Failure Of The Fiat Currency System

By Colin Twiggs

October 9, 2008 6:30 a.m. ET (9:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

There is no means of avoiding the final collapse of a boom brought about by credit expansion.

The alternative is only whether the crisis should come sooner as a result of the voluntary abandonment

of further credit expansion, or later as a final and total catastrophe of the currency system involved.

~ Ludwig von Mises

What we are facing is no mere speed bump in the road to prosperity. The looming threat of credit expansion has been ignored by regulators for the past three decades and we now face a crisis of confidence in the financial system. Unfortunately the only tool that central banks have available is to lower interest rates to artificially low levels in an attempt to support falling asset prices. If they succeed, and demand for credit again expands, we are being set up for another financial collapse in the not too distant future. If they fail, we face the mother of all credit contractions and a global recession that will be remembered in a similar light to the 1930s.

Neither alternative is very inviting, but we should hope for the former in order to buy ourselves some time. I see politicians and commentators talking about rescue packages and running off lists of what needs to be done. Most are band aid solutions that may provide some temporary respite but do not address the underlying distortions in the economy.

Continued credit expansion will merely create further problems in the financial system. Central banks have not shown sufficient restraint to contain credit expansion. There always seems to be a crisis that requires "exceptional measures" (i.e. credit expansion). And when the crisis is over the credit expansion remains, possibly due to political pressure.

The underlying cause is the fiat monetary system. Fiat currency is paper money that is not backed by anything other than a promise to pay by the central government. In effect it is an IOU from the Treasury.

Every past attempt at a fiat currency has collapsed due to a lack of restraint by the issuers — and this time is proving no different. Since August 1971, when Richard Nixon acknowledged that the US government could not honor its commitments, by abandoning the gold standard, we have experienced rampant credit expansion and inflation. While the Bretton Woods gold standard, where foreign central banks could exchange $35 for an ounce of gold, was a far from perfect system, it did place some constraint on money and credit expansion. After that, the printing presses ran hot apart from a brief period under Paul Volcker. Official inflation figures allayed our fears, suggesting that the new monetary system was under control and the "miracle workers" at the Fed could create prosperity out of thin air.

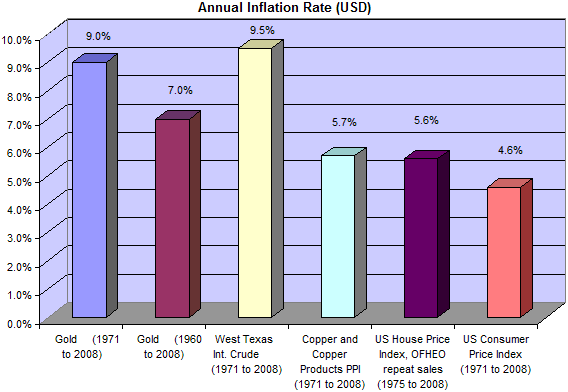

Today we have to exchange $900 for an ounce of gold. That works out at an annual inflation rate of 9 percent since 1971. This may be a slight overstatement as the printing presses were already running prior to abandonment of the gold standard — and $35 per ounce may already have been unsustainable from the mid-1960s. But if we go back as far as 1960, this still works out at an average inflation rate of 7 percent. Makes you wonder how many bondholders have made a real return on their investment in recent years.

If you think it is unfair to compare the dollar to the gold standard, here are some other comparisons:

The Founders of the US Constitution had experienced the disastrous effects of a fiat currency before — when the Revolutionary War was financed by government-issued Continental Currency. Repeated issues gradually debased the currency to the point that the phrase "not worth a Continental" became part of our common language. In an attempt to prevent a repetition, the Constitution made only gold and silver legal tender and forbade the issue of "bills of credit" — what we now refer to as paper money.

To this day, Treasury is prevented from issuing paper money. Unfortunately, financial engineers in the early 20th century found a loophole with which banks today are all-too-familiar: they created an SIV (structured investment vehicle). While the Federal Reserve has an eagle on its crest and an official-sounding name it is not part of the federal government. It may be subject to regulation by Congress, but its stocks are held by the various member banks. That is why, when the Fed issues dollars, they are "Federal Reserve Notes" presentable to the federal reserve banks — and not the federal government, which would be a breach of the Constitution.

I am not advocating abolition of the Federal Reserve, nor immediate re-introduction of the gold standard, which would be too radical a step to have any chance of success. But additional constraints are necessary to prevent further credit creation, including replacing the Fed policy objective with a simple instruction to "protect the value of the currency". The current objective is merely a euphimism for "quietly debase the currency to keep the voters happy". Further measures should include abolition of SIVs (except for the Fed), strict enforcement of conservative (1 to 10) capital-asset ratios, and limits on credit expansion to conform to projected real growth in GDP. Hopefully after a few decades the financial system will have stabilized to the point that we can consider a return to the gold standard — as this is the only standard that has stood the test of time.

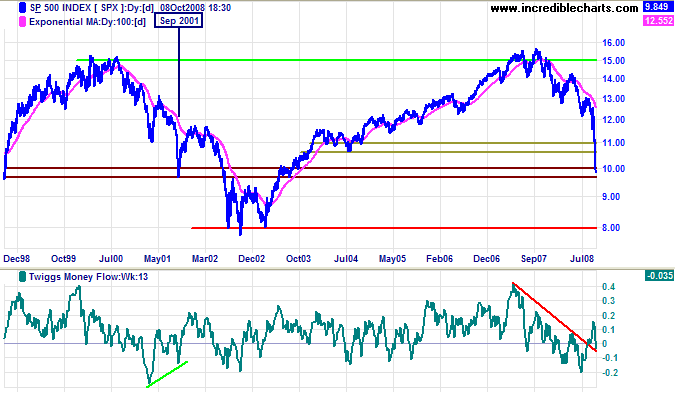

Stocks

The S&P 500 has lost more than a third of its value since its 2007 peak — surpassing the October 1987 crash. Expect a relief rally if the coordinated rate cuts and liquidity measures taken by central banks have the desired effect, but this is unlikely to be the final bottom. V-bottoms are notoriously unreliable and further tests of support are likely. Failure of the band of support between 1000 and 965 would offer a target of 800, the 2002/2003 lows.

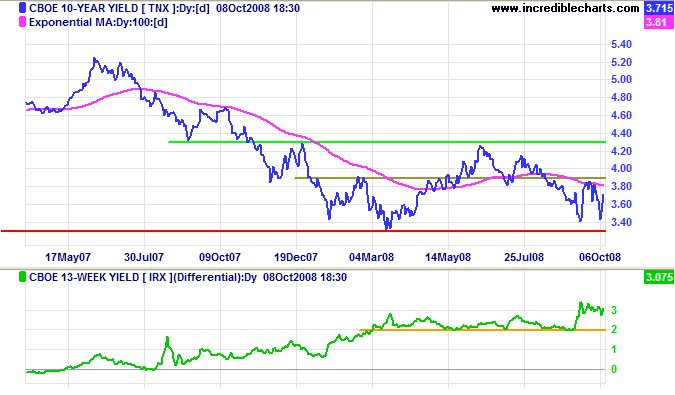

Treasury Yields

Ten-year treasury yields rallied on the strength of yet another rescue plan, but an up-trend, signaled by recovery above 4.30%, still appears some way off. Yield differentials remain high, maintaining profitable bank margins.

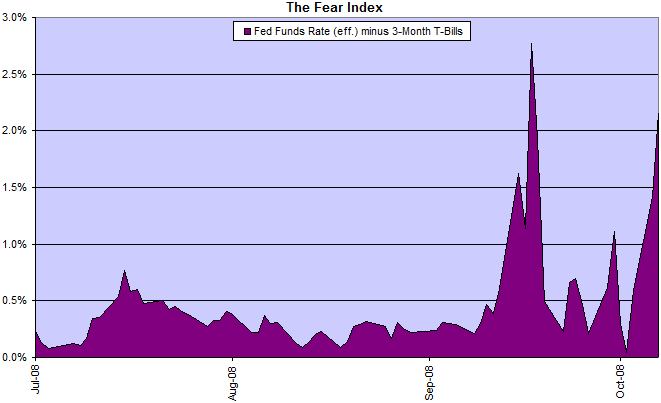

Market Uncertainty

The spread between the fed funds rate and 3-month T-bills remains elevated, reflecting concerns over further bank defaults.

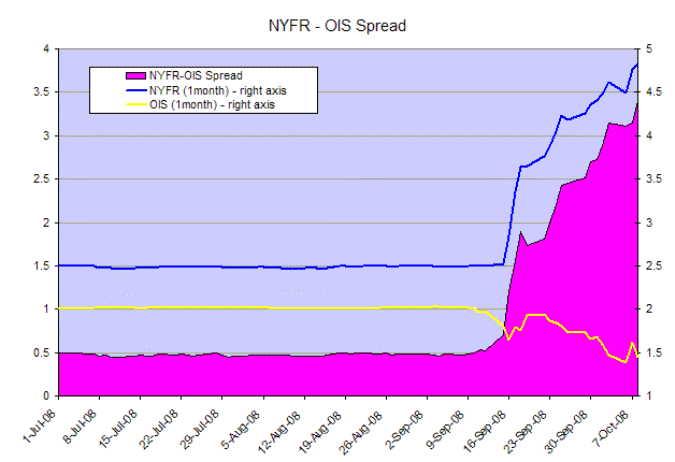

The ICAP 1-month New York Funding Rate (an alternative to LIBOR that is less open to manipulation) is approaching an unprecedented 350 basis points (3.5%) above the overnight index swap rate. The NYFR reflects the rate at which banks are prepared to lend to each other in the open market and the latest spike reflects growing concern over bank defaults.

The Shadow Banking System

The $10 trillion shadow banking system is unravelling:

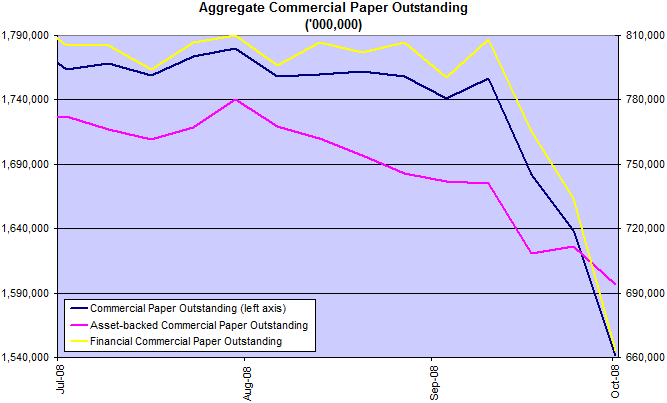

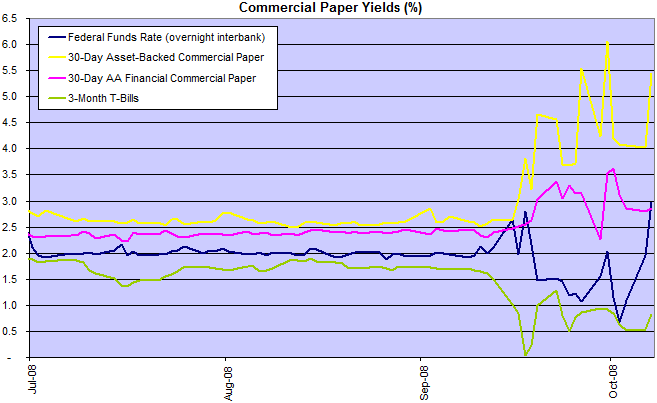

- $2 trillion of commercial paper;

- the $2.5 trillion repo/reverse repo market;

- $4 trillion of brokerage assets, now de-leveraging to conform with Fed regulations; and

- $1.8 trillion of hedge funds.

Total commercial paper in issue is falling rapidly, forcing the Fed to intervene for the first time since the 1930s — directly purchasing commercial paper to maintain liquidity in the corporate market.

Fed purchases of commercial paper may maintain liquidity in the corporate market, but cannot allay solvency concerns. Contracting credit in the shadow banking system is likely to affect the global economy for the next two to three years. Especially sectors such as housing in the UK and Austalia, which have become overly reliant on wholesale funding in the international market.

The effective fed funds rate should be more stable now that the Fed is able to pay interest on bank deposits — and is likely to drop back to 1.50 percent after the latest rate cut.

Corporate Bonds

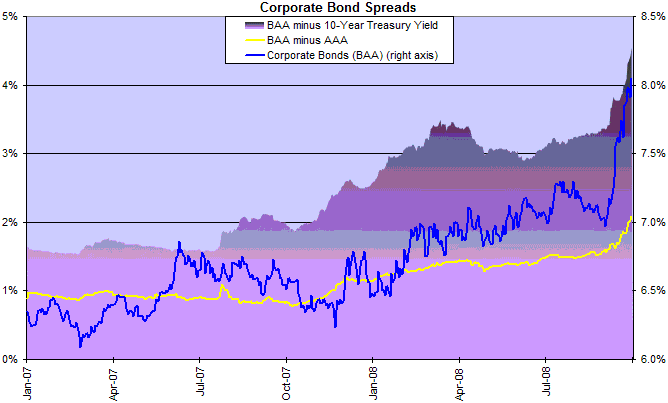

Corporate (Baa/Aaa) bond spreads have climbed to record levels in anticipation of rising defaults.

Housing

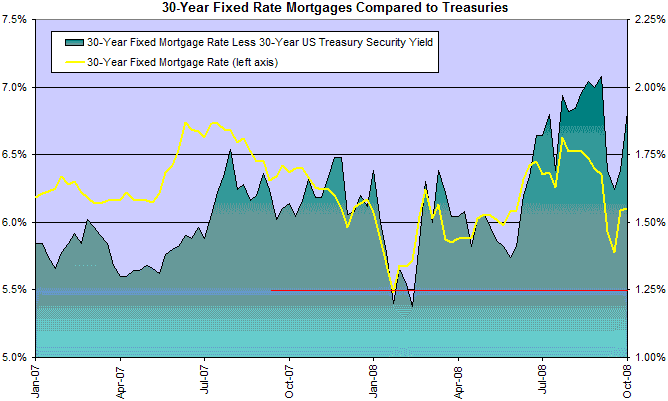

Fixed mortgage rates have experienced some relief after the GSE rescue, but rising spreads reflect lending concerns. In the longer term, rising treasury yields are expected to place upward pressure on mortgage rates.

Bank Credit

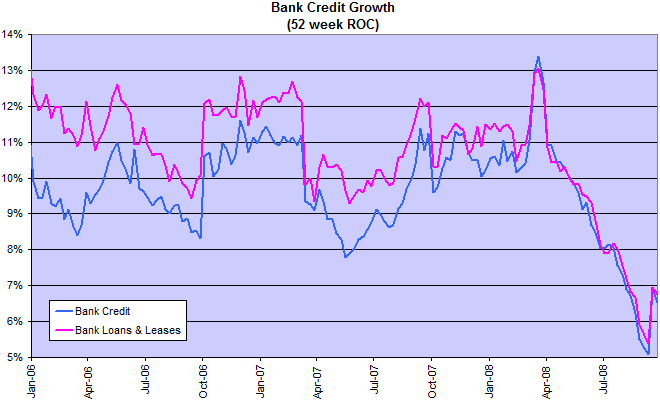

Bank credit growth is expected to slow to close to zero as the credit contraction continues, restricting consumption and new investment.

Combined Fed and Treasury support for the financial system will exceed $1 trillion after the latest increases, dwarfing any previous support. Central banks are being forced to interpose themselves as intermediaries in inter-bank lending in order to keep credit lines open. They are effectively assuming solvency risk, which could backfire if there are more major bank failures.

Congress prevarication over the TARP rescue plan has damaged confidence in the banking system and may necessitate further rescue efforts in the months ahead. The only way to deal with this is to act early and act decisively. Any hint of indecision will only spread further alarm. On the scale of melt-downs, this is a Chernobyl. At times like this, both sides of the House have to pull together.

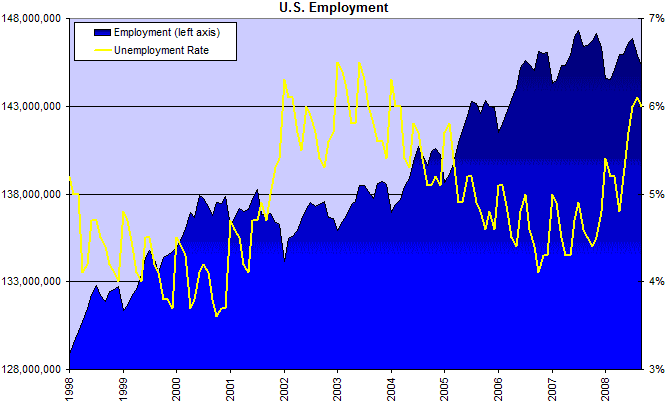

Employment

Expect further rises in unemployment as the credit contraction affects corporates and consumers alike. A recession is inevitable.

That's plain hokum. It's an old political trick: "If you can't convince 'em, confuse 'em." But this time it won't work.

~

Harry S. Truman (1948)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.