A collection of the most highly-rated posts since the start of the Forum.

Thanks to Mosaic for coming up with the idea and providing the initial list.

Trading Diary

December 1, 2003

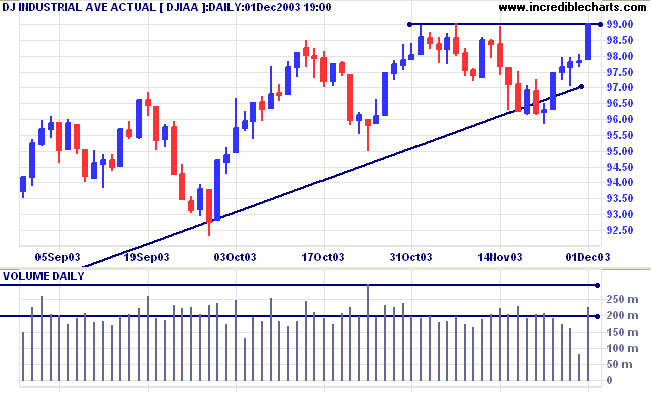

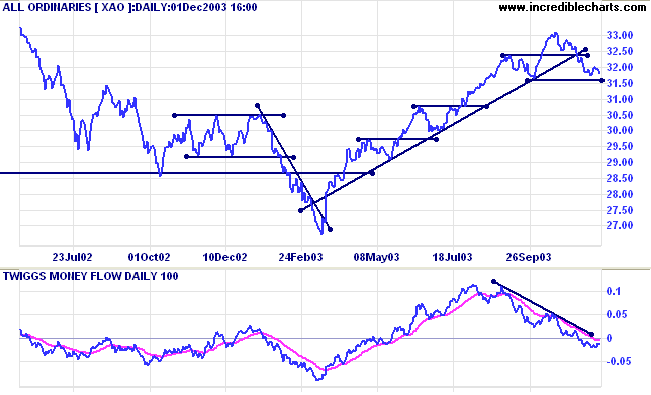

The intermediate down-trend is weak.

The primary trend is up. A fall below support at 9000 will signal reversal.

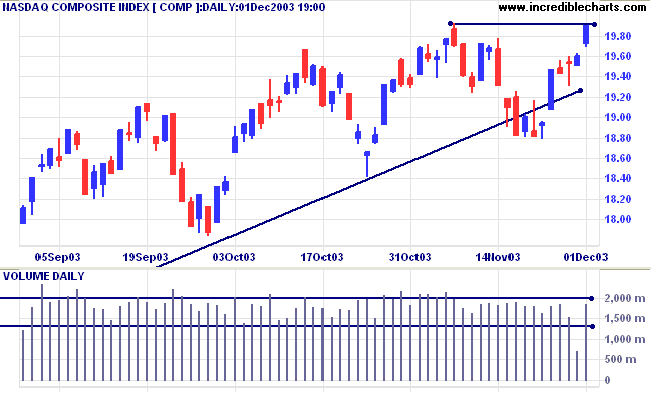

The intermediate down-trend is weak.

The primary trend is up. A fall below support at 1640 will signal reversal.

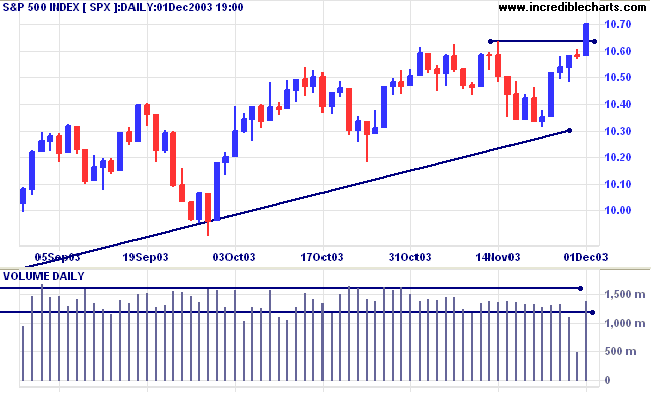

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above the high of 1064. Bearish below 1034 ( last Tuesday's low).

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

The Institute of Supply Management manufacturing index jumped to 62.8, from 57 in October. (more)

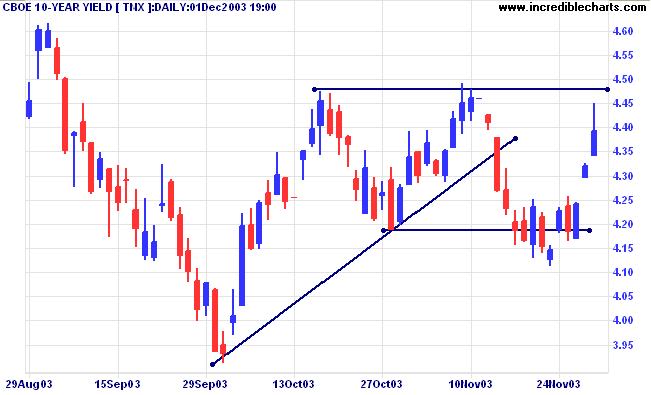

The yield on 10-year treasury notes gapped again to 4.39%. The long upper shadow signals downward pressure ahead of resistance at 4.48% to 4.50%.

The intermediate trend is down after bearish equal highs below a higher peak.

The primary trend is up.

New York (20.33): Spot gold has broken through resistance at 400 to reach $402.00.

The intermediate trend is up. Expect a pull-back to test the new 400 support level.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has whipsawed below.

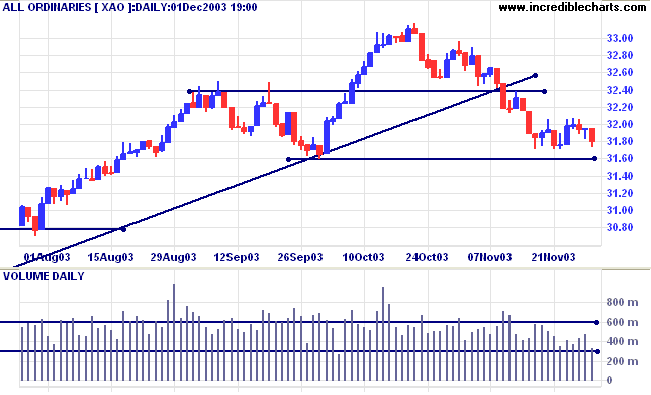

Short-term: Bullish if the All Ords crosses above 3212, the November 12 low. Bearish below 3182 (Friday's low).

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

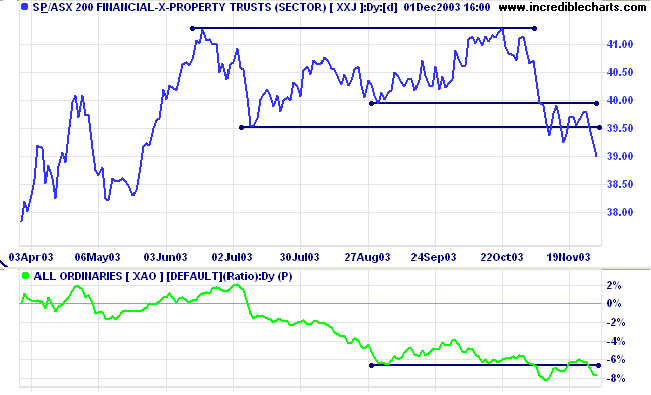

Financial-x-Property [XXJ] has broken below the recent consolidation, confirming the primary down-trend. Relative Strength (xao) continues to decline.

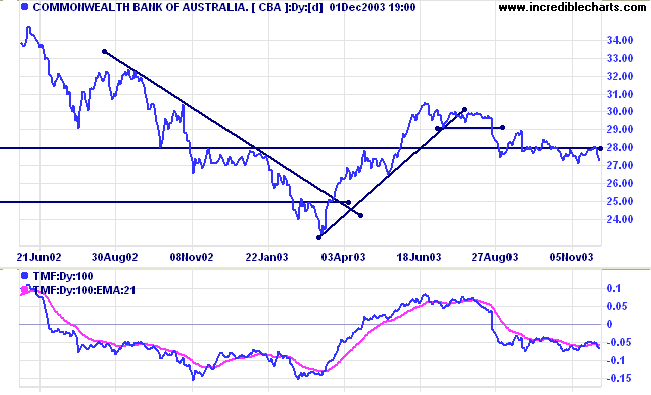

Last covered November 5, 2003.

After a sharp fall below 29.00 CBA has entered a creeping down-trend, with Twiggs Money Flow (100) leveling out in a similar pattern. Relative Strength (xao) is also ranging. This pattern can resolve into either another rally or a sharp down-trend. Judging by the performance of other stocks in the sector, a downward breakout may present the better opportunity.

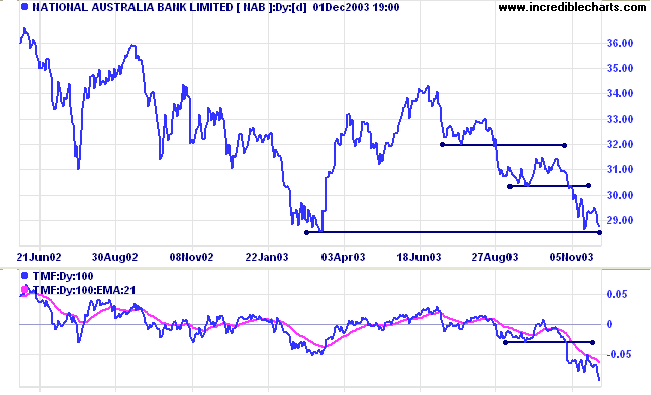

Last covered November 5, 2003.

NAB has been in a primary down-trend since late August and is now testing a major support level at 28.50. Relative Strength (xao) continues to fall and Twiggs Money Flow gives a strong bear signal with a gap between the last trough and the latest peak. The next major support level is at 24.50 (September 2001).

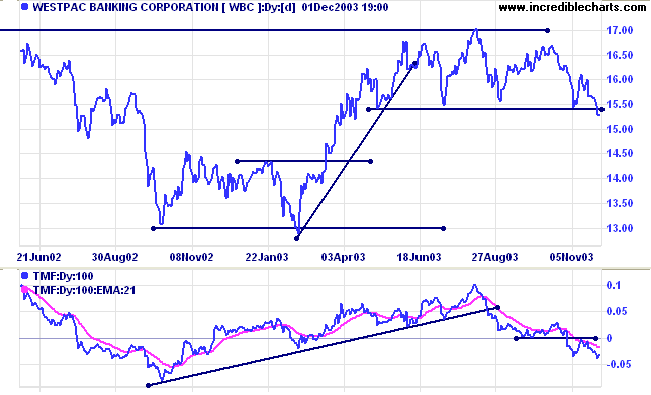

Last covered November 10, 2003.

Westpac has completed a head and shoulders reversal with a fall below 15.40. Relative Strength (xao) and Twiggs Money Flow (100) are both falling. TMF looks particularly bearish, completing peaks below zero. A pull-back that respects the new resistance level will be a further bearish sign. The next major support level is at 13.00.

I wonder to myself a lot:

"Now is it time, or is it not,

That what is which and which is what?"

~ A A Milne: Winnie-the-Pooh.

Please alert Support if you experience any difficulties with the File menu.

We have not received any error reports but I have noticed that the menu opens very slowly

and would like to establish whether this is specific to my PC or is experienced by others.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.