Trading Diary

July 11, 2002

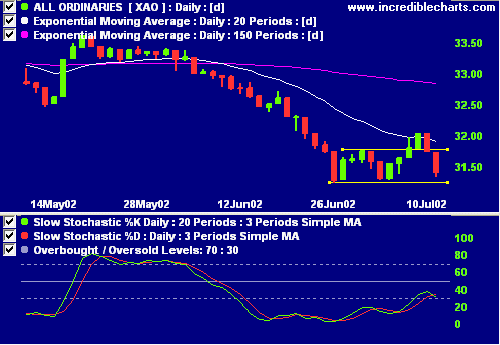

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite rallied more than 2% to

close at 1374.

The primary and secondary cycles are in a down-trend.

The S&P 500 gained 7 points to close at

927.

Primary and secondary cycles trend downwards.

The SEC is investigating whether Bristol-Myers Squibb misled investors about the company's revenue growth. (more)

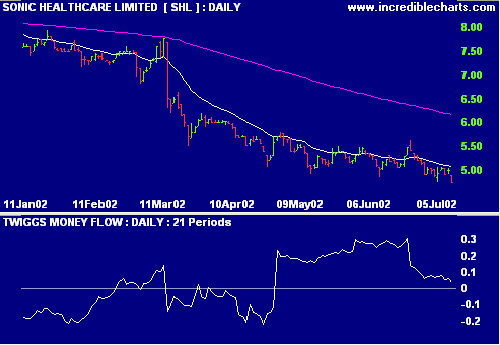

Sonic Healthcare [SHL] has weak Relative Strength (price ratio: xao) and MACD but exponentially-smoothed Money Flow signals accumulation.

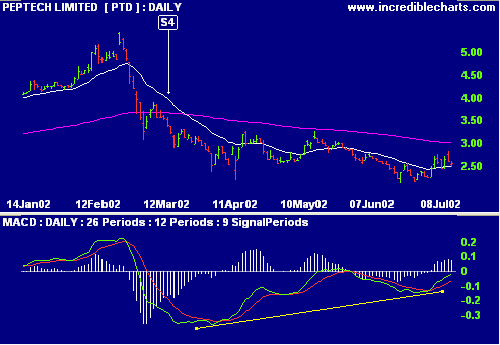

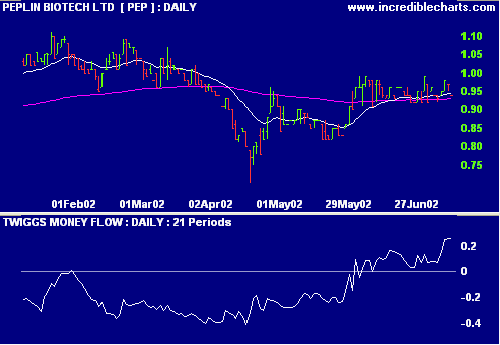

Peplin [PTD]

Peplin Biotech (PEP), on the other hand, shows improving

Relative Strength (price ratio: xao) and MACD, while

exponentially-smoothed Money Flow has swung to accumulation.

When the supermarket has a sale, buyers rush in. When the stock market has a sale, buyers run away.

- from Robert Kiyosaki.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.