|

US stocks The existing hard disks on our server cannot cope with the enlarged database. Upgrade of the server may delay us by a day or two. |

Trading Diary

November 5, 2003

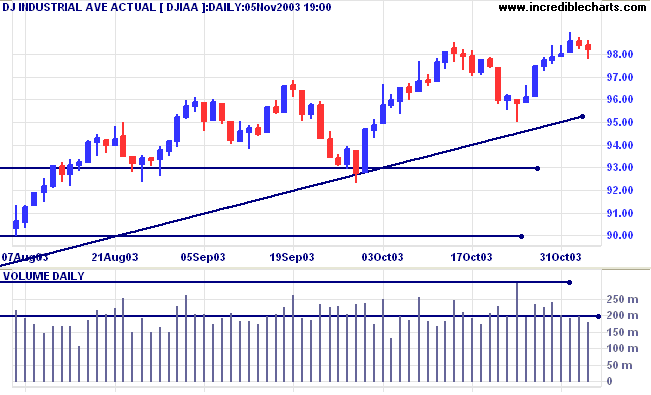

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

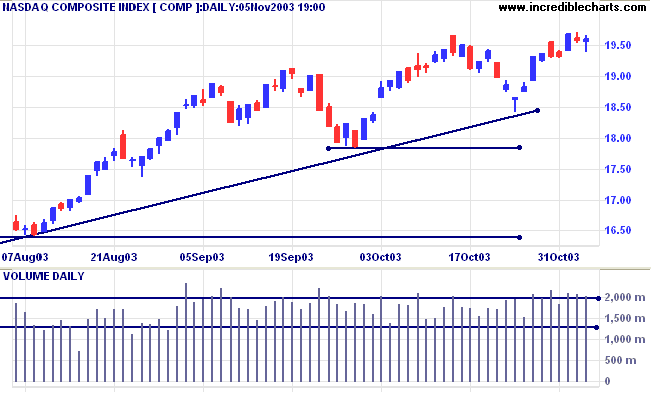

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal. Expect resistance at 2000.

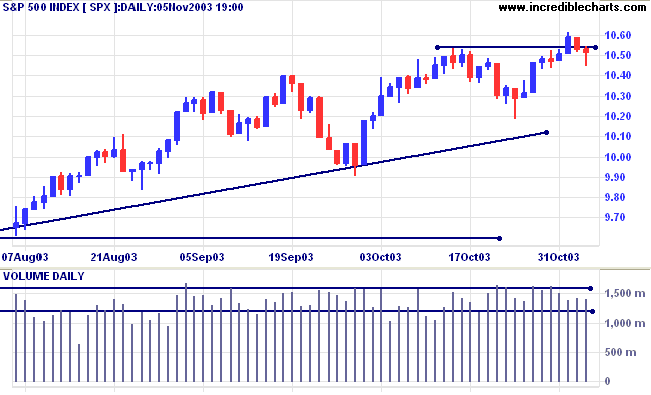

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1055.

Intermediate: Bullish above 1055.

Long-term: Bullish above 960.

The internet equipment maker reported sales up 5.3% for the first quarter and earnings (excluding one-off charges) of 17 cents a share, 2 cents above analysts forecasts. (more)

The yield on 10-year treasury notes rallied to 4.35%.

The intermediate down-trend is weak.

The primary trend is up.

New York (17.32): Spot gold recovered to $381.80.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

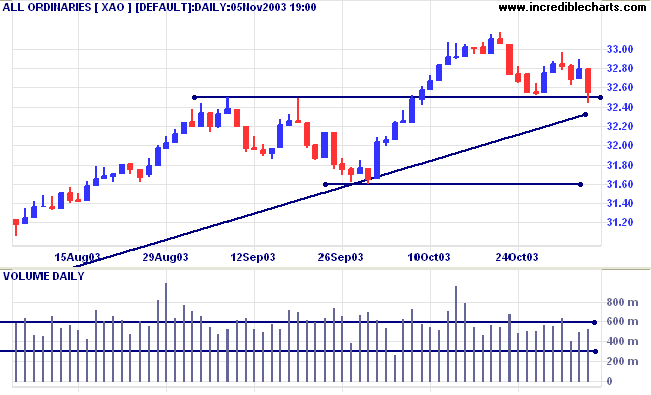

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

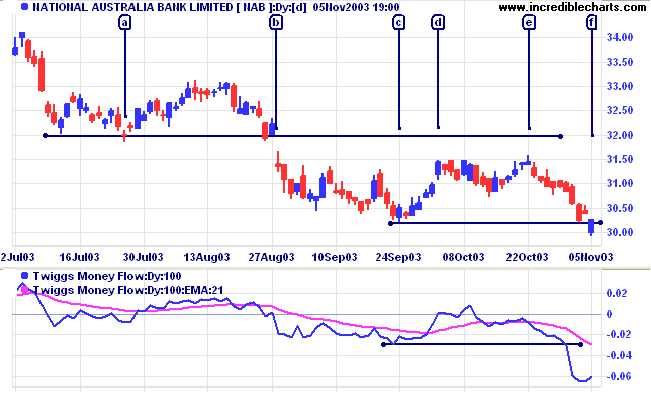

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3296. Bearish below 3238.

Intermediate: Bullish above 3296.

Long-term: Bullish above 3160.

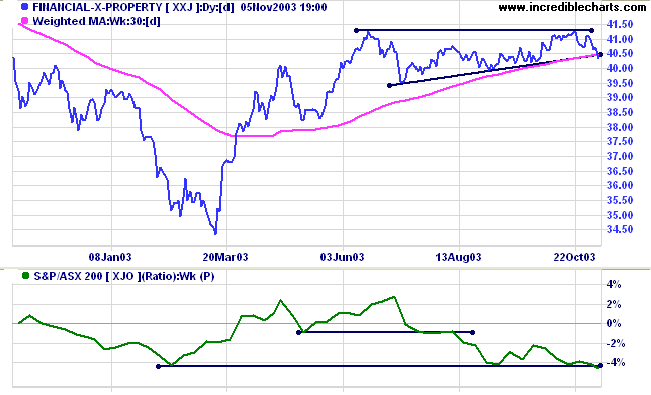

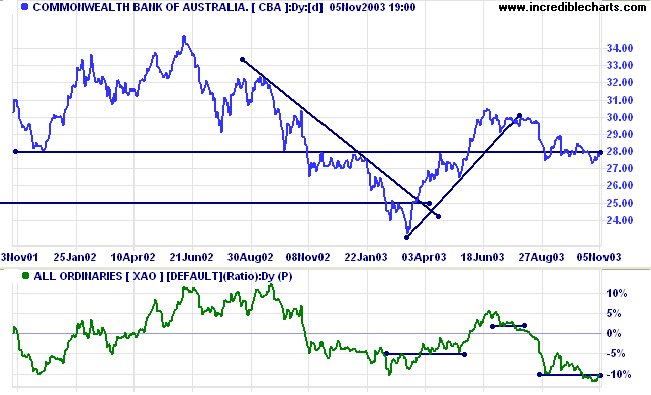

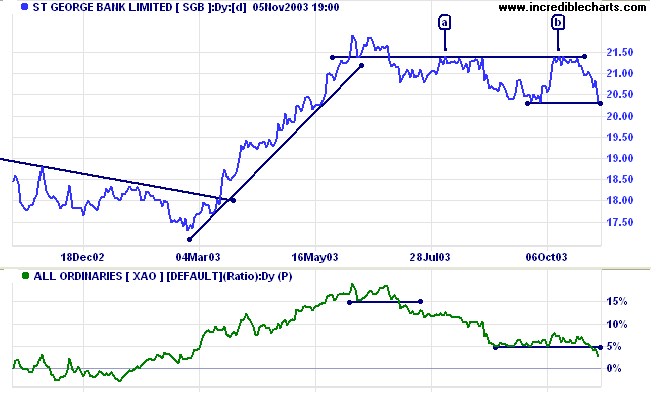

After the Reserve Bank raised interest rates by 0.25 per cent, which they have left rather late in my opinion, the banks are once again in the spotlight. The Financial-x-Property index [XXJ] is weakening and Relative Strength (xjo) has fallen to a new 12-month low.

Last covered on October 16, 2003.

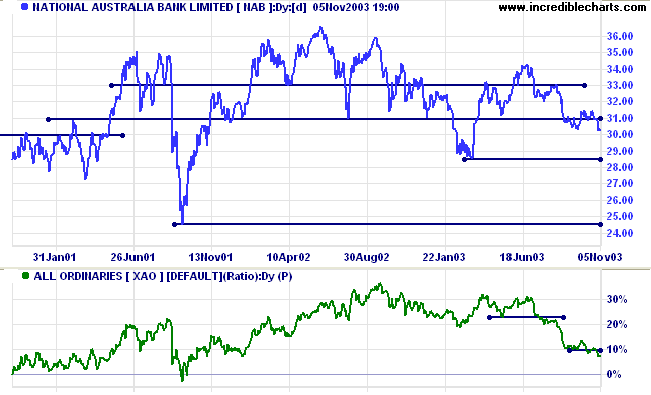

NAB is in a primary down-trend, with falling Relative Strength (xao).

Last covered on October 16, 2003.

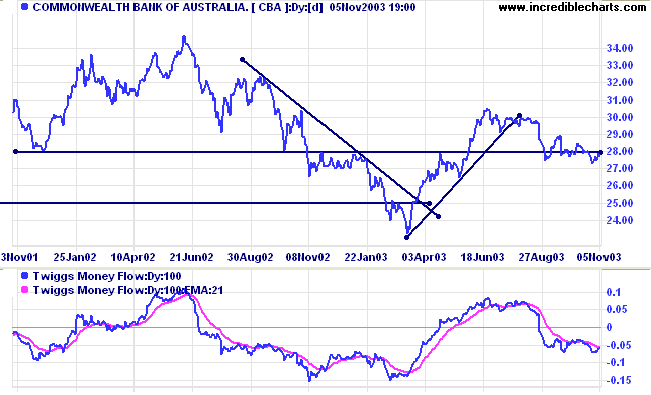

CBA is creeping lower but Twiggs Money Flow (100) has fallen sharply, signaling distribution.

Last covered October 27, 2003.

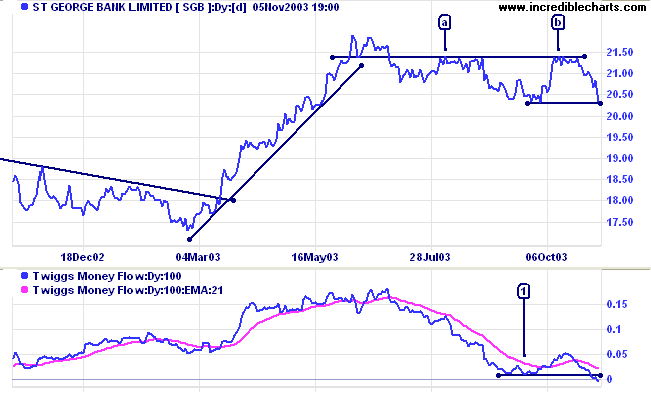

Despite producing record results, SGB is testing support, after two equal highs at [a] and [b] below the earlier high, a strong bear signal.

Twiggs Money Flow has broken below the previous low at [1], another bear signal.

Hold on to them and treasure them.

The first is compassion;

The second is frugality;

And the third is not presuming to be at the forefront in the world.

Now it's because I'm compassionate that I therefore can be courageous;

And it's because I'm frugal that I therefore can be magnanimous;

And it's because I don't presume to be at the forefront in the world

that I therefore can lead those with complete talent.

~ Lao Tse (c. 300 B.C.)

If you have deleted a trendline or

indicator and you want to restore it, try clicking the Undo

button  on the toolbar.

on the toolbar. The Redo  button reverses the Undo.

button reverses the Undo.

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.