The new version will be released within the next few days.

Trading Diary

November 06, 2002

The Nasdaq Composite Index closed up 1.2% at 1418, threatening a primary trend reversal if the index breaks above 1426.

The S&P 500 gained 8 points to close at 923. The primary trend is down, but the index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 40% (November 05).

The Federal Reserve Board surprised the market with a half-percent rate cut to a 40-year low of 1.25%. (more)

Gold

New York: Spot gold is up 70 cents at $US 317.80.

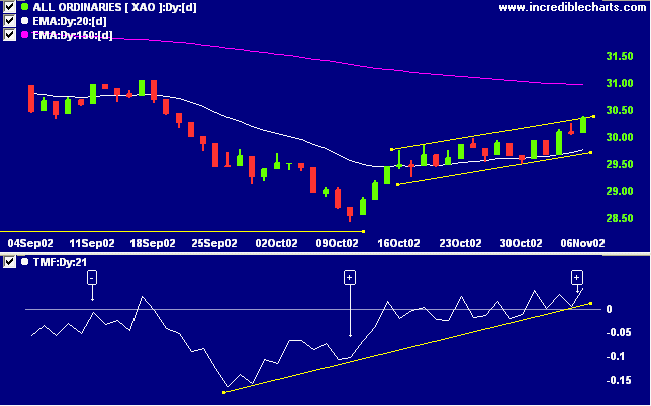

The Slow Stochastic (20,3,3) and MACD (26,12,9) are above their signal lines, while Twiggs money flow signals accumulation.

Last covered on November 5th.

The market was kind and didn't take out the tight stop, it rallied straight from the opening.

Last covered on July 11th.

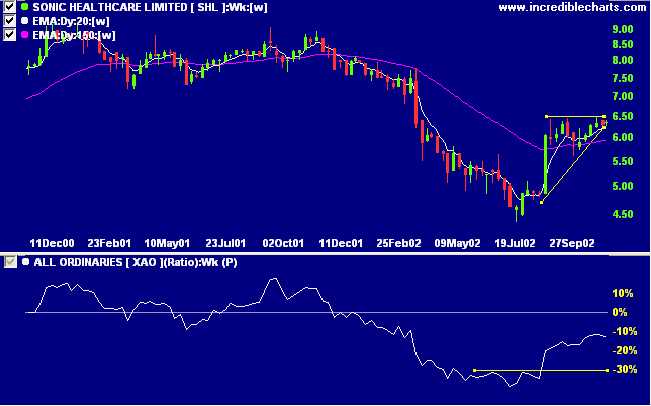

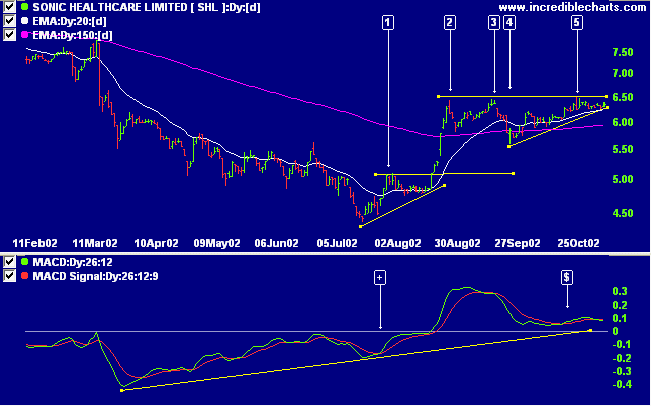

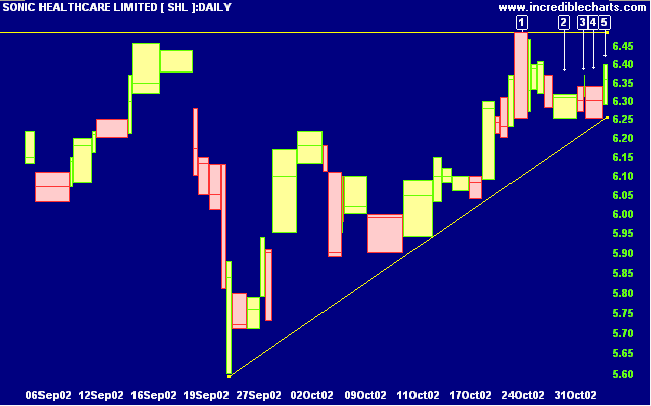

After a stage 4 down-trend, SHL rallied sharply off its low before consolidating with three equal highs, forming a bullish ascending triangle pattern. Relative strength (price ratio: xao) is rising.

A break above the upper border of the triangle at 6.50 will be a bullish signal, while a fall below 6.25 would be bearish.

Still on a military theme:

The Duke of Wellington once likened the campaigns of Napoleon's generals to a fine work of lace, to be admired for their detail, precision and symmetry; whereas he compared his own to a piece of rope: if cut, you could simply tie a knot and keep going.

The same applies to trading strategies.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.