To find out more about US indexes

Trading Diary

June 5, 2003

The Dow formed an inside day, closing at 9041 on higher volume. The index has held above the new 9000 support level.

The intermediate trend is up.

The primary up-trend is up.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The index is in a primary up-trend.

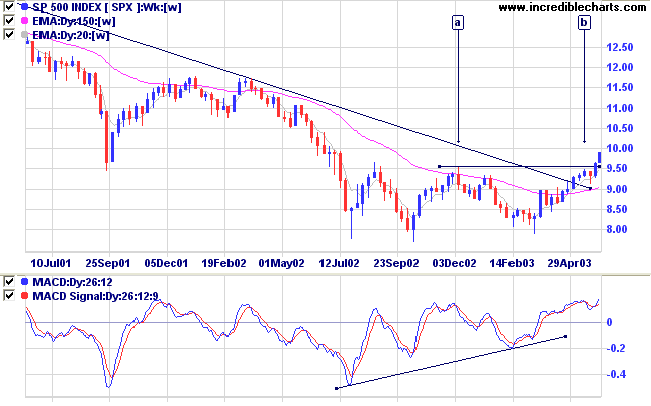

Intermediate: Long if the S&P is above 979.

Long-term: Long - the S&P 500 primary trend has turned upwards after two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal.

New job claims jumped to 442,000 for the week ended 31 May, from a revised 426,000 a week earlier. (more)

New York (16.30): Spot gold recovered to $US 368.30.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

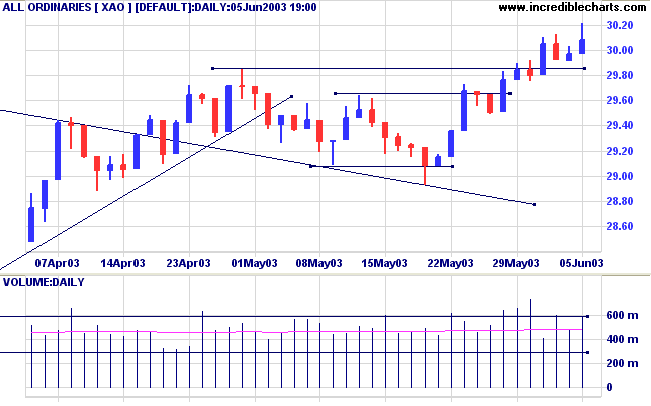

The primary trend is down. A close above 3050 will signal an up-trend.

MACD (26,12,9) is above its signal line, having completed a bullish trough above zero; Slow Stochastic (20,3,3) is below its signal line; and Twiggs Money Flow (21) continues to signal accumulation.

Intermediate: Long if the primary trend reverses up ( closes above 3050 ); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Last covered on May 14, 2003.

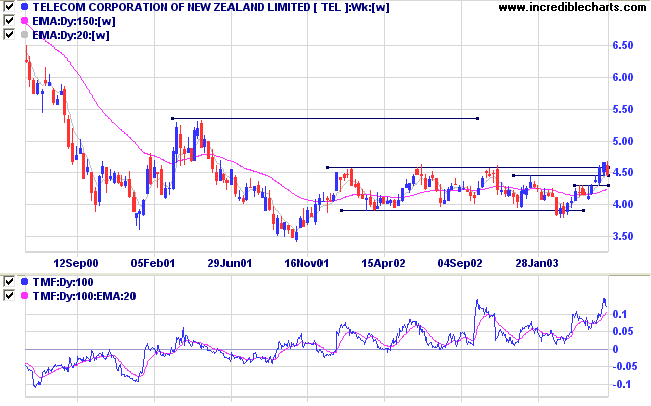

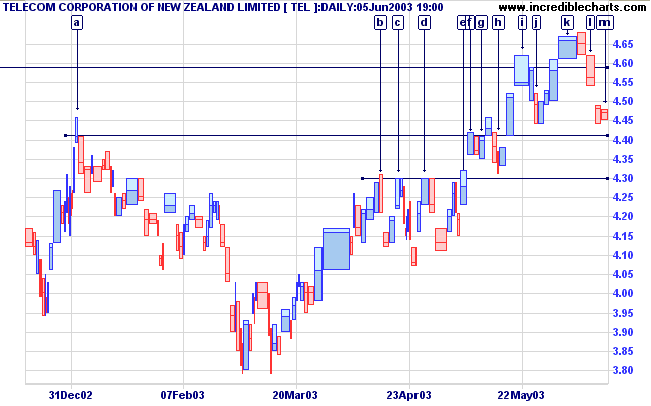

TEL has formed a broad base over the last 18 months.

It recently broke above resistance but then slipped back below.

Twiggs Money Flow (100) shows strong accumulation, holding above zero.

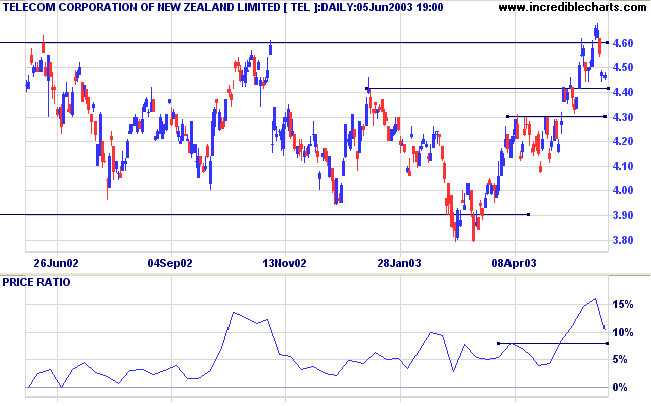

The recent correction on the Relative Strength (price ratio: xao) line is still above the previous peak: a bullish sign if it is able to complete a trough above the last peak. In the longer term the line is slowly rising.

Twiggs Money Flow (21) signals accumulation.

Price penetrated resistance at 4.60 but then slipped back below, testing support at 4.40.

The pull-back to [j] was bullish, with low volume and short duration.

On the next rally, price broke through resistance at [k]. The square bar, heavy volume but smallish range, indicates selling pressure.

Price then broke below support on fair volume at [l].

The downward gap exhausted momentum, with weak closes and low volume at [m].

Consolidation above 4.30 would be bullish. Another break above 4.60 will be a strong bull signal.

it is time to reform.

- Samuel L Clemens (Mark Twain).

Click here to access the Trading Diary Archives.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.