| Money Management |

| The best trades are those where you can place a stop loss underneath a logical support level and within 5% of your entry point. When I refer to a logical support level I mean a recent trough in a pattern or an up-trend, above which price is likely to hold, and not a moving average. |

Trading Diary

August 7, 2003

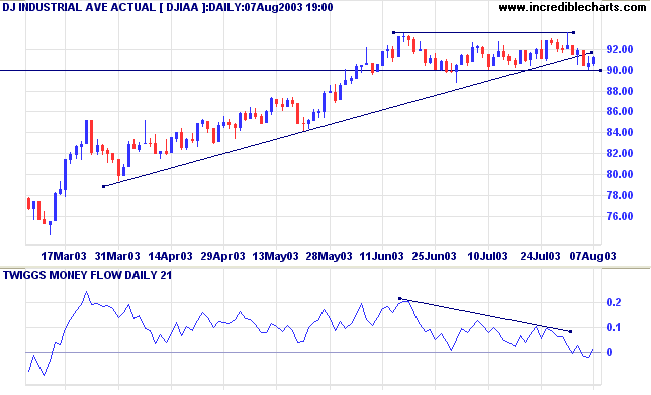

The intermediate trend is up. The index has penetrated the supporting trendline but is consolidating above the 9000 support level, a bullish sign. A break below 9000 will signal a reversal.

MACD and Twiggs Money show bearish divergences, though TMF has crossed back above zero.

The primary trend is up.

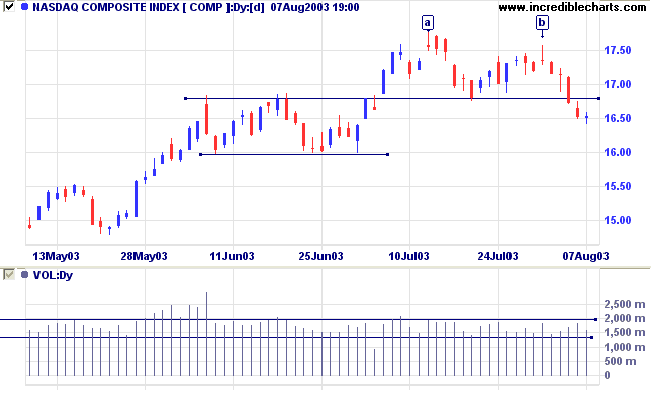

The intermediate trend is down. Support is at 1600.

The primary trend is up.

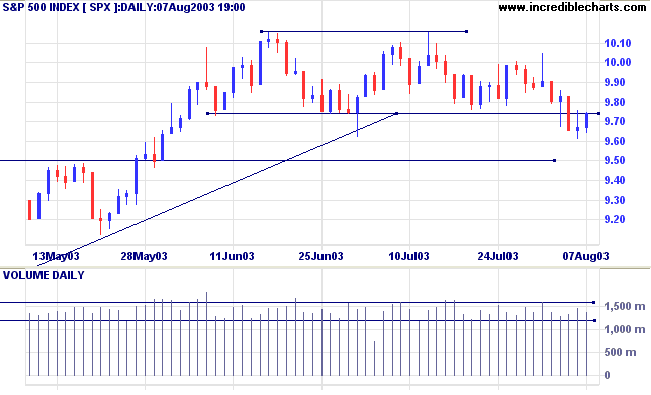

The intermediate trend is down.

MACD and Twiggs Money Flow (21) display bearish divergences.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 964.

Intermediate: Long if S&P 500 is above 1000. Short if below 950.

Long-term: Long is the index is above 1000.

New unemployment claims eased slightly to 390,000, remaining below the key 400,000 level. (more)

The yield on 10-year treasury notes continues to weaken, closing at 4.23%.

The intermediate and primary trends are both up.

New York (17.27): Spot gold closed slightly up at $352.30.

The primary trend is still upwards.

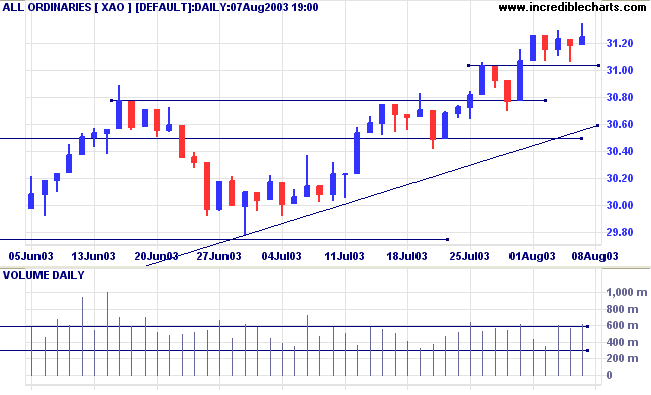

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3127. Short if the index falls below 2978.

Intermediate: Long if the index is above 3127.

Long-term: Long if the index is above 2978 .

Energy stocks are in a stage 2 up-trend. The three stocks with highest 1-year Relative Strength are:

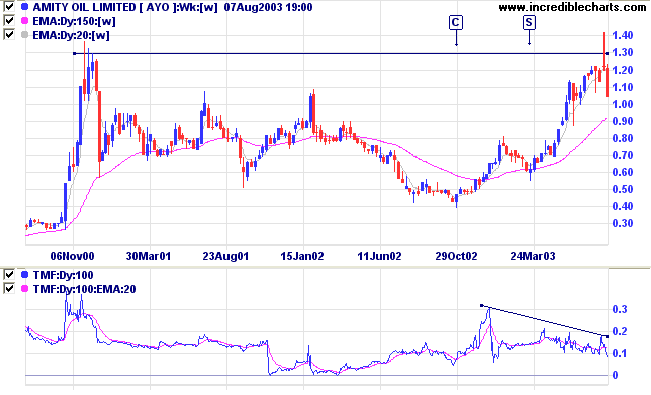

Amity has tested the highs reached almost 3 years ago in late 2000. Note the cup and saucer at [C] and [S].

Twiggs Money Flow (100) and MACD show bearish divergences.

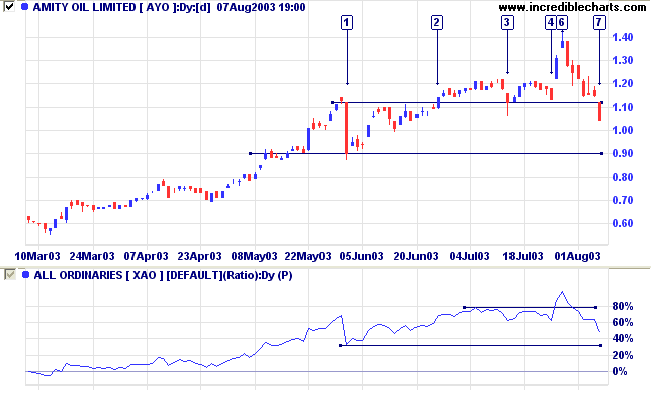

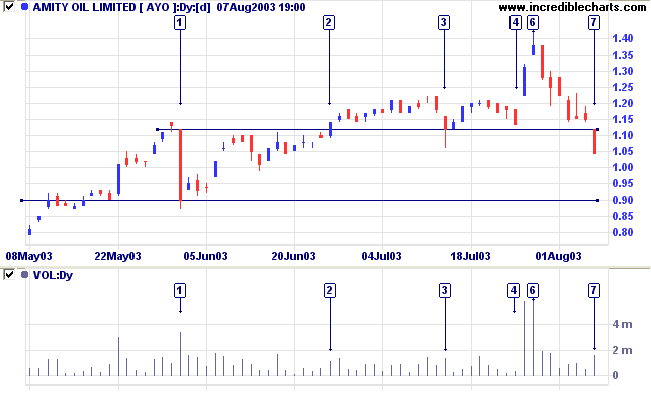

The breakout above resistance at [2] is accompanied by moderate volume, signaling weakness. We then had tests of the new support level: [3] made a false break while [4] showed a bullish dry-up of volume.

The rally to [6] gapped up on consecutive days on big volume, exhausting buying support, before correcting back to 1.12.

AYO has now gapped below the 1.12 support level and a test of support at .90 is likely.

A close below 0.90 would be a strong bear signal.

Last covered July 31, 2003.

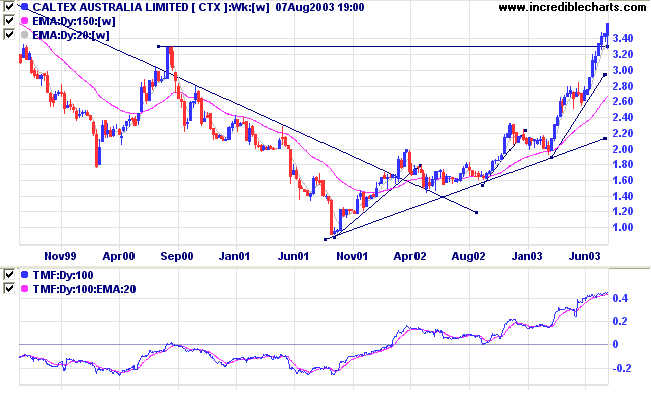

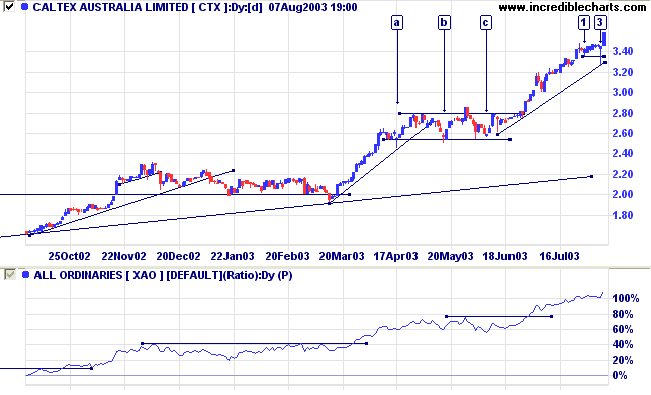

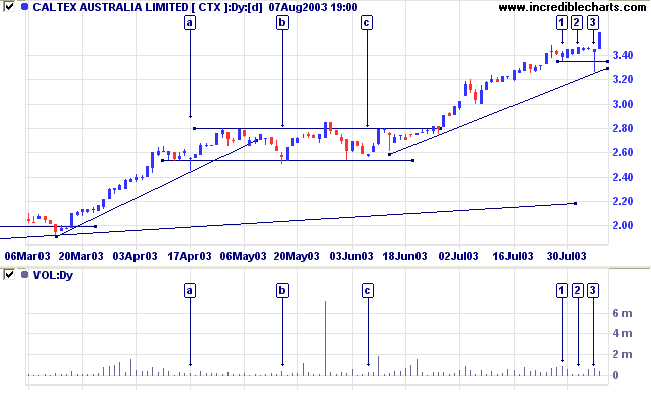

Caltex continues to rally strongly, brushing aside resistance at 3.30.

Price made a false break at [3], back below the previous low of [1], on moderate volume, before continuing with the rally.

A sense of deja vu prevails: a similar false break at [a] followed the previous rally.

Equal lows on low volume, as at [b] and [c], are a bullish sign in an up-trend, presenting opportunities to accumulate. Tight stops can be placed below the support level, within 5% of the entry point (above the high of [b] or [c]).

Last covered on July 21, 2003.

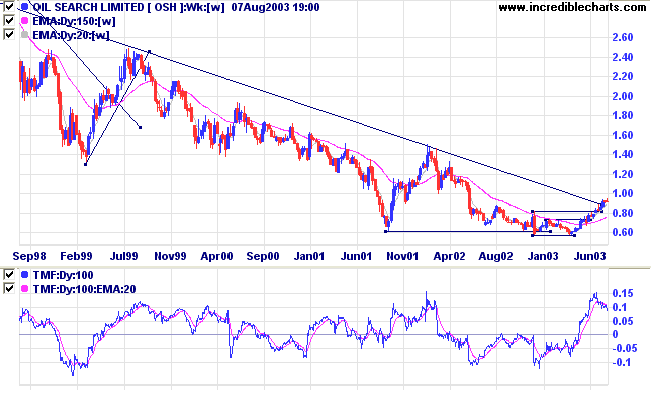

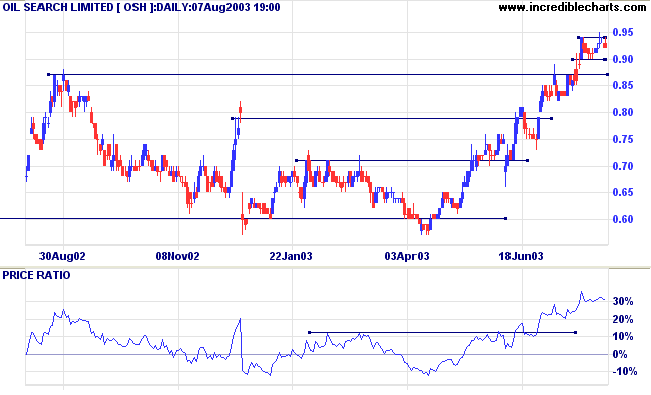

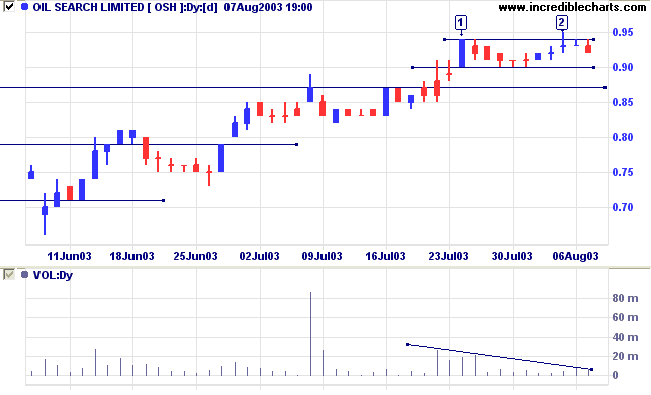

OSH has broken above the downward trendline after forming a broad stage 1 base.

Twiggs Money Flow (100) signals accumulation. MACD is bullish.

OSH has broken through resistance at 0.87 and now displays two equal highs.

Longer-term traders should wait for a secondary correction before accumulating.

A fall below 0.77 would be bearish.

Rules Conditional # 5

Quiet weak markets are good markets to sell. They ordinarily

develop into declining markets. But when a market has gone on

through the stages of quiet and weak to active and declining,

then on to semi-panic or panic, it should be bought freely.

When, vice versa, a quiet and firm market develops into

activity and strength, then into excitement, it should be

sold with great confidence.

~ SA Nelson: The ABC of Stock Speculation (1903).

| Stock Screens: Sector Analysis |

|

Stock screens can be used to analyze

stocks in a specific sector. To determine the Relative

Strength of stocks in, for example, the Energy

sector: (1) Select Energy in the Sector box; (2) Enter 9999 as the 1-year Maximum % Price Move; (3) Submit; (4) Sort the Results by clicking on the %M(1Y) header. Stocks with the highest values will have the greatest relative strength. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.