| Delayed Diary |

|

Apologies for the late diary yesterday. We

experienced an error on the server web pages and had to wait for all cache servers to clear. |

Trading Diary

August 5, 2003

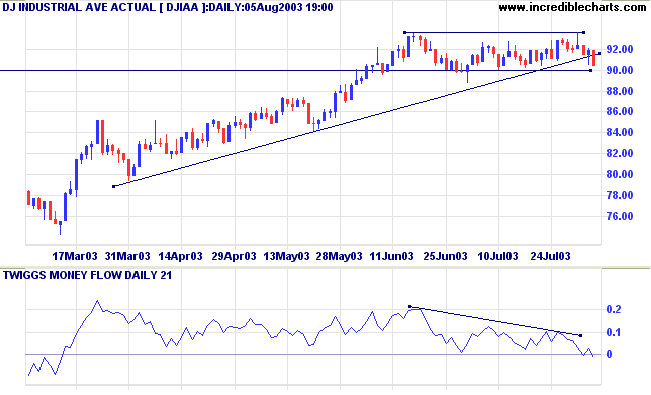

The intermediate trend is up but the index has penetrated the supporting trendline. A break below 9000 will signal a reversal.

MACD and Twiggs Money show bearish divergences.

The primary trend is up.

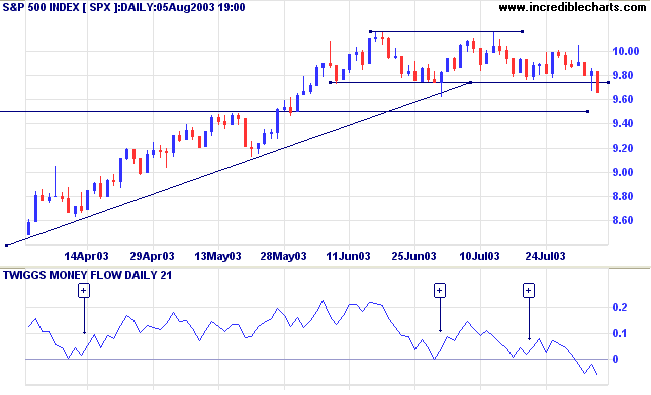

The intermediate trend has turned down, having fallen below 974.

Twiggs Money Flow (21) has crossed below zero, signaling distribution.

The primary trend is up.

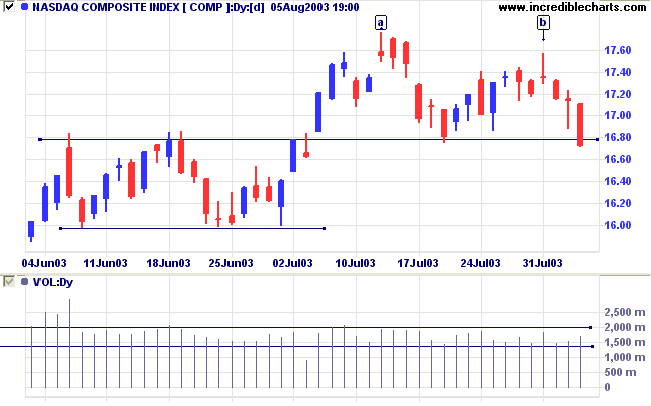

The intermediate trend has turned down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 950.

Long-term: Long is the index is above 1000.

The Network equipment maker meets earnings and sales expectations but its cautiously optimistic outlook led to some selling. (more)

Employers are still cutting jobs, undermining chances of a recovery. (more)

The yield on 10-year treasury notes rallied 12 points to 4.44%.

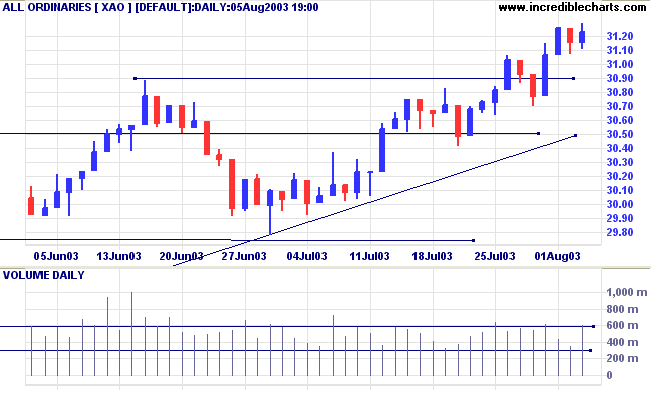

The intermediate and primary trends are both up.

New York (18.57): Spot gold rose to $351.20.

The primary trend is still upwards.

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3127. Short if the index falls below 2978.

Intermediate: Long if the index is above 3127.

Long-term: Long if the index is above 2978 .

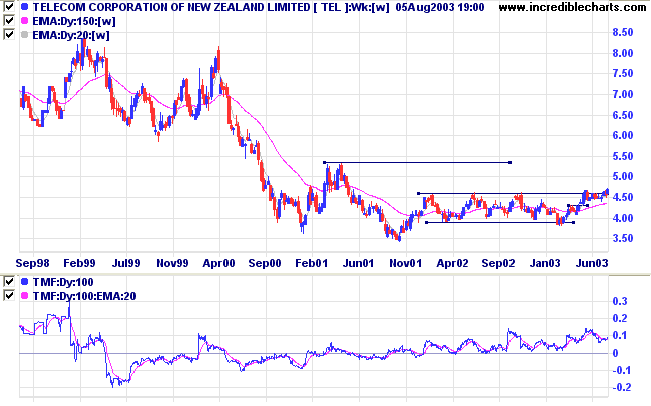

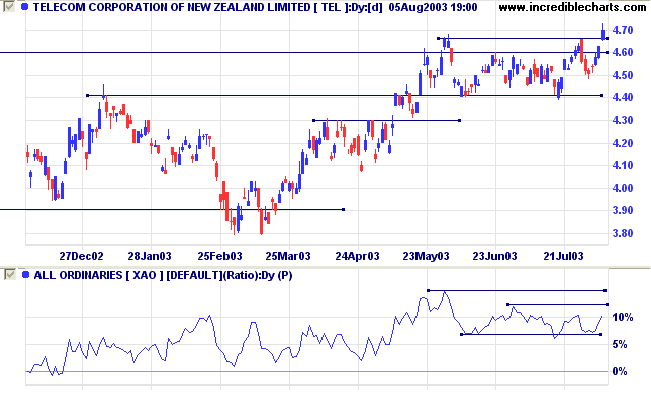

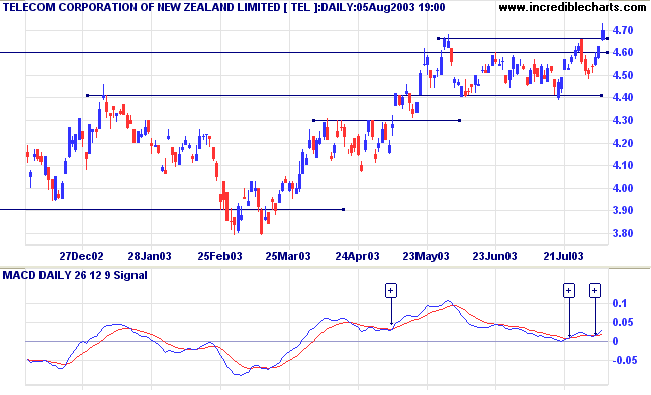

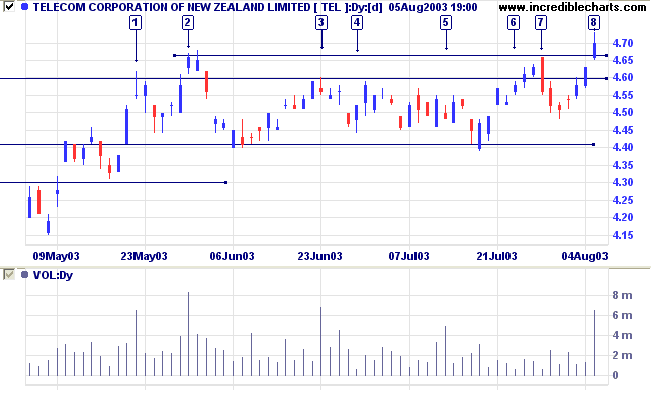

Last covered June 5, 2003.

TEL has broken out above a broad stage 1 base.

Twiggs Money Flow (100) signals strong accumulation.

Relative Strength (price ratio: xao) has eased from the 3-month high in May.

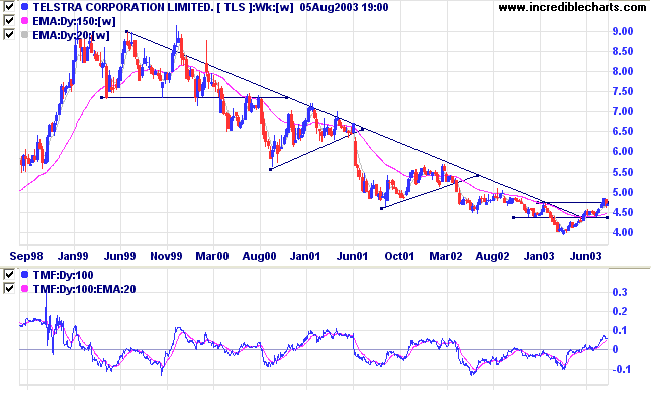

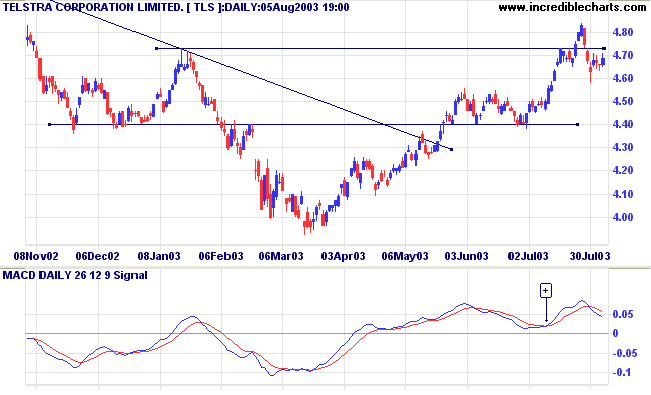

Last covered on August 15, 2002.

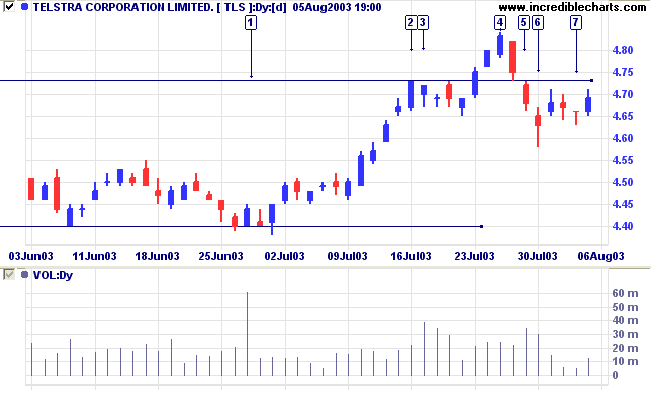

Telstra has started to form a stage 1 base. There are likely to be further tests of support at 4.00 (or 4.50) before a reliable breakout. I suspect that resistance will be heavy because of the large number of small shareholders.

Twiggs Money Flow (100) displays a bullish divergence and signals accumulation, but the signal is nowhere near as strong as TEL above.

A close below 4.40 would be a strong bear signal.

Rules Conditional # 3

In all ordinary circumstances my advice would be to buy at

once an amount that is within the proper limits of capital,

etc.,

selling out at a loss or profit, according to judgment. The

rule is to stop losses and let profits run.

If small profits are taken then small losses should be

taken.

Not to have the courage to accept a loss and to be too eager

to take a profit, is fatal. It is the ruin of many.

~ SA Nelson: The ABC of Stock Speculation (1903).

| Stock Screens: Bollinger bands |

|

Another method of identifying

breakouts is to use Bollinger Bands. To identify

downward breakouts: |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.