The Road To Nowhere

By Colin Twiggs

October 16, 2008 8:00 a.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Fed hints about further rate cuts remind me of Will Rogers observation about Congress: This country has come to feel the same when Congress is in session as when the baby gets hold of a hammer. Artificially low interest rates got us into this mess. So the Fed's proposal to fix it is to — you guessed it — cut interest rates. This is a road to nowhere.

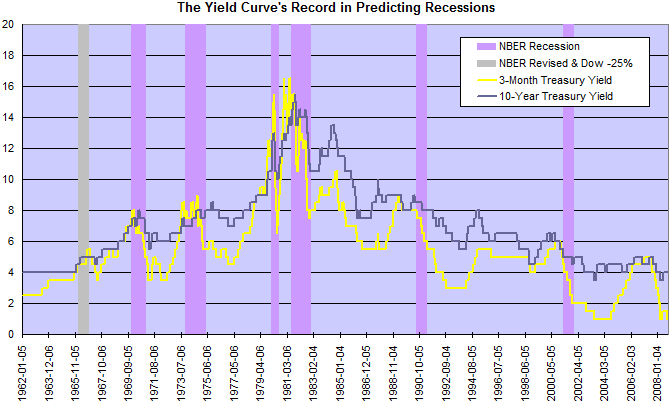

Ever since the mid-1980s, interest rates have been in a downward cycle, with each series of rate cuts ending lower than the preceding one. Each time the economy went into recession, the Fed lowered rates to soften the fall. They succeeded in postponing the inevitable, but also in extending the market further from its equilibrium. So that the next downturn required even more severe action. The Fed would then lower rates further — in order to save the now weakened economy from a hard landing. After successive cycles, we are now approaching the point of zero interest rates.

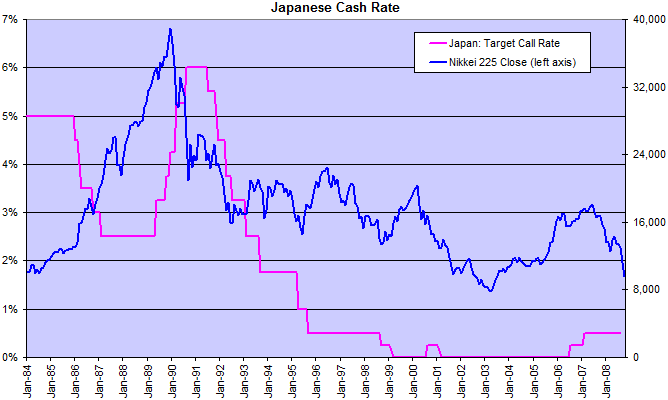

Japan's experience during the 1980s reminds us what is then likely to happen. From 1999 to 2006 the Bank Of Japan cut their overnight rate to zero, but even this failed to lift their economy out of the doldrums. The Nikkei 225 index has been in a downward spiral ever since.

Tax cuts, tax rebates and similar measures are necessary to stimulate the economy. And direct intervention to save important infrastructure — including major banks and manufacturers, like General Motors. But the Fed must resist the temptation to cut rates.

Stocks

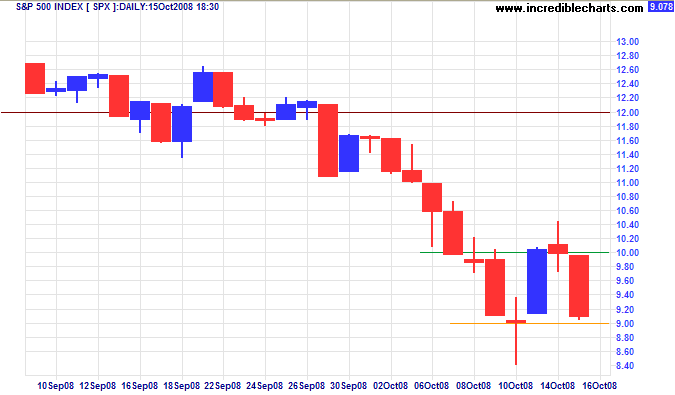

The S&P 500 relief rally ended early. The absence of short sellers, having to cover their positions, contributing to this. The index is again testing support at 900. Failure would offer a short-term target of 800, from the 2002/2003 lows. In the long term, even the 800 support level now appears vulnerable.

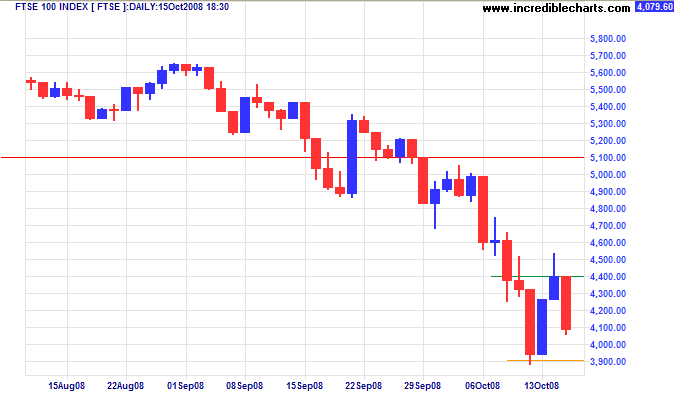

The FTSE 100 is similarly headed for a test of 3900. Breakout would test the 2003 low of 3300.

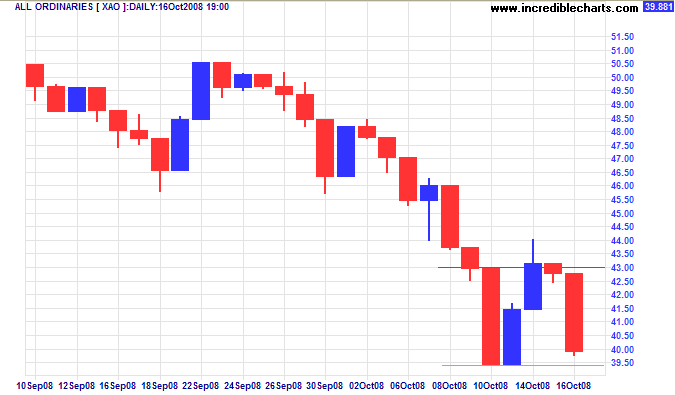

The Australian All Ordinaries is likewise testing short-term support at 3950. Failure will offer a target of 3400: the 2001 to 2002 high — and 50 percent retracement level from 6800.

Treasury Yields

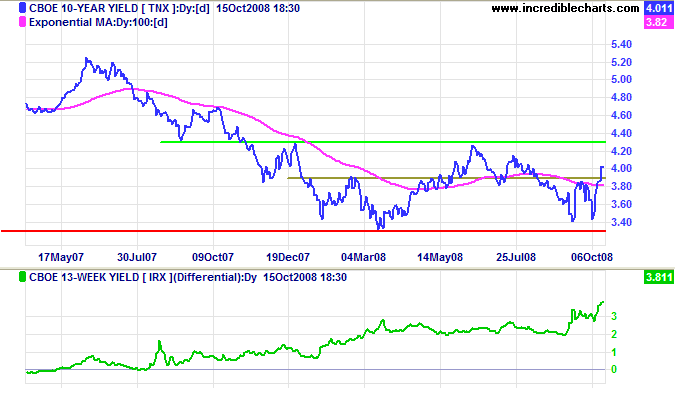

Ten-year treasury yields are headed for a test of 4.30%, after breaking resistance at 3.90%. Yield differentials are high, increasing bank margins.

Market Uncertainty

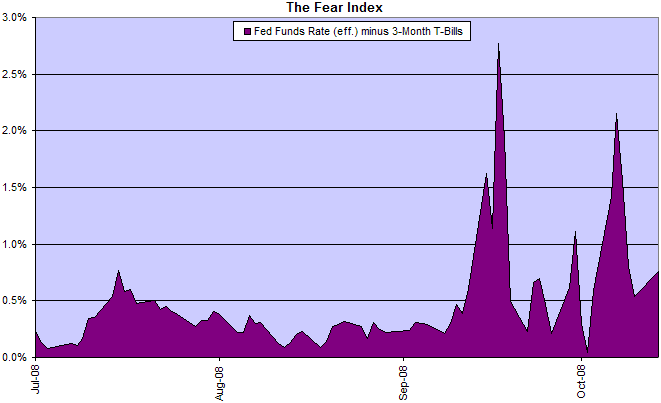

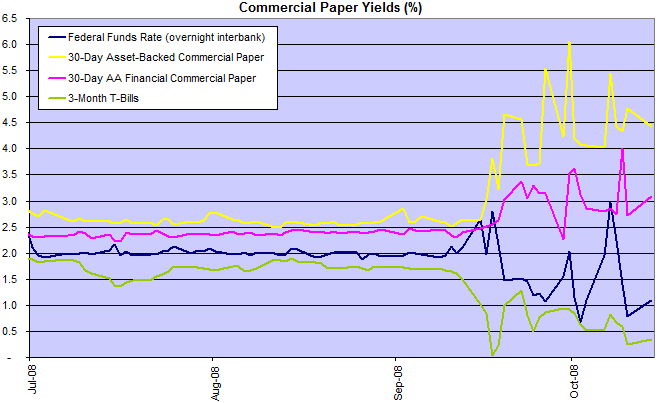

The spread between the fed funds rate and 3-month T-bills is again rising, reflecting concerns that government intervention has failed to re-establish inter-bank lending.

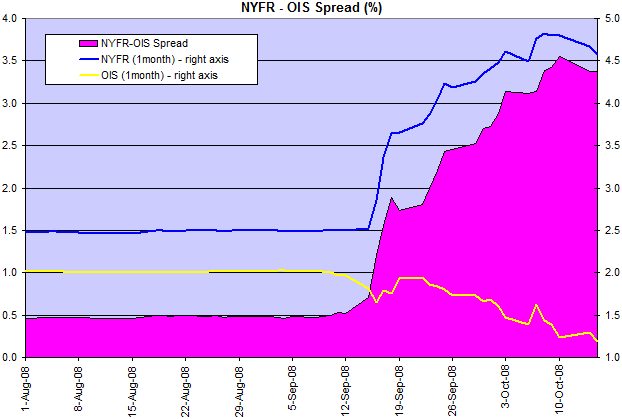

The ICAP 1-month New York Funding Rate (an alternative to LIBOR that is less open to manipulation) remains close to its record 350 basis points (3.5%) above the overnight index swap rate, from last week. The NYFR reflects the rate at which banks are prepared to lend to each other in the open market and the latest spike shows continuing concern over bank defaults.

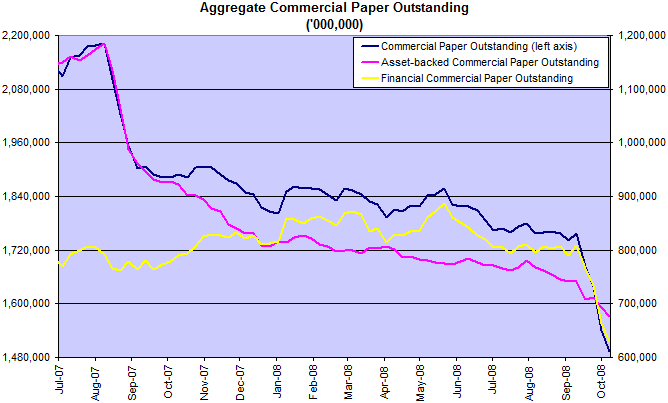

The Shadow Banking System

The $10 trillion shadow banking system continues to unravel. Total commercial paper in issue is falling rapidly, despite the Fed purchasing commercial paper to maintain liquidity in the corporate market.

Contracting credit in the shadow banking system is likely to affect the global economy for at least two to three years. Especially sectors such as housing in the UK and Austalia, which became overly reliant on wholesale funding in international markets.

The effective fed funds rate fell to 1.0 percent — warning of further rate cuts.

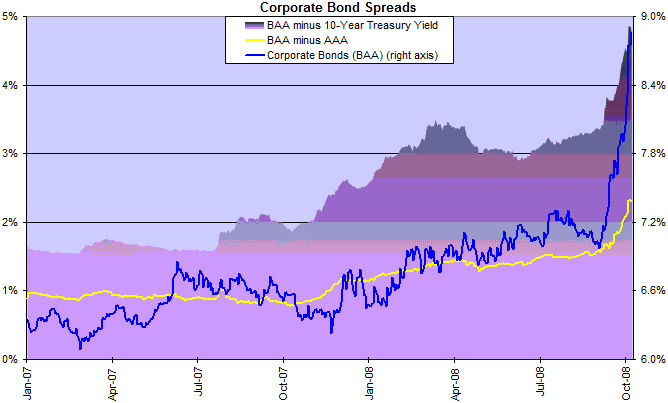

Corporate Bonds

Corporate (Baa/Aaa) bond spreads have climbed to record levels in anticipation of defaults.

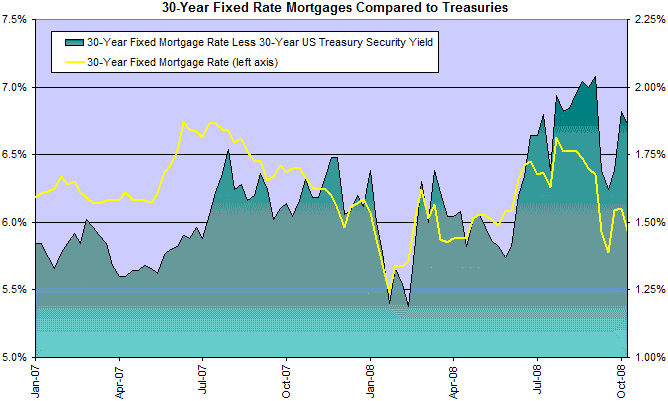

Housing

Fixed mortgage rates experienced some relief since the GSE rescue, but rising treasury yields are expected to reverse this.

Bank Credit

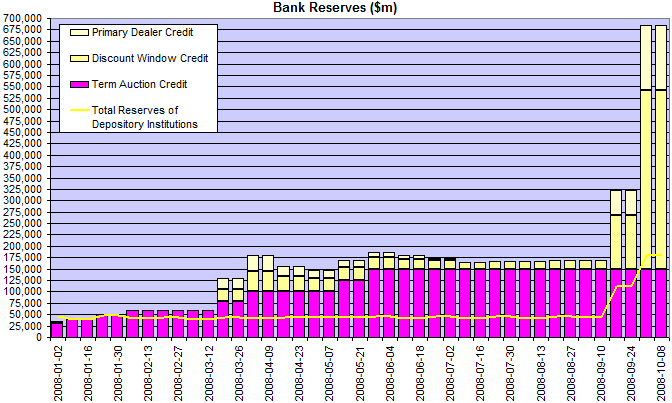

Combined Fed and Treasury support for the financial system will exceed $1 trillion after the latest increases. To put things in perspective, the first column (2008-01-02) on the left below reflects the highest ever level of Fed intervention until that point.

Every calamity is a spur and valuable hint.

~ Ralph Waldo Emerson

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.