Crude Breaks Support

By Colin Twiggs

September 4, 2008 9:00 a.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Market Overview

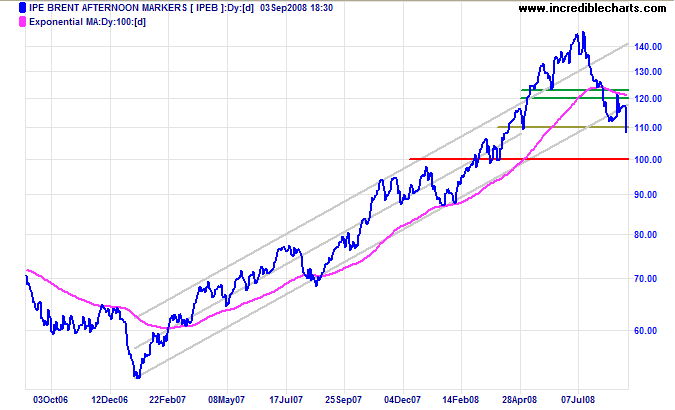

Crude oil broke through support at $110/barrel, warning of a primary trend reversal. The primary down-trend will be confirmed if the key psychological level of $100 is penetrated.

A recession in both the Chinese and US economies could lead to crude testing support at the 2007 low of $50/barrel. But China has been reporting double-digit growth in GDP and it would take a substantial drop in exports to cause a recession.

Stocks

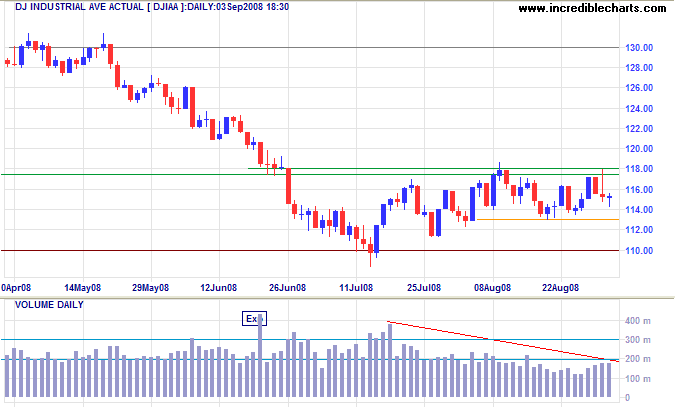

The Dow is consolidating between 11300 and 11800, accompanied by declining volume. Upward breakout would signal continuation of the secondary rally. We remain in a bear market, however, and downward breakout is more likely, warning of a test of 10000 — confirmed if 11000 is penetrated.

Treasury Yields

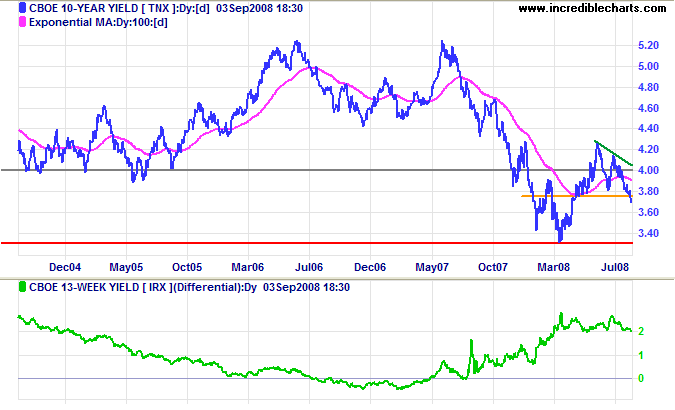

Ten-year treasury yields broke through support at 3.80 percent, signaling a test of support at 3.30 percent. The flight from mortage-backed securities, because of the uncertainty surrounding GSEs Fannie Mae and Freddie Mac, is driving treasury yields down. Yield differentials (with 13-week treasury bills), on the other hand, remain at a healthy 2.0 percent.

Market Uncertainty

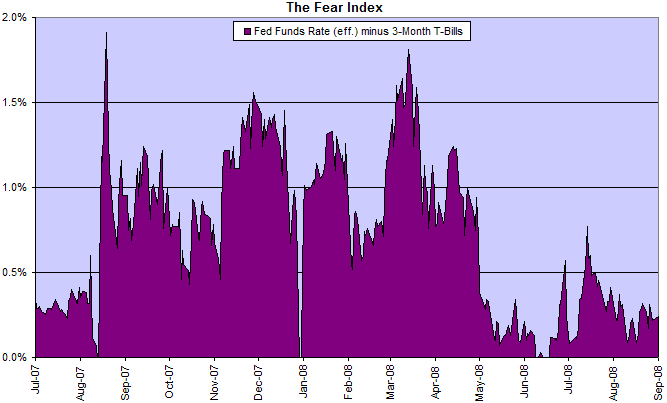

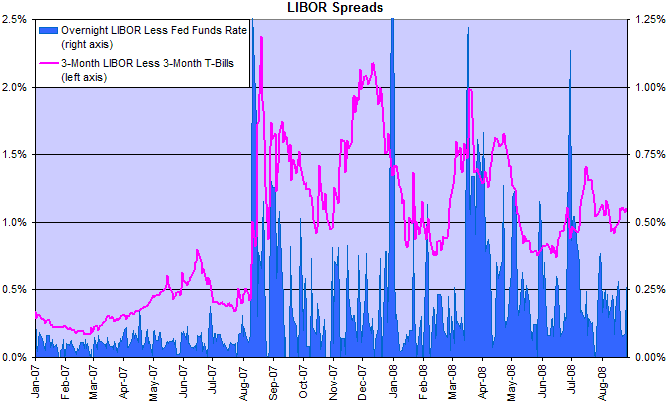

The spread between the fed funds rate and 3-month T-bills is close to zero, but it is clear from falling treasury yields and wide Libor spreads that market tensions remain high.

Compare the yield on 3-month T-bills to 3-month LIBOR, the offshore inter-bank rate which is less prone to Fed manipulation. Banks are demanding a premium of more than 1 percent above the T-bill yield — a long way from the 25 basis points enjoyed in early 2007.

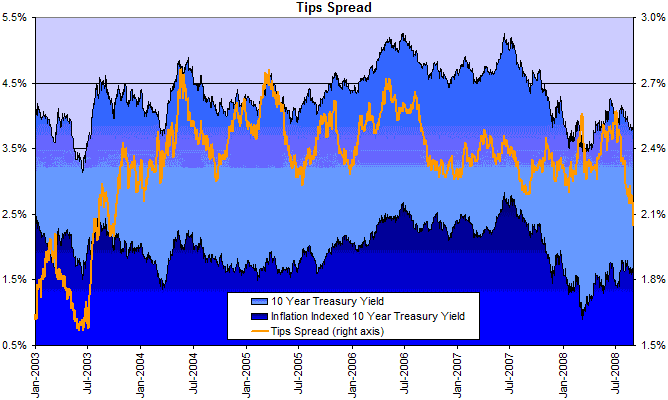

The falling spread between 10-year treasurys and the equivalent TIPS rate reflects the flight from mortgage-backed securities into more secure treasurys, rather than declining inflation expectations.

Financial Markets — Commercial Paper

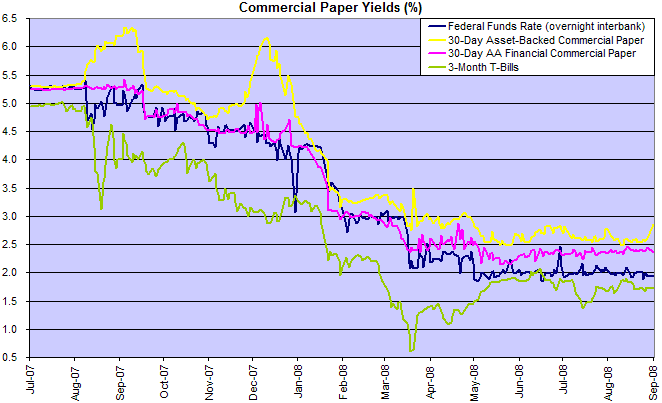

The spread between asset-backed commercial paper and the fed funds target rate (2 percent) jumped sharply — increasing pressure on institutions reliant on wholesale funding.

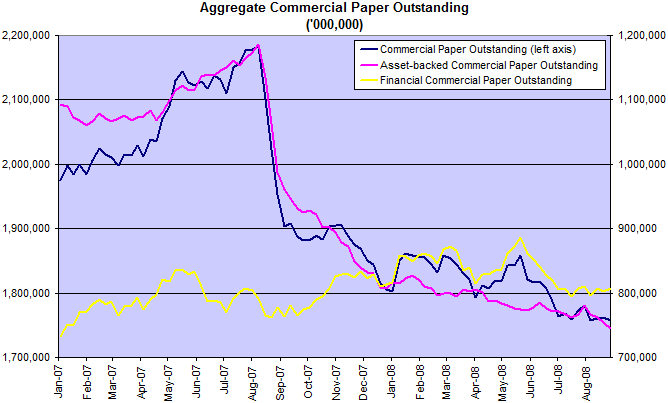

Total commercial paper in issue is expected to decline further.

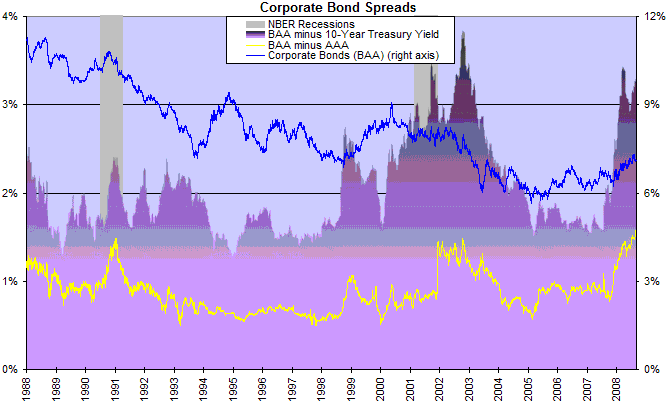

Corporate Bonds

Corporate bond spreads remain high in anticipation of rising defaults.

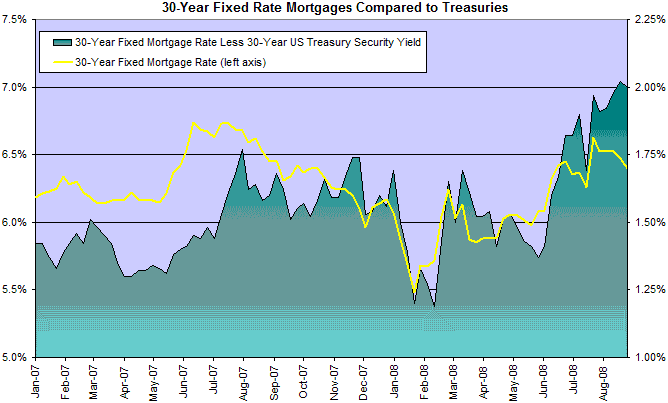

Housing

Mortgage spreads remain high as lenders attempt to re-build their balance sheets. Rising mortgage rates have the potential to further suppress housing demand and prolong the down-turn.

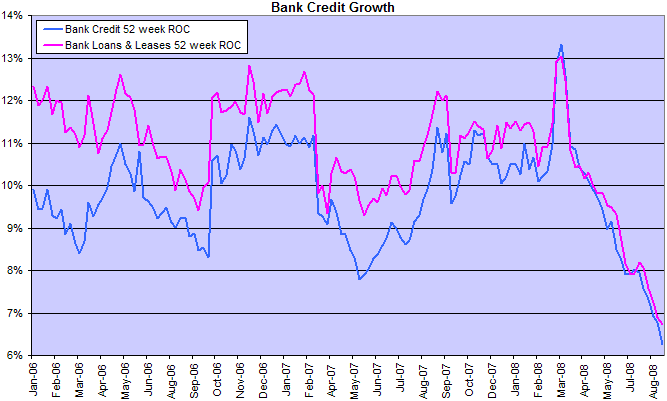

Bank Credit

Credit growth continues to fall, restricting consumption and new investment.

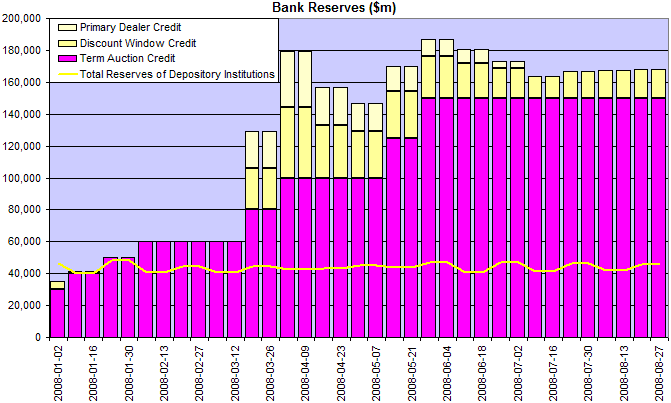

It will be some time (years rather than months) before the financial sector can withstand a reduction in the record levels of Fed support for the financial system. The chart below does not even include the $29 billion Bear Stearns bailout.

The second quarter profile of FDIC institutions reveals some disturbing trends:

| June 2008 | June 2007 | June 2006 | |

| Average Return on Assets (QTR) % | 0.15 | 1.21 | 1.34 |

| Net Charge-Off Rate (QTR) % | 1.32 | 0.49 | 0.35 |

| Noncurrent Loan Rate % | 2.04 | 0.91 | 0.70 |

| Coverage Ratio % | 89 | 120 | 159 |

Profit margins (ROA) have fallen to almost zero as charge-off rates rise. Non-current loans (at least 90 days past due or not accruing interest) have almost trebled. And loss reserves declined to the point that they no longer cover non-current loans, with a coverage ratio of 89%. Further falls in housing prices are likely to result in more bank failures.

A leader is a dealer in hope.

~

Napoleon Bonaparte

To understand my approach, please read About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.