Dollar weakens on Fed announcement

By Colin Twiggs

November 4, 2010 1:00 a.m. EDT (5:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Fed is planning to go ahead with more quantitative easing, but amounts mentioned so far are unlikely to have much of an impact.

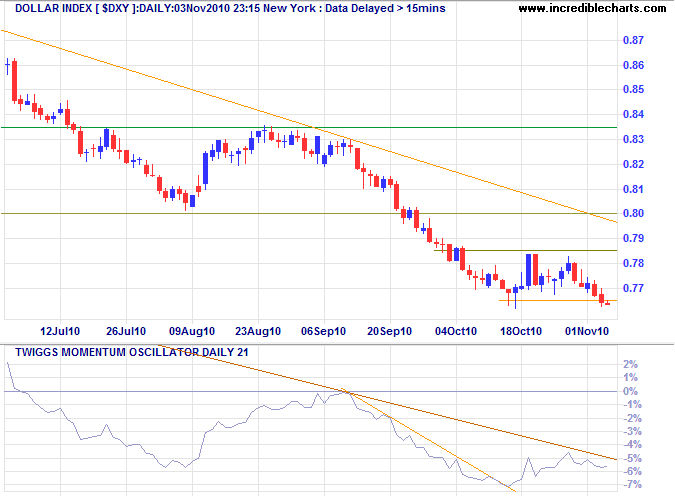

US Dollar Index

The US Dollar Index broke support at 76.5, offering a short-term target of 74.5*. Respect of the declining trendline by Twiggs Momentum (21-day) would warn of a strong primary decline.

* Target calculation: 78.5 - ( 78.5 - 76.5 ) = 74.5

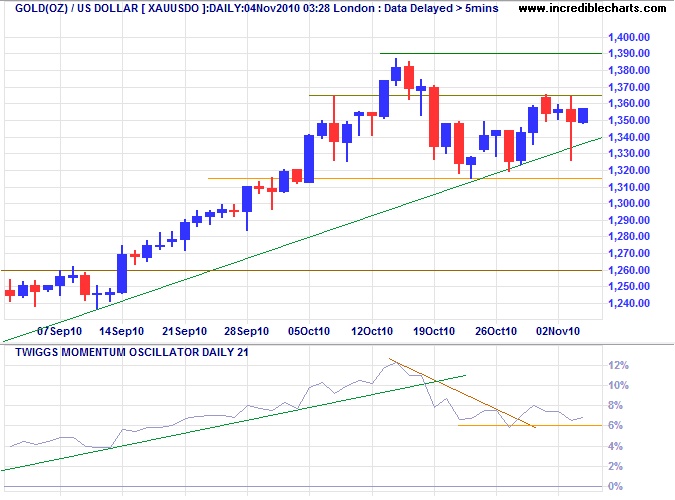

Gold

Spot gold found support at $1320 and is now testing resistance at $1365. Yesterday's long tail indicates buying pressure. Upward breakout would test $1390. Twiggs Momentum (21-day) stopped falling, breaking the declining trendline. Respect of support at 6% (by TM) would indicate another strong advance.

* Target calculation: 1390 + ( 1390 - 1320 ) = 1460

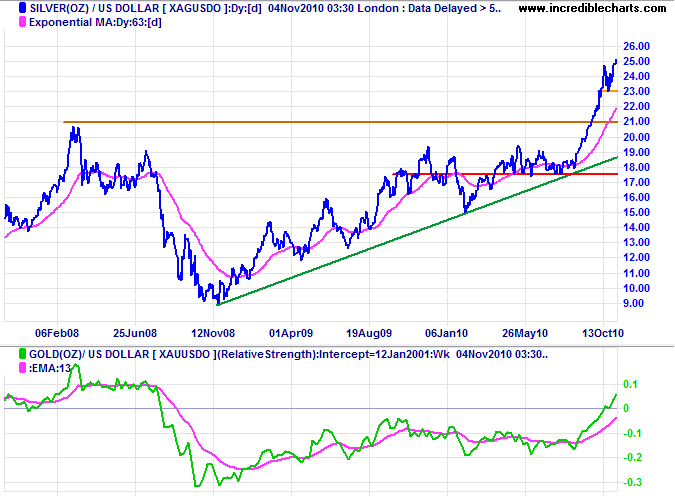

Silver

Silver is out-performing gold, with Relative Strength rising strongly. Breakout above $25/ounce after a short retracement to $23 warns of an accelerating up-trend which could lead to a blow-off.

* Target calculation: 20 + ( 20 - 15 ) = 25

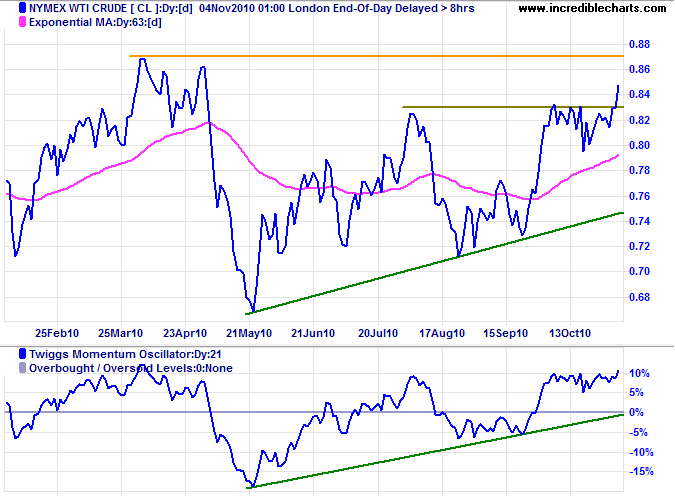

Crude Oil

Nymex WTI Crude is headed for a test of resistance at $87 per barrel. Breakout would offer a target of $107*. A Twiggs Momentum (21-day) trough that respects the zero line would confirm the primary up-trend.

* Target calculation: 87 + ( 87 - 67 ) = 107

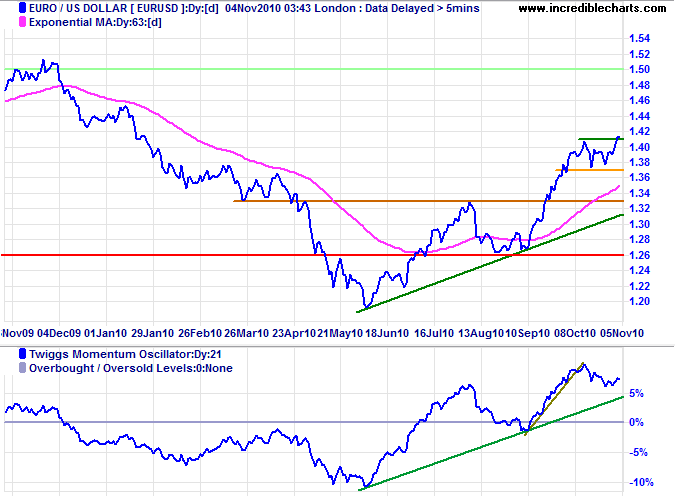

Euro

The euro broke resistance at $1.41, signaling an advance to $1.50*. Twiggs Momentum (21-day) respect of the rising trendline would signal a strong up-trend.

* Target calculation: 1.41 + ( 1.41 - 1.33 ) = 1.49

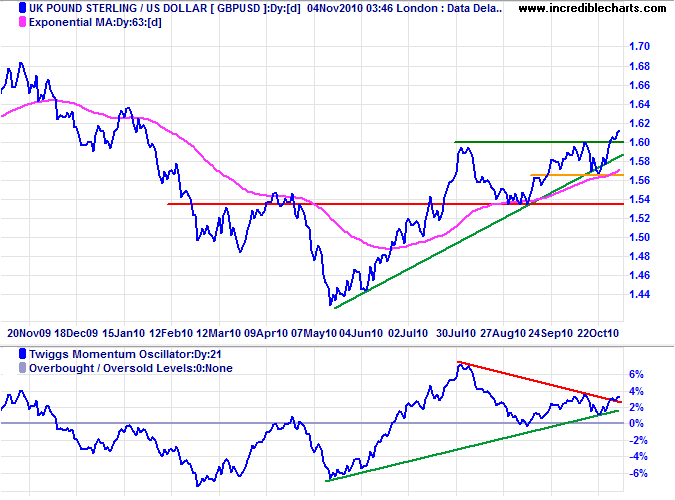

UK Pound Sterling

The pound sterling broke resistance at $1.60, offering a target of $1.66*. Bearish divergence on Twiggs Momentum (21-day) indicates weakness, but penetration of the declining trendline supports the breakout; recovery above 4% would confirm the advance.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

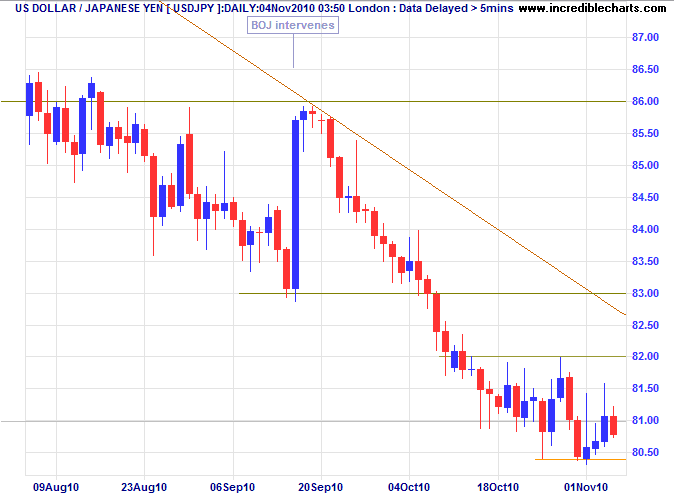

Japanese Yen

The dollar retraced to test the new resistance level after breaking its 1995 low of ¥81. Tall shadows indicate selling pressure. Respect of resistance at ¥82 would warn of another strong decline.

* Target calculations: 83 - ( 86 - 83 ) = 80

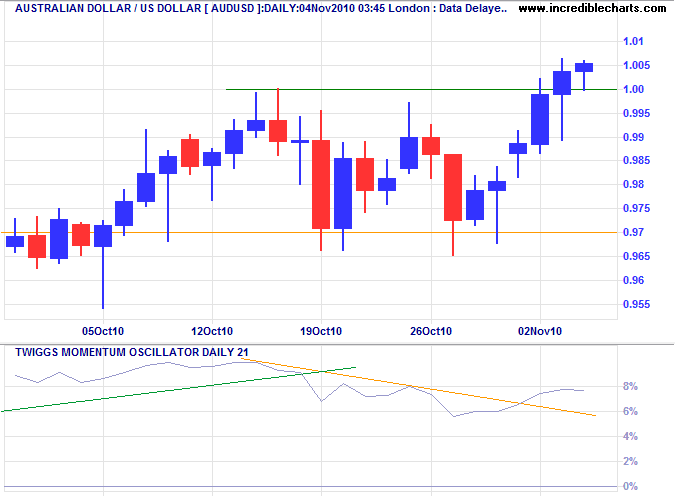

Australian Dollar

The Aussie dollar respected short-term support at $0.97, breaking through parity to register a new high of $1.005. Twiggs Momentum (21-day) penetrated the declining trendline, indicating another rally. Target for the breakout is $1.030.

* Target calculation: 1.00 + ( 1.00 - 0.97 ) = 1.03

People spend too much time finding other people to blame, too much energy finding excuses for not being what they are capable of being, and not enough energy putting themselves on the line, growing out of the past, and getting on with their lives.

~ J. M. Straczynski

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.