China Threatens Correction

By Colin Twiggs

December 23, 2009 6:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

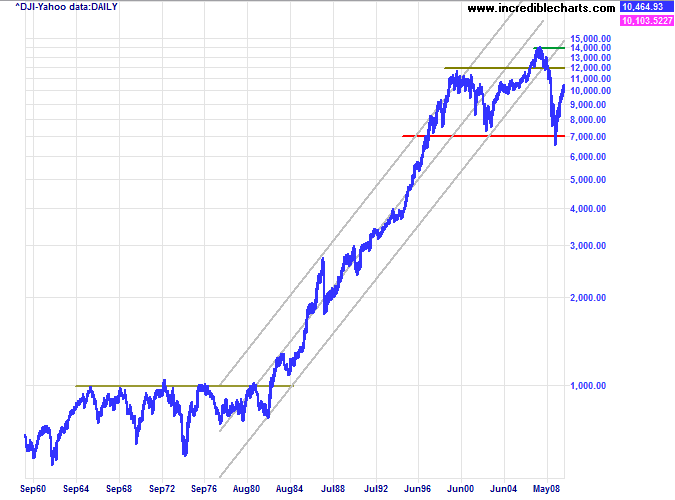

Markets are fraught with uncertainty in the short term but the picture becomes clearer as the time frame grows longer. It is uncertain whether the Dow will be up or down in the next few weeks, but it is most unlikely that the primary up-trend will reverse while interest rates are close to zero. I am also sure that the Dow cannot break out to new highs without a sizable jump in (non-financial) debt levels. You cannot create an asset bubble without a corresponding debt bubble as surely as you cannot start a fire without oxygen. Private debt levels are currently falling, indicating a period of slow growth with market fluctuations dictated by interest rates — similar to the US in the 1960s and 1970s or the last 20 years in Japan.

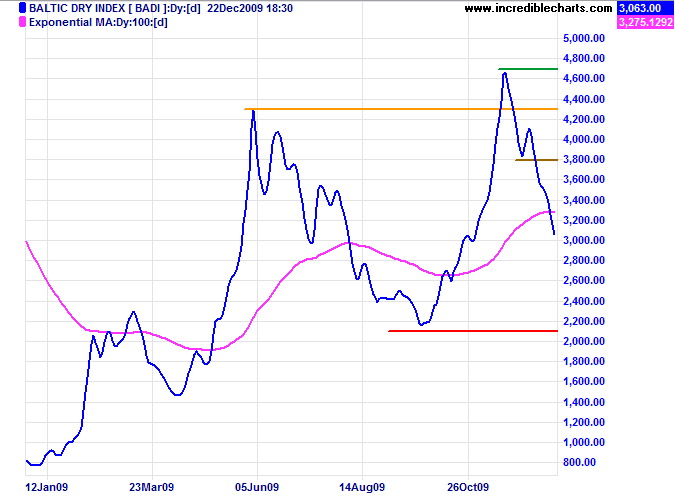

In the shorter term, the Baltic Dry Index reflects falling bulk shipping rates — signaling a decline in commodity demand, primarily from Asia.

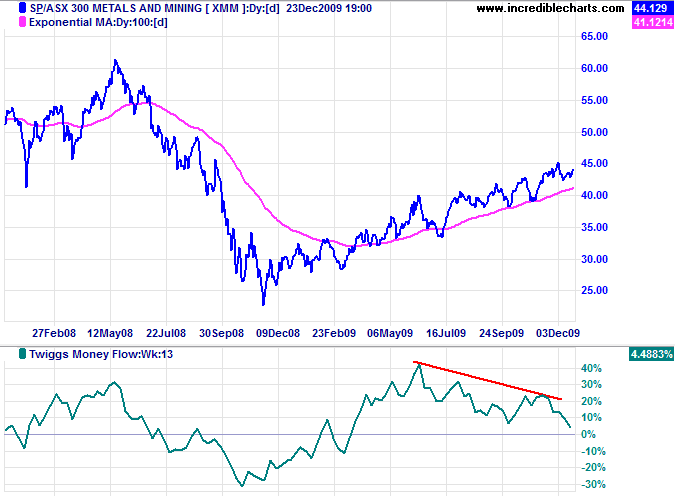

Resources stocks and indexes such as the ASX Metals & Mining Index are so far unaffected, but traders need to remain vigilant. A large bearish divergence on Twiggs Money Flow (13-week) indicates weakness.

USA

Dow Jones Industrial Average

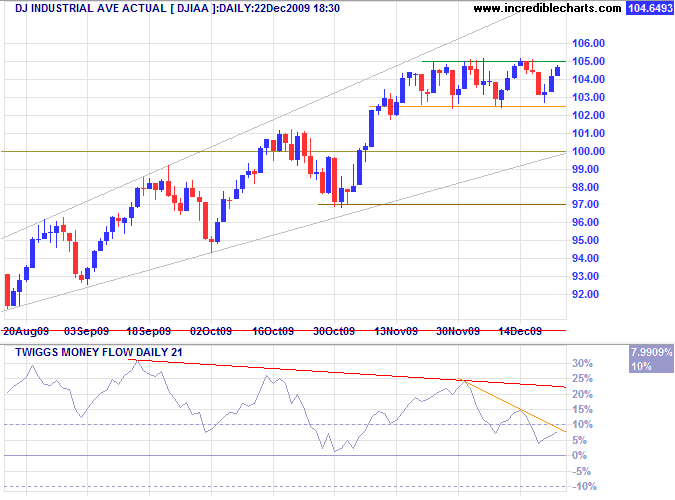

The Dow continues to consolidate between 10250 and 10500; breakout will indicate future direction. Bearish divergence on Twiggs Money Flow (21-day) warns of a correction; breakout below the ascending broadening wedge, at 10000, would signal a test of the base at 9000.

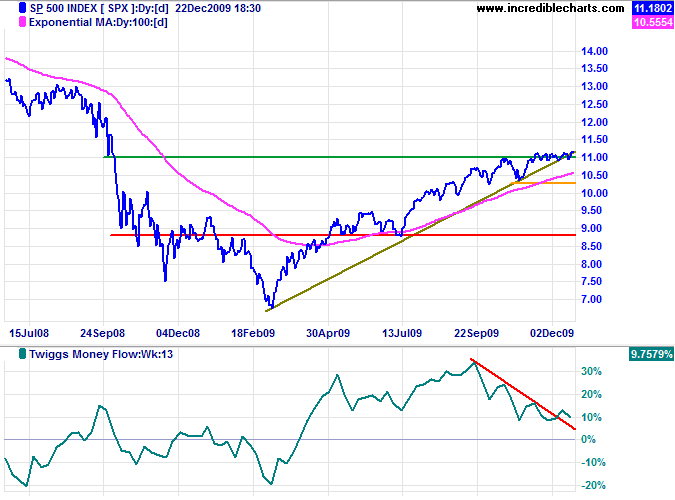

S&P 500

The S&P 500 threatens a breakout above the recent consolidation around 1100, but bearish divergence on Twiggs Money Flow (13-week) continues to warn of a correction. A rise above 1120, however, would signal a primary advance. Reversal below 1080, and the rising trendline, would warn of a correction — confirmed if support at 1030 fails.

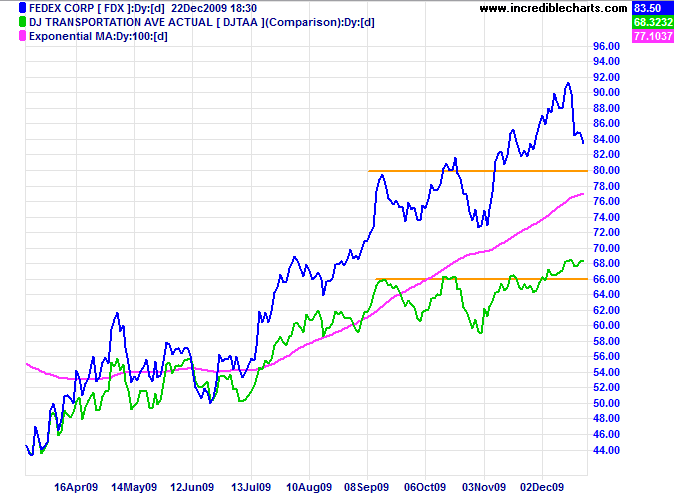

Fedex & Transport

Fedex is retracing to test support at $80; respect would signal a strong up-trend. Primary up-trends for Fedex and the Dow Transport Index are a positive sign for the broader US economy.

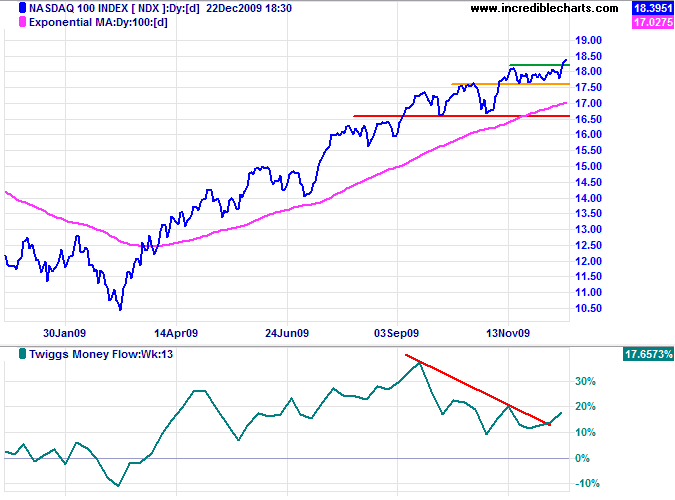

Technology

The Nasdaq 100 broke out above it its recent consolidation, signaling an advance to 1850*. Rising Twiggs Money Flow (13-week) indicates buying pressure. Reversal below 1750 is unlikely, but would warn of a correction.

* Target calculation: 1750 + ( 1750 - 1650 ) = 1850

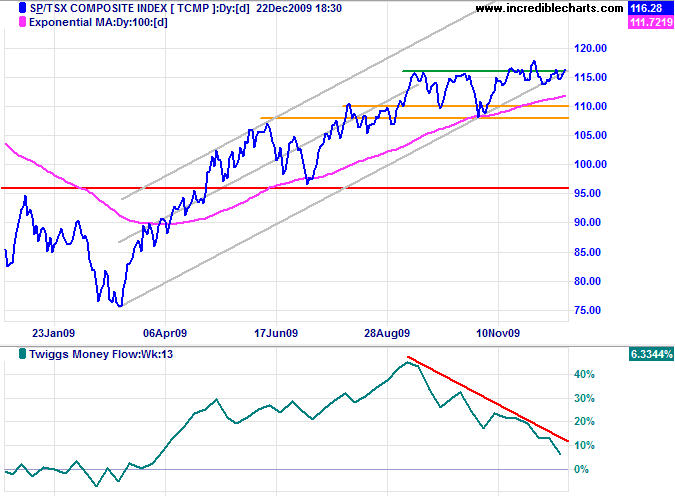

Canada: TSX

The TSX Composite is once again testing resistance at 11600, but the sharp decline in Twiggs Money Flow (13-week) warns of selling pressure. Reversal below 11300 would signal a correction, while recovery above 11800 would indicate a primary advance to 12400*.

* Target calculation: 11600 + ( 11600 - 10800 ) = 12400

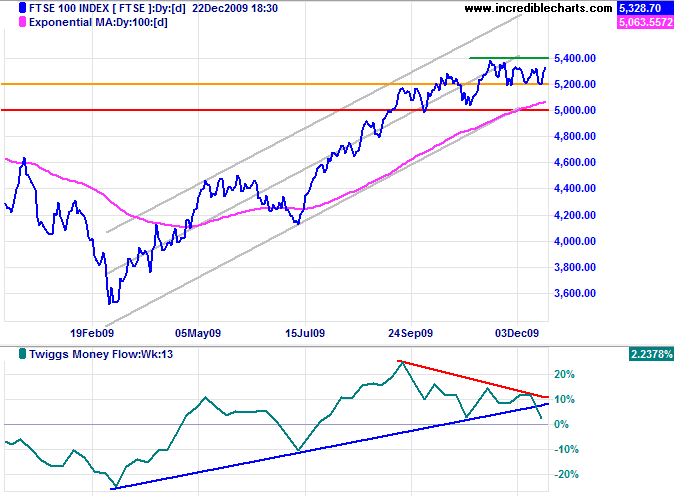

United Kingdom: FTSE

The FTSE 100 Index displays a large bearish divergence on Twiggs Money Flow (13-week); failure of support at 5200 would signal a correction.

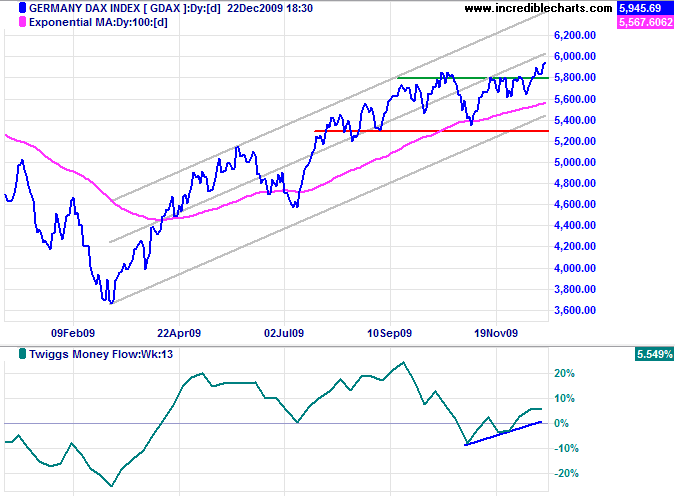

Germany: DAX

The DAX broke through resistance at 5850/5900, offering a target of 6500*. Rising Twiggs Money Flow (13-week) indicates buying pressure. Reversal below 5600 is unlikely, but would warn of another correction.

* Target calculation: 5900 +( 5900 - 5300 ) = 6500

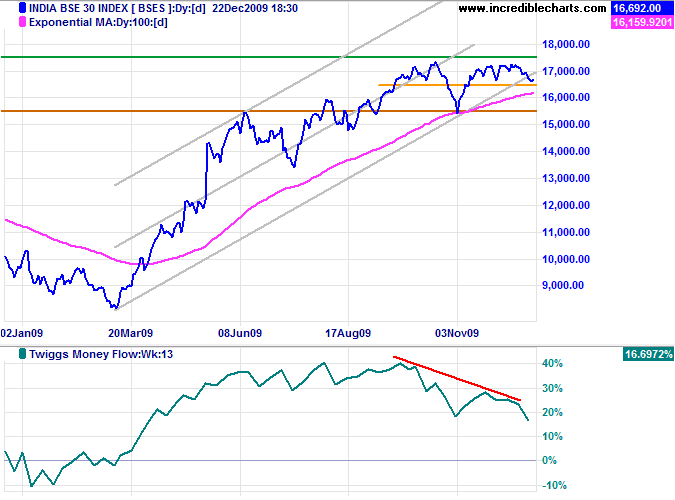

India: Sensex

The Sensex respected resistance at 17300, but rallied Wednesday for another test. The large down-trend on Twiggs Money Flow (13-week), however, warns of a correction; reversal below 16600 would confirm. In the long term, failure of support at 15400 would signal a primary trend reversal.

* Target calculation: 17500 + ( 17500 - 15000 ) = 20000

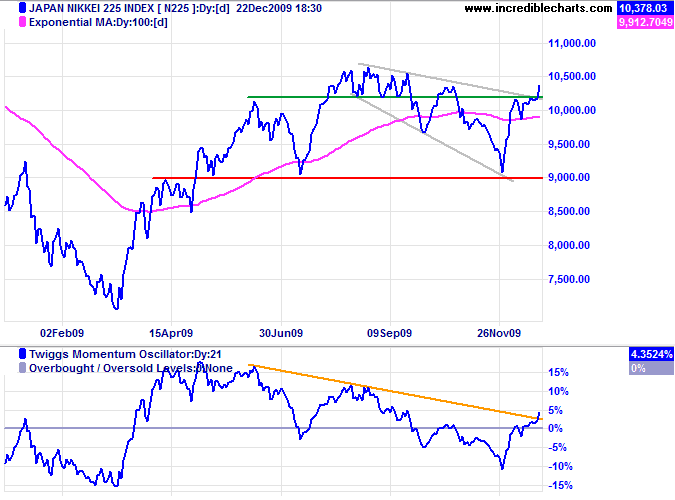

Japan: Nikkei

The Nikkei 225 broke out above 10200, offering a target of 10600 — the base of the large descending broadening wedge formation. Twiggs Money Flow (13-week) continues to reflect selling pressure, but breakout above the declining trendline on the Momentum Oscillator indicates reversal to an up-trend.

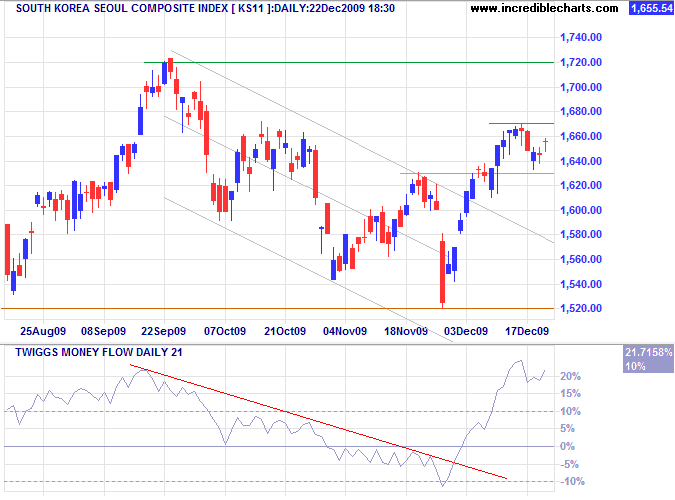

South Korea

The Seoul Composite continues to head for a test of resistance at 1720. Rising Twiggs Money Flow (21-day) indicates buying pressure. Breakout above 1720 would signal an advance to 1940*.

* Target calculation: 1720 + ( 1720 - 1520 ) = 1940

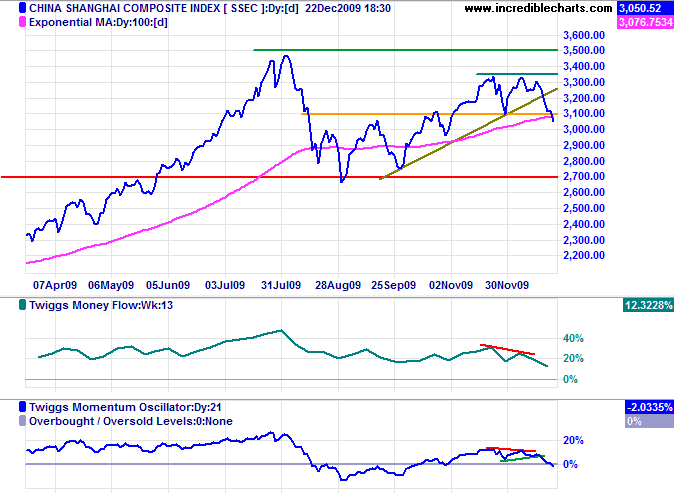

China

The Shanghai Composite Index reversed below support at 3100, failing to recover on Wednesday. Declining Twiggs Money Flow (13-week) and Momentum confirm a correction. The initial target is 2850*, with primary support at 2700. Recovery above 3100 is unlikely but would re-test 3350.

* Target calculations: 3100 - ( 3350 - 3100 ) = 2850

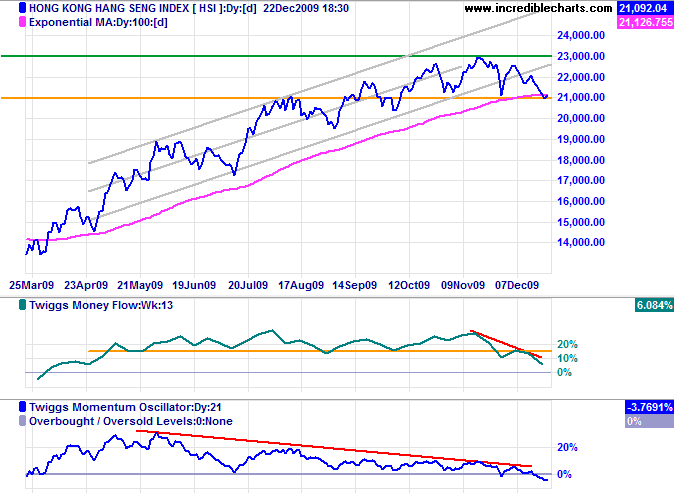

The Hang Seng Index is testing support at 21000; failure would signal a correction. Declining Twiggs Money Flow (13-week) and Momentum Oscillator (21-day) indicate weakness. Primary support is at 19500. Recovery above 22500 is unlikely, but would indicate an advance to 25000*.

* Target calculation: 23000 + ( 23000 - 21000 ) = 25000

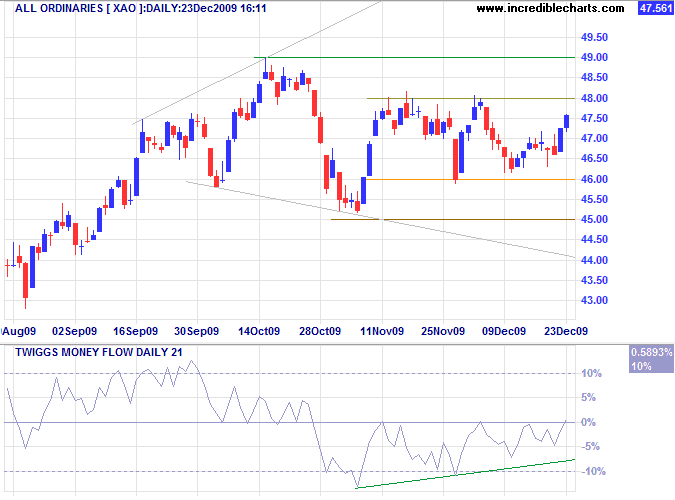

Australia: ASX

The All Ordinaries, so far unfazed by declining Chinese markets and international commodity shipments, is headed for a test of resistance at 4800. Rising Twiggs Money Flow (21-day) indicates short-term buying pressure. Breakout above 4800 would test resistance at 5000*, but reversal below support at 4600 would warn of a secondary correction.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

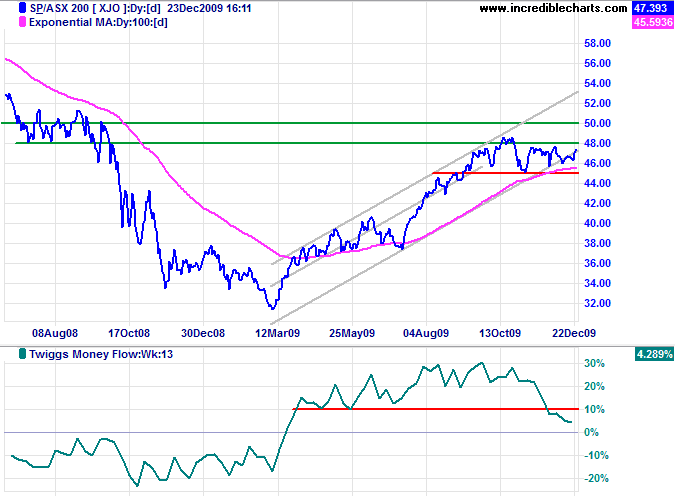

Declining Twiggs Money Flow (13-week) on the ASX 200 warns of long-term selling pressure. Failure of support at 4500 would signal a correction. Resource stocks will be adversely affected if the Baltic Dry Index reverses to a down-trend.

This is my last newsletter of the year and I wish you all peace and goodwill over the Christmas season and prosperity in the year ahead.

When you make peace with yourself,

you make peace with the world.

~ Maha Ghosananda

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.