Bears Grow Stronger

By Colin Twiggs

August 23, 2010 5:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Bearish sentiment abounds. The DAX is headed for a test of primary support. Failure of support would mean that the big six markets, US, Japan, China, UK, Germany and France are all in a primary down-trend. Also, keep a weather eye on Transport: a primary down-trend there would complete the trifecta.

Reminder:

October is the most bearish month in the year, with many major recorded crashes (1929, 1987). We are likely to see consolidation until the end of the quarter, followed by a breach of support. The breach, however, may either resolve into a primary down-trend or rally sharply to complete a bear trap. All we can do is remain vigilant and stick to objective signals — avoid being swayed by the mood of the market.

USA

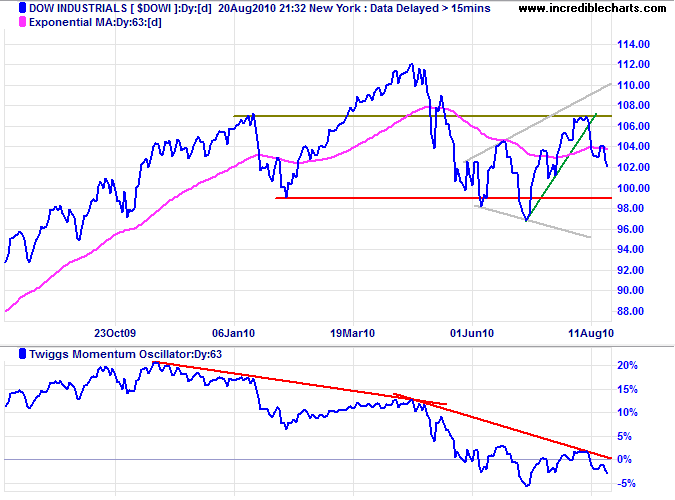

Dow Jones Industrial Average

The Dow encountered resistance at 10400 and is retracing to find support. Reversal below the former primary support level at 9900 would indicate another down-swing, with a target of 8700*. Twiggs Momentum (63-day) reversal below zero signals a continuing down-trend. Failure of the lower border of the broadening wedge formation would confirm.

* Target calculations: 9700 - ( 10700 - 9700 ) = 8700

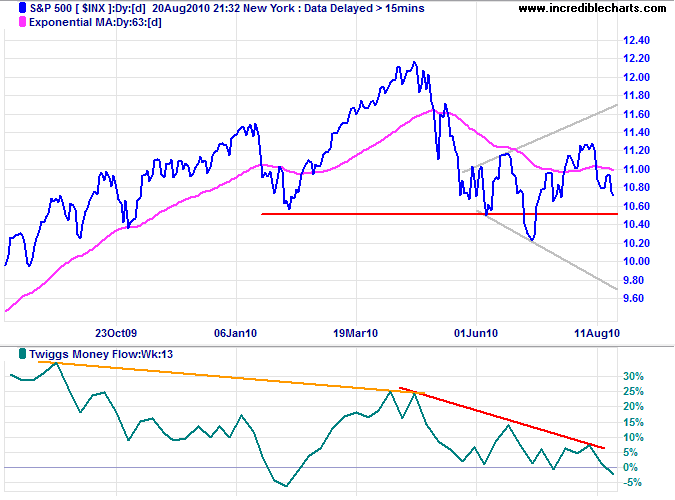

S&P 500

S&P 500 reversal below its former primary support level at 1050 would confirm the primary down-trend. Twiggs Money Flow (13-week) crossing to below zero warns of selling pressure.

* Target calculation: 1050 - ( 1200 - 1050 ) = 900

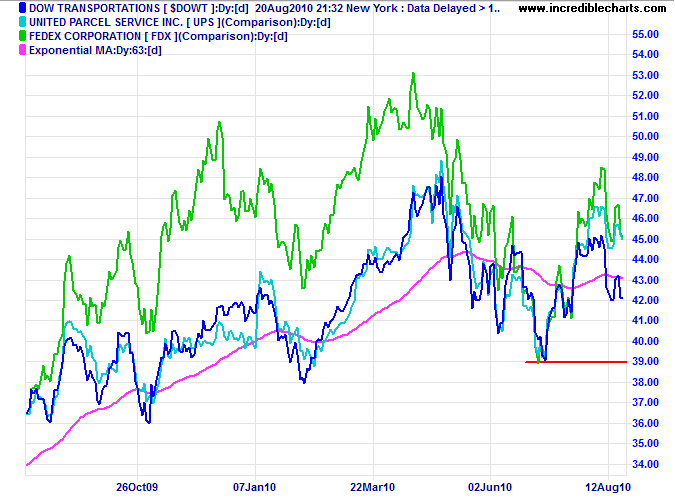

Transport

The Dow Transport Index, and major components Fedex and UPS, are headed for a test of primary support ($DOWT at 3900). Failure would confirm the bear market.

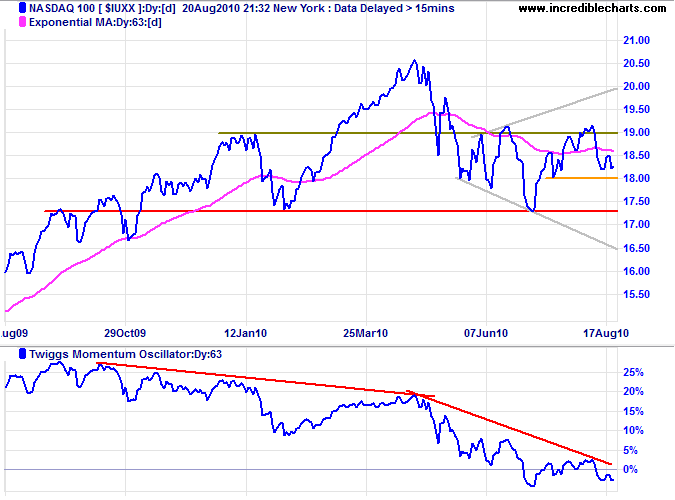

Technology

The Nasdaq 100 is testing short-term support at 1800. Failure would indicate a swing to the lower border of the broadening wedge. Penetration of primary support at 1725 would confirm the down-trend. 63-day Momentum Oscillator reversal below zero strengthens the bear signal. Twiggs Money Flow (13-week) falling below zero would also indicate selling pressure.

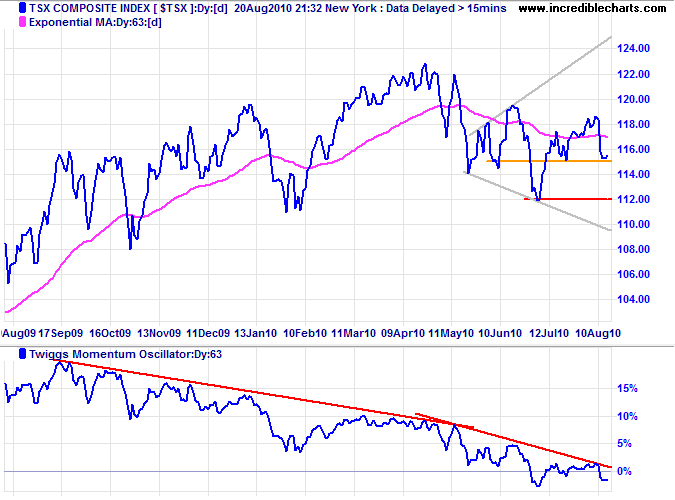

Canada: TSX

TSX Composite found short-term support at 11500; failure would signal a down-swing to the lower wedge border. 63-day Twiggs Momentum below zero indicates a primary down-trend.

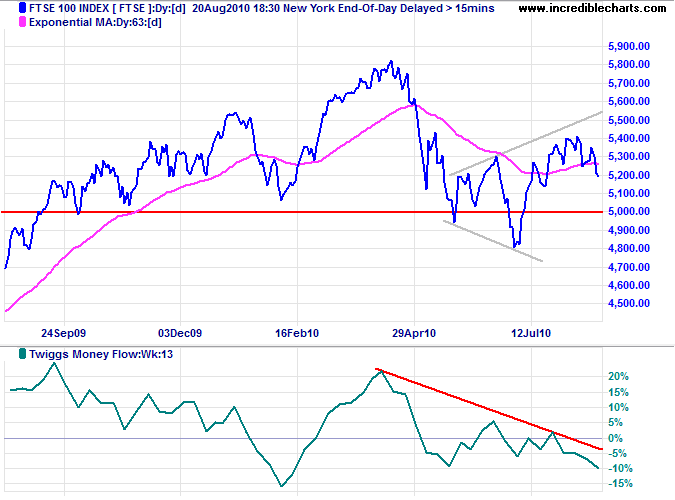

United Kingdom: FTSE

The FTSE 100 is retracing to test the former primary support level at 5000. Failure would confirm the primary down-trend. Declining Twiggs Money Flow (13-week) below zero warns of strong selling pressure.

* Target calculation: 4800 - ( 5400 - 4800 ) = 4200

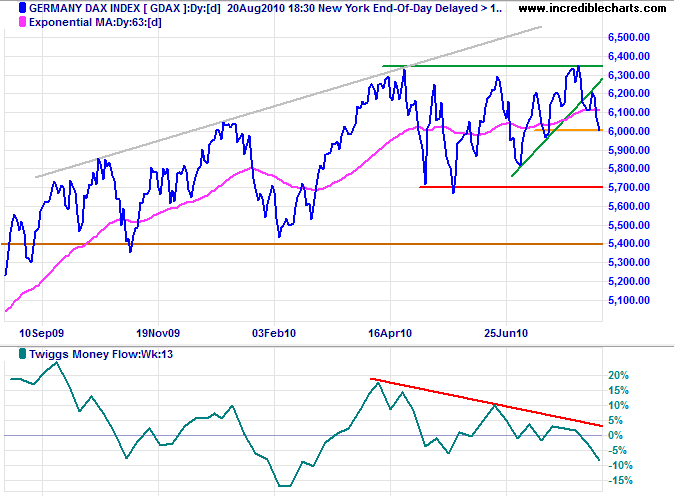

Germany: DAX

Declining Twiggs Money Flow (13-week) below zero again warns of strong selling pressure. Failure of short-term support at 6000 would test primary support at 5700. Bearish divergence on 63-day Twiggs Momentum Oscillator also warns of reversal to a primary down-trend. Penetration of support at 5700 would confirm.

* Target calculation: 5700 - ( 6350 - 5700 ) = 5050

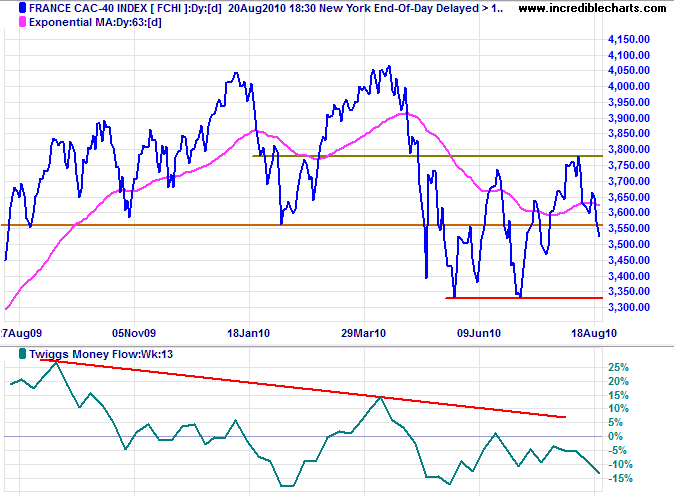

France: CAC-40

The CAC-40 is even more bearish than the FTSE 100 and the DAX, with Twiggs Money Flow (13-week) completing peaks below the zero line — signaling a strong down-trend. Expect a test of support at 3350. Failure would offer a target of 2950*.

* Target calculation: 3350 - ( 3750 - 3350 ) = 2950

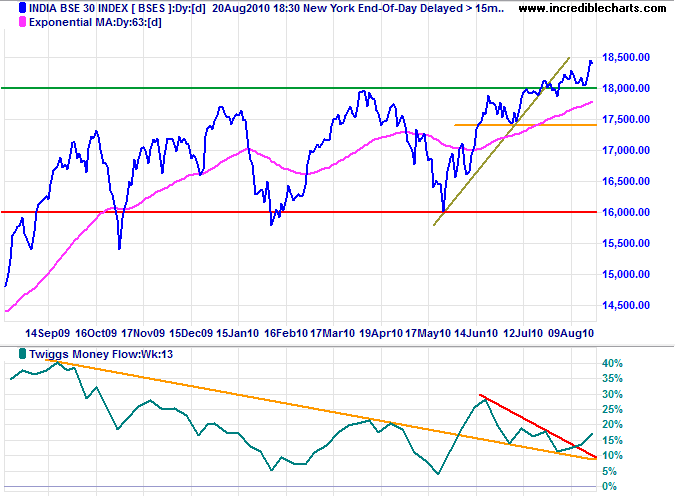

India: Sensex

The Sensex consolidated in a narrow range above 18400 Monday, signaling continuation of the up-trend. Breakout above 18500 would confirm. The target for the primary advance is 20000*. Reversal below 17400 is unlikely, but would test primary support at 16000.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

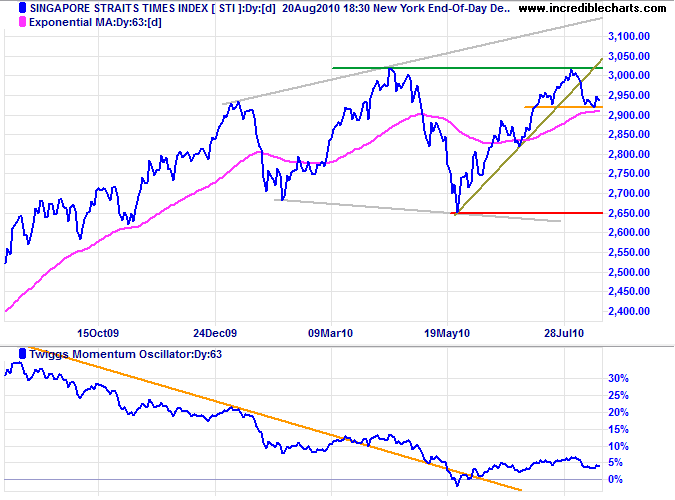

Singapore

The Straits Times Index is testing short-term support at 2920 Monday. Failure would signal a test of primary support at 2650. Twiggs Momentum Oscillator (63-day) holding above zero, however, is a positive sign — and reversal above 2920 would warn of a bear trap.

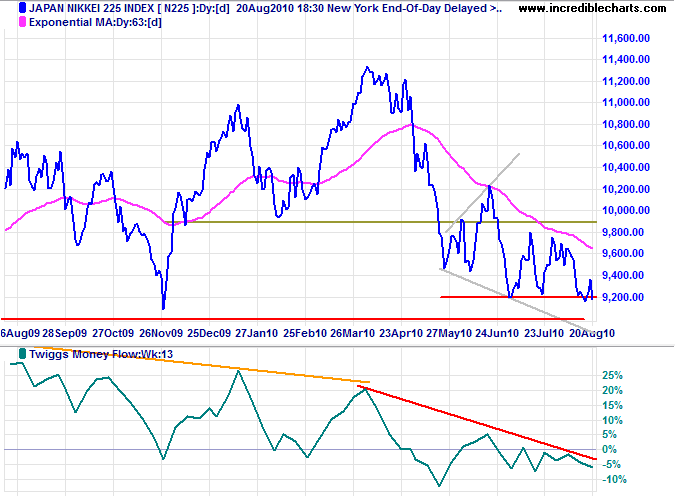

Japan: Nikkei 225

The Nikkei 225 index broke medium-term support at 9200. Penetration of 9000 would confirm another primary down-swing, with a target of 8000*. Twiggs Money Flow (13-week) below zero warns of selling pressure.

* Target calculation: 9000 - ( 10000 - 9000 ) = 8000

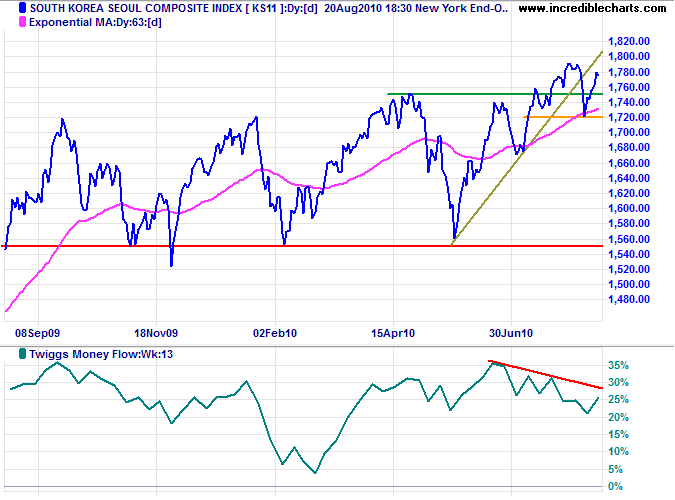

South Korea

The Seoul Composite is testing short-term support Monday. Declining Twiggs Money Flow (13-week) indicates medium-term selling pressure. Expect another test of 1720. Failure would warn of a correction to primary support at 1550. Breakout above 1800 is less likely in the current climate, but would signal an advance to 1950*.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

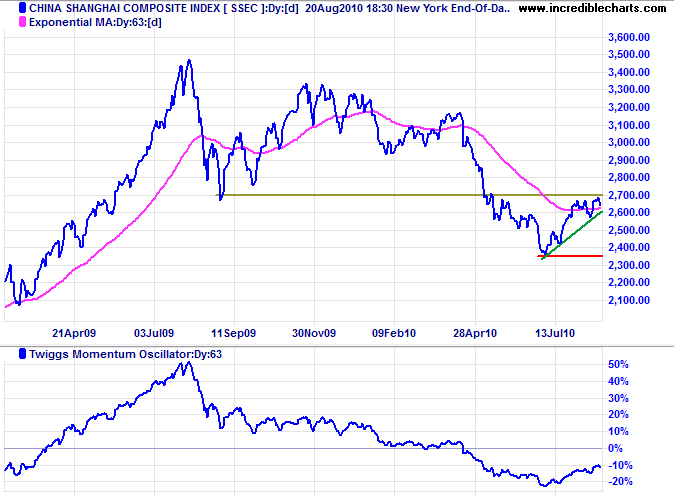

China

The Shanghai Composite respected resistance at 2700. Reversal below the rising trendline would warn that the bear rally is ending. 63-day Twiggs Momentum Oscillator holding below zero indicates continuation of the primary down-trend.

* Target calculations: 2350 - ( 2700 - 2350 ) = 2000

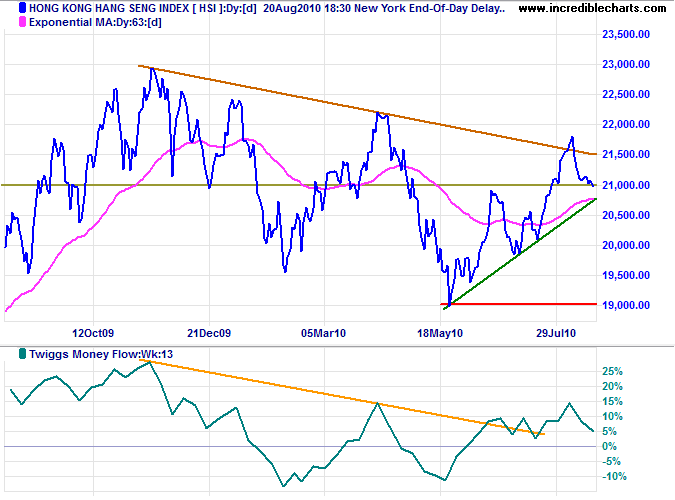

The Hang Seng Index reversed below its new support level at 21000. Respect of resistance at 21000 on the next rally would warn of a bull trap — as would penetration of the rising trendline. Twiggs Money Flow (13-week), however, remains above zero and respect of the zero line would signal another rally. Bullish divergence on 63-day Momentum Oscillator continues to indicate a primary up-trend.

* Target calculations: 21000 + ( 21000 - 20000 ) = 22000

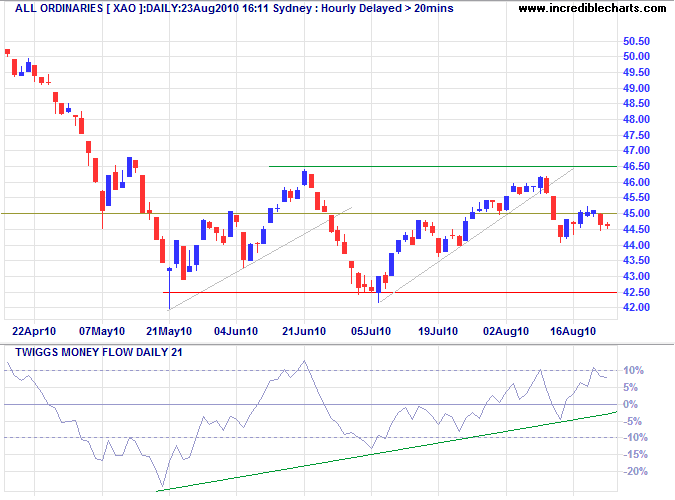

Australia: ASX

The All Ordinaries encountered short-term resistance at 4500, but remains optimistic, consolidating in a narrow band below the resistance level. Twiggs Money Flow (21-day) above zero is a positive sign. The market will probably remain in limbo until the current political uncertainty is resolved.

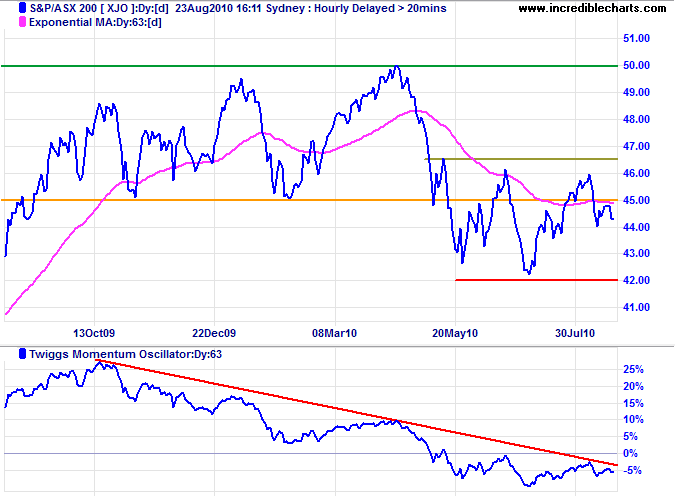

The longer term picture is bleaker, with 63-day Twiggs Momentum Oscillator below zero warning of continuation of the primary down-trend. Declining Twiggs Money Flow (13-week) also indicates short/medium-term selling pressure. Breakout above 4650 remains less likely than penetration of primary support at 4200, signaling a decline to 3800*.

* Target calculation: 4200 - ( 4600 - 4200 ) = 3800

A politician who portrays himself as caring and sensitive because he wants to expand the government's charitable programs is merely saying that he is willing to do good with other people's money. Well, who isn't?

~ P.J. O'Rourke

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.