Mild inflation but no jobs

By Colin Twiggs

November 3, 2010 7:00 p.m. ET (11:00 a.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

....the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

~ FOMC statement, November 3.

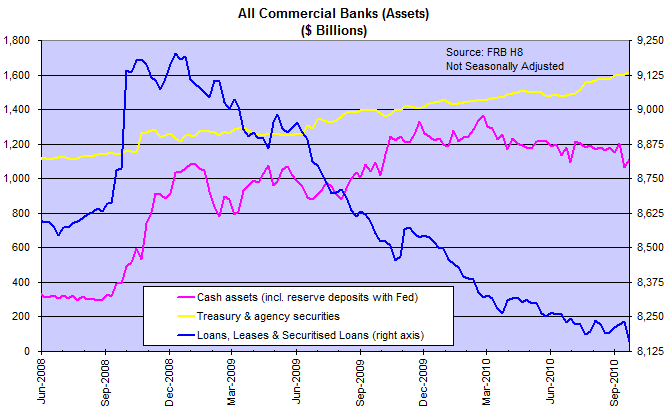

A bit of a damp squib. While the Fed will increase the money supply through purchase of Treasurys, this is unlikely to have the multiplier effect normally associated with the expansion of banking deposits. That is because the banking system is already awash with cash and the new injection of liquidity is likely to follow the same path as the $1.75 trillion so far: back to the Fed in the form of excess reserve deposits from the banks, or invested by them in Treasury and Agency securities. Investment in new Treasurys would have a mild inflationary effect, but neither path is likely to create new jobs on Main street.

The mid-term election delivered control of Congress to the Republicans, continuing the global trend towards "hung parliaments" in Western democracies and indicating a high level of mistrust in the political process. If this mistrust continues, we may witness an evolution over the next few decades — away from the winner-takes-all style of democracy towards more of a Swiss consensus style.

It will be interesting to observe the new GOP in Congress. It has undergone an internal revolution since the Bush-era, dominated by big business and big government in an alliance with Wall-street. There is now an intense distrust of big money and big government; the election result gives the GOP a clear mandate to focus on Main street and small government. Further fiscal stimulus is unlikely, with deficit reduction a priority.

USA

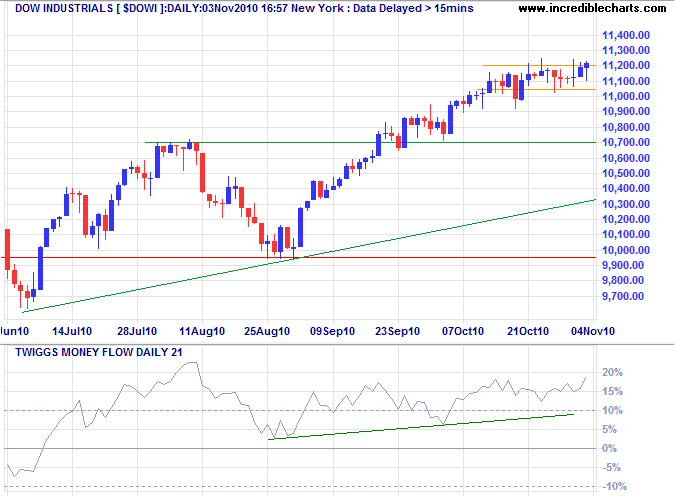

Dow Jones Industrial Average

The Dow continues to test its April high of 11200. Narrow consolidation below resistance favors a breakout. Rising Twiggs Money Flow (21-day), clear of the zero line indicates buying pressure. Upward breakout from 11200 would continue the primary advance to 11400*.

* Target calculations: 10700 + ( 10700 - 10000 ) = 11400

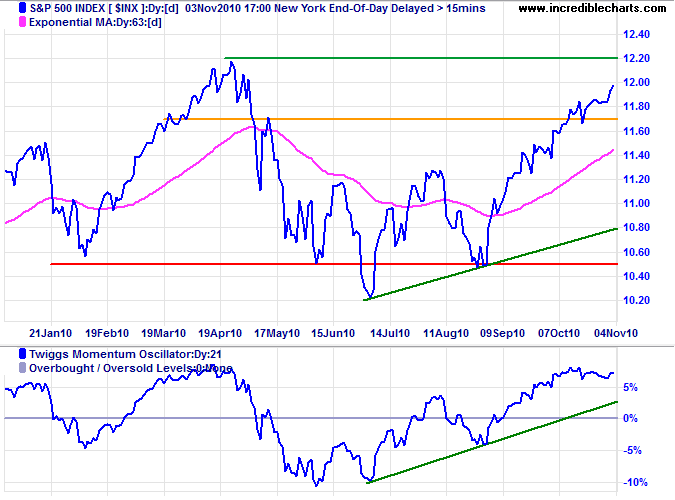

S&P 500

The S&P 500 is headed for a test of the April high of 1220. Expect strong resistance, but Twiggs Momentum respect of the zero line would suggest continuation of the up-trend. Breakout above 1220 would offer a long-term target of 1420*.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

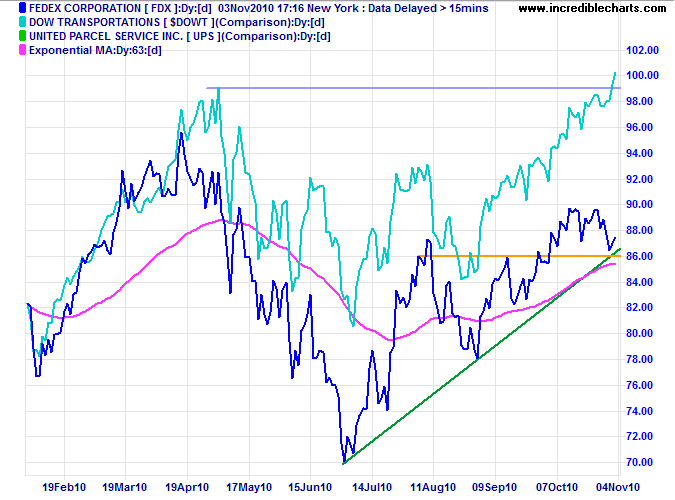

Transport

The Dow Transport index is rising strongly, breaking above its April high. Bellwether stock Fedex is testing support at 86; respect would signal continuation of the up-trend. Both are bullish for the broader economy.

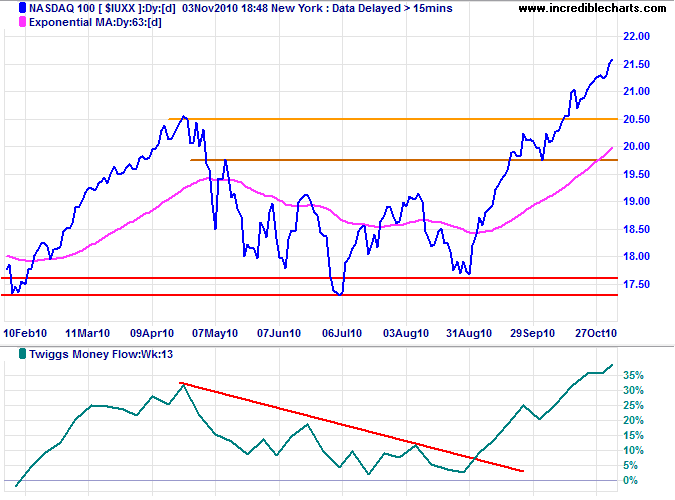

Technology

The Nasdaq 100 is advancing to the 2007 high of 2250*. The sharp rise on Twiggs Money Flow (13-week) indicates strong buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

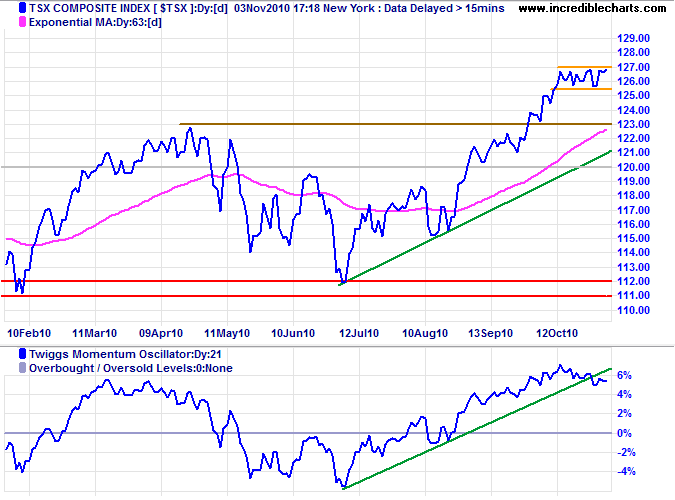

Canada: TSX

A narrow rectangle on the TSX Composite suggests continuation of the primary advance to 13400*. Upward breakout would confirm. Reversal of 21-day Twiggs Momentum below its rising trendline, however, warns of a correction to test support at 12300.

* Target calculation: 12300 + ( 12300 - 11200 ) = 13400

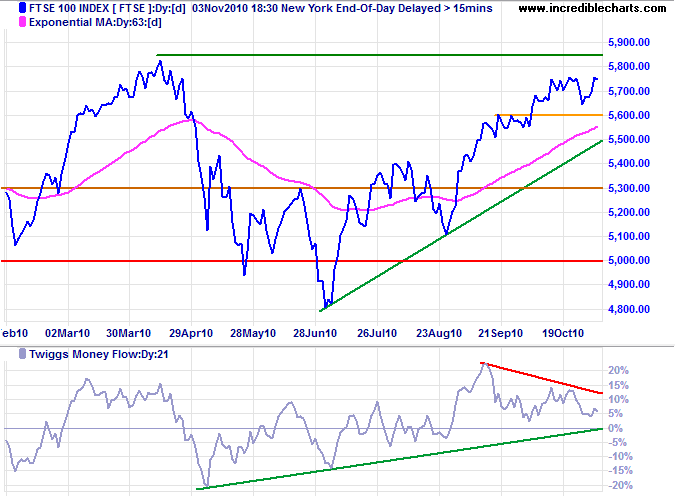

United Kingdom: FTSE

The FTSE 100 is headed for a test of its April high at 5850*. Breakout would offer a long-term target of the 2007 high at 6750*. Bearish divergence on Twiggs Money Flow (21-day), however, warns of medium-term selling pressure.

* Target calculation FTSE: 5800 + ( 5800 - 4800 ) = 6800

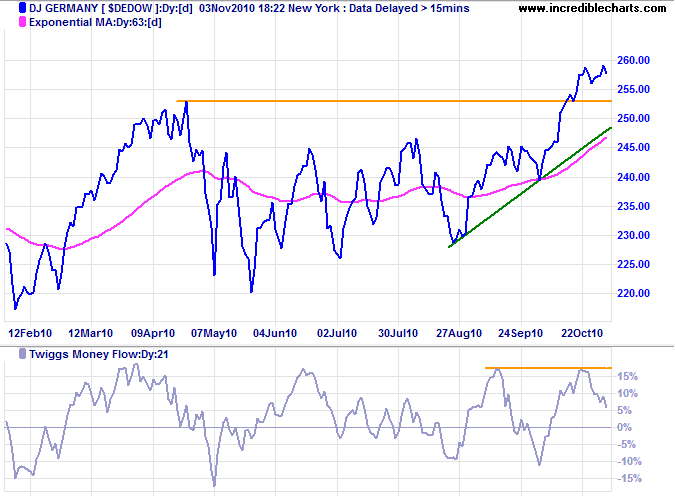

Germany

The DJ Germany index ($DEDOW) broke through its April high, signaling a new primary advance. Bearish divergence on Twiggs Money Flow (21-day), however, warns of retracement to test the new support level.

* Target calculation DAX: 6350 + ( 6350 - 5700 ) = 7000

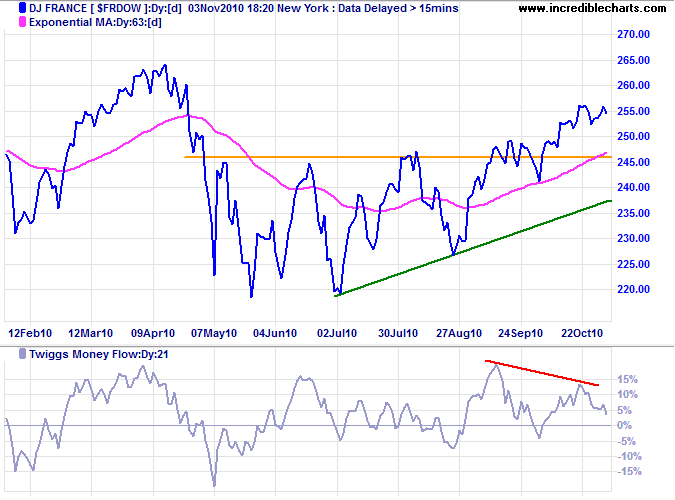

France: CAC-40

The DJ France index ($FRDOW) is advancing to test its April high. Again, bearish divergence on Twiggs Money Flow (21-day), stronger than the $DEDOW, warns of retracement to test the new support level.

* Target calculation CAC-40: 3750 + ( 3750 - 3450 ) = 4050

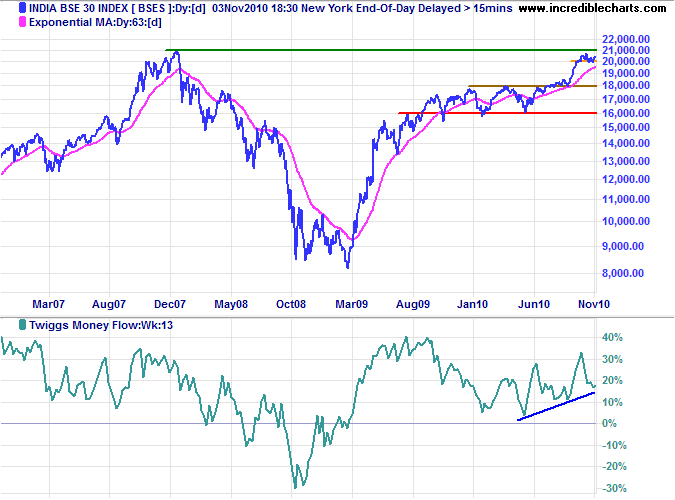

India

The Sensex respected support at 20000 and is preparing for another test of the 2007 high at 21000. Rising Twiggs Money Flow (13-week) indicates strong buying pressure. Breakout would signal a strong primary advance into blue sky territory — with no significant resistance. Failure of support is unlikely, but would indicate another correction.

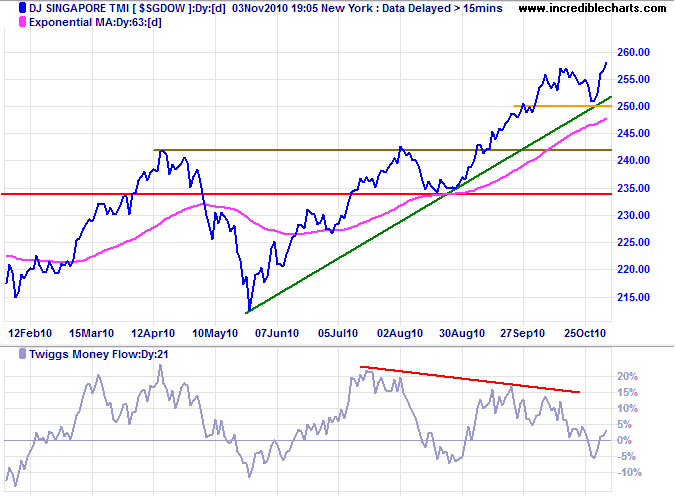

Singapore

The DJ Singapore index respected the rising trendline, indicating continuation of the primary advance. Bearish divergence on Twiggs Money Flow (21-day) warned of a correction, but recovery above the zero line to accompany the breakout indicates the danger has passed.

* Target calculation STI: 3000 + ( 3000 - 2650 ) = 3350

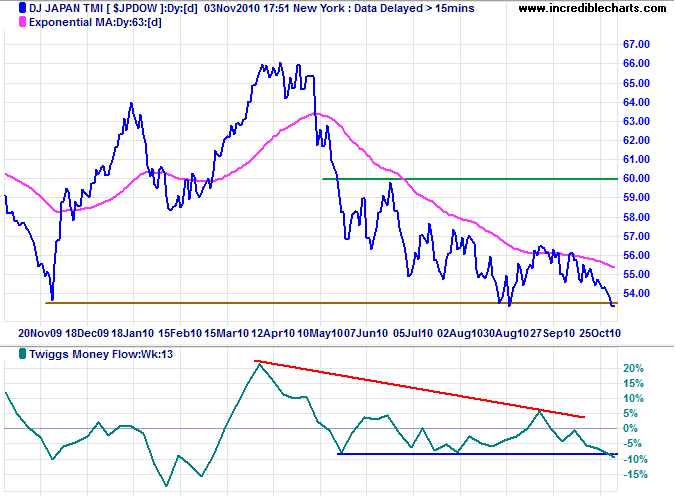

Japan

The DJ Japan index ($JPDOW) broke long-term support, signaling a fresh primary decline. Declining Twiggs Money Flow (13-week), below the zero line, indicates strong selling pressure.

* Target calculation N225: 9000 - ( 11000 - 9000 ) = 7000

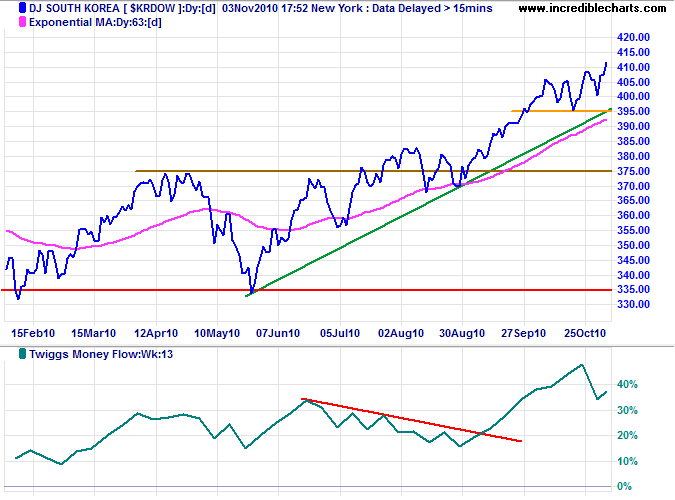

South Korea

The DJ South Korea index respected its rising trendline, indicating continuation of the primary advance. Twiggs Money Flow (13-week) high above zero confirms strong buying pressure.

* Target calculation KS11: 1750 + ( 1750 - 1550 ) = 1950

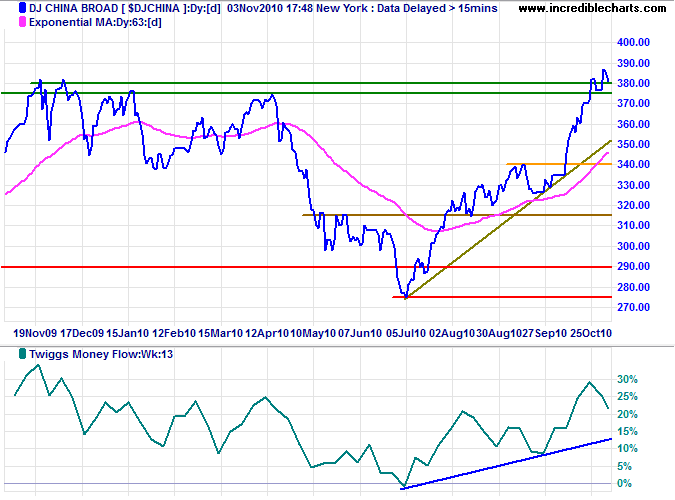

China

The DJ China index broke through resistance at 380, but is now retracing to test support. Respect would signal a fresh primary advance. Rising Twiggs Money Flow (13-week) indicates buying pressure. The target for an advance is 480*. Reversal below the rising trendline is unlikely, but would warn of another correction.

* Target calculations: 380 + ( 380 - 280 ) = 480

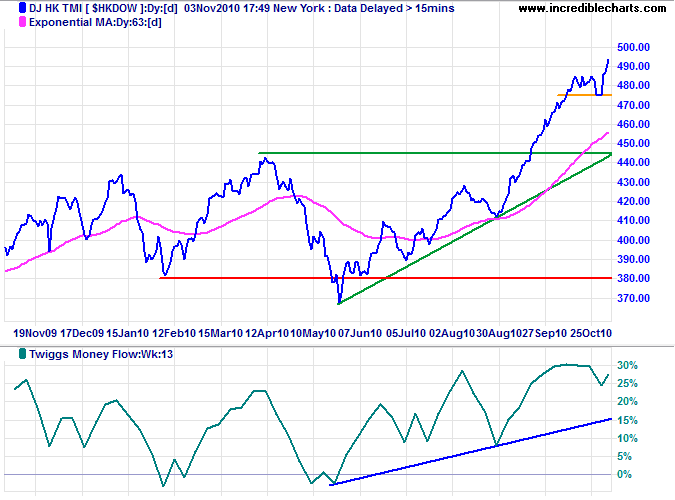

The DJ Hongkong index broke out of its small consolidation, signaling continuation of its strong primary up-trend. Rising Twiggs Money Flow (13-week) confirms buying pressure.

* Target calculations: 21800 + ( 21800 - 20600 ) = 23000

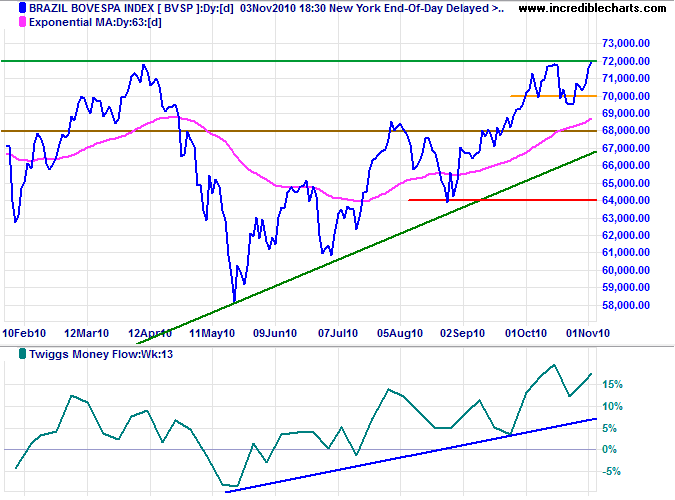

Brazil

The Bovespa index is testing resistance at 72000 after a brief retracement. Rising Twiggs Money Flow (13-week) indicates strong buying pressure. Expect a test of the 2008 high of 73500/74000.

* Target calculation: 70000 + ( 70000 - 60000 ) = 80000

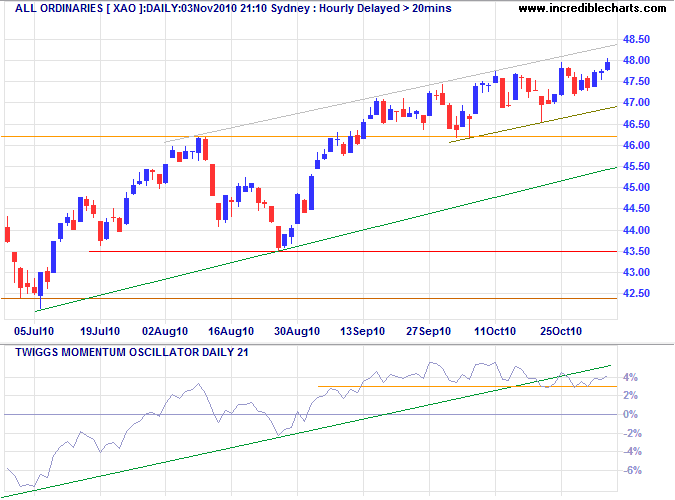

Australia: ASX

The All Ordinaries is edging upwards in a narrow trend channel. Twiggs Momentum (21-day) dipped below its rising trendline, indicating weakness, but respect of 3% would suggest this has passed. Expect an advance to 5000*.

* Target calculation: 4650 + ( 4650 - 4250 ) = 5050

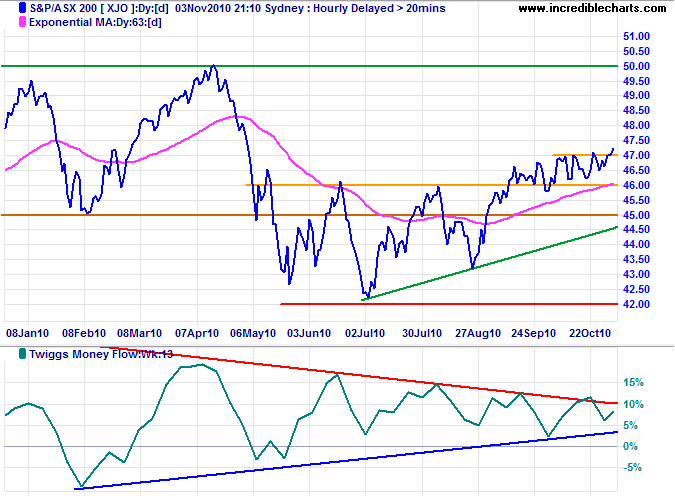

The ASX200 broke above 4700, indicating a test of the April high at 5000. Twiggs Money Flow (13-week) continued respect of the zero line indicates long-term buying pressure.

A man who has committed a mistake and doesn't correct it is committing another mistake.

~ Confucius

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.