slow, creeping trend developed until the breakout above resistance at [B]. Since then the stock has been in a fast trend, with the troughs ending at or above the previous peaks.

Relative Strength (price ratio: xao) is rising and MACD is bullish. Twiggs Money Flow has completed a trough above zero at [C], a strong bull signal, and signals accumulation.

- The fast trend may develop into a spike, where the trend goes almost vertical. Tighter stop losses (possibly a trailing stop) should be introduced, to lock in profits in case of a sudden reversal.

- The fast trend may weaken, breaking below the supporting trendline. Here the trader has to beware of false breaks, where price dips below the trendline and then immediately reverses back above, normally identifiable by a lack of volume confirmation. The trader's normal exit strategy should cope with this and should only be adjusted if price respects the trendline from below (price peaks below the trendline).

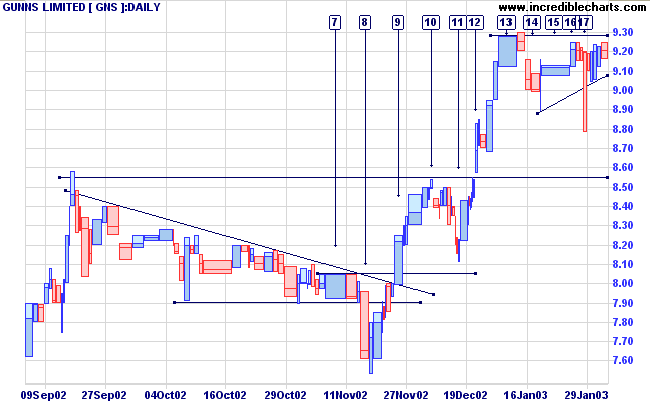

The "fat" bar at [13] showed sellers entering the market but the pull-back to [14] was, again of short duration.

A close below 9.00 would be bearish.

For further guidance see Understanding the Trading Diary.

Many intelligence reports in war are contradictory;

even more are false, and most are uncertain.

Everything in war is very simple, but the simplest thing

is difficult.

The difficulties accumulate and end by producing a kind

of friction. . . .

This tremendous friction . . . is everywhere in contact

with chance,

and brings about effects that cannot be

measured,

just because they are largely due to chance. . .

.

Moreover, every war is rich in unique episodes.

The good general must know friction in order to overcome

it whenever possible,

and in order not to expect a standard of achievement in

his operations

which this very friction makes impossible.

Is there any lubricant that will reduce

this abrasion?

Only one . . . combat experience.

- Prussian military thinker

Claus von Clausewitz:

translated from Vom Kriege ("On War") (1831)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.